GM,

First, some administrative announcements. Half a year ago, Blocktrend received nearly 5,000 OP tokens as a reward from the RetroPGF 3 public funding program, currently valued at approximately 320,000 TWD. As previously promised, these OP tokens will be fully distributed to our paying members (based on membership status as of January 29, 2024) as a subscription rebate. Without the support of our paying subscribers, Blocktrend wouldn’t have been able to continue writing articles and contributing to the community up to now. Although I would love to keep this money, giving it back to our members is more meaningful than keeping it.

We now need everyone to provide their wallet address for receiving OP tokens (on the Optimism chain). The amount of OP tokens each person receives will depend on the total amount of subscription fees paid. For example, lifetime members who paid more will receive more OP tokens. Blocktrend has an ultimate goal in participating in RetroPGF: we hope that one day the OP rebates members receive will be more than the subscription fees they paid. In other words, becoming a paying member would pay off just through receiving OP airdrops, and you might even profit. Lifetime members could be making money while doing nothing 🤣

The deadline for submitting your wallet address is June 30th at 24:00, and the OP rewards are expected to be distributed in the first week of July. Regardless of whether you have submitted your wallet address before, please fill it out again. I will remind everyone about this in every article from now on. Additionally, starting in July, Blocktrend will resume publishing three articles per week. Now, let’s get to the main topic.

Last week, the Financial Supervisory Commission (FSC) issued a press release announcing the formation of a "Real World Assets (RWA) Tokenization Task Force" in collaboration with six financial institutions and the Taiwan Depository & Clearing Corporation (TDCC). This initiative aims to prepare for the promotion of RWA tokenization in Taiwan, with the ultimate goal of having financial institutions submit pilot business projects or innovative experiment applications. In other words, in the future, we should be able to see concrete application cases of RWA proposed by financial institutions in Taiwan.

Although Blocktrend previously discussed RWA tokenization in an article1 about MakerDAO's transformation, and there have been sporadic application cases worldwide, the fact that Taiwan's FSC and financial institutions are beginning to explore RWA at this time is still considered progressive. After all, most people are still quite confused about what RWA is and what benefits it offers. Therefore, this article aims to inform readers about the current state of RWA development and the importance of tokenization in the financial sector. Let's start with what RWA is.

Digital Handshake

RWA stands for Real World Assets. In Chinese, it translates to 現實世界資產. The Financial Supervisory Commission (FSC) provided a definition in their press release:

RWAs include financial assets like stocks and bonds, physical assets such as real estate and precious metals, and even intangible assets like carbon credits. Tokenization of RWAs involves utilizing technologies like blockchain, cryptography, or smart contracts to represent these assets as digital tokens, facilitating subsequent transactions or services. Internationally, tokenized real world assets are considered to have potential advantages such as 24/7 cross-border and cross-timezone trading, reduced investment thresholds, increased operational efficiency, instant settlement, enhanced liquidity, and transparency. However, they also pose challenges in terms of regulation, legality, and interoperability.

To many financial experts, RWA might sound like a vague term that encompasses everything. This is because RWA is a deliberately created term aimed at distinguishing these assets from on-chain native assets like BTC, ETH, and NFTs, and is used to refer broadly to assets that have not yet been tokenized.

RWAs are not new, but tokenization is a novel concept. Whether it's real estate tokenization2, rental income tokenization mentioned in last week's article, or the renewable energy tokenization3 shared by Sun Fotjia at Blocktrend's invitation at the end of 2023, these are all financial innovations.

Although I can easily list many benefits of tokenization, I didn't realize how important it is in the financial sector until writing this article.

In its 2023 annual report, the Bank for International Settlements (BIS), known as the "central bank of central banks," pointed out that asset tokenization is the next phase in global financial development. Tokenization can solve the long-standing issue of "Delivery Versus Payment" (DvP) in the financial system. To put it simply, it means simultaneous exchange of money and goods in the digital world. Hyun Song Shin, the Head of Research at BIS, explained the importance of tokenization through the history of financial development:

Over the past 500 years, trade and commerce have developed at an unimaginable speed. Initially, buyers and sellers had to carry heavy boxes full of metal coins to complete transactions. Later, transactions were recorded on paper ledgers by trusted intermediaries. ... With the advent of the electronic age, ledgers became digital files, making money and financial assets intangible. ... The most critical development after intangibility and digitalization will be tokenization, which digitally represents ownership on programmable platforms.

In essence, tokenization aims to achieve a "digital handshake."

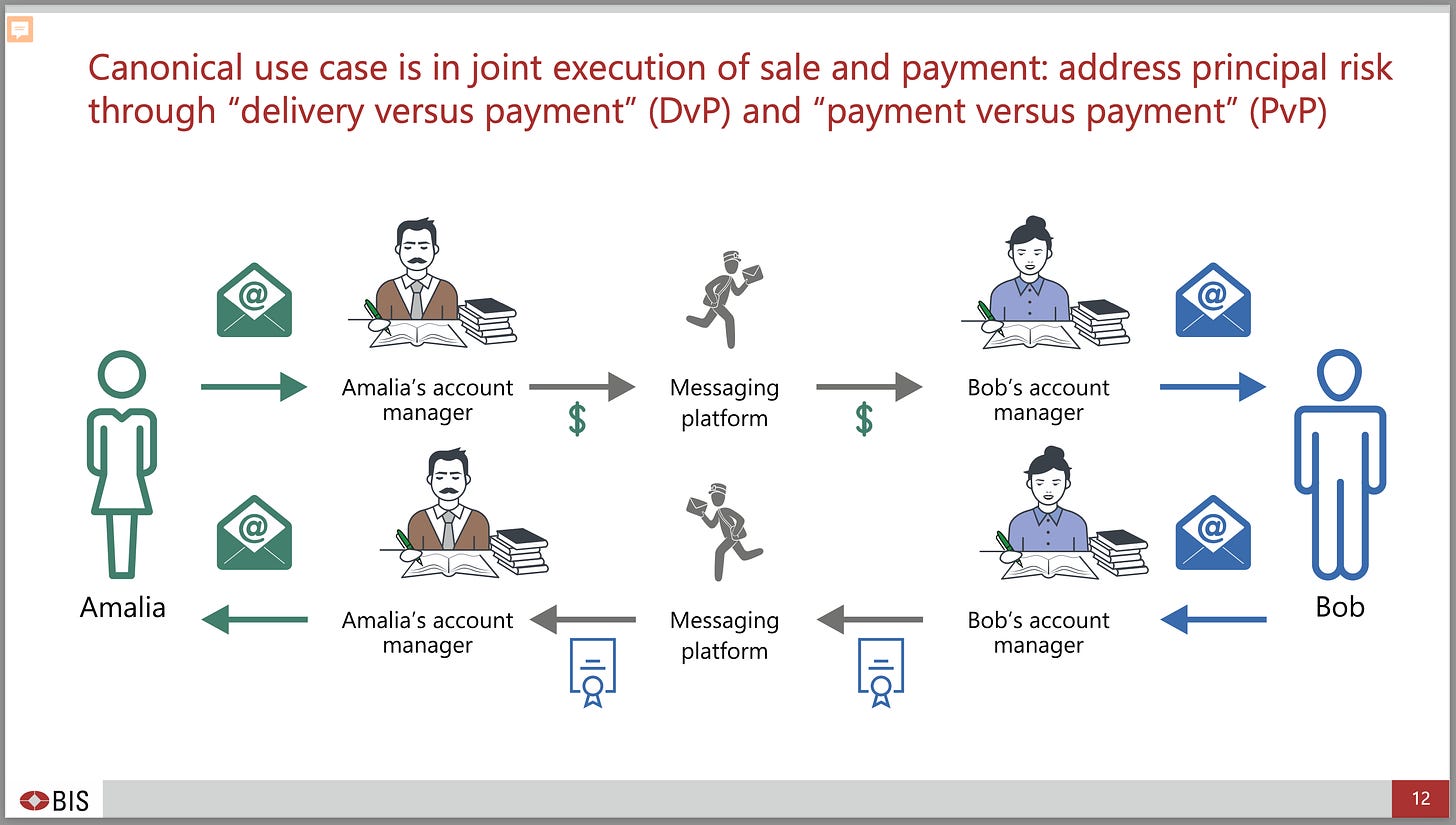

In the real world, the simultaneous exchange of money and goods is natural. However, in the digital world, neither money nor goods are physically present. Digitalization breaks geographical limitations, but transactions become more complex than simple hand-to-hand exchanges. When money and goods cannot be delivered simultaneously, transaction risks arise. The following diagram illustrates a digital transaction between Amalia and Bob, highlighting the complexities even in simple two-party transactions, let alone international trade orders. The more parties involved, the higher the transaction risk.

But We can't go back to physical handshakes. The Bank for International Settlements (BIS) notes that the world currently lacks a unified ledger. Deposits, securities, and real estate are all in different databases that do not interoperate. However, if RWAs could be tokenized and placed on a unified ledger, this problem could be solved. The question is, how to do it?

Examples

Don’t ask cryptocurrency investors because RWA tokens have been around in the crypto world for years, with many options available.

The most famous example is Tether (USDT), which everyone has used. Tether holds US dollars and US treasuries at various financial institutions and issues USDT stablecoins equivalent to one dollar each. This is a concrete case of tokenizing RWAs like USD and US treasuries.

Paxos, the company that issues USD stablecoins for PayPal, also launched4 PAX Gold (PAXG) in 2019. Paxos backs PAXG with physical gold bars, with each PAXG token representing one troy ounce of physical gold. If necessary, holders can actually redeem the gold bars from the vault.

Furthermore, the now-defunct cryptocurrency exchange FTX issued stock tokens in 20205, even listing Airbnb stock tokens (ABNB) before Nasdaq. Holding one ABNB token indirectly represented owning one share of Airbnb through a German financial institution. However, ABNB tokens purchased on FTX could not be directly exchanged for Nasdaq-listed ABNB stocks or withdrawn to the blockchain. They were merely FTX's debt to the users.

Blocktrend also discussed RealT6, an American real estate tokenization company, which allows investors to become digital landlords by holding tokens.

These examples prove that RWA tokenization is not new, and more types of tokenized RWAs will emerge in the future. However, apart from USDT, which is well-known, other RWA tokens remain relatively obscure, with few people having ever held them.

The key issue is the lack of trading, application scenarios, and legal protections. For example, while Paxos has tokenized gold, holding PAXG is not significantly different from holding a gold savings account. PAXG is more susceptible to hackers or exchange bankruptcies. If Paxos were to go bankrupt, the value of these tokens would be in question. In the end, the only benefit of tokenization seems to be the ability to purchase with cryptocurrency, which should not be the main goal of tokenization.

Additionally, in traditional finance, many assets already have derivative financial applications—securities can be loaned, and real estate can be mortgaged. However, after RWA tokenization, the functionalities become limited to simple buy-low-sell-high transactions, with liquidity not matching the original market, greatly reducing attractiveness.

Whether due to regulatory barriers or the lack of proactive development of application scenarios by issuers, the result is that RWA tokenization does not seem so magical. Investors do not see concrete benefits and therefore do not buy in. And even if there are RWA tokens and application scenarios, the final issue is—where is the money? This is the most difficult problem to solve.

The Paradox of RWA

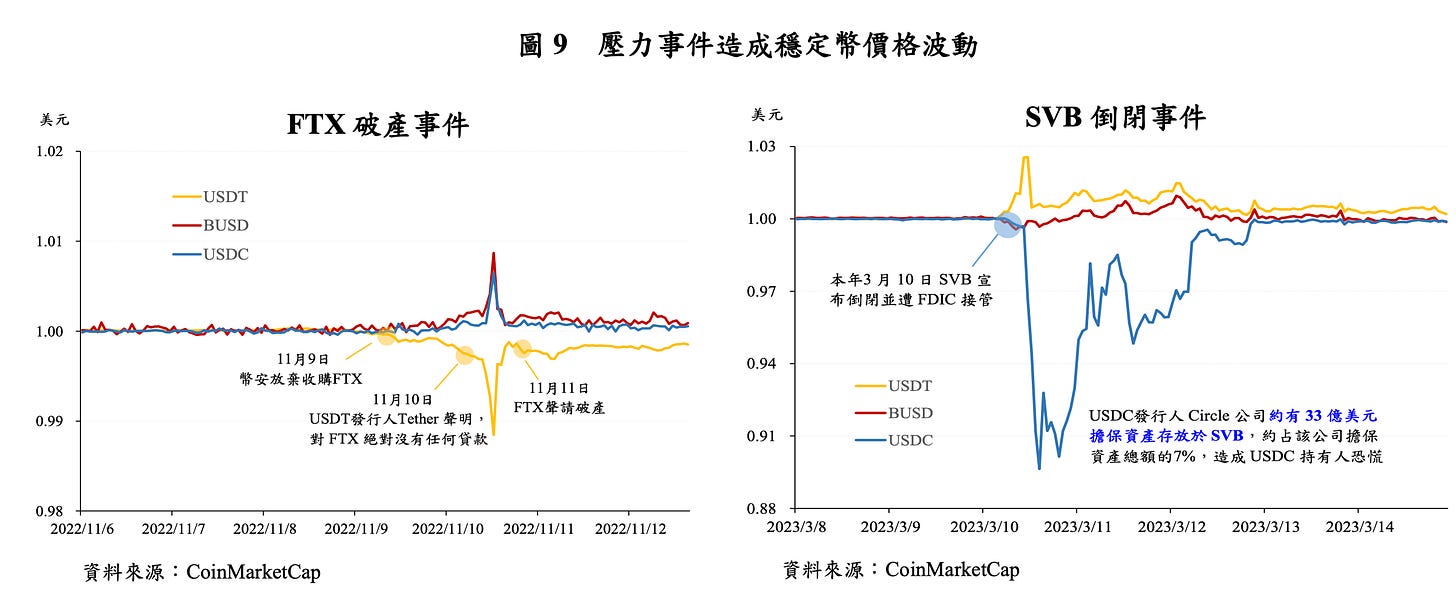

The BIS would show you the diagram below, stating that stablecoins on the blockchain are not money because their prices are unstable. Only central bank digital currencies (CBDCs) issued by governments are real money 🙄

But here’s the problem. The issue arises because countries worldwide haven't agreed on which blockchain or platform central bank digital currencies (CBDCs) should be built on. For instance, the United States is unlikely to want to use China's digital yuan platform. If each country goes its own way, and RWA tokens, financial applications, and CBDCs are not on the same platform, the original problem of lacking a unified global ledger remains unsolved.

Non-interoperability of RWA tokens is already a reality. Large financial institutions like Goldman Sachs and JPMorgan Chase have opted to build their own blockchains. Governments around the world seem to have a "blockchain purity" obsession, remaining tight-lipped about which platform they will use to issue RWA tokens or CBDCs. Some are using "permissioned blockchains" created by large financial institutions, while others say deciding which technology to use is a final step and might not rule out building their own.

However, building blockchains is neither a government's expertise nor its responsibility. Even if a government successfully builds a blockchain and issues RWA tokens and CBDCs on it, who will develop financial applications on it?

In contrast, platforms like Ethereum are already battle-tested blockchains with a rich ecosystem of financial applications. Issuing RWA tokens and CBDCs on these blockchains aligns more closely with the original intent of asset tokenization.

In recent years, although there have been sporadic RWA tokens issued globally and Taiwan has successfully issued its first security token, current regulations are inherently not designed for RWA tokens. If securities tokens remain locked in brokerage databases and cannot be withdrawn to personal wallets or integrated with global decentralized financial services like cryptocurrencies, how unfortunate would that be?

As someone who enjoys holding various assets in token form, I am very excited about the development of RWA tokenization. However, I also worry that the ideal scenario of seamless digital transactions might end up being locked in blockchains and accessible only to a select few.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.