The Three Layers of Significance in the Creativity Secret Room Case | Two Common Questions about Bitcoin Halving

#601

GM,

This Saturday at 2 PM, I've been invited to speak at the MaiCoin lecture hall for a discussion titled "Bitcoin Halving: Bull Market Code or Bubble Burst?" with another guest, Mr. Li Jiansi. The event is free, and everyone is welcome to sign up.

This article covers two important pieces of news: the three layers of significance highlighted by the Creative Private Room case, and what to expect from this week's Bitcoin halving. Let's start with the Creative Private Room.

Three Layers of Significance

Since Blocktrend exposed the four wallets related to the Creative Private Room, public attention on the case has shifted gradually from Huang Zijiao to website operations. Background information on the incident is recommended through reports from "mnews" and "The Reporter," with XREX's analysis report also detailing the flow of funds. However, the website administrators are still at large, and the Creative Private Room has cunningly hidden its new payment addresses, requiring written requests for access, which adds complexity to tracking. Whether the authorities can bring the masterminds to justice remains uncertain.

I'd like to add further layers of significance highlighted by this incident:

Transparent and Traceable Online Money Flow

The New Norm of Collaborative Crime Prevention

The Race between Money Flow and Information Flow

Cryptocurrency's unlawful use is often reported in the news, leading many to associate it solely with criminal activity. However, this is a stereotype. Through this incident, many now understand how transparent online money flow can be. Transactions— who sent money to whom and when— are not only publicly accessible but also globally backed up by decentralized "miners," preventing post-transaction tampering or destruction of evidence.

Previously, law enforcement had to rely on official powers to obtain financial data from institutions, but now anyone can access data from the blockchain. Numerous free tools for visualizing money flow are available online to aid in investigations. This is already common overseas, with renowned online detective ZachXBT exposing criminal footprints full-time, having not only helped French authorities track down suspects but also exposed many grey-area schemes1.

However, these are stories of others; the Creative Private Room has further acquainted Taiwanese society with online money flow. It's believed that many will now, like me, instinctively check the inflow and outflow records upon seeing a wallet address. This prompts consideration of new possibilities for future cases— collaborative crime prevention between authorities and the public.

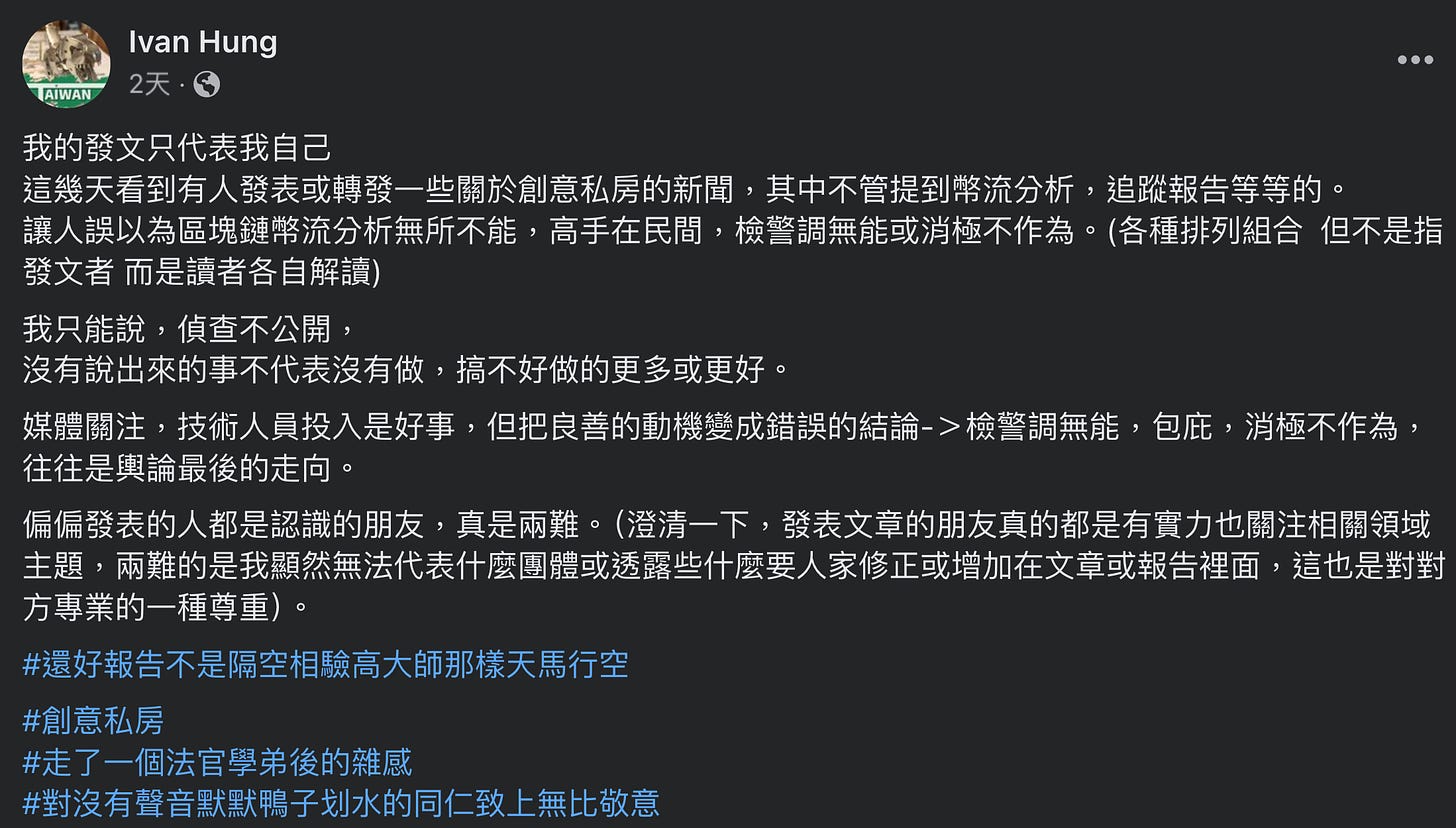

Prosecutor Hong Min-chao, familiar with online money tracking, has spoken out on behalf of the quietly working investigators, implying that they had long been aware of these clues but couldn't disclose details due to ongoing investigations.

I can fully understand the dilemma faced by law enforcement in handling cases, often fearing premature exposure that could compromise investigations. I also believe that authorities have likely known the wallet addresses associated with Creative Private Room for some time but chose not to act prematurely, opting instead to wait for the opportune moment. However, such investigative methods are likely to face significant challenges in the future.

In traditional criminal finance, only a few financial institutions are privy to information, allowing law enforcement to conduct covert operations. However, blockchain-based finance operates inherently in the open, making it public information. Once someone exposes criminal financial flows, triggering public opinion, law enforcement finds it challenging to remain passive.

In this incident, the blockchain anti-money laundering tool, MistTrack, upon identifying the four wallet addresses linked to Creative Private Room, immediately flagged them as high-risk addresses and automatically notified global exchanges to initiate collaborative defense mechanisms, showcasing a different operational logic.

Over the past few years, I have been invited by judicial units multiple times to share practical experiences with cryptocurrency. As law enforcement gains more experience, the use of tools is no longer a concern. However, mastering tools is just the first step; investigative methods must also evolve and incorporate private entities such as exchanges and anti-money laundering tools as collaborative partners. Otherwise, tensions between law enforcement and society may deepen, with legislators more frequently presenting clear evidence of financial flows, questioning why law enforcement remains inactive—an untenable situation.

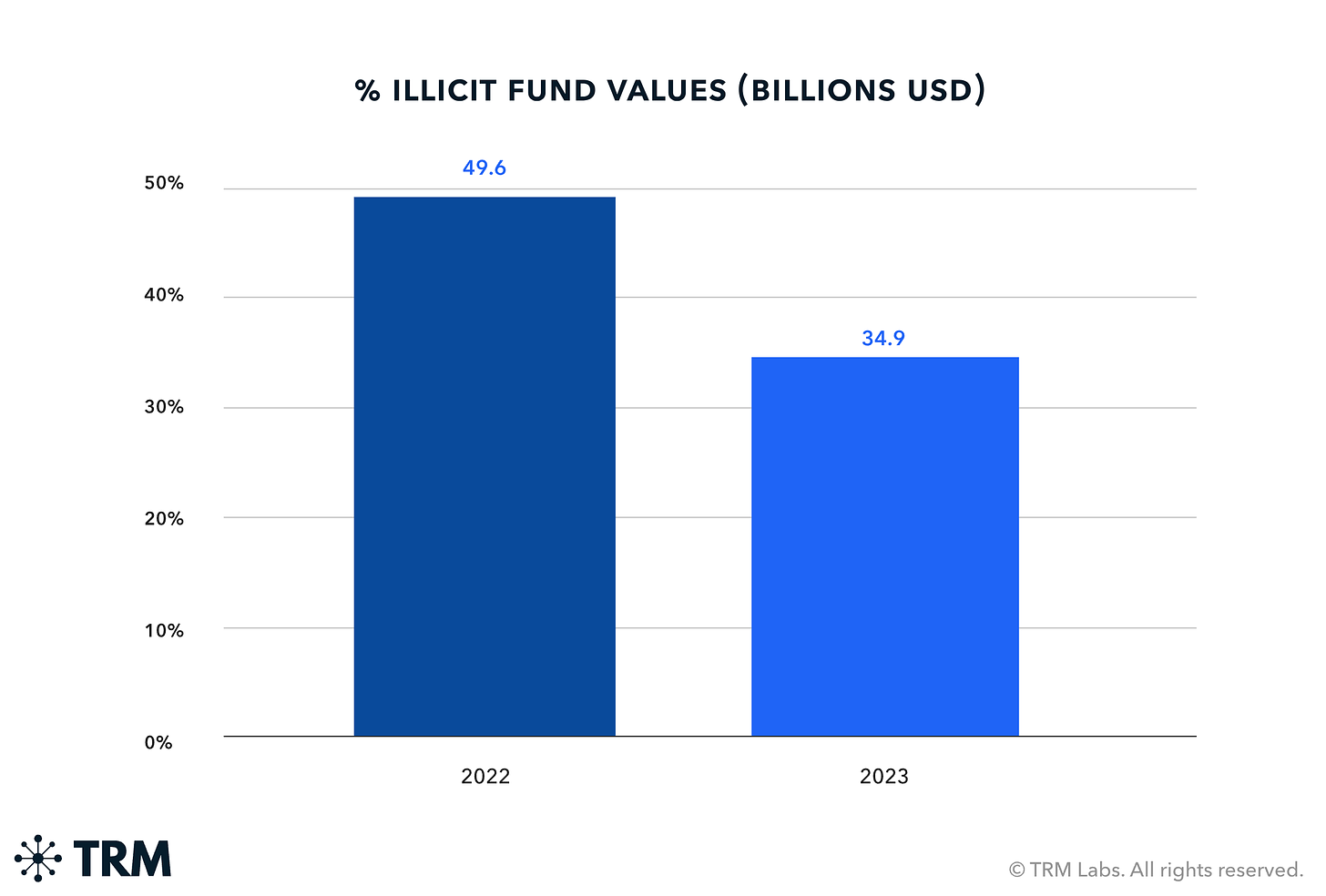

Previously, cryptocurrencies were often associated with illicit activities, mainly due to criminals exploiting the lack of robust online financial tracking tools globally. As these tools mature, illicit financial flows from cryptocurrencies decreased from $49.5 billion in 2022 to $34.8 billion in 2023. Despite the significant reduction of nearly one-third, there is still ample room for improvement. The primary challenge lies in the race between financial flows and information.

Using the Creative Private Room case as an example, they might have utilized numerous straw accounts to shuttle funds between different wallets and exchanges. Even if the money flow is traced, the key is whether they can catch the culprits red-handed. Cryptocurrencies enable global money flow as conveniently as information, but law enforcement's integration of multiple sources of information takes time. Each cryptocurrency crime case is like a race between information and money flow, with money flow moving faster than information. Law enforcement may only end up catching a bunch of straw accounts. Only when the speed of information integration matches the transfer of money flow is there a chance to catch the culprits.

Bitcoin Halving

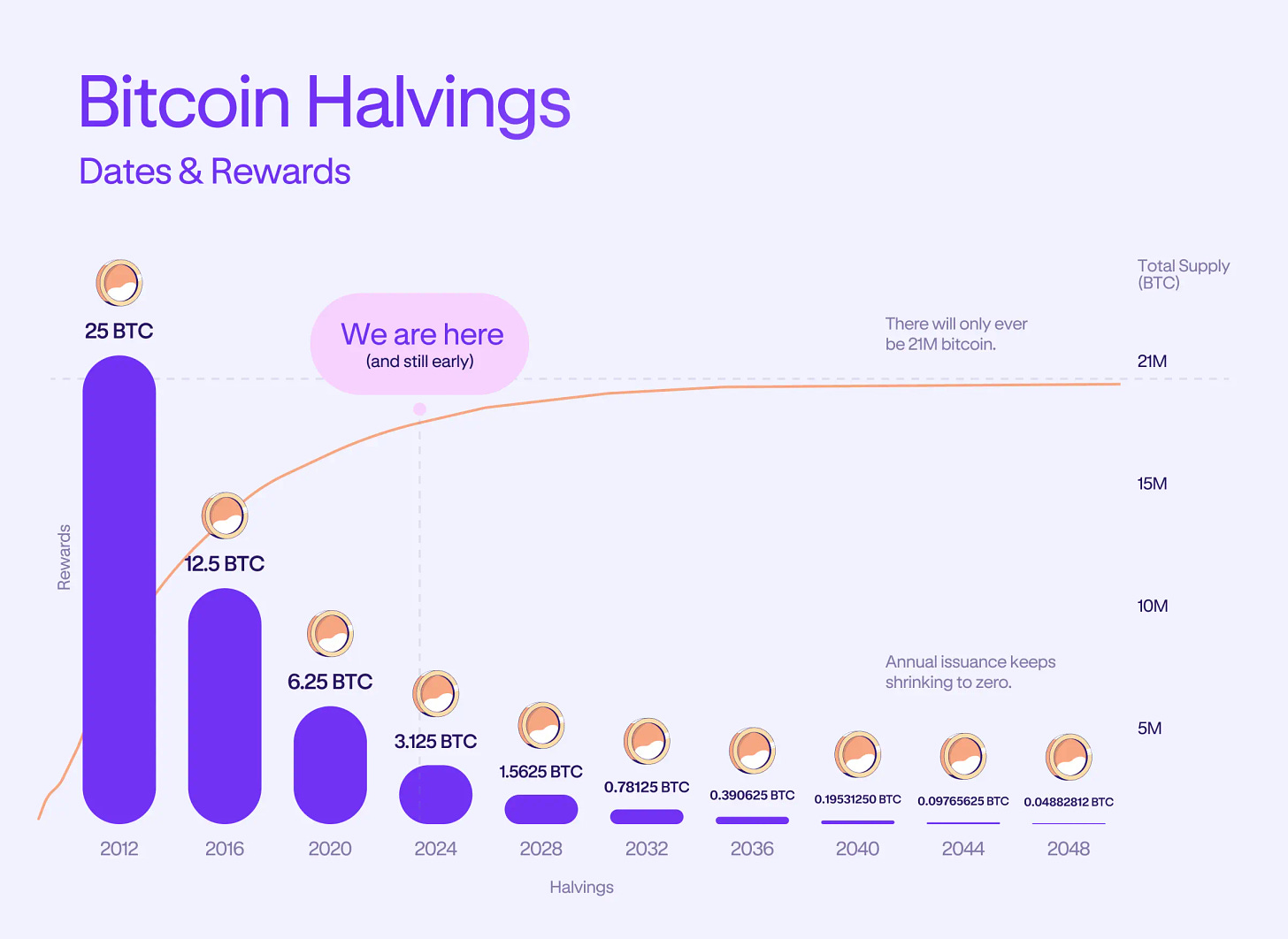

The roughly four-year cycle of Bitcoin halving is about to occur this week. Here are a few figures for reference:

This is Bitcoin's 4th (or 29th from the end) issuance rate halving.

The precise event will occur at block number 840,000.

The block reward after halving will be 3.125 BTC.

By then, 93.75% of BTC will have been mined.

In the year following the past 3 halvings, BTC's historical (USD) price surged by 88 times, 3 times, and 5 times, respectively.

Here are answers to two common questions regarding Bitcoin halving:

Will the price of Bitcoin rise after halving?

Will the decrease in mining profitability due to halving make Bitcoin less secure?

The first question already has a straightforward answer, but a simple response may not be convincing enough, so let's delve into it more concretely.

Will the price rise?

To answer this question, we first need to understand who is asking. The chart below illustrates the historical price of Bitcoin in the eyes of Argentinians. Even if someone has little interest in currency, they know that upon receiving Argentine pesos, it's best to quickly convert them into BTC because the price of Bitcoin only rises. If you warn an Argentine about investment risks, they will likely caution you about the government's printing risk instead.

If the person asking is a loyal Bitcoin believer, your response should be adjusted to: "The price has never changed. 1 BTC always equals 1 BTC! It's just that the fluctuations are significant every time you convert to 'foreign' currency. But that's someone else's problem."

The following response is only applicable if you are sure that the other party's primary spending currency is similar to yours, such as USD, TWD, or HKD.

The fluctuation in BTC price is related to market supply and demand. When demand exceeds supply, prices rise; when supply exceeds demand, prices fall. The halving of Bitcoin issuance directly affects the supply of BTC entering the market. Miners who used to mine 900 BTC per day will only mine 450 BTC per day after halving. If demand remains constant, the price of BTC should rise. However, the unpredictability of BTC price is due to constantly changing demand.

For example, in 2021, when Elon Musk allowed consumers to purchase Tesla with BTC, BTC gained a tangible use case, and Musk's influence also boosted market sentiment2, driving the price of BTC to briefly reach $65,000. However, three months later, Musk reversed course, citing environmental concerns and discontinued BTC payments, causing the price to plummet3.

Political, economic, or environmental issues all affect market demand, too numerous to list. I choose to believe that over time, more and more people will start buying BTC due to factors such as ETF listing. At this point, with decreasing supply and increasing demand, prices will rise.

The second question is more advanced. Even those who have bought and sold Bitcoin may not necessarily understand how Bitcoin operates.

Is Bitcoin Secure?

After Bitcoin halving, is the system still secure? The security of the Bitcoin system is not protected by technology alone but by the collective effort of miners worldwide. Satoshi Nakamoto designed a set of economic incentives to attract miners, which can be summarized by the following two rules:

The Bitcoin system rewards miners who contribute computational power.

Miners, while mining for profit, also protect the security of the Bitcoin system.

The higher the price of Bitcoin, the more miners are willing to invest in mining. More miners and higher computational power contribute to a more secure Bitcoin system. Conversely, if there are too few miners with low computational power, hackers could gain "absolute accounting rights" by controlling a few miners and manipulate transaction records. Therefore, having a large and decentralized pool of miners participating in mining makes it difficult for hackers to compromise the system.

The conditions for miners to participate in mining are straightforward: if it's profitable, they will continue. Miners earn BTC as income, but their expenses are usually in fiat currency. Currently, the "startup cost" for miners is approximately $40,000. This is calculated based on the global Bitcoin mining power consumption combined with the "daily issuance rate" to estimate the average production cost per Bitcoin.

Bitcoin halving reduces the "daily issuance rate" by half. If miners continue to work under the same electricity consumption, the average production cost per Bitcoin will double to $80,000. Currently, the price is less than $70,000, so after this round of halving, some miners with high operating costs may be eliminated.

Two major factors affecting miner operating costs are energy prices and equipment efficiency, with the former usually making a larger difference. In other words, where miners mine is more important than what equipment they use. In the article "Bitcoin Doesn't Waste Energy, Destroying the Environment Is Overstated," I pointed out:

Taiwan relies mainly on thermal and nuclear power generation. For Taiwanese, every unit of electricity should be used wisely and not for mining. However, not every country's energy structure is similar to Taiwan's. Places like Iceland, Sichuan, and Yunnan in China, which are major Bitcoin mining centers, rely mainly on renewable energy for power.

These renewable energy sources not only suffice for national use, but Iceland's government actively develops energy-intensive industries to export electricity-derived products to other countries. Bitcoin mining has become a new member of energy-intensive industries. Aluminum refining is highly energy-intensive, with relatively low transportation costs. Many countries with surplus energy resources build aluminum smelters to utilize their surplus natural resources. Iceland's energy production far exceeds local capacity, so they export energy through aluminum products. Now, they are developing Bitcoin mining under the same natural conditions and can export instantly through the internet.

Each Bitcoin halving affects the distribution of global Bitcoin miners. Over time, the distribution of miners will shift from decentralized to concentrated, with fewer places suitable for mining, ultimately leaving only a few major mining centers globally.

In terms of system resilience, the more concentrated the miners, the more fragile the system becomes. Strictly speaking, the security of Bitcoin does decrease. However, there are many factors affecting miner income: rising prices, increased transaction fees, or competitors exiting the market. Recently, transactions on the Bitcoin blockchain have been active4, and transaction fees alone are enough to offset miner losses. Additionally, miners' main competitors are other miners, so when competitors retreat, other miners receive more block rewards.

In the long run, miners will move towards lower costs. Recently, the U.S.-listed mining company Marathon announced plans to reduce mining costs to zero by 2028. As competition among miners intensifies, the barrier to entry into mining increases, and the cost and difficulty of obtaining a significant amount of computational power for hackers also increase. Therefore, it can be said that the security of Bitcoin is actually improving. Currently, even with slight changes in the security of Bitcoin, there is no need for the general public to worry. Bitcoin remains secure after halving.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.