GM,

Last week, Singapore's major crypto event Token2049 just wrapped up. Before the event, Solana released the following video, mocking the fact that most big crypto gatherings have more scythes than green investors.

I rarely participate in such grand events. However, from the photos shared by friends, the atmosphere seems a bit like a parallel universe. Inside, it’s all singing and dancing, while outside, the crypto winter rages on. Blocktrend has covered many Web3 startups, but we seldom discuss the failures. Recently, two DeFi and NFT startups announced their closures. This article focuses on how they handled the aftermath of their setbacks. Let’s start with the Wallet Visa card.

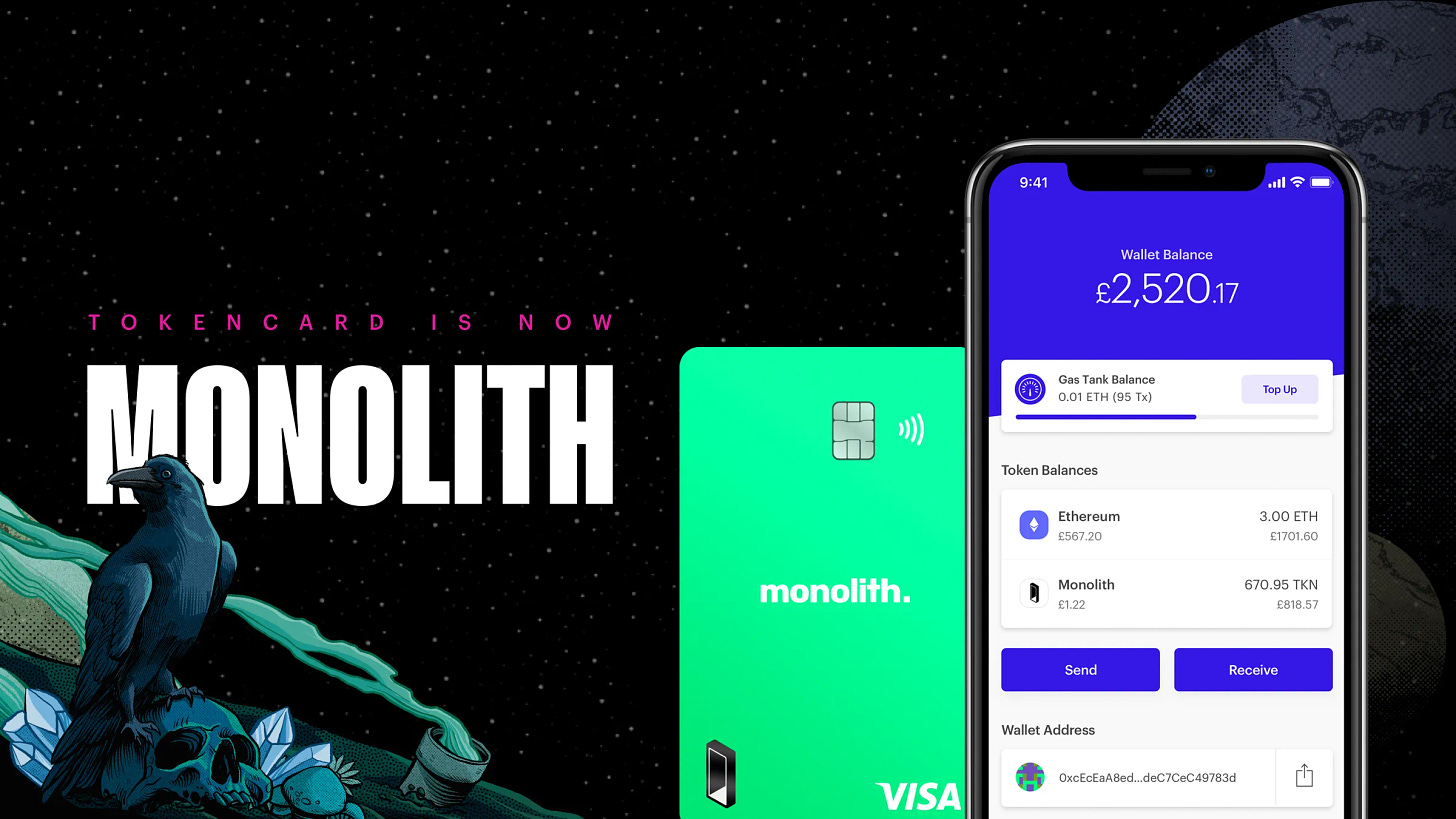

The First Wallet Visa Card Shuts Down

Last month, Blocktrend discussed the MetaMask Mastercard1. The biggest difference between it and the Crypto.com Visa card is that it’s not at risk if the exchange collapses. The MetaMask Mastercard directly deducts funds from the MetaMask wallet, where the individual manages their own assets. As long as the private key (or seed phrase) is secure, the funds can be recovered.

But who knows what will happen until it actually does? Now we have a real-life example demonstrating this. The MetaMask Mastercard’s operation model is not original. The blockchain startup Monolith pioneered this space, launching the Monolith Visa card in 2019.

This card has 35,000 users globally and has processed $113 million in transactions. Unfortunately, in entrepreneurship, it’s not about who starts first, but rather about timing. Just as companies were beginning to issue "financial cards that deduct directly from wallets," the veteran Monolith announced the closure of its operations and the discontinuation of the Monolith Visa card. Cards held by users will become invalid after October 8, 2024:

Monolith is ceasing operations, and the product will be discontinued. We will shut down this app and terminate your card account. After October 8, 2024, your Monolith card will be deactivated, and the account will be closed. You will no longer be able to manage crypto assets or load your Visa card through the app... However, you can recover your wallet using the seed phrase elsewhere and continue using it.

Why did Monolith collapse? Monolith acted as a bridge between cryptocurrency and everyday spending, but the changes at both ends of the bridge were too dramatic, eventually causing it to collapse. Monolith’s founder, Mel Gelderman, wrote about the challenges faced during the startup journey in a blog post, describing how the company was caught in pressures both internal and external.

Externally, Monolith faced challenges from partners and regulators. Gelderman explained that Monolith was the first company to issue a cryptocurrency Visa card when most issuers were reluctant to do business with the crypto space, leaving only a few partners willing to cooperate. Even during Monolith’s preparation period from 2016 to 2019, half of those card issuers had already gone out of business. Additionally, Monolith was registered in the UK. While the UK government wasn’t as aggressive as the US in cracking down on cryptocurrency, it wasn’t exactly friendly either.

On the other hand, the cryptocurrency infrastructure itself was not yet ready. Blocktrend recently discussed how multi-signature wallets would become increasingly popular2 in the future, but Monolith was essentially a product ahead of its time, advocating for multi-signature wallets in 2019 and promoting the idea that a crypto Visa card was only safe if it deducted funds directly from a wallet. Unfortunately, at that time, cryptocurrency financial cards were just becoming popular, and FTX hadn’t collapsed yet, so people would ask: What’s wrong with Monolith deducting directly from an exchange account?

Even though Monolith was later proven to be right, it was already too late because Ethereum's gas fees were too high. Monolith’s service was built on the Ethereum mainnet, and users had to bear additional on-chain gas fees for every card transaction. After 2020, gas fees for each transaction surged to tens of dollars. Unless someone had nothing but cryptocurrency left, they’d definitely choose another card to pay the bill. Monolith couldn’t wait for L2 solutions or the adoption of multi-signature wallets, nor did it have the resources to scrap and rebuild its entire product, ultimately leading to its shutdown.

Ironically, some users chose Monolith not because it was particularly user-friendly, but because they were anticipating its closure. Monolith’s main feature was that assets were stored in wallets controlled by the users themselves. Every new user who downloaded the Monolith app essentially created a new cryptocurrency wallet. However, only eligible users could link this wallet with the Monolith Visa card to make direct payments from the wallet.

Therefore, while Monolith announced the end of its services, there wasn’t much cleanup required. For users, it’s akin to having a financial card expire. Although the Monolith card can no longer be used, the wallet remains unaffected. Users just need to export their private keys and restore them using MetaMask or another wallet. Aside from losing the card, there’s no real loss or dispute for the users. This was Monolith’s graceful exit, proving that their initial commitment to decentralization was the right one. They just chose the wrong timing for their venture.

What if Monolith hadn’t stuck to its decentralized approach at the time? We can look at the NFT trading platform OurSong for answers.

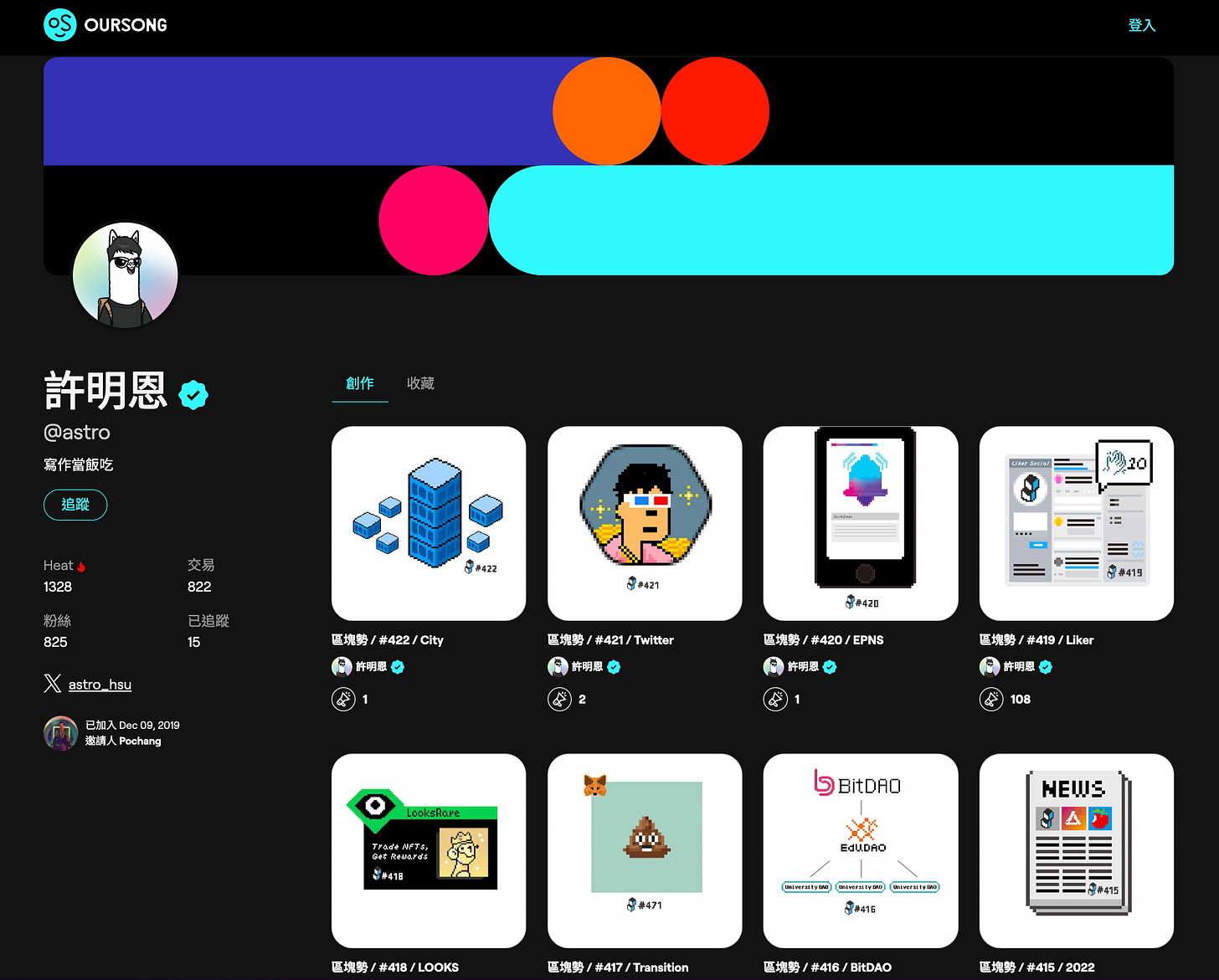

OurSong Shuts Down

OurSong was one of the easiest platforms for creating and trading NFTs. Blocktrend was among the platform’s first creators, releasing article NFTs for readers to collect before NFTs became mainstream. Not long after, Shiyuan Fried Chicken, a famous stall in Taipei's Shida Night Market, launched NFT vouchers on OurSong, catapulting the platform into fame.

At the time, some readers asked what would happen if OurSong shut down. I knew it would be a disaster. That’s why I promised a lifetime guarantee for Blocktrend NFTs, stating that, depending on the development of blockchain and the metaverse, we would migrate the NFTs onto the blockchain. Now, that promise is finally being put to use. Last week, OurSong announced the suspension of its services, and users were urged to handle the cryptocurrency and NFTs in their accounts as soon as possible:

"Due to the termination of payment-related services by Circle, the payment system used by OurSong, we will be changing our existing transaction model and undergoing a transformation. In the meantime, we will be suspending our services. OurSong will suspend all services except for withdrawals on November 30, 2024. Until then, you can still access your account and manage your personal account data. The OurSong app will stop being available for download on October 15, 2024, and services will be suspended on November 15, 2024. If you need to withdraw OSD from your account, you can still do so via the web version."

The termination of Circle's payment services is just an excuse for OurSong’s closure. The real reason is the cooling down of the metaverse hype and the lack of use cases for NFTs. OurSong is a centralized platform, and just like when a cryptocurrency exchange shuts down, people need to withdraw their assets within a certain time frame. Withdrawing cryptocurrency is relatively simple, but the most troublesome part is dealing with NFTs.

OurSong has required users to withdraw their NFTs by November 15, 2024, or the NFTs will be "buried" with the platform. However, the problem is that each NFT withdrawal incurs a withdrawal fee. Unlike cryptocurrency, NFTs can’t be easily liquidated or sold at a loss, so withdrawing all of them in one go isn’t as simple.

Users are faced with two choices: let their NFTs sink with OurSong or deposit more money to "rescue" their NFTs. I initially tried to save my NFTs, only to discover that I had no cryptocurrency left in my account to pay the withdrawal fees. With OurSong also disabling deposits, this essentially locked the NFTs on the platform. It’s a frustrating outcome and stands in stark contrast to Monolith's situation.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.