GM,

First, I would like to announce an event. The latest round of public funding, Gitcoin Grants 21, is now open for applications. This round of Gitcoin Grants includes 11 different funding themes, covering a wide range of areas. Among them, Blocktrend will be participating in the Asia Round, which is specifically set up for Asian projects. As long as your project contributes to the Asian public ecosystem or the founder is Asian, you can apply for the Asia Round.

The Asia Round is led by the "Global Chinese Community of Universal Digital Commons" (GCC), which has previously sponsored Blocktrend. GCC allocates $25,000 and Gitcoin contributes $50,000, totaling $75,000 in funds to support Asian projects. I recommend everyone to apply for their projects as soon as possible. GCC will be responsible for reviewing whether the projects meet the eligibility criteria. The more applications we receive, the more choices we will have for the community vote. Let’s get to the point.

If the situation across the Taiwan Strait suddenly escalates today, how would you adjust your personal asset allocation? There are many factors to consider, and in a hurry, it might seem practical to stock up on supplies first. But you can’t possibly spend all your savings on food. How should you allocate the remaining money to reduce risks? Blocktrend readers are sure to think of cryptocurrencies.

This article discusses how to prepare for such a moment with cryptocurrencies, inspired by the trailer of the Taiwanese TV drama “Zero Day Attack,” and why it’s too late to worry when the time comes. I wrote this to prepare in advance, but I hope that in the end, it will just be a "false alarm" and not actually needed.

Zero Day

The TV series “Zero Day,” scheduled for release in 2025, has already generated buzz online before its premiere. The series sets a fictional backdrop of China taking military action against Taiwan and explores the various chaos Taiwan might face on the eve of a conflict across the Taiwan Strait. Last week, the production team released two trailers, one minute and seventeen minutes long, respectively.

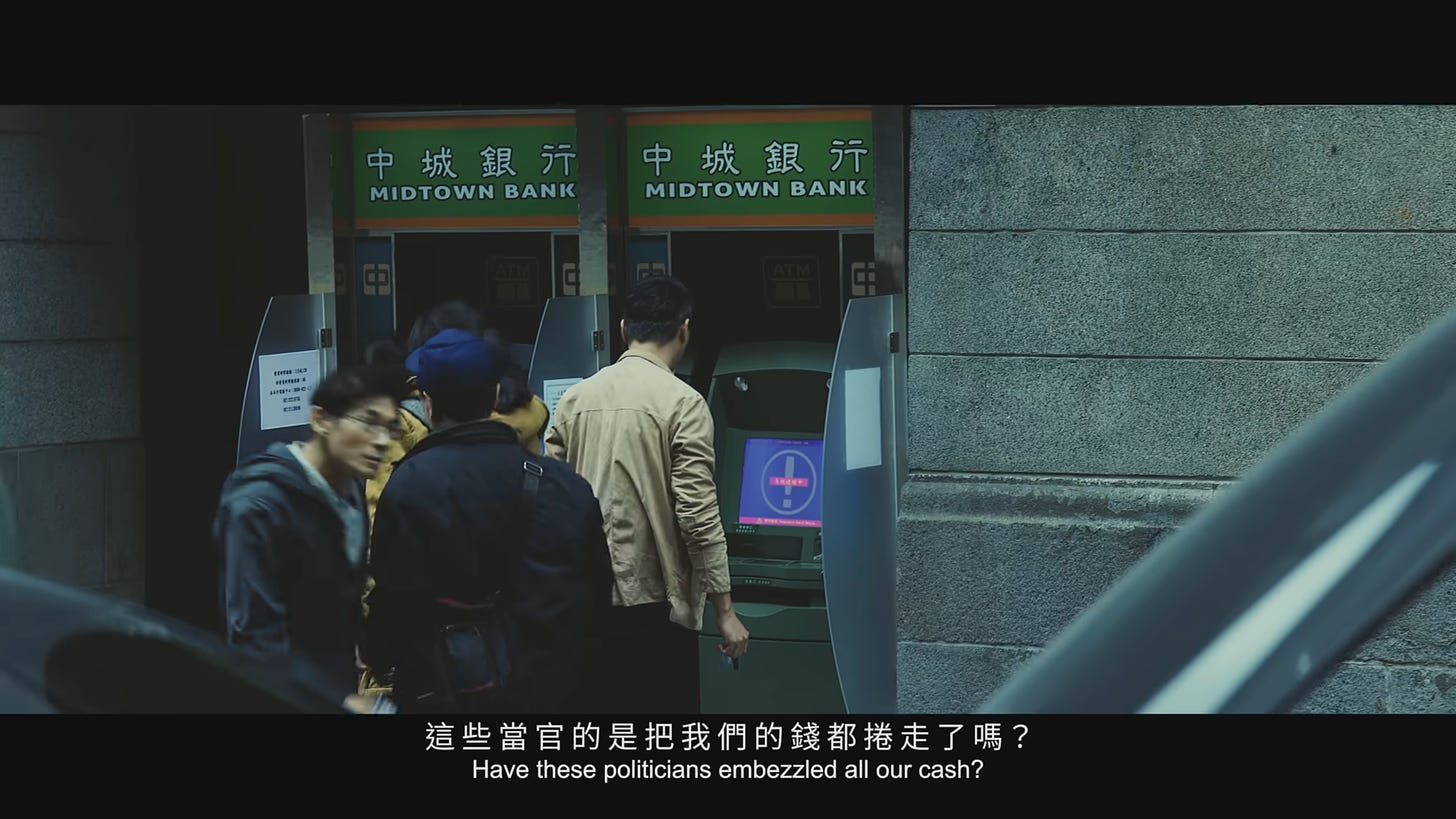

The release of the trailers coincided with the Wan’an military exercise, with air raid sirens blaring on the streets. The next day, a powerful typhoon hit, and convenience store shelves were emptied. These coincidences heightened the sense of realism in “Zero Day ” forcing people to start thinking about how to prepare for a "zero day." After watching, the scene that left the deepest impression on me was the following: people rush to ATMs to withdraw cash, only to find the screen displaying a system connection error. They angrily question: “Did those officials just take all our money?”

This scene is quite realistic. Two years ago, after Russia invaded Ukraine, the Ukrainian central bank restricted ATM cash withdrawals to stabilize the financial order and prevent bank runs. According to a report by the Central News Agency:

Russia's invasion of Ukraine caused asset prices to plummet. Today, the National Bank of Ukraine implemented financial stability measures, suspending foreign currency cash withdrawals and limiting the amount of Ukrainian currency cash that can be withdrawn from ATMs. Russia launched a full-scale attack on Ukraine by land, sea, and air... A large number of people in the capital Kyiv and other cities lined up to withdraw cash and rushed to buy food and drinking water.

Fortunately, under the control of the central bank, Ukraine successfully navigated the initial period of financial chaos. A year later, the Kyiv Independent described this as Ukraine's "banking miracle." Even during the most intense phases of the war, people could still use mobile apps for online banking. It was quite remarkable. Conversely, if Ukraine's banking system could continue to operate despite such severe conditions, a situation where ATMs don't dispense cash and banks shut down would be much worse.

In such times, survival is paramount. The more primitive the currency, the more valuable it becomes1.

Practicality vs. Convenience of Transactions

Cattle and rice were the most primitive forms of currency, with clear practical uses. For our ancestors, if no one wanted to accept cattle or rice as payment, the worst-case scenario was to consume these currencies. Nothing is more practical than a currency that can provide a meal.

However, the biggest problem with using cattle and rice as currency is that they are difficult to preserve. Cattle can get sick, and rice can spoil. You also need enough space to store them. Imagine trying to store NT$500,000 worth of rice at home; readers living in Taipei or Hong Kong probably wouldn’t manage.

Later, people switched to using precious metals as currency, such as the silver ingots and copper coins often seen in historical dramas. Precious metals are more suitable as currency than cattle because they facilitate transactions and are easier to preserve. However, silver ingots are not edible, and in the event of war, having a lot of silver ingots could still lead to starvation.

Nowadays, the most commonly used forms of currency—banknotes, bank deposits, and even cryptocurrencies—are each more convenient for transactions. Banknotes are lightweight, bank deposits are just electronic signals, and cryptocurrencies can be stored in wallets independently of banks. But in times of war, the more modern the currency, the more "useless" it becomes.

Understanding the history of currency development makes it clearer how to prepare for a "zero-day attack." It should be seen as a spectrum, with the most primitive and most modern forms of currency at opposite ends. I would use the most primitive form, food, to meet immediate daily needs, and the most modern form, cryptocurrency, to prepare for a long-term struggle. However, the exact proportion to prepare in each form depends on the actual situation. The key is that these currencies must be capable of self-preservation.

For example, gold passbooks from banks are useless in such times; gold bars are assets that can be self-preserved. I’ve never actually bought gold bars, but I have seen them for sale at Costco. Currently, a kilogram of gold bars costs around NT$2.5 million.

However, based on Ukraine's experience, gold bars are used by the state to exchange goods with other countries, not as a medium for everyday transactions like buying food. The logic is simple. If you casually pull out a kilogram of gold bars for a grocery store owner, they wouldn’t know how to give you change. Gold bars are hard to divide, and even weighing and determining purity is an issue.

So, if they can't be used to buy things, why do wealthy people like to buy gold bars? The key is portability. An Apple MacBook Air weighs 1.24 kilograms. Gold is lighter than a MacBook Air, yet it can store higher value and be self-preserved, making it the highest unit value currency.

In the future, whether leaving Taiwan or after the war ends, gold bars can be easily converted into the legal tender of various countries. Therefore, gold naturally becomes the "refuge asset" of choice for the wealthy. Unless a higher unit value, easily tradable value carrier can be found? This is where cryptocurrencies come in.

Another Option

Cryptocurrencies are not just BTC or ETH. Essentially, they are a value storage medium, using new technology to meet old needs.

Some people might say that before a war, one should open a bank account in another country and deposit money there, as it's the safest option. However, if you only want to store money in an overseas bank, holding USD stablecoins like USDC or USDT has the same effect. The issuers of USD stablecoins, Circle and Tether, spread your dollars across overseas banks. And USD stablecoins are like withdrawal certificates for these overseas deposits, which can be stored in centralized exchanges or withdrawn to personal wallets for self-custody.

Others might say that if the U.S. intervenes in a Taiwan Strait war, the dollar might devalue, so investing in gold is the safest bet. For those familiar with cryptocurrencies, holding gold stablecoins like PAXG2 or XAUT also has the same effect. Each gold stablecoin is backed by an equivalent amount of gold bars stored in vaults in the UK and Switzerland. If desired, gold stablecoin issuers allow holders to redeem physical gold bars with their stablecoins.

Returning to unit value calculations, cryptocurrencies are just digital signals with no weight, yet they can theoretically carry infinitely large assets and can be allocated according to personal preference. Most importantly, cryptocurrencies, like gold bars, can be self-custodied.

In times of war, people carrying physical gold bars must find ways to hide them to avoid being robbed. However, cryptocurrencies can be stored on card-like cold wallets or even just written as a string of words in a notebook. This is the greatest advantage of cryptocurrencies, making them a better refuge asset.

Of course, there will be critics who say that cryptocurrencies are easily lost or hacked, and money could be stolen by fraudsters even before the war begins. This is due to unfamiliarity with the mechanism rather than a flaw in cryptocurrencies themselves.

As someone who helps hundreds of people create wallets every year, I agree that wallet operations are not yet "foolproof" and do not align with general user habits. Over the years, developers have continuously improved mechanisms and reduced risks, from initial private keys and mnemonic phrases to multiparty computation and passkeys3, aiming to make it increasingly difficult for people to lose their cryptocurrencies. However, no security mechanism can prevent human error, especially if people insist on transferring money to scammers.

In a "zero-day attack" scenario, those unfamiliar with cryptocurrencies will have to find ways to hold gold bars and manage overseas accounts. But those familiar with cryptocurrencies have an additional refuge asset option. Using cryptocurrencies requires deliberate practice, and early preparation is essential to stay calm and navigate crises when war occurs.

How would you prepare for a zero-day attack? Share your thoughts in the comments or on Discord.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.