GM,

Recently, cryptocurrency investors in Taiwan have been quite anxious because the largest local exchange, the MaiCoin Group, is facing a crisis of trust. Many users reported that when attempting to withdraw their assets, they received emails stating that manual reviews would take 7 to 14 days, raising suspicions about whether MaiCoin is stalling for time due to financial troubles. Some users even shared "dream posts," implying that there may be operational issues at MaiCoin.

Is this really the case? Over the weekend, I wrote a post on social media, encouraging everyone to run if they're afraid, do more research, and be cautious of scams, which garnered a lot of responses.

But that was just an emergency response. To this day, there is still a lack of a comprehensive discussion of the issue online. In this article, I will first explain why MaiCoin requires such a long time to review user withdrawals and then discuss how it got caught in this trust crisis.

Knowing Your Users

During my military service in the police department, I participated in night patrols. There were two standards for deciding whether to stop a driver: concrete evidence and behavior. Not wearing a helmet is concrete evidence, but the standard for determining behavior is much more vague. Sometimes, police would deliberately approach drivers to greet them and observe their reactions; those who appeared nervous or abnormal would be asked to pull over for further ID checks.

Exchanges are the gateways for people entering and exiting the world of cryptocurrency, and the responsibility is especially significant. Whether it's investing in cryptocurrency using New Taiwan Dollars (NTD) or converting cryptocurrency earnings back into NTD and transferring them to a bank, everything must go through this process. Users want exchanges to be as "neutral" as possible—ideally like a vending machine, where you insert 10 dollars and get a drink. However, law enforcement sees it differently and demands that exchanges "know their users" as much as possible, report suspicious activity proactively, and even freeze assets if necessary.

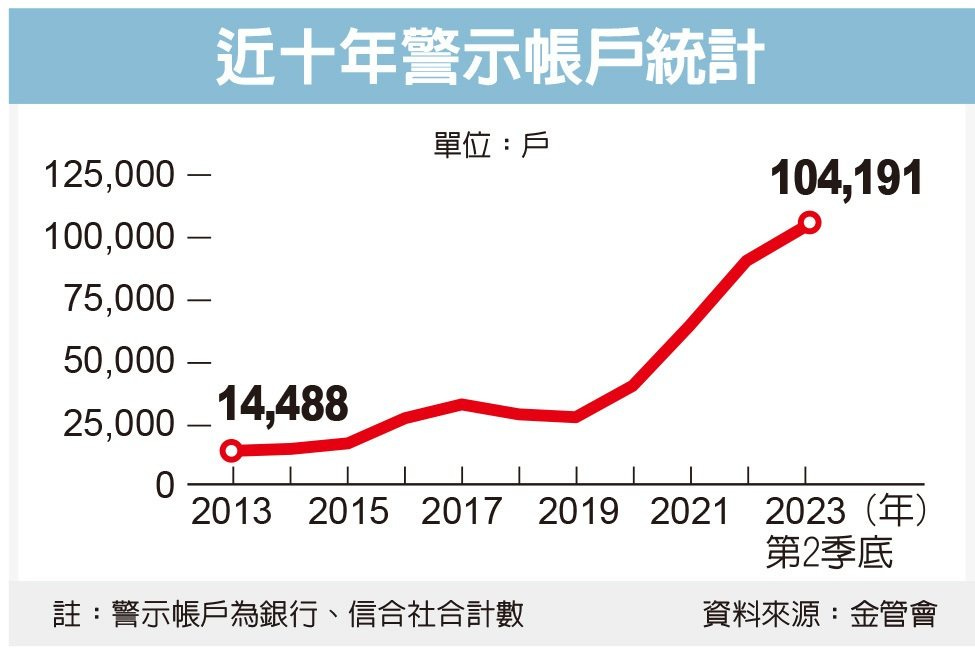

Caught between these two opposing forces, exchanges walk a tightrope, struggling to maintain balance. The recent surge in fraud has only added to the pressure. According to statistics from the Financial Supervisory Commission (FSC), as of September 2023, the total number of flagged bank accounts (frozen accounts) in Taiwan has surpassed 100,000, with consistent growth over the past five years. The National Police Agency reports that cryptocurrency accounts for nearly 30% of all fraud cases. Even the District Prosecutor's Office has been overwhelmed by the volume of fraud cases.

Seeing this dire situation, the government will inevitably order banks to strengthen risk management, and the banks will, in turn, demand that exchanges enforce stricter controls. But this is where the problem lies. Ideally, exchanges would have sharp eyes, accurately targeting fraudsters without affecting regular users. However, in reality, even sharp eyes are useless because the hardest part isn’t dealing with the fraudsters—it’s dealing with the victims.

Exchanges maintain blacklists, tracking the wallet addresses of fraudsters. Whenever a user tries to transfer money to a blacklisted address, the exchange will step in to block the transaction. But those who have already fallen into investment scams don’t feel grateful—they only feel like their financial path is being blocked.

With fraud tactics constantly evolving, and increasing pressure from banks, exchanges become more suspicious and cautious. "Widening inspections" will inevitably impact many regular users. Perhaps even MaiCoin didn’t foresee that a measure intended to prevent fraud would snowball into a major trust crisis, forcing legitimate users to flee.

Trust Crisis

Exchanges aren’t law enforcement agencies, and they don’t hold the same societal status as banks. When police expand inspections, people might blame those who threaten public order. When assets are frozen by a bank, people’s first assumption likely isn’t that the bank is in trouble. But when assets are frozen by an exchange, users question: on what grounds?

Over the past few weeks, several MaiCoin users have complained about their withdrawals being blocked. A user named "binary9507" shared their experience on the PTT forum. On August 21, they deposited around NTD 20,000 (600 USDT), intending to transfer the funds to the offshore exchange Binance, only to receive a notification from MaiCoin that the transaction required a risk control review. MaiCoin asked for personal identification and proof of income. MaiCoin explained that due to the recent increase in users flagged for risk control, the review process would take 5 to 7 days.

After binary9507 submitted the documents, MaiCoin took seven days to respond, only to request additional documents. Worse, the review period had to be recalculated, extending it another 7 to 10 days. This infuriated him, prompting him to ask why MaiCoin didn’t request everything at once. What if the funds were urgently needed?

Some users even went to the police to file a report, accusing MaiCoin of asset embezzlement. Others exaggerated the situation, irresponsibly spreading "dream posts" that accused MaiCoin of facing operational issues, causing widespread panic.

There were also opportunists. Some began spreading rumors that over-the-counter (OTC) trading was the safest method or that using C2C (consumer-to-consumer) trading platforms would avoid these risks. This is a blatant lie. Face-to-face transactions not only carry the risk of counterfeit cash or crypto, but also pose personal safety threats. With C2C trading, one must be cautious about the source of funds—both fiat and crypto could be black money. Without the proper tools to track financial flows, users are left vulnerable, like lambs to the slaughter. Unfortunately, these risks only become apparent after stepping into these traps.

Thus, MaiCoin, which originally aimed to assist the government in combating fraud, found itself at the center of a trust crisis. From a business model perspective, exchanges earn money through transaction fees. Fraud groups are also users, and they contribute more to revenue than most individuals—not only by bringing new users (victims) to the platform but also by conducting large transactions. However, for long-term sustainability, exchanges must consciously forgo these profits.

MaiCoin is not the only exchange freezing user assets. XREX Exchange also amended its terms of service this year. If a user is deemed suspicious by the platform, their account can be frozen for up to six months, and they may even face a 25% punitive penalty fee.

XREX’s measures are even stricter than MaiCoin's. If a user asks why their account was frozen, the likely answer will be “no comment.” The difficulty for exchanges lies in their inability to disclose the specifics of their risk control processes; otherwise, fraud groups would learn how to exploit loopholes.

This time, the trust crisis MaiCoin has ignited seems to stem from excessive risk control, with too many false positives affecting regular users, while the platform struggles to “unfreeze” them effectively. Users’ anger has become uncontrollable. Some accuse MaiCoin of being "tyrannical," while others blame the Financial Supervisory Commission (FSC) for being too restrictive. However, the root issue remains the growing number of fraud victims, forcing the platform to intervene.

Solution

It's challenging to strike the right balance in risk control. MaiCoin has adopted a suffocating level of control, trying to outlast the fraudsters. But no one knows if it’s truly hitting the mark. The best-case scenario would be banks reporting a significant drop in fraud cases. The worst-case scenario would be that MaiCoin drives away a large number of regular users while fraud remains rampant.

MaiCoin certainly doesn’t want to lose its legitimate users. The problem is that fraud groups are too cunning. Without addressing the core issue, if users flee from MaiCoin, fraudsters will simply follow them to platforms like BitoPro or XREX. There’s no guarantee that these exchanges won’t implement even stricter measures.

Establishing a network of joint defense between exchanges is the only way to make it harder for fraud to thrive. Blocktrend discussed1 this in July when covering the establishment of the Taiwan Crypto Association. At the time, I called it the most significant milestone in the history of Taiwan’s cryptocurrency industry, as it was the first horizontal organization formed with the goal of regulation.

The association likely felt the pressure from the market and hurried to announce last weekend that it would release self-regulatory guidelines by the end of September. According to reports:

The Taiwan Crypto Association is accelerating the drafting of self-regulatory guidelines, expected to be released by the end of September. To combat fraud, the guidelines plan to incorporate a joint defense mechanism with law enforcement. Violations of the self-regulatory guidelines could result in penalties of up to NTD 500,000... The so-called joint defense mechanism with law enforcement involves continuous two-way communication between businesses and law enforcement agencies. If there are suspicious patterns indicating potential fraud, businesses can voluntarily provide information to assist law enforcement. Moreover, if law enforcement requests data from businesses, they are obligated to comply.

The role of the association is to coordinate among exchanges, turning risk control from isolated efforts into a unified front. Just like how, once a person is flagged as having a warning account by one bank, other banks will also freeze their accounts simultaneously.

Currently, exchanges don’t communicate with each other. A user may be unable to withdraw funds at Exchange A, but have no issues at Exchange B. Once a joint defense mechanism is established, and all exchanges share the same blacklist (or risk tags), the chances of false positives and missed frauds will decrease. If a user is blacklisted by Exchanges A and B and then attempts to register at Exchange C, the risk tag will alert C to reconsider allowing the user access.

However, compared to the fraud groups, the association is still moving too slowly. The joint defense mechanism not only requires consensus among all exchanges, but there’s also the concern of whether this would infringe on user privacy.

Ultimately, MaiCoin’s trust crisis highlights the fragile confidence people still have in exchanges. MaiCoin, founded in 2013, has weathered many storms, yet public trust in it hasn’t significantly improved. When assets are frozen, users can’t discern whether it’s due to anti-fraud measures or signs of a potential collapse, which ties back to lessons learned from history.

After the collapse of FTX in 2022, public trust in exchanges hit rock bottom. To regain confidence, many platforms started providing proof of funds. MaiCoin also commissioned two audits from an external accounting firm. Unfortunately, during this crisis, I haven’t seen anyone mention these audits.

Perhaps what people are thinking is that even if the audits were legitimate at the time, falsifying records would be all too easy. Even XREX, which is most diligent in disclosing its assets, only releases a report on its reserves every three months. I can’t help but wonder: if XREX were to face a trust crisis, how much impact would those reports really have?

Traditional finance has well-established external audit mechanisms, yet banks still fail. For cryptocurrency, more must be done to build user confidence.

Before the collapse of FTX, exchanges were like black boxes. Afterward, exchanges began proactively disclosing information and inviting external audits. But as time passes without incident, people forget the importance of asset reserves. Exchanges spend money on reports, yet no one pays attention, which makes it hard to sustain such efforts.

Every system is meant to make it harder for exchanges to act unethically. The strictest regulation for financial institutions isn’t requiring banks to install cameras in their vaults, but rather conducting more frequent external audits. When exchanges realize that even if they could misappropriate funds, the short window of opportunity makes it unprofitable, they’ll keep user assets safe and maintain proper asset segregation. With the right incentives, the outcome will follow, and people will come to realize the real problem lies with fraud groups, not exchanges themselves.

I believe MaiCoin hasn’t misappropriated assets and is far from collapsing (based on MaiCoin and MAX asset balances). It’s simply been overwhelmed by fraudsters, disrupting its day-to-day operations and triggering public outcry. I hope they can pull through this difficult period. After the dust settles, if MaiCoin were to issue an NFT to users who weren’t affected by the risk control measures, it would serve as a fitting and memorable conclusion.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.