Exchange Regulation is Here! How the Taiwanese Government Ends Chaos Without Ending the Industry

#612

GM,

First, some administrative announcements. As we enter the second half of 2024, the schedule for Blocktrend will return to three articles per week starting today. This change symbolizes that I've finally survived the first period of being a new parent (?) . Not having to wake up in the midnight means I can get a full night's sleep, and life is now in color. Additionally, the RetroPGF $OP airdrop survey closed on June 30. After confirming the eligibility, I will distribute the allocated $OP to each member, with the airdrop expected to be completed within a week. Now, let's get to the main topic.

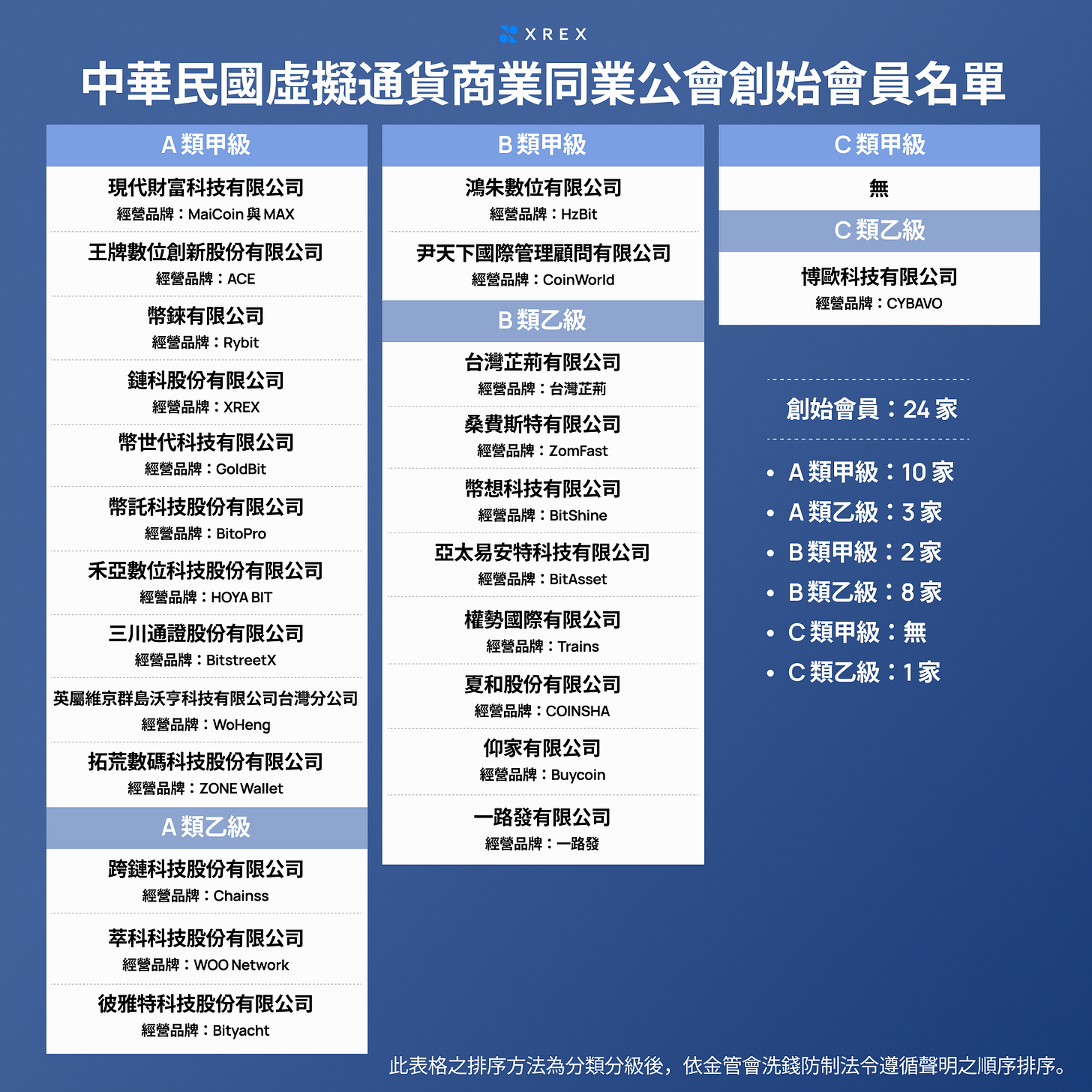

Over the past month, the Taiwan Virtual Currency Association was officially established, marking the most significant milestone in the history of Taiwan's cryptocurrency industry and symbolizing the beginning of a new chapter for the sector. Among the 24 founding members, some are familiar names, such as MAX, BitoPro, and XREX, while others are new even to me.

Most industry organizations in the crypto world are primarily for social networking, but the Taiwan Virtual Currency Association is different in that it represents the integration of cryptocurrency into the formal system in Taiwan. The association is not just about social gatherings but also bears the responsibility of assisting the government in implementing exchange regulations. However, the name "Taiwan Virtual Currency Association" itself sounds rather formal and bureaucratic. I only hear people refer to cryptocurrency this way in legal seminars.

Additionally, many people are uneasy about government regulation. On one hand, they want the government to regulate exchanges to ensure the safety of everyone's assets. If the exchanges are listing worthless tokens, even silently reciting "not your key, not your coin" won't help. On the other hand, there is a concern that the government, unfamiliar with cryptocurrency, might create inappropriate regulations that stifle innovation. Fortunately, the Taiwanese government has listened to these concerns and is moving in the right direction.

This article will discuss the impact of regulation on you and me, and why the establishment of the association is the most significant milestone to date. Putting cryptocurrency aside, I would like to conduct a public opinion survey first. If you needed to take a taxi today, how would you hail one?

I usually choose Uber, but for a long time, Uber was not considered a legal taxi service in Taiwan.

The Significance of Regulation

Uber entered the Taiwanese market in 2013, registered as an internet company, responsible for matching drivers with passengers through a mobile app. Using Uber to hail a ride was like asking online if anyone could give you a lift. The ride could be with a taxi, but more often, it was with an unlicensed private vehicle. This sparked a lot of controversies. Traditional taxi drivers were the first to protest, accusing Uber of illegally transporting passengers: how could an information company run a taxi business?

The government also noticed that Uber's financial transactions were all overseas. Not only did they miss out on taxes, but passengers also lacked legal protection in case of an accident. As Uber's operations expanded and thousands of rides were taken daily, government pressure increased. But the question remained: how should Uber be regulated?

Issuing fines was the simplest solution. The government even temporarily ordered Uber to cease operations and shut down the company. For a while, Uber passengers and drivers were like underground traders, hiding from the authorities. However, as Uber's user base grew, strict enforcement faced public backlash. People began questioning whether these regulations were outdated.

After a series of negotiations between the government and Uber, the "Uber Clause" was passed in 2019. This law clearly stated that Uber drivers must have a professional license to operate a taxi, and the vehicles must be registered as taxis. Nowadays, using Uber is as legitimate as calling a taxi.

Cryptocurrency operators are also facing a dilemma similar to Uber's early days. Cryptocurrencies are often associated with illegal activities such as fraud, money laundering, and market manipulation. Even when asked about my industry, I have to think twice before answering to avoid being stigmatized. This is especially evident in dealings with banks—crypto operators have lower loan approval rates and worry about banks refusing their business. From this perspective, government regulation is undoubtedly beneficial. Proper regulation can not only reduce criminal activities but also give industry players a chance to be treated equally.

Although regulating cryptocurrencies is a global trend, there is no standard approach worldwide. To understand why Taiwan's approach is correct, we can first look at where others went wrong.

Establishing the Association

China is the most extreme example. After noticing the chaos of ICOs in 2017, the Chinese government imposed a ban on cryptocurrencies. Everything from trading and mining to media had to shut down. The Chinese government believed that without cryptocurrencies, there would be no regulatory issues. However, in reality, cryptocurrency activities in China merely went underground. The inability to conduct legitimate business openly led to rampant illicit activities below the surface. While the government turned a blind eye, victims had no recourse.

China is an exception, as most countries in the world understand that cryptocurrencies are hard to ban completely. But when it comes to regulating cryptocurrencies, countries are generally divided into two camps: the knowns and the unknowns. I once used the platypus to illustrate the difference between these two perspectives1:

In 1798, people discovered the platypus for the first time. The platypus, a mammal that lays eggs, was a biological anomaly. The knowns believed that biological classifications could not be wrong. Mammals simply do not lay eggs. They argued that the platypus was a hoax, with someone having sewn a duck's bill onto a beaver's body. They believed that finding this "seam" would reveal the truth. The unknowns, on the other hand, thought that the platypus appeared strange because it was classified based on limited human knowledge. To debunk the hoax, experts dissected platypus specimens to find the seam. To their surprise, there was no seam to be found. The platypus naturally grew this way. Eventually, biologists created a special category for the platypus, called the family Ornithorhynchidae.

The United States belongs to the "knowns" camp. The government believes there is nothing new under the sun, and that cryptocurrencies are merely securities in another form, thus no new laws are needed. However, in reality, the U.S. Securities and Exchange Commission (SEC) has often "dissected the platypus" over the past few years without success. Recently, the SEC announced that it would stop trying to find the "seam" on ETH, effectively admitting that it is not a security, ending in an awkward concession.

In contrast, the governments of the UK2, Japan, and Taiwan lean more towards the "unknowns" camp. These countries believe that cryptocurrencies do not fit into existing regulations and that new laws (or specialized laws) are necessary, giving cryptocurrencies more room to develop. Taiwanese businesses do not have to worry about frequent court appearances like their American counterparts, which is a point of pride.

While the general direction is correct, it is too early to celebrate. How the specialized law is drafted and by whom is crucial. In recent years, there have been instances where legislators and scholars proposed comprehensive legal frameworks, claiming they were the specialized laws needed for cryptocurrencies. They argued that once passed, these laws would effectively deter crime and help the industry grow. However, such top-down legislation often overlooks practical implementation challenges.

In 2020, the U.S. Treasury proposed a bill requiring exchanges to verify the identities of external wallets for transactions over $3,000 before allowing withdrawals3. This regulation faced strong opposition from the industry because it managed wallets like bank accounts, with good intentions but impractical enforcement, pushing the legitimate economy underground.

This shows that laws must consider practical feasibility and not be made behind closed doors. The Taiwanese government adopts a self-regulatory approach, where the Virtual Currency Association, formed by industry players, sets self-regulatory standards that gradually form the basis of a specialized cryptocurrency law. According to a press release from the association:

Chairman of the Financial Supervisory Commission, Jinlong Peng, reported to the Legislative Yuan's Finance Committee on June 12 that the management of VASPs (Editor's note: exchanges) is being gradually incorporated into regulation in four stages... The formal establishment of the Virtual Currency Association signifies Taiwan's step-by-step regulatory approach, currently at the critical second stage. This phased approach has received unanimous support from the industry, demonstrating the power of public-private collaboration and becoming a model for new international regulatory technology!

How to draft this specialized law sees two opposing forces in society: the specialized law proponents, represented by judicial units, and the association proponents, represented by industry players. Both aim to establish a specialized cryptocurrency law to regulate exchange operators. The difference lies in the former advocating for direct legislation, while the latter supports initial self-regulation. Currently, the Financial Supervisory Commission favors the association's approach, much to the relief of industry players. However, some legal experts question whether having industry players regulate themselves is akin to having the players also serve as referees.

Regulatory Association

In October 2023, Professor Yueh-Ping Yang from the NTU College of Law pointed out that many aspects of the draft bill proposed by legislators were left to the (at the time, yet-to-be-established) association to formulate self-regulatory standards. He criticized this as a form of leniency and lacking democratic legitimacy. This criticism is not without merit. After all, the association had not been established yet, and it was unknown who its members would be and how decisions would be made. There were concerns that all members might collude, using the association for their own benefit at the expense of consumers' interests, and no one could guarantee otherwise.

However, this is also the main point that the newly established Virtual Currency Association is eager to clarify. The new vice president of the association, Hsu Hui-Tsung, stated:

Self-regulation is not about advocating for the industry to govern itself, but about first developing a series of corresponding technologies as 'infrastructure,' ultimately forming the conditions for 'external regulation.'

It's a common consensus that players cannot act as referees; cryptocurrency industry players cannot regulate themselves. But who should set the rules of the game? The players on the field certainly understand the gameplay best, while third parties outside the field have less vested interest. The best scenario is to find a balance, where both sides jointly establish a cryptocurrency law that is enforceable and protects consumers. The good news is that this is precisely the direction currently adopted by Taiwan's Financial Supervisory Commission. If the same situation occurred in the United States, the price of cryptocurrencies would likely soar.

In Taiwan, associations serve as a communication bridge between the government and industry players, which is very different from the frequent court battles in the U.S. For example, the Taiwan Bankers Association is composed of banking industry players, but its operations are almost an extension of the government's Banking Bureau. If an industry player is blacklisted by the association, it is as if they are cut off from all banks and unwelcome everywhere. The Virtual Currency Association aims to become such a "regulatory association," with the urgent task of regulating its own members.

When all industry players follow the same set of standards, such as a unified real-name verification process, segregation of customer assets, and a review mechanism for listing and delisting cryptocurrencies, newcomers to the crypto world won't need to constantly ask in forums, "Is XXX exchange reliable?" Veterans in the crypto community also won't need to guess which exchange seems wealthy enough to cover losses. Any legitimate industry player on the approved list should theoretically have no issues.

The establishment of the Virtual Currency Association signifies that the Taiwanese government has recognized the growing number of cryptocurrency users and the necessity of creating a specialized system for management. When people no longer have to worry about exchanges going bankrupt or being scammed by worthless tokens, cryptocurrencies will have a chance to enter the mainstream.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.