Tornado Cash Landmark Ruling: The Return of the Platypus and the Unsanctionable Smart Contract

#653

GM,

Last week, the U.S. Federal Appeals Court (equivalent to Taiwan's High Court) delivered a groundbreaking ruling by overturning the Treasury Department's sanctions against Tornado Cash, a cryptocurrency mixer. This decision is nothing short of historic! What’s even more remarkable is that Judge Don R. Willett explicitly reminded the U.S. government in the ruling that addressing regulatory challenges brought by emerging technologies should be the responsibility of Congress through new legislation, rather than relying on courts to "flexibly interpret" outdated laws to fill the gaps. It was a direct wake-up call to the government.

This ruling shakes the very foundation of the U.S. government's recent approach to cryptocurrency regulation—reminding us that there’s nothing truly new under the sun. It marks yet another moment where technology challenges the boundaries of the law. Many have hailed this as a victory for privacy, but that only tells half the story. The court did not overturn the sanctions because privacy is important; rather, it was because the government lacks the authority to sanction smart contracts. To understand the lawsuit's nuances, we need to start with why mixers like Tornado Cash were sanctioned in the first place.

The Mixer Ban

Tornado Cash is a tool for privacy accessible1 to the general public, helping users create a financial disconnect on the blockchain. According to its official website:

Tornado Cash enables private transactions on the blockchain. It enhances transaction privacy by severing the on-chain link between the source and destination addresses. It achieves this by using smart contracts to accept cryptocurrency deposits and allowing users to withdraw them to a different wallet address.

For instance, many startups pay salaries in cryptocurrency and require employees to provide wallet addresses. To prevent their company from easily discovering how much cryptocurrency they hold, some employees first transfer their salaries to Tornado Cash to create a financial break, before ultimately depositing the funds into their personal wallets. While the amount of assets someone holds isn’t necessarily a secret, it also doesn’t need to be entirely exposed to their employer. This is the essence of privacy—a basic human right Tornado Cash aims to protect.

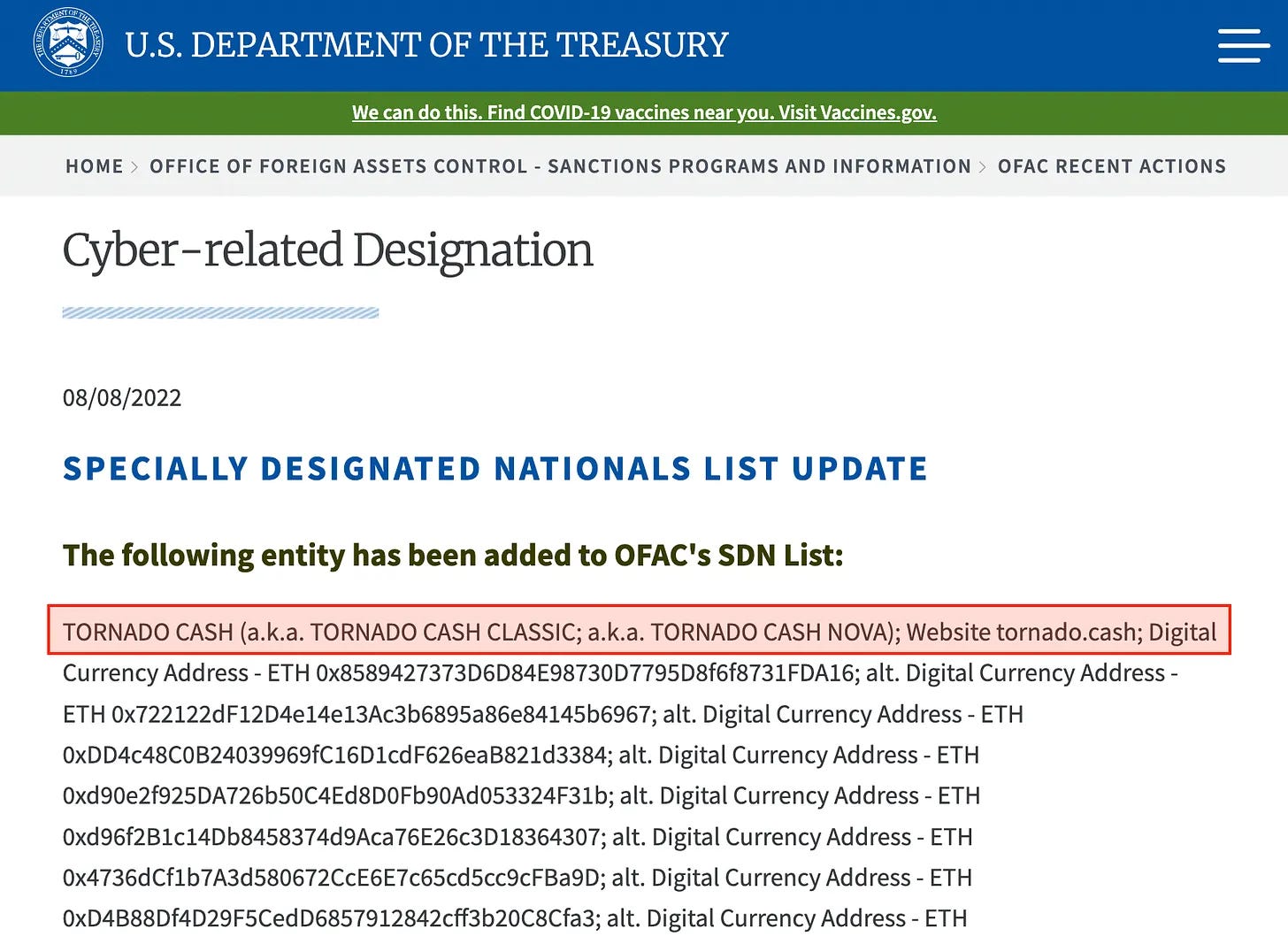

However, if you search for Tornado Cash, most results are news related to hackers and money laundering. North Korea’s “hacker elite team,” the Lazarus Group, is its most infamous user. Time and again, people have watched in dismay as hackers transferred cryptocurrency worth hundreds of millions of dollars into Tornado Cash, after which the funds simply vanished. The amount of money North Korea has laundered through mixers rivals its annual export revenues, effectively creating a massive loophole in economic sanctions. This enraged the U.S. government, which decided to sanction2 Tornado Cash altogether. According to a 2022 announcement:

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) announced sanctions against the cryptocurrency mixer Tornado Cash. Since its creation in 2019, the service has been repeatedly used for money laundering, processing over $7 billion worth of cryptocurrency. While most cryptocurrency activity is lawful, bad actors can use mixers, darknet markets, and exchanges to evade sanctions.

This was a "scorched earth" approach. Even though the U.S. government recognized that the majority of mixer use cases are legitimate, it imposed severe sanctions because it couldn’t stop North Korean hackers from exploiting the tool.

After the sanctions were issued, the market was thrown into turmoil.

Circle, the issuer of USDC, immediately announced it would freeze all USD stablecoins held in Tornado Cash. OKX exchange reacted even more harshly, labeling any funds coming from the mixer as “dirty money.” Accounts receiving funds from Tornado Cash were outright closed. The most controversial development, however, was the arrest of developers who had previously modified Tornado Cash’s smart contract code, with some facing the possibility of decades-long prison sentences. Naturally, Tornado Cash’s website became inaccessible shortly thereafter.

Unhappy with the sanctions imposed by the U.S. Department of the Treasury, Tornado Cash users filed a lawsuit. Although they lost in the initial trial, the U.S. Court of Appeals recently delivered a surprising decision, ruling that the Treasury had overstepped its authority and that the sanctions must be revoked.

The appellate court’s decision was unexpected, but the reasoning wasn’t based on privacy or freedom. In fact, the judge personally supported the government’s sanctions but acknowledged that the current laws simply couldn’t justify them. As the ruling explicitly highlighted legal inadequacies, many speculate that the Treasury is more likely to seek legislative amendments than pursue an appeal. This twist is what makes the entire legal turnaround so fascinating.

The Rationale Behind the Lifting of Sanctions

The plaintiffs in the case were six Tornado Cash users. However, this wasn’t a simple David vs. Goliath tale; the plaintiffs were backed by Coinbase’s legal team and donations from the cryptocurrency community.

This strong support was reflected in their legal strategy. Instead of escalating the case into a debate over universal values like privacy and freedom, the plaintiffs tactically focused on the most winnable aspect, helping the court quickly grasp the unique nature of Tornado Cash’s smart contract. According to the court’s decision:

The court agrees that the Treasury’s efforts to combat foreign money laundering are justified. However, current laws cannot adequately address emerging technologies. The International Emergency Economic Powers Act (IEEPA), enacted during President Carter’s administration in 1977, requires amendments from Congress to regulate modern innovations like mixers. Until then, Tornado Cash’s immutable smart contracts do not qualify as “property” belonging to any foreign individual or entity, and thus: (1) cannot legally be sanctioned, and (2) the Treasury has exceeded its statutory authority.

This reasoning is profoundly “legalistic.” Most people assume the government naturally has the right to sanction any target, but legal experts delve into whether the government has overstepped its authority, unnecessarily restricting individual freedoms.

The IEEPA, cited by the Treasury, was born in 1977 during the Cold War. At that time, besides developing military weapons, the U.S. created this economic tool, granting the president sweeping powers to freeze Soviet bank deposits in the U.S., ban trade between American companies and the USSR, and seize Soviet assets within U.S. borders.

Fast-forward to 2022, the Treasury invoked this law to sanction Tornado Cash and its so-called “property” — its smart contracts. Theoretically, the six plaintiffs could have challenged the Treasury on three main fronts:

Freedom of Speech: Arguing that writing code is a form of free expression.

Responsibility: Asserting that users, not neutral tools, should be sanctioned.

Privacy and Security: Advocating for anti-terrorism and anti-money-laundering efforts that still protect personal privacy.

However, they chose not to confront these issues head-on. Instead, they zeroed in on a detail that had gone largely unnoticed: that Tornado Cash’s smart contracts do not constitute “property.” This implied the Treasury had overreached, expanding the authority granted by law beyond its intended scope.

Surprisingly, this ambush strategy succeeded. The judge, in the decision, meticulously analyzed the definition of “property,” ultimately concluding that Tornado Cash’s smart contracts are not property and thus revoked the sanctions:

The Supreme Court defines property as “something that can be owned, either as a tangible object or a right.” When someone owns property, they generally have the right to possess and control it, with exclusion rights being fundamental. However, the immutable smart contracts involved in this case are not property because such contracts cannot be owned.

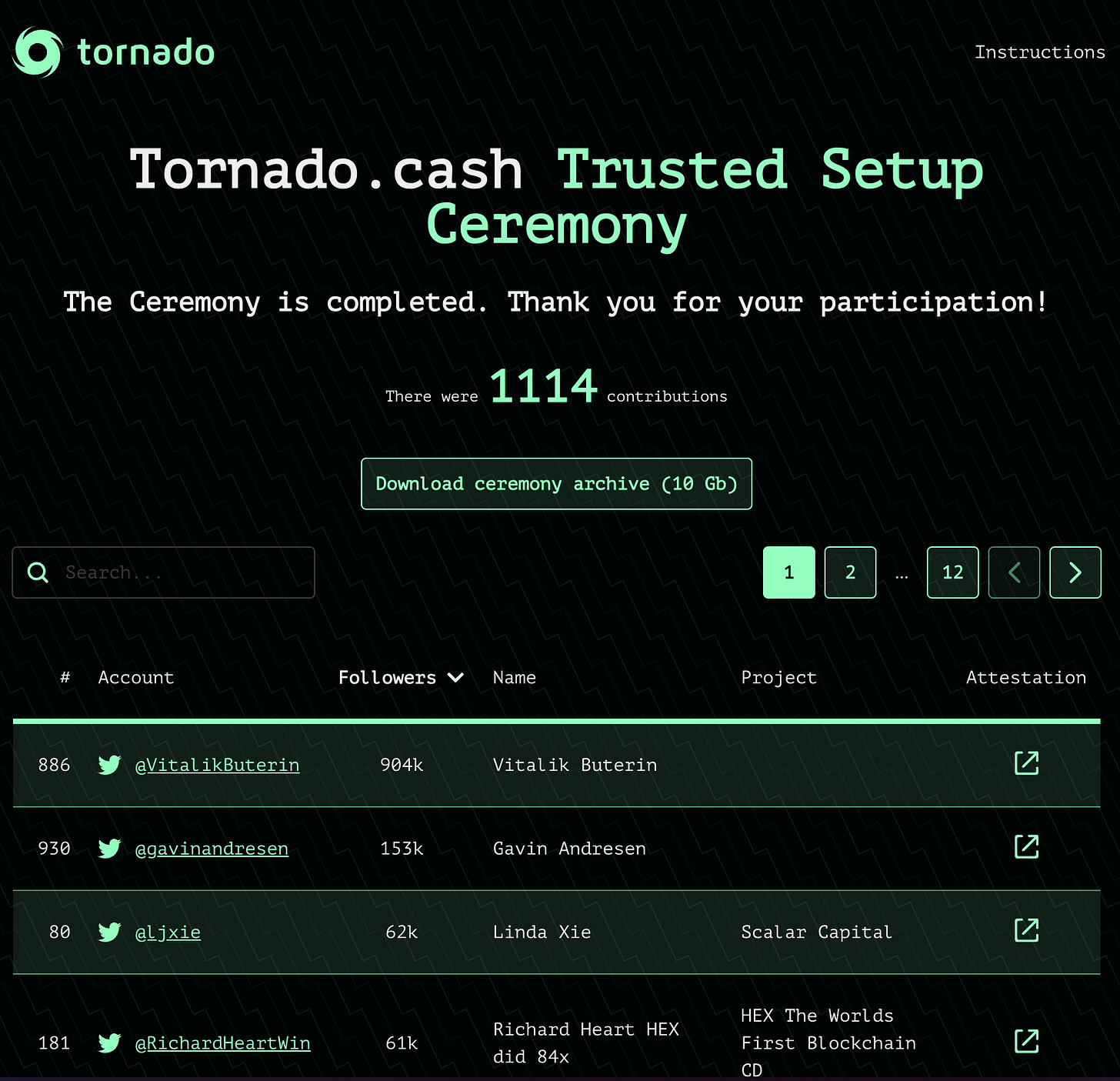

Most smart contracts are designed to allow for updates, upgrades, or emergency shutdowns. But the developers of Tornado Cash had deliberately relinquished these powers early on to achieve true decentralization. In 2020, they hosted what they called a Trusted Setup Ceremony, during which the ability to modify the smart contract was “permanently laid to rest.” Over 1,100 participants witnessed the event, which transitioned Tornado Cash’s smart contracts into a permanently immutable state. Unless the Ethereum blockchain itself is entirely shut down, the program will continue to execute automatically based on its preset rules, immune to any external interference.

It was this “Trusted Setup Ceremony” that convinced the judge to overturn the initial ruling, determining that Tornado Cash’s smart contracts are akin to a kite with its strings cut—completely beyond the control or ownership of any individual. Since the smart contracts could no longer be classified as “property,” there was no entity left to sanction.

However, this raises a larger question: What exactly is Tornado Cash’s smart contract? How should it be managed? The judge concluded that it represents a novel financial service created by technology—unprecedented and ownerless—requiring entirely new legislation for regulation. Put simply, it’s a platypus.

The Unsanctionable Platypus

I’ve previously likened cryptocurrencies to a platypus3—an egg-laying mammal. The U.S. government has long refused to acknowledge the existence of such a “platypus” in the cryptocurrency world, clinging to the belief that traditional classifications are infallible—cryptocurrency must simply be a form of security. This overestimates human foresight while underestimating the diversity of nature.

Now, even smart contracts have become judicially recognized as “platypuses,” defying traditional legal categories and momentarily falling outside the reach of regulation. The ruling states:

The International Emergency Economic Powers Act (IEEPA), enacted in 1977, predates the modern internet… We fully understand the practical issues arising from technologies that fall beyond the Treasury’s sanctioning authority. However, we must adhere to the law, not arbitrarily modify it. The primary role of legal interpretation is to discern the law’s inherent meaning and limits, not what judges wish it to be… It is not the court’s duty to fill legislative gaps or mitigate adverse outcomes. We reject the Treasury’s request to redefine the law under the guise of interpretation. Legislation is Congress’s responsibility.

This is an exceptionally bold ruling. While the judge recognized the potential risks of revoking the sanctions, they had to concede that current laws are inadequate. The matter has been thrown back to Congress, which must address it through legislation.

This is a pivotal moment where technology challenges the boundaries of law. But cryptocurrency is not unique in this regard. When automobiles first appeared, the British Parliament attempted to regulate them as though they were carriages. Each automobile required someone to walk ahead waving a red flag to avoid scaring horses. Many mock the “Red Flag Act” today, failing to realize a similar technological revolution is unfolding now.

Traditionally, financial services always had an identifiable operator behind them. Tornado Cash, however, set a precedent, making smart contracts akin to mathematical formulas—available to everyone yet owned by no one.

This disrupts established perceptions and surpasses existing legal frameworks. Laws inherently lag behind technological innovation; during the early stages of new technologies, regulatory gaps are the norm. The real danger is when governments refuse to adapt, stubbornly labeling cars as nothing more than “horseless carriages.”

Over the past few years, the U.S. government has tried to manage blockchain technology using outdated paradigms, sidestepping the core issue: decentralization’s very essence is that it cannot be controlled by anyone. It’s the proverbial elephant in the room—visible to all yet discussed by none.

This time, the judge pinpointed the crux of the problem, asserting that the government cannot regulate fundamentally unownable smart contracts using a law from 1977 designed to govern “property.” The significance of this ruling is not in supporting or opposing cryptocurrency but in the judiciary’s recognition that smart contracts have transcended the current legal framework.

The most significant impact of this ruling isn’t the revocation of the sanctions or a victory for privacy but the initiation of a new societal dialogue. It forces us to acknowledge the existence and implications of smart contracts.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.