GM,

A quick reminder: To celebrate Taiwan’s championship win in the WBSC Premier12 baseball tournament, DeFi project Furucombo has generously sponsored annual Blocktrend memberships for 20 individuals. This initiative aims to help more people access Blocktrend and become Web3 world champions. I’m leaving the allocation of these spots to you. Each paying member can nominate one person, and lifetime members can nominate two. Over the past week, a few people have been recommended and joined daily—thank you all! I appreciate this natural pace of growth. However, less than half of the spots are now left. Miss this, and you might have to wait for the next championship win (?).

Additionally, starting next week, Blocktrend will take its annual year-end publishing break, with articles and podcasts on hold for two weeks.

Now, let’s dive into the main topic. This article brings together three news stories, all centered around USD stablecoins. We’ll begin with Ripple (XRP), whose price has recently surged, pushing its market cap to rank as the third-largest globally.

Ripple Issues Stablecoins

Ripple (XRP) and the XRP Ledger debuted in 2012, backed by Ripple Labs, one of the earliest companies in the crypto space. Their focus has been on cross-border payment solutions.

Imagine needing to send money from Taiwan to India. The default method is typically a wire transfer via the Society for Worldwide Interbank Financial Telecommunication (SWIFT). However, SWIFT is not a true transaction system but rather a messaging system—less advanced than modern instant messaging apps. For instance, if I wanted to transfer money from Taiwan's Fubon Bank to Punjab National Bank in India, SWIFT would facilitate the communication via telegram-like messages. Punjab National Bank, upon receiving the message, would process the transaction for the Indian recipient and then reconcile the payment with Fubon Bank.

This traditional process has three major issues:

High Costs: Banks must pay SWIFT membership and usage fees.

Slow Speed: Transactions are limited by banking hours and are even slower when intermediaries are involved.

Low Capital Efficiency: Banks must maintain pre-funded accounts with correspondent banks abroad to facilitate settlements.

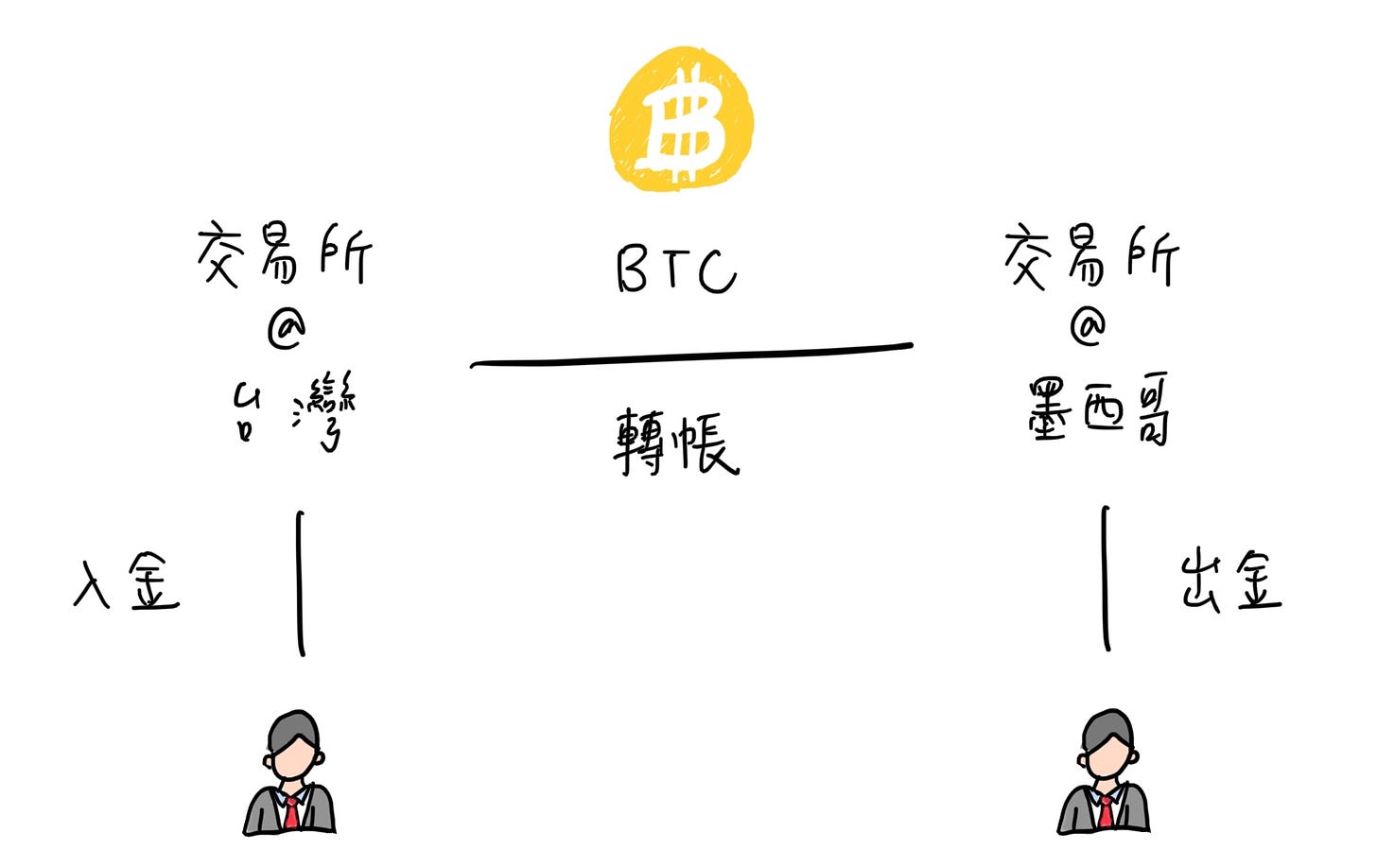

Ripple Labs proposes an alternative: why not use XRP and the XRP Ledger for transactions instead of SWIFT? Here’s how it works: Fubon Bank would buy XRP with New Taiwan dollars (TWD), then transfer the XRP via the XRP Ledger. Punjab National Bank, upon receiving the XRP, would sell it for Indian Rupees (INR) and transfer the funds to the Indian recipient.

This model draws inspiration from Bitcoin and feels like a throwback in the crypto world. In the early days, Bitcoin was often viewed as a bridge currency for cross-border payments. Companies like Coinbase and Circle started by offering such services. Ripple Labs adapted the idea, swapping Bitcoin for XRP and actively partnering with financial institutions.

The primary challenge with Ripple's model is the volatility of XRP’s price. Banks naturally question, “What if XRP’s value fluctuates significantly during the transaction, causing the Indian bank to receive less money? Who bears the loss?”In the past, Ripple Labs could only shrug and leave it to the banks to manage the risk. Now, Ripple’s long-awaited stablecoin, Ripple USD (RLUSD), is about to launch, offering a solution to reduce these transaction risks:

Ripple has announced a USD-pegged stablecoin with a 1:1 backing ratio.

The stablecoin will be 100% supported by reserves in USD deposits, short-term Treasury bills, and other cash equivalents.

These reserve assets will be audited by third-party accounting firms, and Ripple will release monthly attestations.

The most significant disruption stablecoins bring to the financial industry is overturning the assumption that "money stays put." Traditionally, banks have had to keep funds in foreign correspondent banks to facilitate cross-border settlement and reconciliation. But with stablecoins, cross-border transactions become far more dynamic—because now, money can move!

Banks can reclaim the funds parked at correspondent banks abroad. When a customer needs to make a cross-border transfer, the bank can simply convert the funds into stablecoins in real-time and transfer them via the blockchain. This approach is not only cheaper and faster but also improves capital efficiency.

Bridge1, a stablecoin startup recently acquired by Stripe for $1.1 billion, also focuses on this business model. However, Ripple Labs’ approach feels more cumbersome in comparison. Ripple not only has to maintain the XRP Ledger and XRP itself but now also shoulders the responsibility of issuing a USD stablecoin—and even aims to enter the decentralized finance (DeFi) space.

Ripple Labs may have abundant resources and the ability to take on multiple roles, but the key to developing an ecosystem lies in diversity. If you open the iPhone App Store and find only apps developed by Apple itself, the phone becomes far less appealing. Moreover, it's still unclear whether any financial institutions will adopt Ripple's solutions. The introduction of a USD stablecoin overlaps with the original use case of XRP. So, who would still want to buy XRP? Judging by the recent surge in its price, the answer might just be retail investors in the market.

Businesses use blockchain to enhance transfer efficiency, but what catches the attention of everyday users are the numbers tied to returns. Recently, Coinbase Wallet launched an unprecedented incentive campaign: simply holding USDC stablecoins in your wallet earns you a 4.7% annual interest rate on your balance!

4.7% High-Yield Savings with USDC

A wallet differs from an exchange account. A wallet functions like a personal purse, while an exchange account is more akin to a bank account. But this initiative by Coinbase Wallet is as if you could stash cash in your wallet and receive monthly cash rewards from the wallet brand itself. Sounds too good to be true, right? That was my first reaction, too. According to the official announcement:

Coinbase Wallet is introducing USDC rewards. It’s a simple way to earn USDC, and it’s almost universally accessible. Coinbase Wallet users can earn a 4.7% APY reward just by holding USDC stablecoins in their wallets. This means your funds remain entirely accessible and under your control.

Unlike a bank’s deposit interest, which stems from loans or investments, the USDC distributed in this campaign isn’t generated from such activities. Instead, it’s a direct subsidy. The USDC sitting in people’s wallets doesn’t generate yield for anyone; the 4.7% reward is fundamentally a part of Coinbase’s marketing budget.

To participate in this initiative, users must download the Coinbase Wallet app, deposit USDC, and agree to the terms of service on the wallet's asset page. Once completed, they will be eligible to receive a 4.7% annual interest reward, distributed monthly. Although Coinbase Wallet hasn’t specified how long this campaign will last, it’s unlikely to be a short-term promotion. This is because Coinbase earns revenue from USDC issuance itself.

USDC is co-issued by Circle2 and Coinbase3, backed by cash and short-term U.S. Treasury reserves. Treasury bonds generate yields, and Coinbase is using this revenue to subsidize USDC holders. If the number of participants remains manageable, sustaining the subsidy shouldn’t be challenging. Coinbase’s ultimate goal is to attract bank deposits—encouraging users to "bring deposits on-chain." Currently, U.S. banks offer less than 1% annual interest for savings accounts and under 3% for one-year fixed deposits. By converting dollars to USDC and storing them in a wallet, users can earn 4.7% on their balance—a highly competitive rate.

If this campaign drives up USDC’s market capitalization, increases its circulation, and boosts transaction volumes on the Base blockchain, it becomes a worthwhile investment for Coinbase. With these subsidies, holding USDC in a Coinbase Wallet becomes a far superior option compared to depositing cash in a traditional bank. The benefits include higher interest rates, self-custody of assets, and even waived on-chain transaction fees covered by Coinbase4. The opportunity cost of keeping money in banks is becoming increasingly apparent.

Even Trump Endorses DeFi

Even the soon-to-be U.S. President, Donald Trump, has begun advocating for dollar-based stablecoins.

Ahead of the U.S. election, Trump endorsed a DeFi project called World Liberty Financial, aiming to secure the dollar’s global dominance through stablecoins and decentralized finance. Trump himself serves as the project’s "face of the brand," holding the position of Chief Crypto Advocate.

What Is the Project About? The project released a "Gold Paper" to explain its purpose, and I asked AI to summarize it:

World Liberty Financial is a decentralized finance (DeFi) project with a vision to reinforce the global dominance of the U.S. dollar while opposing centralized control from central bank digital currencies (CBDCs). The project issues a governance token called WLFI, allowing holders to participate in collective decision-making. However, no single holder may wield more than 5% of the voting power... While Trump holds the title of Chief Crypto Advocate, it’s not an official position.

I had high hopes for Trump’s views on dollar-based stablecoins and CBDCs, but I was utterly disappointed.

The entire "Gold Paper" is vague on what the project actually intends to accomplish, apart from announcing the sale of governance tokens. For example:

Will they issue a dollar stablecoin? Unknown.

Will their DeFi focus be trading or lending? Unknown.

What can investors actually do with the governance tokens? Also unknown.

The project strongly resembles a celebrity scam, with the most absurd part being Trump’s full awareness of it. Does Trump not understand cryptocurrencies? Perhaps, but when it comes to exploiting hype, he’s already got real-world experience.

The use cases for cryptocurrency are becoming increasingly diverse, spanning cross-border payments, personal finance, and now political endorsements. However, an ironic scenario unfolded just days ago during the declaration of martial law in South Korea: Bitcoin prices on local exchanges fell to $63,000, and even the USDT stablecoin depegged, dropping below $0.75. This prompted critics to argue that cryptocurrencies lack safe-haven functionality, but such conclusions may be misinterpreting the cause and effect.

Whether crypto can act as a safe haven depends on the mindset of its market participants. For speculative investors focused on price movements, political instability prompts panic selling — a "sell first, ask questions later" mentality. Conversely, practical users understand that in extreme situations, holding cryptocurrency becomes even more critical. For instance, during South Korea’s political unrest, wouldn’t holding dollars be safer than holding won?

The recent crash in South Korea's crypto prices reflects the fact that the market is dominated by investors rather than genuine users. It’s not that cryptocurrencies lack safe-haven functionality; rather, people are not yet ready to use them for that purpose.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.