The Digital New Taiwan Dollar is Misguided! The Central Bank is Worried About Business Models and Anonymity Wallets Require Phone Numbers

#617

GM,

This article discusses the latest developments in the digital New Taiwan Dollar (NTD) and some strange phenomena I've observed. The topic involves public interest, and the full text is open for discussion and sharing.

Digital Voucher Platform

Last week, the Legislative Yuan's Finance Committee invited Central Bank Governor Yang Chin-long to present a special report on the "digital NTD." In a meeting that lasted three hours, Governor Yang revealed that the Central Bank is working with the Ministry of Digital Affairs to jointly prepare a "digital voucher platform" to simulate the issuance and usage scenarios of the digital NTD, which could be launched as early as the end of this year. According to a report from "Commercial Times":

The current government platforms for issuing art and culture vouchers, agricultural travel vouchers, etc., are chaotic, and users have to download different apps to obtain them. The Central Bank is planning to collaborate with the Ministry of Digital Affairs on a "shared platform for government-issued vouchers," which may start trial operations by the end of this year or early next year. Citizens will be able to apply for a "digital voucher wallet" through banks. The application process will be similar to applying for a bank account, requiring basic information to undergo KYC (Know Your Customer) verification and a comparison against a qualified list by the Ministry of Digital Affairs. When the government issues digital vouchers, they will be deposited into the "digital voucher wallet."

A Central Bank official stated: "Although the Central Bank has not yet decided whether to issue the digital NTD, we can still use 'digital vouchers' as a precursor. The processes are very similar; in the future, the digital NTD will also be stored in a digital wallet, but currently, the wallet contains digital vouchers. This will also give us an opportunity to identify any improvements needed in the overall operation or any new functions that can be added."

A survey commissioned showed that up to 90% of the public have not heard of the digital NTD.

The digital New Taiwan Dollar (NTD) is the digital version of paper currency. Unlike bank deposits, the digital NTD can only be stored in a "wallet" and managed by individuals. The advantage is that transactions can be conducted like cash purchases, maintaining transaction privacy without worrying about digital footprints being tracked. The downside is the risk of losing it. The digital NTD wallet has a "key," just like a physical wallet and key; if it gets lost, it cannot be recovered.

The Central Bank was compelled to issue the digital NTD due to external pressures. In 2019, Facebook announced the Libra project, intending to issue a stablecoin through blockchain. With billions of users worldwide, more than the population of China, who knows if Zuckerberg was plotting to establish an independent nation online? The plan was immediately suppressed by the U.S. government, and various countries began developing their own stablecoins—Central Bank Digital Currencies (CBDCs)—to resist Libra's invasion.

Eventually, Libra died in its infancy. Without external pressure, central banks worldwide not only lacked the motivation to advance but also became increasingly unclear about their objectives. Central Bank Governor Yang Chin-long admitted in his report that there is no timetable for the launch of the digital NTD, mainly observing the developments in other countries. To put it positively, it's about aligning with global trends and not working in isolation. To put it negatively, it means having no clear direction and just trying not to fall behind.

Without a goal, there is no direction for improvement, and whatever the Central Bank does, it seems it cannot be deemed wrong. Last month, the Central Bank released the results of a commissioned survey, which, at first glance, presented the public's awareness and expectations of the digital NTD. However, upon closer examination, I found two major unreasonable aspects in this report.

Protecting Privacy with Phone Numbers

The survey interviewed about 6,000 people, including the general public, industry professionals, government agencies, and experts. The results from the general public were the most dramatic. Although 90% of people had never heard of the digital NTD, up to 70% expressed willingness to use it after being introduced to it. Initially, I was surprised by the high acceptance rate, but after reading the description, I understood:

CDBC has innovative applications, such as the government's distribution of stimulus vouchers, consumption vouchers, or tax refunds directly into wallets, foreign currency ATM exchange functions, QR code withdrawals, or programmable payment smart contracts, all of which the public has shown demand for.

These scenarios can indeed use digital NTDs, but the question is, what are the benefits of switching to digital NTDs? I'm unsure how many people delved into the differences, but the next question in the survey might reveal whether people genuinely like digital NTDs or simply like receiving money from the government:

45.2% of people are concerned about transaction records with digital NTDs, while 51.4% are not concerned.

It's important to know that digital NTDs should have two main features: privacy protection and programmability. Without these features, it's better to stick with bank transfers.

Digital NTDs, like cash, allow private transactions and custom transaction rules. However, based on the survey results, people do not seem to care much about privacy. Even with transaction records, over half of the respondents are not worried. Furthermore, the current privacy protection for digital NTD transactions is much weaker than expected:

Considering risk management, CBDC wallets will be divided into anonymous and named wallets based on the subject, method of opening, and level of identity verification. Anonymous wallets only require a phone number without other personal information, addressing privacy needs... Named wallets require intermediaries to perform real-name authentication and properly manage users' personal data. The central bank can only view user transaction data processed with de-identification technology.

Last week, Blocktrend discussed why Taiwan Mobile established a cryptocurrency exchange1. One advantage is that telecom companies already possess people's phone numbers, which means they have completed relatively strict "real-name verification." Yet, the central bank claims, "We only take your phone number, not other personal information, to protect your privacy." This doesn't completely eliminate privacy concerns, but it offers a flimsy layer of privacy.

Using named wallets is even less appealing. If intermediaries must perform bank-level real-name authentication, what advantage does the digital NTD offer?

Some might defend the central bank by saying these rules prevent crime and money laundering. I agree that crime prevention is legitimate, but it's not the central bank's responsibility. Cash is neutral, and people's physical wallets are not named. Cash is also used for crime, but no one holds the central bank accountable for it.

The digital NTD is equivalent to cash. The central bank should focus on the digital issuance, anti-counterfeiting, and destruction processes. Crime prevention and commercial applications are others' responsibilities. The central bank cannot and should not handle these tasks.

Beyond privacy issues, the report also reveals the central bank's concern about the digital NTD's business model. This surprises me!

Worrying About the Business Model

In the survey, the central bank asked the industry (financial institutions, payment providers, virtual asset providers) about their views on the digital NTD. One question was about "feasible business models according to industry players":

Industry players believe feasible business models include charging merchants, charging enterprises for value-added services, and intermediary institutions using the central bank's CBDC system for free (Figure 16).

I have included the question and the response chart below. The question is clearly from the central bank, and judging by the responses, it appears to be a multiple-choice question rather than a fill-in-the-blank one.

Putting aside the respondents' answers, the very nature of the question itself is quite puzzling. Why does the central bank need to think about a business model? Is issuing digital New Taiwan Dollars a business venture? What is the purpose of consulting industry stakeholders on this matter?

This highlights that the central bank has lost its way, mistaking digital New Taiwan Dollars for another form of mobile payment. Currency is a fundamental infrastructure of the country. Issuing, maintaining, and updating it requires costs, but these have already been covered by the people through taxes. If businesses do not have to pay for using physical cash in their operations, why should they pay for using digital New Taiwan Dollars?

One of the response options is "charging corporate users for value-added services," which completely deviates from the intended path of digital New Taiwan Dollars. The central bank issuing digital New Taiwan Dollars should be like Tether issuing USDT; it only needs to manage issuance and destruction. How people use digital New Taiwan Dollars should be their freedom, and the central bank should not step in to demand fees for value-added services. Imagine how absurd it would be if Tether charged Binance or Uniswap for value-added services.

This report was published a month ago. It's unclear whether the experts researching digital New Taiwan Dollars are too embarrassed to point out these flaws publicly or if everyone thinks these designs are unproblematic. However, as an active participant in the cryptocurrency space, I completely disagree with the current design mechanism of digital New Taiwan Dollars. So, what should be done correctly?

Referencing Cryptocurrency

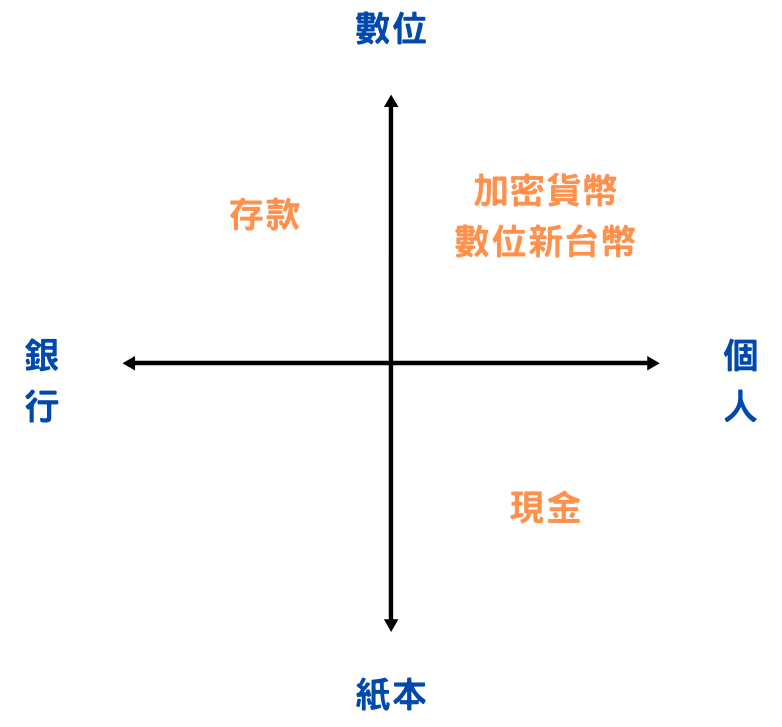

Cryptocurrency offers the most worthwhile model to reference, given that the characteristics of digital New Taiwan Dollars are highly similar to those of cryptocurrencies. I will use the diagram below to illustrate this point. The horizontal axis represents who holds the asset value, dividing it between individuals and banks. The vertical axis represents the form of the asset, divided into physical and digital.

In the diagram, the bottom right represents cash, a physical asset managed by individuals. The top left represents deposits, a digital asset managed by banks. Both cryptocurrencies and digital New Taiwan Dollars fall into the top right category, which are digital assets managed by individuals. This is not a coincidence. Initially, central banks worldwide aimed to counter cryptocurrencies, and now the platform they use to issue digital New Taiwan Dollars is also based on blockchain technology (Hyperledger Besu).

To put it bluntly, digital New Taiwan Dollars are essentially stablecoins on a private blockchain. I believe there are experts within the central bank who understand how digital New Taiwan Dollars should be correctly designed. However, they face significant resistance because the majority of their colleagues are not experts in cryptocurrency; they are traditional finance experts. Ironically, the more expertise someone has in traditional finance, the harder it is for them to understand cryptocurrency. For the central bank to get it right, it must not only refer more to the experiences within the crypto community but also learn to unlearn old paradigms.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.