Stripe Returns to Cryptocurrency Payments: Enabling USDC Payments, the Necessity of Intermediaries

#603

GM,

Firstly, the 20th Gitcoin Grants public funding event has begun. This time, Blocktrend is honored to be recognized by two organizers, ENS and Hypercerts, qualifying for their respective $100,000 and $35,000 funding pools. However, the actual amount of funding allocation depends on the collective decision made by the public through voting with their spare change.

You are invited to contribute $1 (approximately 0.00033 ETH) to support your favorite projects in receiving matching funds. The participation threshold for Gitcoin Grants this time has been significantly lowered, with two main improvements:

Fees: Hosted on Arbitrum, fees have been greatly reduced to within $1.

Passport: No need to open Gitcoin Passport to collect stamps or real-person scores.

In other words, if your wallet has sufficient balance, you can donate directly without worrying about fees or real-person scores. Encourage everyone to participate, and feel free to share the projects you support on Discord. Let's get to the main point.

Where can cryptocurrencies be used? A few years ago, in order to answer this question, I personally visited stores willing to accept cryptocurrency payments. Although the process was not complicated, there were not many stores willing to accept cryptocurrencies. Because electricity bills and employee salaries still had to be calculated in New Taiwan Dollars. The benefits of accepting cryptocurrencies were not high, but the processing was cumbersome.

After many years, cryptocurrency payments are finally becoming more popular. With the increasing participation of more payment service providers, the friction for merchants to handle currency conversion is reduced. Last week, Stripe, the payment service company used by Blocktrend, announced the return of cryptocurrency payments and the launch of USDC payments. This article discusses the significance of Stripe's adoption of USDC.

Payment Pioneer

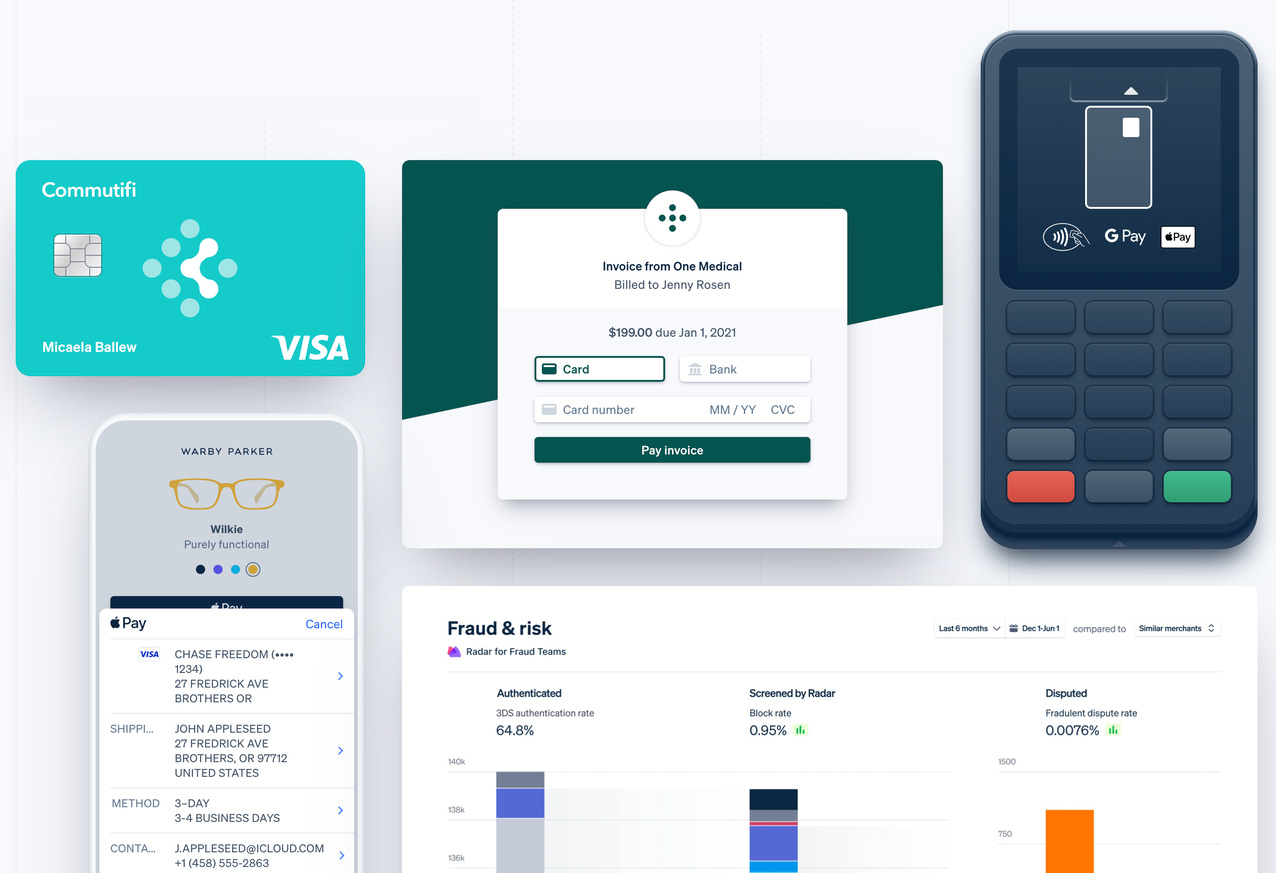

Taiwanese users may be less familiar with Stripe. It is one of the world's leading payment service providers. With a market share of over one-third of global online payments, it is second only to PayPal. If you want to do business online, Stripe is the card reader used to collect payments from customers.

A good card reader is like a adapter, capable of supporting any currency and payment method, ideally able to automatically convert received money into the currency specified by the merchant, simplifying the payment process. Stripe not only achieves this but also turns this digital card reader into just a few lines of code. E-commerce owners only need to paste this string of code, and the store can open immediately.

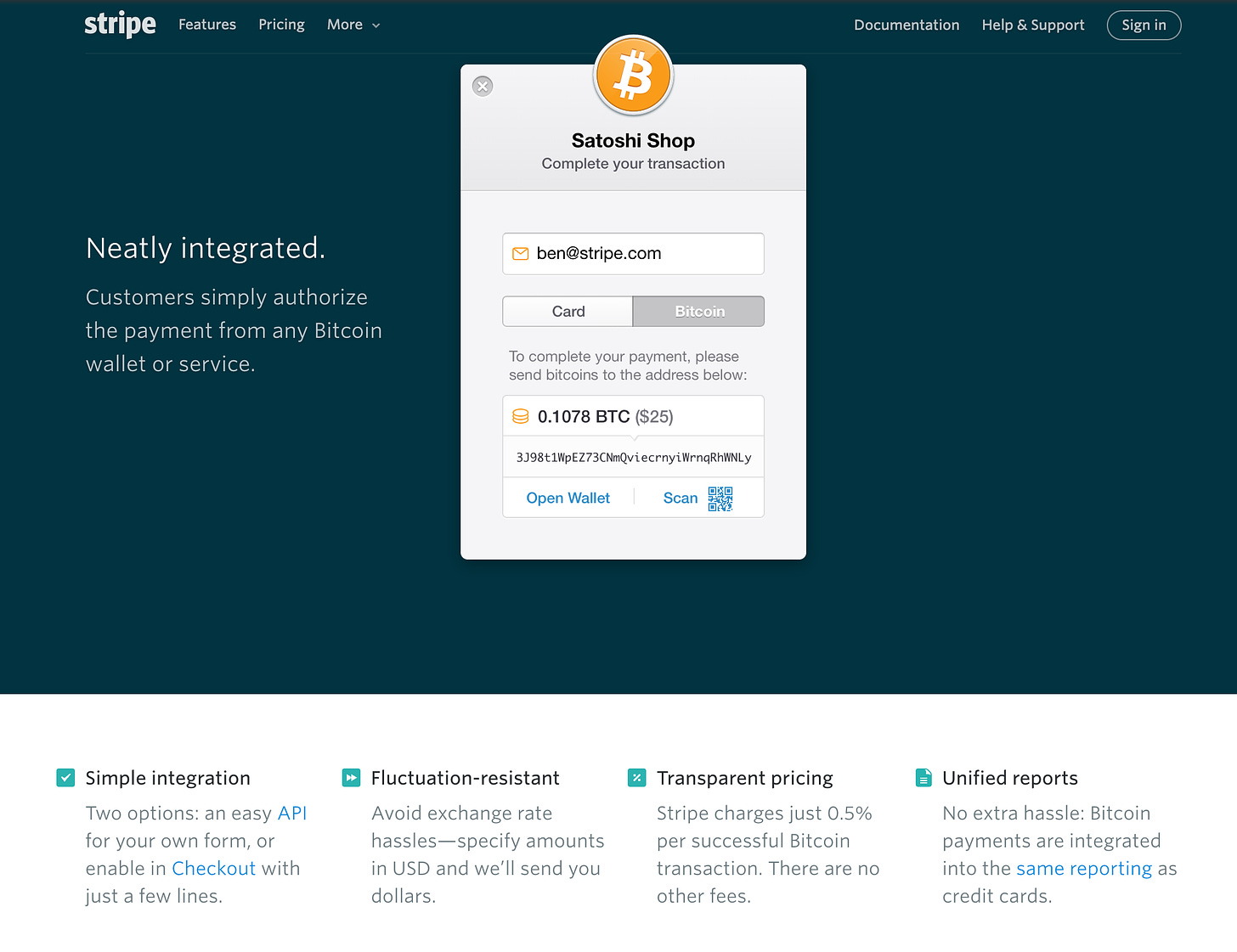

Stripe pays close attention to emerging payment tools globally. In 2014, Stripe noticed that more and more people were holding BTC, and since the Bitcoin whitepaper also emphasized itself as a payment system, Stripe announced its support for BTC, becoming the world's first payment service provider to do so. This innovation caused a sensation at the time, attracting extensive coverage from various media outlets.

The following image shows the Bitcoin payment interface Stripe created for merchants at that time. It must be praised that this interface and payment process, even when viewed ten years later, are still relevant. Merchants specify receiving $25, and customers can choose to swipe their cards or open their wallets to pay the equivalent of $25 in BTC. The quantity will adjust dynamically with the currency price. After receiving BTC, Stripe immediately exchanges it for USD through exchanges and credits it to the merchant's bank account within 7 days. Stripe only charges a 0.5% transaction fee per transaction, which is quite competitive.

However, by 2018, Stripe announced the termination of Bitcoin payment services. The main reasons were the volatility of the currency price and the skyrocketing miner fees, which made Bitcoin less like a payment tool. Stripe observed that the number of businesses accepting BTC payments was decreasing. According to their announcement at the time:

"In the past year or two, as the block size reached its limit, Bitcoin has become more of an asset than a payment tool... The utility of Bitcoin in payments has decreased, and transaction confirmation times have increased significantly, leading to higher failure rates for transactions priced in fiat currency. In addition, miner fees have also increased significantly. Each payment incurs tens of dollars in miner fees. This makes the cost of Bitcoin payments as expensive as bank wire transfers. Therefore, we have decided to gradually reduce the functionality of Bitcoin payments."

Miner fees are the number one enemy of cryptocurrency payments. Consumers feel the direct impact of high transaction costs, but merchants bear even greater risks. The timing of transaction confirmations is a major issue. After consumers check out, they naturally want to receive the goods immediately. But if the transaction hasn't been confirmed on the blockchain, the merchant hasn't truly received the money. Consumers want things to happen quickly, but merchants may not necessarily share the same sentiment.

If there's a major backlog in blockchain transactions, causing the confirmation time to exceed one hour, and the currency price undergoes drastic fluctuations during this time, merchants may end up receiving more or less money than expected. Should they refund the excess? Should they accept the shortfall? These are the problems merchants encounter after starting to accept cryptocurrency payments. I can quite understand why Stripe decided to terminate Bitcoin payments back then.

However, Stripe didn't close the door completely and still sees potential in the development of cryptocurrencies. Whether it's the Lightning Network designed specifically for Bitcoin payments (which I've recently started using!), Ethereum, or even Stellar, which hasn't been discussed much in recent years, any of these could be reasons for Stripe to reconsider supporting cryptocurrency payments.

What seemed like an excuse for Stripe's actions in the past is now seen as a well-considered decision. Six years later, Stripe officially announced that it will resume supporting cryptocurrency payments!

Stripe Supports USDC

Last week, John Collison, co-founder of Stripe, announced at a developer conference, "Cryptocurrency is back!"

Collison demonstrated how to pay with cryptocurrency through Stripe at the event. The video is less than 3 minutes long, and I recommend everyone to take a look when you have time. Below are screenshots of the process. The checkout process remains the same as it was 10 years ago: the merchant specifies the price of the item as $99, and the consumer can choose to pay with a card or with cryptocurrency. After clicking "pay," Stripe prompts the user to connect their wallet. The difference this time is that Stripe no longer supports BTC payments but offers options such as USDC on Ethereum, Polygon, and Solana chains.

Collison demonstrated using USDC on the Solana chain, so he had to connect the Phantom wallet. When making the payment, he intentionally slowed down, reminding everyone to pay attention and not to blink – in the past, choosing to pay with cryptocurrency took several minutes, waiting for the transaction to be successful, but now it's just a matter of moments.

Sure enough, as soon as Collison clicked "send," the screen immediately jumped to the page confirming the successful payment. At the same time, the merchant's bank account had already received the money. On the merchant's receipt page, you could see the on-chain transaction record of the consumer paying 99 USDC, while the merchant's bank account had already been credited with $98.01. The missing $0.99 was the 1% fee charged by Stripe. This system operates on the same logic as it did 10 years ago, with only two differences: the currency and the blockchain.

USDC is a stablecoin pegged to the US dollar, maintaining a close to 1:1 exchange rate most of the time. If Stripe were to open a corporate account directly with the issuer of USDC, Circle, then there would be no need to worry about exchange rate fluctuations caused by market confidence. Whatever amount of USDC is received can be reliably exchanged for US dollars. The Polygon and Solana blockchains are representatives of negligible transaction fees, but it would be even better if Stripe could switch to a second-layer network for Ethereum.

This less than 3-minute demonstration won applause from the audience. On that day, Stripe also added a line to their announcement from 2018, when they ceased support for Bitcoin payments, announcing that they would open up payments with stablecoins this summer. This is a more important moment than when Tesla allowed BTC purchases. Stripe is not just a business; it is an online card reader used by over one-third of the world's online stores, meaning that suddenly hundreds of thousands of businesses worldwide are willing to accept cryptocurrency.

Merchants also don't have to worry about handling USDC; they can simply convert it to fiat currency and deposit it directly into their bank accounts. You might say, "What if the merchant wants to accept USDC?" They already can!

The necessity of intermediaries

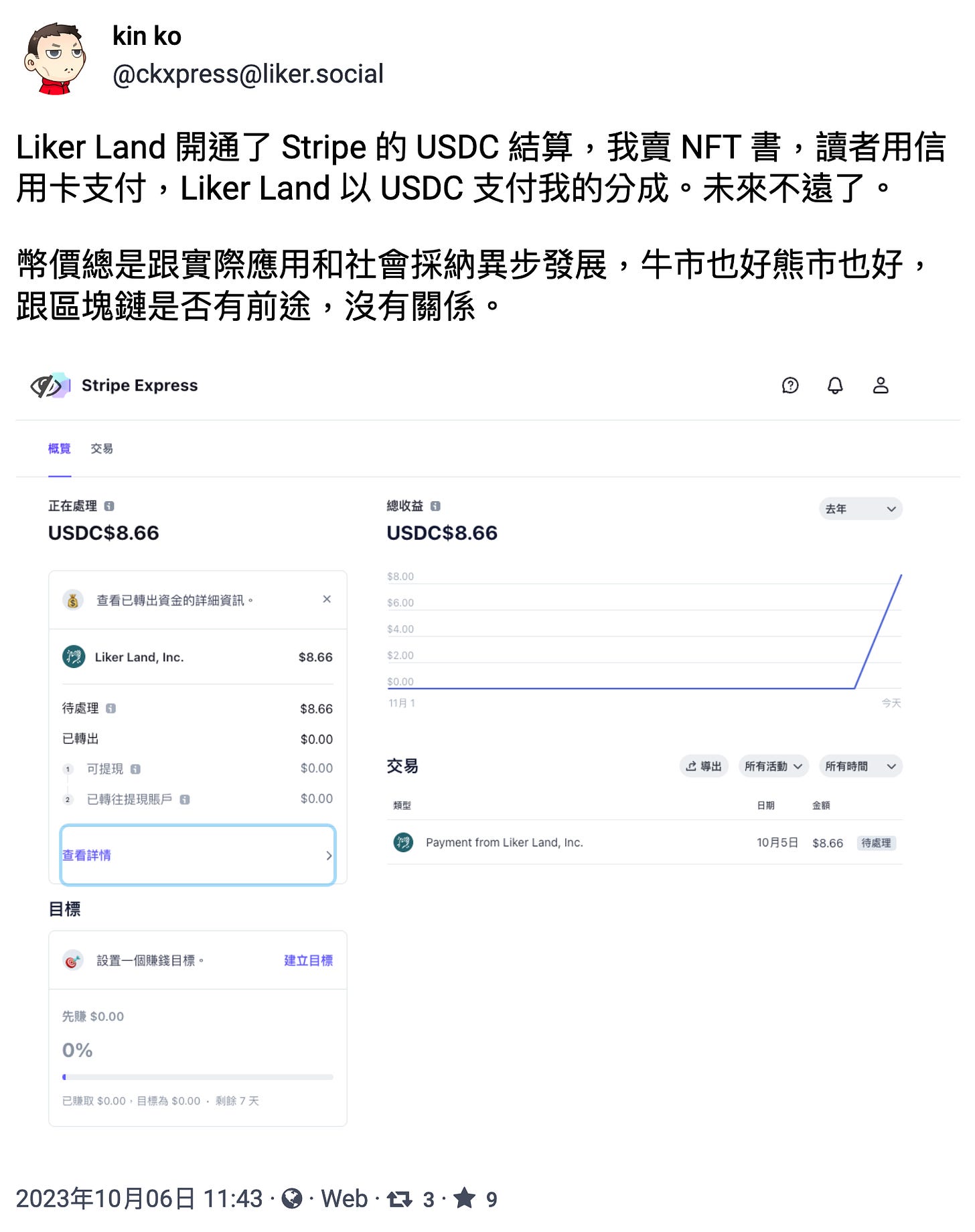

Blocktrend discussed this innovation1 in 2022, but the quickest way to understand it is by looking at actual use cases. I borrowed a screenshot from the founder of LikeCoin, Kin Ko, selling books in 2023 as an example. At that time, Kin Ko listed the book he wrote for sale on the NFT bookstore Liker Land, where readers could pay with their credit cards using fiat currency. After Liker Land received payment for the book, it didn't necessarily have to be deposited directly into a bank account. In the backend, they could choose to withdraw it in USDC to a designated wallet, and they could even distribute USDC as royalties to the author. This system still exists today.

In other words, Stripe's support for cryptocurrencies can now be divided into two scenarios: payment and receipt. If people want to pay with cryptocurrency, they can connect their wallets and pay with USDC. If merchants want to receive cryptocurrency, they can provide their receiving addresses and choose to withdraw USDC. Stripe remains the intermediary, just like the online card reader.

This is very different from people's past expectations of cryptocurrency payments. People always talk about cryptocurrencies being peer-to-peer transactions, bypassing intermediaries, and thus revolutionizing the entire financial sector. However, this only applies to the "special case" where both parties agree to transact in cryptocurrency. The more common scenario is that what you want to pay and what the merchant wants to receive are not the same. Not to mention cryptocurrencies, you must have experienced situations like opening LINE Pay, only for the merchant to say they only accept JieKou, or when you want to use a vehicle for payment but the merchant only issues traditional invoices.

The online payment industry is more complex, so intermediaries like Stripe, which can reduce transaction friction, become more valuable. However, Stripe also demonstrates that the fees and processing speed of cryptocurrency payments are indeed much more efficient than traditional payment systems. Originally, Stripe charged merchants 2.9% plus $0.3 in fees. If consumers pay with cryptocurrency, Stripe only charges merchants 1% in fees, and the funds can be credited immediately.

At that time, I will encourage everyone to subscribe to Blocktrend using USDC to save on transaction friction. But even if I'm optimistic, I don't think there will be a chance to switch to USDC for subscribing to Blocktrend this year. One-time payments are the simplest transaction model, while Blocktrend adopts regular and fixed deductions, which involve much more complex authorization. This also tests whether Stripe can once again propose new methods to reduce transaction friction for both parties and make cryptocurrencies a mainstream payment tool.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.