The Biggest Acquisition in the Crypto Space! Why Did Stripe Spend $1.1 Billion to Acquire Stablecoin API Startup Bridge?

#643

GM,

The most shocking news this week is that payment giant Stripe announced its acquisition of a stablecoin startup, Bridge, for $1.1 billion. What’s intriguing is that Bridge was founded less than two years ago. However, after reading several reports, you’ll notice that very few actually explain what Bridge does or why it’s worth such a hefty price tag from Stripe. Most articles gloss over the details, simply calling Bridge a “stablecoin infrastructure” company.

But before you blame the reporters for being vague, it’s worth noting that even Bridge’s own website describes their main product as a “stablecoin API for developers.” Not exactly a detailed explanation. Even after diving into Bridge’s documentation, it’s filled with technical API descriptions that don’t immediately make their business model clear. To write this article, I had to piece together clues from across the internet to finally understand what Bridge is actually doing and why Stripe would spend so much to acquire this seemingly obscure startup. Let’s start with Stripe’s recent features.

The "Online Card Machine"

Stripe is the leading brand when it comes to “online card machines,” with over one-third of global online stores using it for payments. If you want to set up an online store, Stripe is essentially your checkout counter. Store owners don’t need to know how to code—simply copy and paste the Stripe code, and you’re ready to open for business. Stripe will automatically handle payment collection, generate reports, and transfer funds to your designated account.

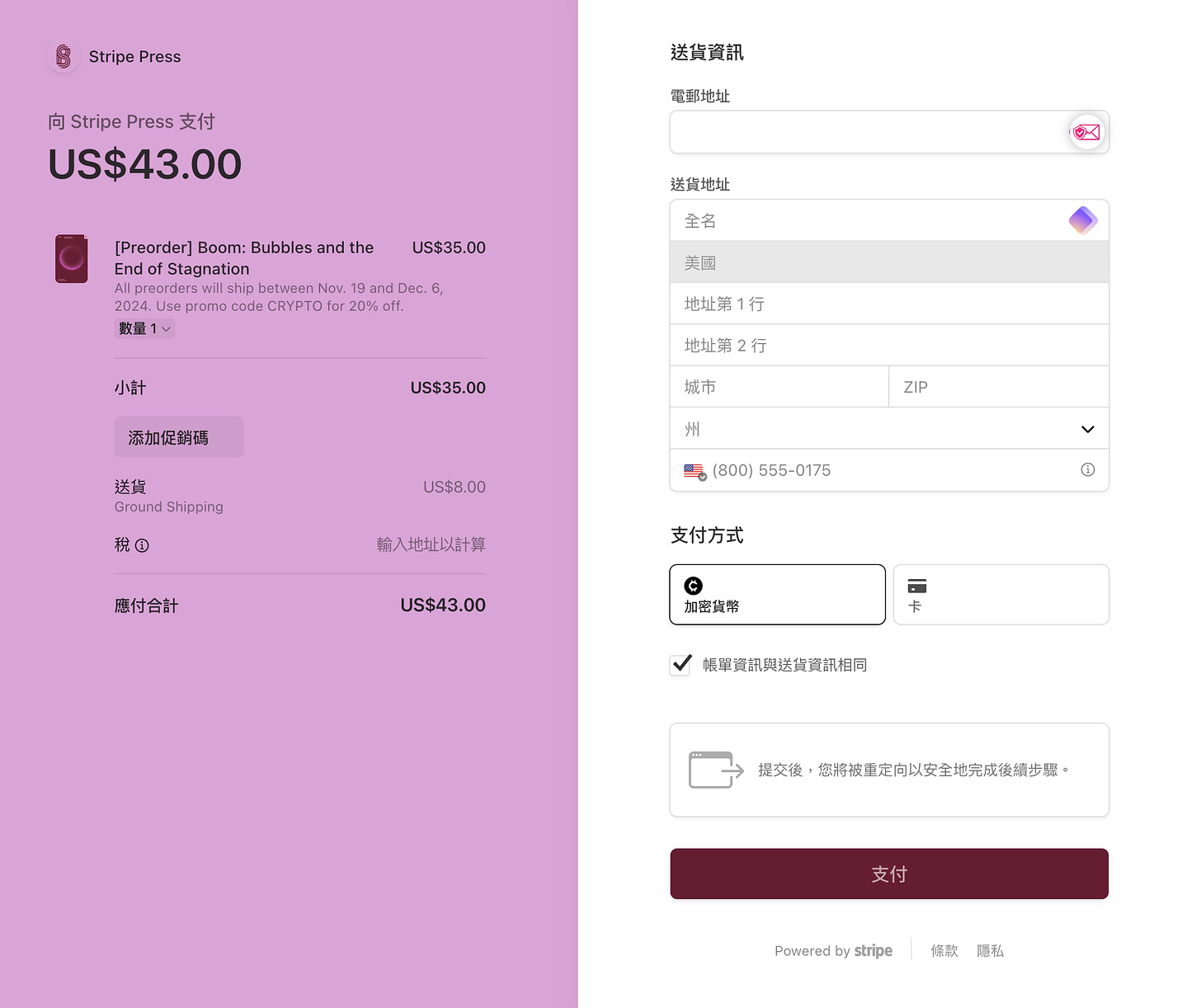

Six months ago, Stripe announced its return to the crypto space1 by adding cryptocurrency payment options to its “card machine” services. During the announcement, Stripe co-founder John Collison even demonstrated paying with USDC, a dollar-pegged stablecoin. While doing so, he emphasized, "Pay close attention—don’t blink. In the past, using cryptocurrency would take several minutes to complete a transaction, but now it’s instantaneous."

Stripe supports cryptocurrency, proving blockchain infrastructure is ready for everyday consumer needs-the low transaction fees and instant payments on-chain demonstrate that blockchain has matured enough to handle day-to-day transactions. Now, not only can consumers make payments using cryptocurrency, but merchants can also choose to receive payments in USDC2. Stripe's role is to act as the "middleman" between merchants and consumers, allowing both sides to complete transactions in their preferred currencies.

The main subject of today’s article, Bridge, functions similarly to Stripe but in the realm of cryptocurrencies. Bridge sees stablecoins as the next major global payment network, akin to credit cards, bank transfers, or SWIFT, poised to transform the payments market.

Bridge

In simple terms, Bridge uses stablecoins as an intermediary, enabling the conversion and global transfer of any two currencies. Bridge supports assets like USD, EUR, USDC, USDT, and PYUSD, and it can also help businesses issue their own stablecoins. For example, if I want to send TWD (New Taiwan Dollar) to a friend in Brazil, Bridge would convert my TWD into a USD stablecoin, transfer it via blockchain to Brazil, and then convert the stablecoin into the desired asset in my friend’s account. According to Bridge's description:

Even though we live in a globally connected economy, people still deal with local currencies. If you live in a country with an unstable economy or hyperinflation, you face real challenges. For instance, Nigerian consumers often cannot subscribe to services like Netflix or ChatGPT because merchants don’t accept Nigerian currency. Without the ability to use credit or debit cards, they are left out... Bridge is a new liquidity platform that leverages stablecoins to solve these global financial challenges.

Last year, Bridge partnered with the U.S. government, aid organizations, and creator platforms to make payments to people all around the world using stablecoins.

Bridge’s Chief Revenue Officer shared how companies like Uber and SpaceX became their customers. Uber drivers hail from all corners of the globe. When Uber’s headquarters in the U.S. needs to pay a driver in Taiwan $100, the cost of international wire transfers alone can be $25. If you add up the remittance fees Uber pays to drivers worldwide, the total becomes staggering.

SpaceX’s story is the opposite. Starlink’s customers come from all over the world, each paying in different currencies. SpaceX uses Bridge’s service to first convert these various currencies into USDC, which is then deposited into SpaceX's accounts.

Whether it's sending or receiving money, Bridge's mission is to act as an intermediary using stablecoins to connect fiat currencies with cryptocurrencies. Zach Abrams, co-founder of Bridge, outlined three key use cases for stablecoins:

Stablecoin in, stablecoin out

Stablecoin in, fiat currency out

Fiat currency in, fiat currency out

The first scenario is the simplest, assuming both parties are familiar with handling cryptocurrencies. However, practical issues may arise, such as when you want to pay in USDT but I prefer to receive PYUSD, or if we’re using different blockchains. That’s where Bridge steps in, saying, “Just connect to our stablecoin API, and we’ll handle the rest.”

The second scenario is more complicated, as it involves converting between stablecoins and fiat currencies, often requiring the involvement of stablecoin issuers. But again, Bridge says, “Just connect to our stablecoin API.”

In the third scenario, both parties don’t care about stablecoins—they just want to lower transaction costs and speed up transfers. Here too, Bridge says, “Just connect to our stablecoin API.”

From this, it's clear that Bridge isn't merely a stablecoin infrastructure provider; it's a service provider focused on enhancing asset liquidity using stablecoins. The biggest challenge for Bridge is ensuring that the supported currencies have sufficient liquidity so customers can exchange assets anytime. That's why Zach Abrams mentioned in interviews that if there’s more comprehensive regulation and liquidity introduced into the market, Bridge could offer even more stable services.

Bridge’s product is straightforward: businesses only need to integrate their API, and all the complexities of remittance, currency conversion, and cross-chain transactions are handled by Bridge. As the name suggests, Bridge connects the first and last mile between different assets, countries, and payment methods. This bridge is built around stablecoins, converting everything into stablecoins first to facilitate seamless transactions.

Stripe's acquisition of Bridge isn’t just about buying out a potential competitor; it brings fresh momentum to the payments industry.

The Significance of the Acquisition

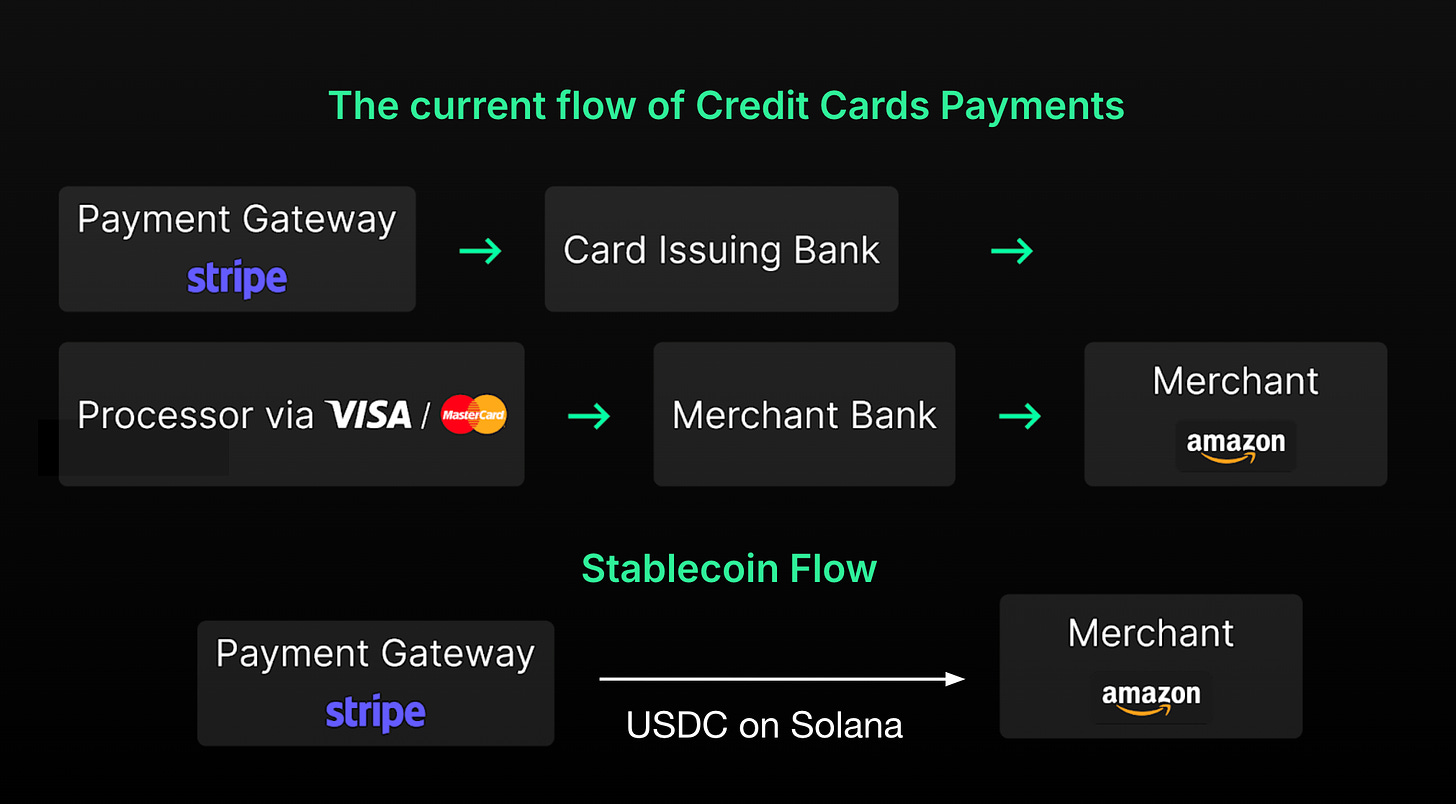

Below is a comparison chart made by a user, showing the flow of payments with credit cards versus stablecoins. It highlights how Stripe can use stablecoins to improve its service, reducing fees and speeding up transaction times. As a long-time user of Stripe, Blocktrend frequently uses it for receiving payments. I’ll share my firsthand experience to explain this further.

After a reader makes a payment via credit card, I receive a notification. However, it takes two business days for the funds to actually arrive in my Stripe account. During this time, we’re waiting for the issuing bank, Visa/Mastercard, to process the transfer. The final amount I receive is approximately 92% of the original payment.

Two days and 92%—that’s Stripe’s current performance. But what if people started using stablecoins for payments instead? The waiting time would drop to zero days, and I’d receive 96% of the payment. Although blockchain fees are so minimal they can be practically ignored, Stripe’s transaction fees still apply. If we calculate how much Blocktrend could save on payment processing fees by supporting stablecoin payments, the savings would be significant when multiplied by the volume of transactions Stripe processes for me each year.

Moreover, stablecoins won’t just change the way consumers and merchants transact; they’ll also impact how banks manage their funds. Currently, the two-day delay in receiving payments through Stripe is largely due to financial institutions reconciling their accounts. But Bridge could tell banks, "You don’t need to park so much money in correspondent banks—just use stablecoins as an intermediary when transferring funds." This method is not only faster but also improves capital efficiency.

This is a truly disruptive model. Cross-border payments today are built on the premise that moving money is inherently difficult. Stablecoins finally enable money to move across borders fluidly and efficiently. When this premise is overturned, how will financial institutions manage their assets in the future? If stablecoins can truly become as widely used as credit cards, SWIFT, or bank transfers, developing into a standalone payment category, then Stripe’s $1.1 billion acquisition of Bridge will prove to be a smart investment.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.