Member Gathering Registration | Preparing for the Digital Euro: Connectivity Without Electricity, Internet Access, and Balancing Privacy and Law Enforcement

#572

GM,

A reminder that registration for the winter season members' gathering, to be held today (11/9) at 12:00 PM, will open at noon. There is a limit of 50 participants for this event. In case the registration limit is reached, we will maintain a waiting list, and send out registration confirmations and notifications for those on the waiting list next week. Please make sure to complete your registration form. The event details can be found in the poster below. Now, let's get to the main topic.

Two weeks ago, the European Central Bank made a significant announcement - the digital Euro is entering the preparatory phase. They also released a substantial amount of documents, charts, and videos, indicating the importance they attach to this development. The European Central Bank had initially introduced the concept of the digital Euro three years ago, a topic that Blocktrend had previously discussed1. They referred to it as a digital banknote accessible to everyone. The information released by the European Central Bank not only clearly explains the purpose of introducing the digital Euro but also addresses the privacy dilemma I raised in my previous article. The transaction records of the digital Euro must strike a balance between not being as detailed as bank deposits and not being as untraceable as physical cash.

But let's start with my experience in Egypt.

Public Toilets

In Egypt, aside from the eye-opening currency experiences2, even using a public restroom provides a unique experience. Public toilets are not common in Egypt, and private toilets generally charge a fee of 10 Egyptian pounds as a cleaning fee, often coming with complementary disposable toilet paper. Occasionally, you may come across unattended private toilets where no fee is collected, but these are not public toilets. In the lack of public resources, services are often provided by private entities.

Finding a paid toilet isn't particularly difficult, but what if someone needs to use a restroom but has no money? Can homeless in Egypt afford to use a restroom? I don't know the answer. The more basic the life necessity, the less it should rely solely on private services. Being accommodated for a lack of funds to use a restroom might be possible, but being excluded from financial services can be a serious problem.

Digital payment tools around the world are mostly controlled by private companies, such as LINE Pay, PayPal, or Alipay. While the majority of people registering for these payment tools is a matter of choice, the fact that they are private services inevitably leaves some people excluded. This might not have been a significant issue a decade ago when digital payments were still a novelty for a minority of users. However, by 2020, the European Central Bank recognized that times had changed and introduced the concept of the digital Euro, referring to it as digital cash to make digital payments accessible to everyone.

At that time, many were uncertain about the implications. Payment service providers worried about government interference in their industry, and cryptocurrency investors were concerned about whether the digital Euro would be a form of cryptocurrency. Now, the European Central Bank is telling us that it is neither of these. The digital Euro is a novel payment method, bridging the gap between bank deposits and physical banknotes and coins. However, most people need not delve into these technical details. It's all about knowing how to use it!

Digital Euro

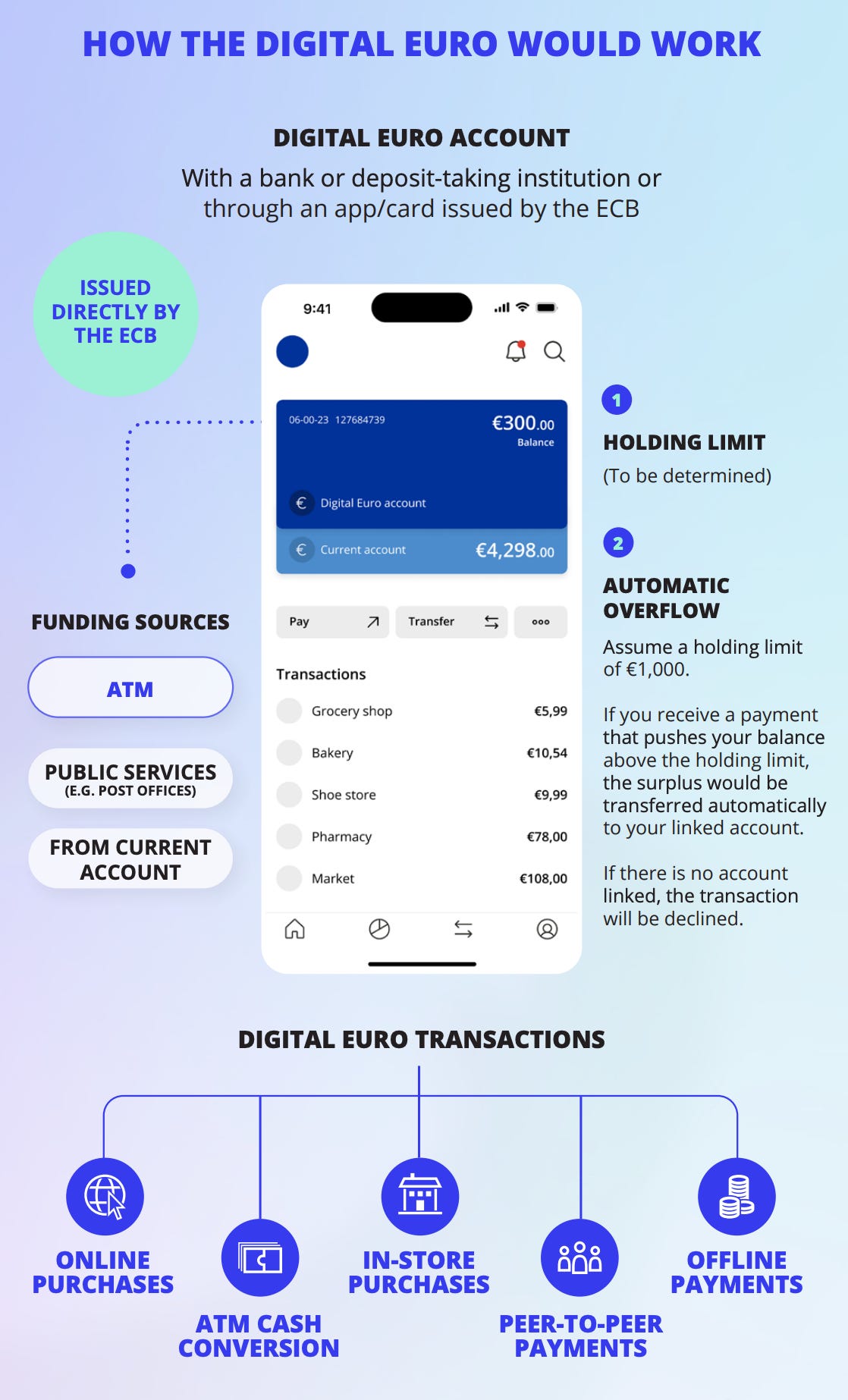

Below is a conceptual diagram of the digital Euro presented by the European Central Bank, demonstrating how digital technology simulates cash, including withdrawing it from ATMs. Digital cash must be stored in a digital wallet. Third-party providers can develop these wallets, which have maximum storage limits. If the wallet is empty, it can be automatically topped up from your bank account, and conversely, if the wallet is full, you can automatically transfer the surplus to your bank account.

But these existing payment tools can already accomplish those functions. The most significant feature of the Digital Euro is enabling even those without a mobile phone or internet access to use it, just like physical cash. Moreover, it preserves individual payment privacy, something that private companies neither want to do nor can do. According to the European Central Bank:

As Europe enters the digital age, the Digital Euro represents the next step in the evolution of our currency. It lacks a physical form like coins or paper bills, but when used for digital payments, it possesses characteristics akin to both cash and a public good. The central bank holds no interest in people's payment habits or any commercial motives. According to the European Central Bank, based on legal and technical designs, they cannot access user's personal data in the future. Moreover, even individuals without internet access, a bank account, or a credit card can utilize it for digital payments, much like utilities such as electricity and water supply – daily payments are basic services for individuals and the economy. Such services should not solely rely on private enterprises.

From the perspective of the European Central Bank, the Digital Euro's role resembles that of public restrooms. It exists to fulfill people's basic life necessities, not to generate profits. However, for banks and payment service providers, the European Central Bank seems like a market competitor, with the potential to introduce a wallet as a payment tool one day. When more people use the Digital Euro for payments, the deposits held by banks and payment service providers will decrease.

At present, it is unclear how the European Central Bank plans to persuade existing payment service providers to support the Digital Euro, and users have no clear incentive to switch. Whether this endeavor will turn out to be futile remains unknown. However, what piques curiosity the most is how the Digital Euro, designed for offline use, will function without an internet connection. The European Central Bank intends to make the Digital Euro resemble physical cash, truly existing in users' mobile devices or card wallets:

The offline solution will follow a peer-to-peer verification model, allowing people to make payments in close proximity without intermediaries. Payments will be settled directly between two devices, with no need for third-party verification or record-keeping. Devices for offline payments must hold a certain amount of Digital Euros. However, if you wish to top up an offline device, an internet connection is required.

Although there are no technical details provided at this moment, I would speculate that the Digital Euro is unlikely to be a form of cryptocurrency. Cryptocurrency wallets, in reality, do not store any assets but rather store private keys. Without an internet connection, cryptocurrency wallets cannot access the latest account information, meaning they would not know the balance in the account. The Digital Euro, on the other hand, stores asset balances on the device and permits private transactions between two offline devices.

The Digital Euro is more similar to physical cash than cryptocurrency, making it more intuitive to use. However, if you lose the device containing Digital Euros, it's akin to losing a wallet. Besides, the European Central Bank emphasizes that even when people engage in offline transactions, the wallet will not leave any transaction records, safeguarding people's transaction privacy. But law enforcement agencies might fly into a rage when they find this.

Privacy and Law Enforcement

The European Central Bank states:

The Digital Euro will provide enhanced privacy protection for offline, small-value, close-proximity payments since such payments entail lower risks. Offline Digital Euro transactions are the closest to a cash-like experience. Users can store Digital Euros on their personal devices, similar to withdrawing physical cash from an ATM. However, since offline payments require close-proximity transactions, this may reduce the risk of criminal abuse.

This is a classic case of the Digital Euro using digital technology to simulate physical cash.

Digital assets break the limitations of distance, enabling transactions without the need for face-to-face interaction and without the issue of convenience. Furthermore, the digital world leaves traces of all activities, recording all transactions. However, the European Central Bank is deliberately simulating physical cash this time. They not only set upper limits on the stored value in wallets but also require transactions to be initiated via NFC (Near-Field Communication) with close-proximity contact. Additionally, they intentionally do not retain records of these small-value close-proximity transactions. The goal is to make the Digital Euro more akin to physical cash.

Although the specific upper limit for small-value transactions is not yet known, if it were around $300 or less, it would likely cover the majority of transaction scenarios, safeguarding transaction privacy. I believe that if the European Central Bank can find a way to ensure that both parties in a transaction recognize each other's faces in the future, it would be even more perfect from a security perspective. These fragmented transactions are unlikely to pose significant risks, and they bring transaction trust back from the digital world to physical contact between individuals, thus reducing the risk of criminal activities.

The question still remains about who the users of the Digital Euro will be. The Chinese government can mandate e-commerce and payment platforms to promote the digital renminbi from top to bottom. However, the European Central Bank's plan currently involves offering subsidies to attract people through economic incentives. I'm not sure about the European Central Bank's design capabilities, but if the Central Bank of Taiwan wanted to attract me to use their developed wallet through subsidies, it would indeed require a substantial incentive.

Blocktrend is an independent media outlet sustained by reader-paid subscriptions. If you think the articles from Blocktrend are good, feel free to share this article, join the member-created Discord for discussion, or add this article to your Web3 records by collecting the Writing NFT.

In addition, please recommend Blocktrend to your friends and family. If you want to review past content published by Blocktrend, you can refer to the article list. As many readers often ask for my referral codes, I have compiled them into a single page for everyone's convenience. You are welcome to use them.