GM,

Yesterday, I sent out a TWD 100 BTC airdrop for the Bitcoin Pizza Day event. If you participated in this event1 by filling out the form, you can now open your wallet or exchange account to confirm whether you've received the BTC. With the recent lower coin price, perhaps you can use these BTCs to buy more pizzas to celebrate in a few years.

Every time Blocktrend holds an airdrop event, we receive some very positive feedback. The content is basically saying that it is thanks to these events that there's a chance to handle cryptocurrencies personally, rather than just buying low and selling high within exchanges. It doesn't seem like much at first glance, but this is the main reason why early participants airdropped Bitcoin through websites and why Blocktrend still occasionally holds these kind of "money-sprinkling" events. Now, onto the main topic.

The legal battle between the US SEC and the two exchanges, Binance and Coinbase, has just begun, but some people have already chosen to change their field. The Silicon Valley venture capital firm a16z, which has heavily invested in cryptocurrency start-ups over the past few years, announced this week that it will open its first overseas office in London, UK. Even UK Prime Minister Rishi Sunak joined the celebration, claiming that the UK will become a global center for Web3 innovation.

While the US government is still struggling to define whether cryptocurrencies are commodities or securities, the UK government has recognized cryptocurrencies as a "platypus2" and must establish new laws to deal with them. The UK's Financial Conduct Authority (FCA) has even launched a new set of cryptocurrency marketing regulations this year, covering not only the most familiar cryptocurrency airdrops and registration rewards, but also stipulating a 24-hour cooling-off period for people who want to invest in cryptocurrencies.

These regulations have sparked debate among supporters and opponents in the UK. This article discusses how the UK government regulates cryptocurrencies, and what are the reasons for support and opposition?

a16z Plants Its Flag in the UK

Founded in 2009, a16z was once proud to be a venture capital firm based in "Silicon Valley". The pandemic made a16z rethink the necessity of physical offices, eventually choosing to move its headquarters to the cloud. Theoretically, the office is wherever people are, but this week a16z announced that it will open its first physical office overseas in London, UK, a move loaded with symbolic meaning. According to the a16z announcement:

Over the past year, the success of blockchain and its surrounding software development — usually referred to as crypto or Web3 — relies on clear regulatory frameworks. Such systems can provide an open path for startups while protecting consumers from scams and manipulation. Regulatory rules can eliminate the "casino" culture derived from cryptocurrencies, and let constructive applications fully utilize their potential.

We've long cooperated with legislators and regulators around the globe. It's evident through our interactions that the UK government sees the potential of web3. Prime Minister Sunak also believes the UK should be the center of web3 innovation. The UK authorities are willing to work with the industry to formulate policies that encourage startups to develop decentralization... Turning projects from centralized startups into truly decentralized networks requires time and space. Therefore, we need to promote decentralized regulatory frameworks instead of hindering decentralization with policies.

Cryptocurrency knows no borders; all people need are internet access and a wallet. Many crypto startups even work remotely from day one. Where a company is established has become a bargaining chip. In recent years, the most common thing crypto startups have told governments is: "If the regulations aren't friendly, we won't choose to settle here."

What seemed like empty threats have become a reality with a16z setting up an office in London. This move is a hedge against risk on a business level and a form of protest against the U.S. government on a political level. People might not be too familiar with how the UK government regulates cryptocurrencies. However, in February of this year, the Financial Conduct Authority (FCA) in the UK proposed a set of marketing regulations for crypto assets and sought public opinion. The regulations are expected to take effect on October 8. They also give the outside world a glimpse into the UK government's view on cryptocurrencies.

Asset Categories

Unlike in the US, where the SEC governs securities and the CFTC oversees derivatives, the UK's Financial Conduct Authority (FCA) is responsible for both. This allows the UK government to skip the US's current "ghost beating" phase of defining what a cryptocurrency is before determining who should govern it. The UK can directly discuss how to manage cryptocurrencies.

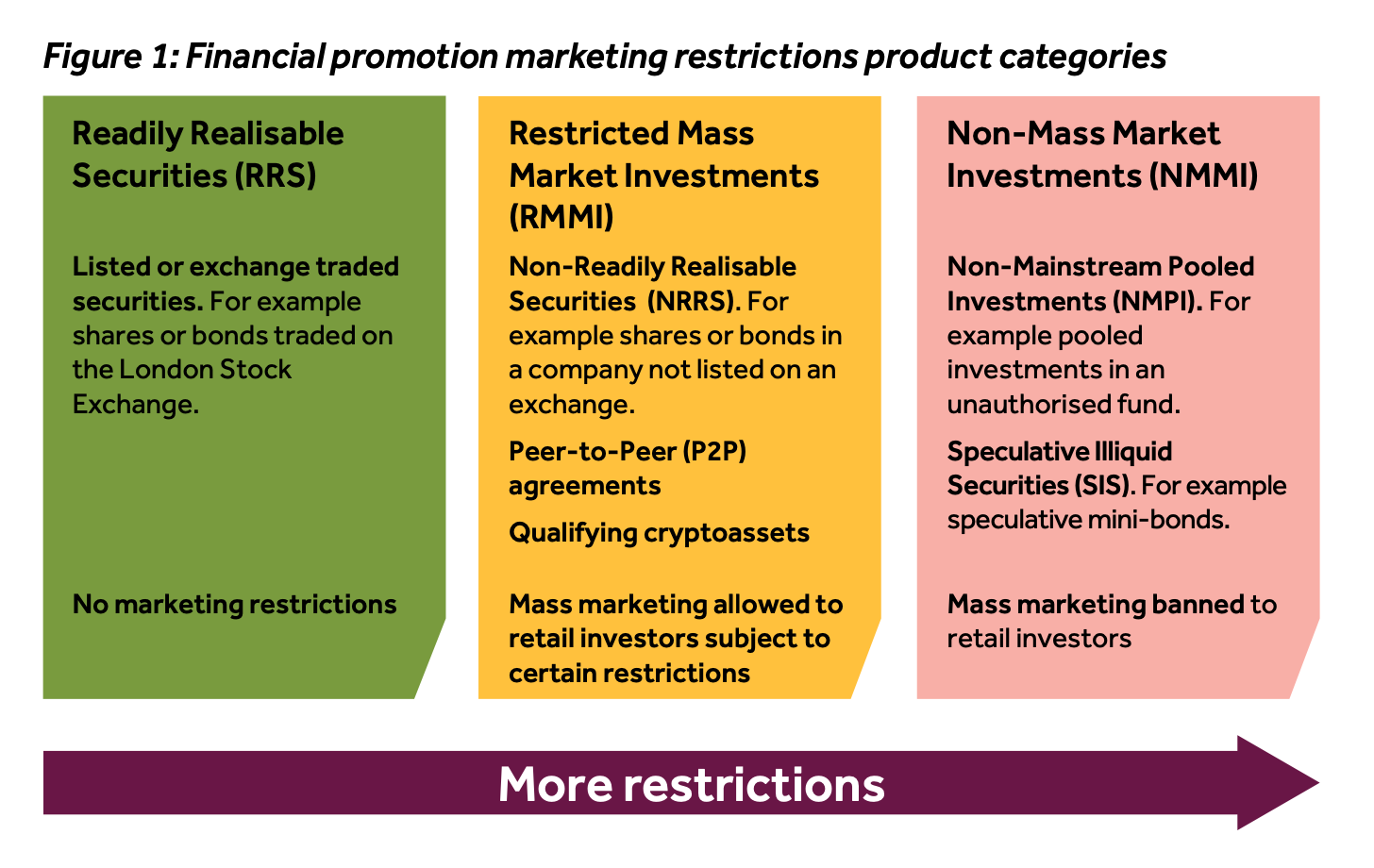

Generally, the UK government sees buying and selling cryptocurrencies as high-risk investments, but not so risky as to ban public participation. As long as investors clearly know what they're doing, it's acceptable. The chart below shows the FCA's financial asset categories, divided into three levels of investment risk: green, yellow, and red.

Green represents products open for public investment, such as stocks within a securities exchange. There are no special marketing restrictions here. Yellow represents limited public investment, with P2P lending and cryptocurrencies falling into this category. Marketing these investments must face certain restrictions. The strictest is red, representing investments unsuitable for the public. Speculative, illiquid securities are prohibited from being marketed to the public.

There is still controversy and no definitive conclusion as to which category cryptocurrencies should be classified under.

For example, when the FCA consults cryptocurrency industry players on this classification, they argue that cryptocurrencies, in terms of market value, liquidity, and 24-hour operation, are superior to similar P2P loans and should be classified as green. However, when the FCA consults traditional financial industry players, they are told that cryptocurrencies are subject to significant price fluctuations and technical risks (such as code being hacked) and should therefore be classified as red, requiring stricter regulation. The two sides have completely opposite positions.

In the end, 37% of the respondents agreed that cryptocurrencies should be classified as yellow, 17% remained neutral, while 45% disagreed. I think this result is quite good, as people who think the regulation is too lax or too strict would vote against it. To get more people to agree than disagree is very difficult. The FCA plans to continue seeking opinions, partly considering the cryptocurrency turmoil over the past year or two, and partly to avoid stifling innovation and driving businesses away with overly strict restrictions.

If we use everyday goods as a metaphor, yellow is like alcohol - it can be advertised, but there must be a warning that "excessive drinking is harmful to health" to remind consumers. The FCA has similarly prepared a set of warnings for cryptocurrencies: "Do not invest unless you are prepared to lose all of your investment. This is a high-risk investment. If something goes wrong, you are unlikely to be protected. Spend 2 minutes to learn more."

Even the wording of this warning has been subject to many opinions from the respondents.

For example, some people think that the warning should not have to be word for word, some flexibility should be allowed. I guess what they mean is that although BTC and meme coins are both called cryptocurrencies, the risks of investing in them are very different. On the other hand, opponents argue that the term "investment" is not appropriate for cryptocurrencies at all. After all, it's very different from investing in stocks, so how can it be referred to with the same verb? I guess if they could change "invest" to "gamble" or "lose money," they would wholeheartedly agree.

The FCA believes that both their own past statements and those of international regulatory bodies refer to "investing" in cryptocurrencies. They may consider adjustments in the future, but for now, they will keep it as it is. In addition to defining the most basic asset classes and communication terms, the FCA also has specific restrictions on marketing tactics for cryptocurrencies, such as prohibiting the use of referral bonuses and airdrops to attract people to invest in cryptocurrencies.

Prohibition of airdrop temptation

According to CoinDesk:

Crypto companies and celebrities in the past have been accustomed to offering NFTs related to their projects as a marketing means to users or fans, and some projects even use the airdrop of cryptocurrencies as a marketing strategy. FCA's Head of Payments and Digital Assets, Matthew Long, said that these free NFTs and airdrops, if used to encourage people to invest in crypto assets, could result in investors buying cryptocurrencies that are found to be problematic after the fact. Cryptocurrency airdrops and NFTs themselves will not be banned, but we do ban the use of airdrops as a marketing means.

I guess a "Bitcoin Pizza Day" airdrop event like the one hosted by Blocktrend, which does not seek any return, is probably fine. But it's probably not okay if it encourages people to register with an exchange, and requires them to trade a certain amount of cryptocurrency, to have a chance to qualify for an airdrop later. At first glance, this rule doesn't seem controversial, but I realized that the FCA is thinking more deeply than many people when I looked carefully at the statement:

We do not consider existing economic incentives for crypto assets or mechanisms related to business models as 'lures'. For example, crypto assets that provide voting rights to holders and are used to establish governance mechanisms for platforms or projects will not be considered a 'lure'. However, if it is used to encourage investors to purchase specific crypto assets, this will be considered a 'lure'. For example, a certain feature or benefit is only valid for a certain period of time, it will be considered an illegal act.

The FCA's but clause is quite cleverly written; it's not easy to distinguish which are 'business lures' and which are 'economic incentives'.

For instance, if the ban were extended to participating in Bitcoin mining and not earning any income, it would be equivalent to declaring a ban on mining in the UK. Economic incentives are the basis of blockchain operation, but luring people to invest in cryptocurrencies is another matter. Once regulations are implemented, not only can people no longer earn rewards by recommending friends to register accounts, but exchanges may also not be able to lure new customers by giving away 100 BTC to new account registrants.

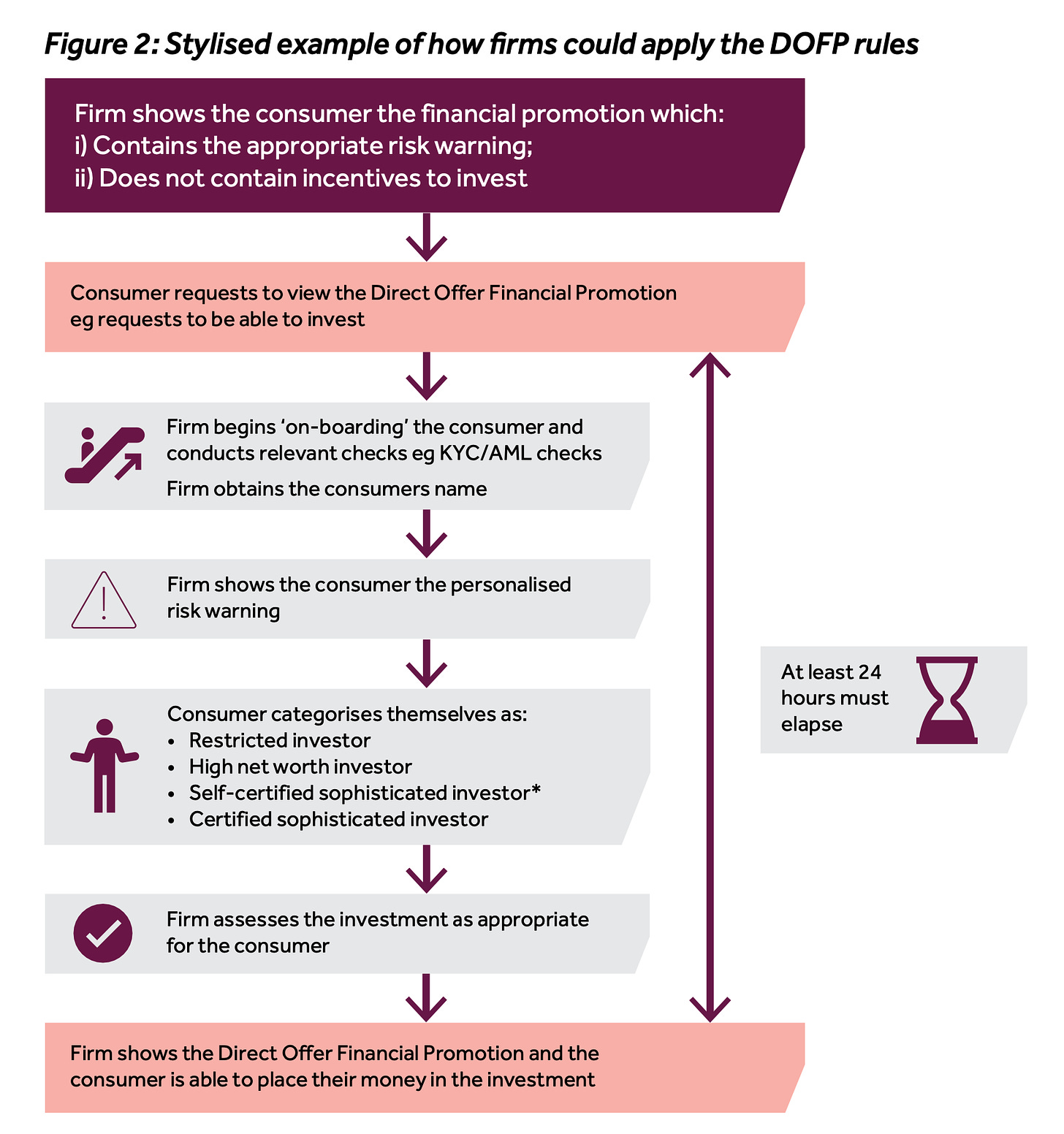

Finally, the FCA introduced a new regulation for a 24-hour cooling-off period for investment. This is in response to the initial classification of cryptocurrency assets. Because investing in cryptocurrency carries substantial risk, the FCA requires companies to reserve at least 24 hours for investors to 'regain their senses' before proceeding with the next step.

At first glance, this rule seems to have widespread implications and crypto industry players have expressed opposition, arguing that this deliberately added process could lead to customer attrition. But based on my actual experience, it's not that serious. It depends on where the start and end of the 24 hours are.

For example, in the almost universally experienced case of registering with an exchange, the cooling-off period begins 24 hours after account registration. There are probably not many exchanges that allow investors to start buying and selling within 24 hours. Exchanges usually require users to upload identification, make a phone call for verification, or bind a bank account, etc., and the whole process often takes more than 24 hours. Once the identity is verified, it can be considered as having cooled off, and trading can begin.

From these rules, it's not hard to see the UK FCA's attitude towards cryptocurrencies. The US government takes a top-down approach with the attitude of 'what's new under the sun?' and insists on treating cryptocurrencies as some kind of asset class that it is familiar with and has management

rules for. But the UK government is more pragmatic, starting from the results, assessing the specific risks of cryptocurrencies, and then going back to discuss how to adjust the regulations to balance industry innovation and investor protection.

This makes it easy to understand why a16z chose to set up its first overseas office in the UK. If blockchain will eventually become as prevalent as cars, then while the US is still debating whether cars are a type of carriage, the UK is already setting road rules for driving cars.

Blocktrend is an independent media outlet sustained by reader-paid subscriptions. If you think the articles from Blocktrendare good, feel free to share this article, join the member-created Discord for discussion, or add this article to your Web3 records by collecting the Writing NFT.

In addition, please recommend Blocktrend to your friends and family. If you want to review past content published by Blocktrend, you can refer to the article list. As many readers often ask for my referral codes, I have compiled them into a single page for everyone's convenience. You are welcome to use them.