GM,

This past week, cryptocurrency prices plummeted significantly due to a batch of BTC that had been locked away for 10 years starting to stir, preparing to enter the market.

Back in 2014, the world's largest Bitcoin exchange, Mt. Gox, declared bankruptcy, and a total of 850,000 BTC went missing, which are now valued at nearly $50 billion. Mt. Gox has finally completed its asset liquidation and began returning BTC to its users in batches starting last week.

Most of the lost 850,000 BTC are now impossible to recover, but it is estimated that 140,000 BTC will gradually be unlocked. Originally, this was good news—who would have thought that BTC lost 10 years ago could still be retrieved? However, over the past 10 years, Bitcoin's price has increased 100-fold. The market is concerned that this batch of unlocked BTC will be sold off and converted into cash.

Mt. Gox once accounted for 80% of the world's trading volume, being synonymous with Bitcoin trading, even more dominant than Binance at its peak. Even now-prominent exchanges like Coinbase and Kraken were lagging behind back then.

However, Mt. Gox was also quite short-lived, declaring bankruptcy just 4 years after its founding. Most people probably hadn't even entered the crypto space by then. This article takes you back 10 years to see how people bought and sold Bitcoin and how the Bitcoin now being returned was lost back then.

Magic: The Gathering

2010 was a crucial year in the history of Bitcoin's development. While most people are familiar with Bitcoin Pizza Day, there was another individual who did something even crazier that year—Gavin Andresen, a Bitcoin developer who communicated with Satoshi Nakamoto via email.

To let more people experience BTC, Gavin set up the Free Bitcoins website1 in June 2010. By simply entering a CAPTCHA and filling in a wallet address, anyone could receive 5 BTC for free. When the website closed six months later, Gavin had given away a total of 19,700 BTC, earning him the title of the "most foolish" in history.

The main character of this article, the Mt. Gox exchange, also transformed into a Bitcoin exchange in 2010. The full name of Mt. Gox is Magic: The Gathering Online Exchange, originally a trading site for the card game Magic: The Gathering.

In 2010, Mt. Gox founder Jed McCaleb stumbled upon an article introducing Bitcoin. He wanted to buy some to try it out, but found that there was no market for BTC transactions, and the buying process was quite complicated. As a business-savvy software engineer, Jed decided to transform Mt. Gox into a Bitcoin exchange and bought his first Bitcoin from his own website.

However, Jed decided to sell it just half a year later. In an interview, Jed stated that while Mt. Gox was cool and necessary, he didn't want to run a technically boring exchange for the long term.

Afterwards, Jed went on to found Ripple Labs, serving as CTO and issuing Ripple (XRP). He later founded the Stellar blockchain and issued Stellar (XLM), becoming a well-known billionaire. In contrast to Jed's success, the French engineer Mark Karpelès, who took over Mt. Gox, did not fare as well.

Running an exchange was very challenging. Most people were encountering Bitcoin for the first time. The exchange had to handle a large volume of user inquiries on one hand, and frequent hacker attacks on the other. Jed was eager to get rid of this hot potato, whereas Mark only realized the severity of the situation after becoming the boss.

Eventually, Mt. Gox shut down in 2014, and Mark was taken away by the Japanese police.

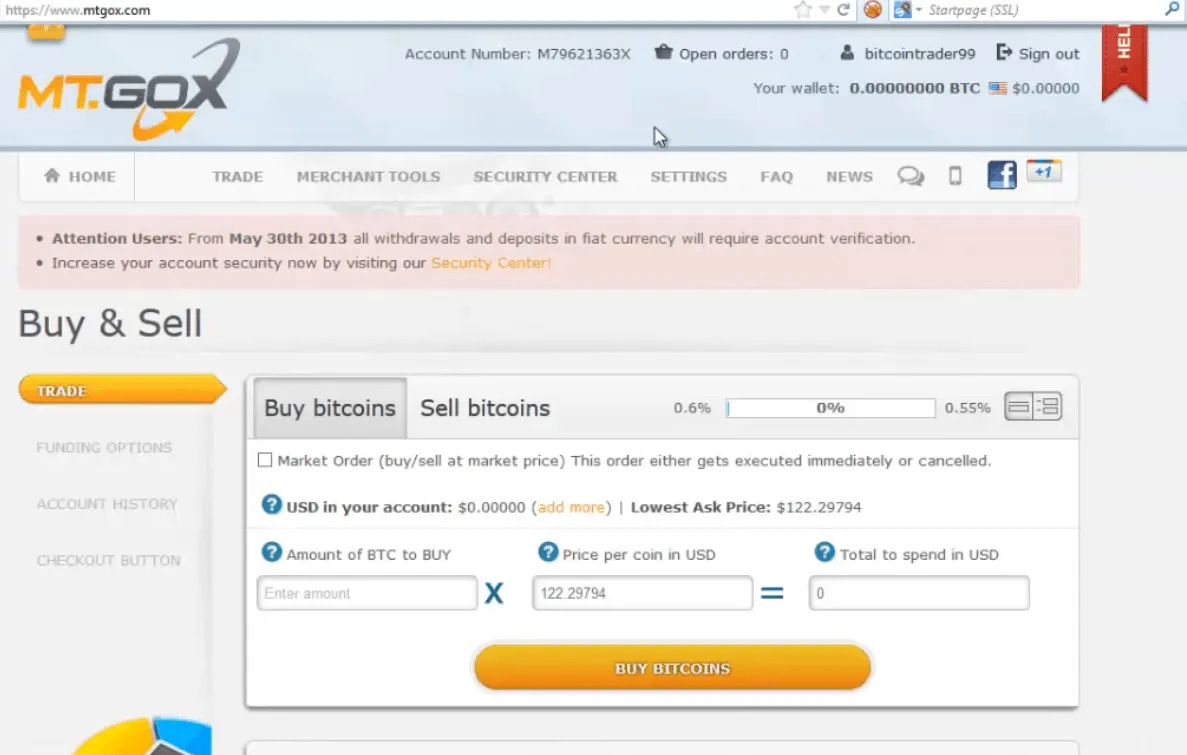

The First Exchange

Below is a screenshot of the Mt. Gox exchange interface from back in the day. Its functions were quite simple. The entire exchange only supported Bitcoin and fiat currency transactions, with no other cryptocurrencies available for trading. But just facilitating smooth deposits and withdrawals for users worldwide was a major challenge.

At that time, this was the only exchange in the world. Mt. Gox was based in Japan, and deposits and withdrawals were done via international wire transfers. In other words, before buying Bitcoin, you had to go to a bank and make a transfer in person. When the money reached Mt. Gox’s bank account, they would take a few days to verify the source of the funds before the money appeared in the exchange account.

Mt. Gox was very cautious with fiat currency but was quite lax when it came to Bitcoin security. Today's exchanges mandate two-factor authentication to ensure asset security. However, as the world's first exchange, Mt. Gox had no precedent to follow. Hackers only needed to obtain a user’s account credentials to access the account, convert dollars to Bitcoin, and withdraw it. At that time, there wasn't even a trading password.

According to a June 2011 post by Mark on the Bitcoin forum:

Recently, we have encountered many cases. So far, 10 people's Bitcoins have been hacked because someone used their passwords to log into their accounts. But we have 60,000 accounts, so these should be isolated cases. Although the victims' posts on major forums have caused panic, the situation is not that serious. If Mt. Gox were really hacked, there would be more than 10 victims. We are working hard to add a 'withdrawal password' as an additional security measure.

Mark might have been right, but Mt. Gox’s security incidents continued to occur. Just a few days later, they were indeed hacked.

Hackers directly accessed the exchange administrator's account. Instead of transferring Bitcoin out, they changed the Bitcoin trading price from $17 to $0.01, acquiring 2,000 BTC at a low price and transferring it out of the exchange. Mt. Gox immediately shut down the website to prevent the situation from escalating. According to Mark's apology statement at the time:

The system currently used by Mt. Gox was built when Bitcoin was only worth a few cents, and it was not prepared for the recent explosive growth. Therefore, even though Mt. Gox handles millions of dollars in transactions daily, it is not an impregnable fortress ... Our security measures are not strict enough.

Clearly, this was not the last time Mt. Gox would be hacked. However, Mt. Gox miraculously overcame one crisis after another, and people’s trust in the exchange only increased. It wasn't until 2013, when Mt. Gox faced a new crisis, that the situation took a sharp turn for the worse.

Bank Accounts Frozen

In May 2013, the FBI announced the seizure of Mt. Gox's bank accounts, totaling $2.9 million. The reason was that Mt. Gox had stated they were not engaged in money transfer services when opening the bank accounts, violating anti-money laundering regulations. A few months later, another Mt. Gox bank account was frozen by the U.S. government.

The account freezes directly impacted Mt. Gox's ability to process USD withdrawals. Users found that after selling BTC for USD, they could not withdraw their funds, causing market panic. Mt. Gox announced that this was a temporary situation but did not mention the account freezes by the U.S. government.

Internally, the exchange was in disarray. Despite the frozen bank accounts, engineers did not stop users from making deposits. Users could still deposit money into Mt. Gox accounts, but Mt. Gox could not access those funds.

A few days later, Mt. Gox announced the resumption of withdrawals, but only a few users were successful. Online public opinion was already boiling, and some people even protested outside Mt. Gox’s office in Tokyo, Japan. Thus, Mt. Gox muddled through until February 2014, when it announced the closure of the exchange and filed for bankruptcy in a Japanese court a few days later.

It was only after the documents were exposed that people realized the U.S. account freeze was just the last straw. The main reason for the collapse was a series of unknown hacking incidents over the past four years, resulting in the loss of 850,000 BTC, of which 750,000 belonged to users. Mark was, of course, under heavy suspicion, with people accusing him of embezzlement. However, after years of investigation by the Japanese government, it was found that while Mark had significant management flaws, the hackers were others.

Originally, Mt. Gox was left with nothing, but during the asset liquidation process, 200,000 BTC were unexpectedly found in a wallet that was supposed to be empty. This discovery highlights the chaos within Mt. Gox at the time; no one even noticed that 200,000 BTC were missing. Fortunately, this found amount became the main fund for compensating Mt. Gox users.

Although people could only get back a small portion of their Bitcoins, the massive price increase over the past 10 years turned it into an unexpected windfall. They also received Bitcoin Cash (BCH) from the 2018 fork2. Many people joked that if Mt. Gox hadn’t “forced them to lock up” their Bitcoins, they would have sold them all long ago 🤣. If I were one of those affected, I would certainly consider selling some of the BTC upon receiving the repayment, just to confirm that this wasn’t a 10-year-long dream.

The story of Mt. Gox reminds me of the FTX exchange3. Both rose rapidly in a short time along with the increasing coin prices. They made money so quickly that they didn’t have the “distraction” to establish proper systems, accumulating a lot of technical debt and creating room for manipulation. Users were kept in the dark until it was too late, usually when the exchange stopped withdrawals. It was only then that people realized that no matter how sincere Mark seemed or how smart SBF was, the mess they created was already too big to fix.

Both incidents underscore the need for exchange regulation. Japan’s relatively comprehensive cryptocurrency regulations came about because they were forced to clean up the mess left by Mt. Gox in 2014. This is why Japanese users were able to emerge unscathed from the later FTX incident. Although current media attention on Mt. Gox mainly focuses on its impact on coin prices, I believe its more important legacy is that it made cryptocurrencies more complete in terms of regulation and technology.

Many people envy Mt. Gox users for being able to get their BTC back. This is largely a matter of luck, but it also serves as a reward for having participated in this piece of history, allowing future users to have more convenient and secure exchanges to use.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.