Ethereum's Most Impactful Upgrade Is Here! The Cancun Upgrade (Dencun): A Tenfold Reduction in Transaction Fees and Unlocking New Business Models

#596

GM,

BTC continued to break historical highs yesterday. In contrast, ETH still has a final stretch to reach its 2021 all-time high of $4,700. When will it be ETH's turn to set a new historical high? I'm not an expert, but I am quite confident that after March 14th, Ethereum's usage and user numbers will hit a new high – the Blocktrend upgrade (Cancun-Deneb, abbreviated as Dencun) is here.

Compared to Ethereum's London1 and Shanghai2 upgrades in the past few years, the upcoming Cancun upgrade3 this week will undoubtedly be the most impactful for users. This is because it addresses a crucial issue directly affecting everyone – high on-chain transaction fees. Some may say, "I keep my money on Binance; on-chain upgrades don't concern me, right?" After reading this, I believe you'll have a different answer.

Why is it so challenging to reduce on-chain transaction fees?

For the younger generation born into a world with widespread internet access, it's difficult to imagine a "primitive life" without it. Similarly, those who joined Web3 after the Cancun upgrade might find it hard to comprehend the on-chain life before 2024.

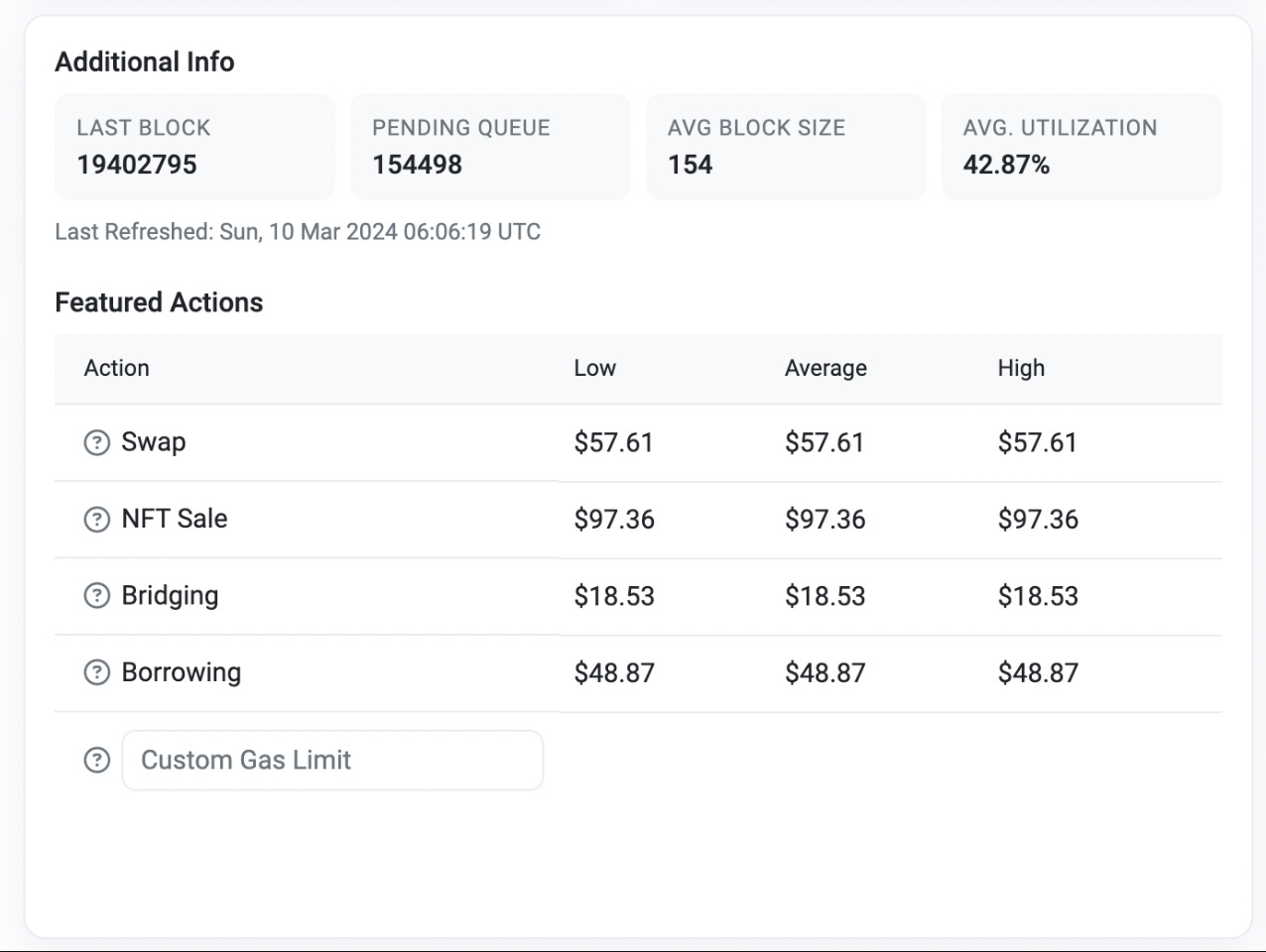

Below is a screenshot of Ethereum usage costs as of my writing. Swapping tokens costs $57 worth of ETH as a fee, while buying and selling NFTs requires a fee of $97. The high fees are a result of Ethereum's "narrow bandwidth." Ethereum can only process 13 transactions per second, leading people to pay higher fees for priority and immediate transaction confirmation. In the "arms race," this has driven up the overall cost of using Ethereum. As a result, most people cannot afford it, turning Ethereum into a "chain for the elite," limiting the development of on-chain applications.

To reduce transaction fees, Ethereum's operational efficiency must be improved. Addressing on-chain congestion is essential for lowering transaction costs. Ethereum, much like a democratic system such as Taiwan's, hesitates to compromise by concentrating power in a few hands (centralized systems) to enhance administrative efficiency. Instead, it continues to seek a balance between democratic values (decentralization) and economic development (lowering transaction fees).

In the past few years, Ethereum has successfully maintained decentralized operations, but the call for "democracy doesn't put food on the table" has grown louder. Many have migrated to other blockchains like Solana. It wasn't until 2023, with the gradual formation of Ethereum's Layer 2 network (L2), that people finally glimpsed the dawn of economic development – the worst days were over.

Constructing L2 is Ethereum's new solution to balance efficiency and decentralization. Technically, it processes transactions off-chain (L2) before bundling and posting them on-chain (L1). It's akin to constructing elevated bridges on congested highways to alleviate traffic. Now, using Ethereum L2 for transfers, such as with OP, Arbitrum, or Base, incurs fees ranging from $0.2 to $1. This is over 50 times cheaper than Ethereum (L1) but still not entirely negligible.

The good news is the upcoming Cancun upgrade this week, which will further reduce fees by 10 to 100 times on top of L2. In other words, transaction fees for using Ethereum L2 will become so cheap that they can be ignored, similar to using Polygon or Solana.

How much cheaper will it be?

Some may say, "Reducing fees by 10 to 100 times, isn't that too broad?" This is because many factors affect transaction fees, including the possibility of increased activity after the upgrade. The actual reduction is still unknown until the upgrade is completed. Some have even opened prediction markets (considered gambling in Taiwan), allowing people to bet on specific numbers.

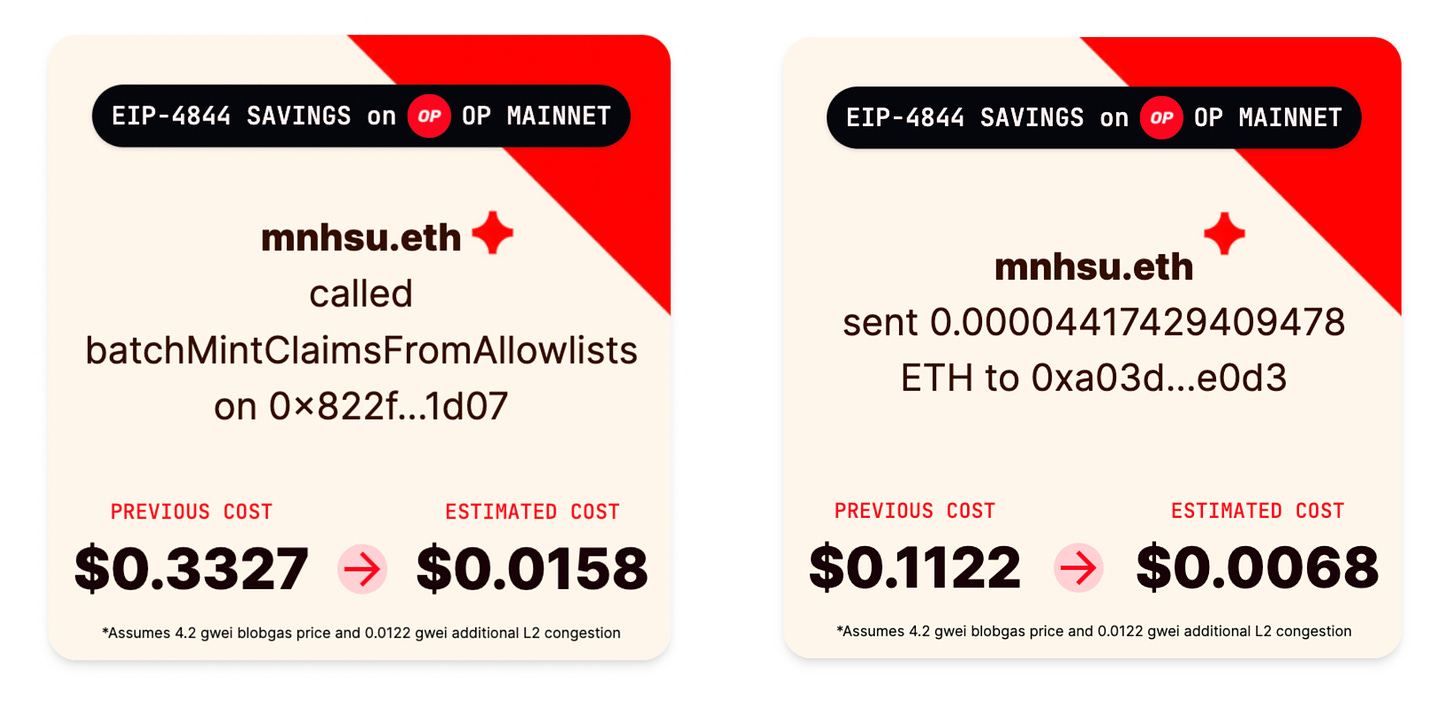

Recently, someone developed a fee simulator, setting parameters to give us a preview of the upgrade's benefits. It's straightforward to use – just paste the hash value of any past transaction, and it will calculate the difference in fees before and after the Cancun upgrade. I tried two transactions myself, one complex (expensive) NFT minting and the other a straightforward (cheap) ETH transfer.

In the left side of the image below, you can see that initially, I spent 0.3327 USD worth of ETH to mint an NFT, which is approximately 10 TWD and already considered affordable. However, after the Cancun upgrade, the transaction fee can be further reduced to 0.0158 USD, approximately 0.5 TWD. This is a 20-fold decrease in cost compared to the original.

On the right side, you can see a transaction where I sent ETH to participants during a speaking engagement. Initially, in order to send 5 TWD, I had to pay a transaction fee of 3.5 TWD. However, after the Cancun upgrade, the cost can be reduced to 0.2 TWD. I intentionally used a 5 TWD transfer as an example because small transactions are part of people's daily lives and represent the greatest contribution of the Cancun upgrade to blockchain technology.

Whether for cross-border large transactions using banks or cryptocurrencies, the cost-effectiveness is already evident, and widespread adoption is only a matter of time. However, for individuals, activities like sharing videos, bookmarking articles, or creating game characters are part of everyday life. If each of these actions incurred a 5 TWD transaction fee, it might not be a significant economic burden, but it would be a considerable psychological burden. The Cancun upgrade not only reduces costs but also brings about a qualitative transformation from quantitative improvements.

Quantitative Change Leads to Qualitative Change

In 2020, Blocktrend introduced4 the smart contract wallet Argent, praising its innovative features. Not only did Argent introduce smart contracts to replace private keys, but it also actively promoted ENS domain names, integrated DeFi applications, and even generously covered on-chain transaction fees for all users. Its user-friendly design was so impressive that even Blocktrend's editors created a new wallet 🤣.

However, Argent's success, attracting a large user base, combined with the bull market and soaring on-chain costs, made transaction fees an unsustainable expense for Argent. The subsidy mechanism ultimately faded away. No matter how useful the features were, saving money proved more crucial. Since then, I rarely opened Argent because people had to face the old problem of safeguarding private keys to avoid paying expensive fees.

Smart contract wallets, devoid of private keys, eliminate the risk of losing keys. If you change your phone, recovery is possible through social recovery mechanisms. Protection against phishing attacks is enhanced through whitelists or the introduction of multi-signature mechanisms. While these features are excellent, each action incurs transaction fees ranging from tens to hundreds of dollars. On-chain security seems to have become a privilege for the wealthy.

Therefore, I am optimistic that after the Cancun upgrade, smart contract wallets will rapidly become more widespread, and transaction fee subsidies will make a comeback. In fact, Coinbase has already implemented a subsidy strategy in advance5. Users of Coinbase Wallet transferring ETH and USDC on Polygon or Base chains have their transaction fees covered by Coinbase. Such subsidies are expected to become more widespread in the future. The decision on who bears the transaction fees will determine the development of business models.

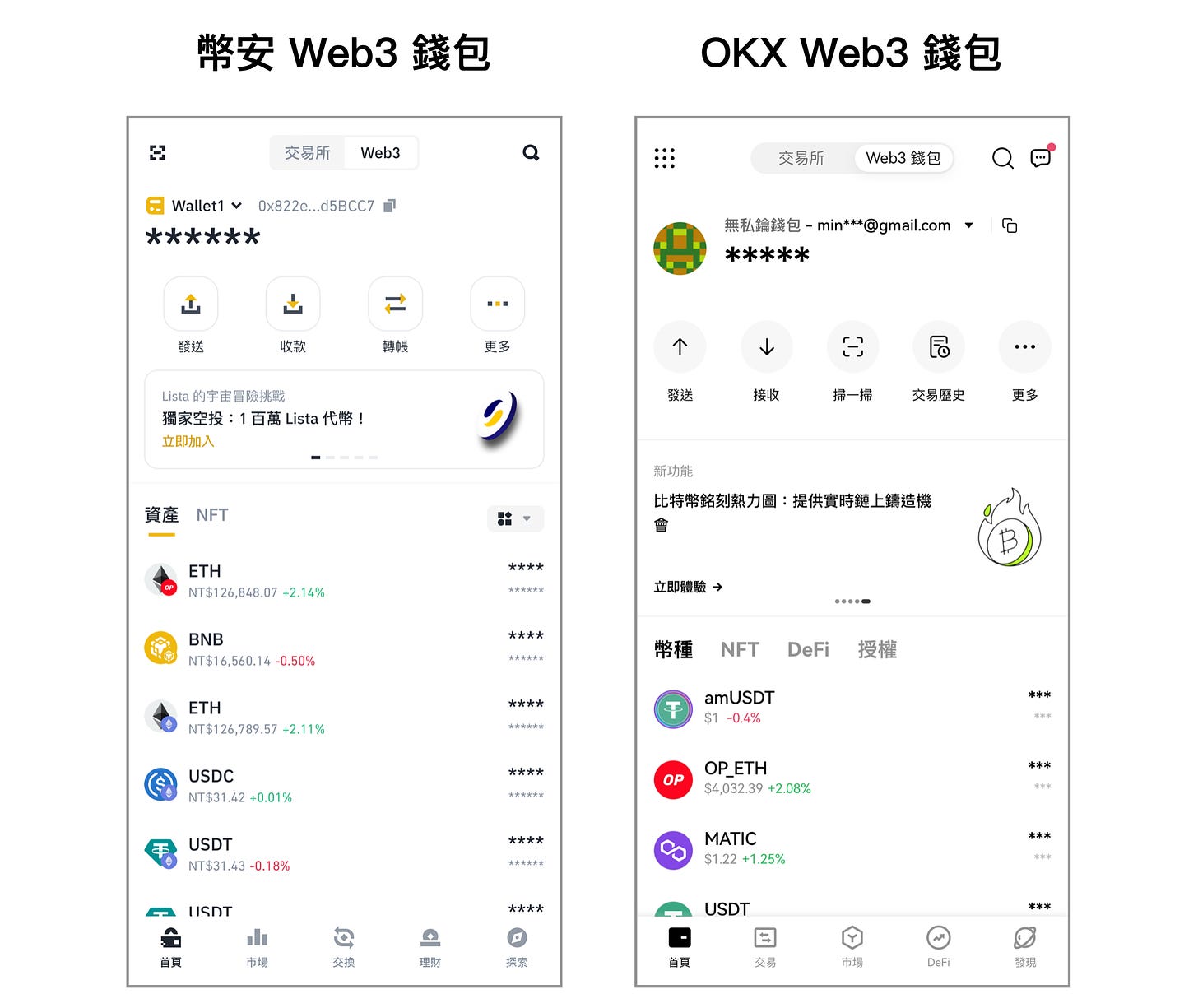

The most evident shift is seen in centralized exchanges. Previously, platforms like Coinbase, Binance, and OKX aimed to keep users within their exchanges. However, in recent months, they have all added Web3 wallet features6 within their apps, making it easier for users to move funds out of exchanges and into the decentralized world. The most reasonable explanation is that the decentralized world has become a new battleground for various exchanges. When using Coinbase Wallet with fee subsidies, but Binance Trust Wallet without, where would you choose to keep your funds?

As users enter Web3, they no longer need to consider transaction fees, allowing applications beyond finance to flourish. For example, as introduced by Blocktrend last week, Paragraph enables users to collect NFT articles7. Additionally, the Chinese writing platform Matters recently announced a shift towards developing on the OP chain. After the Ethereum Cancun upgrade, developers who once "ran away" are now reevaluating the possibility of returning. In terms of development capabilities, Ethereum still outshines other ecosystems.

OP Labs CEO Karl Floersch vividly describes the future:

When on-chain applications can seamlessly integrate with other products, rapid cross-application development will soon emerge. For instance, people can obtain NFTs in online games, conduct DeFi transactions, or even embed decentralized social media into games. These complex operations not only interconnect but can be achieved at zero cost.

However, in reality, many people have yet to take the first step. Without transferring assets from Ethereum (L1) to L2, all the above remains theoretical.

The end of scarcity

Currently, support for L2 on exchanges is not yet widespread. As of my writing, several major exchanges in Taiwan still do not support withdrawals to the OP chain. Some more conservative ones only offer Ethereum and Tron as options. They are expected to catch up gradually over the next few months, following Ethereum's upgrade schedule.

While Ethereum is set to complete its upgrade on March 14 in Taiwan, each L2 has its own timetable. For example, the OP chain will be the first to follow, but Polygon zkEVM will complete its upgrade in May. When L2 transaction fees significantly differ from Ethereum, those who are still observing will finally take action.

Regarding the Cancun upgrade, most online content focuses on technical aspects. For instance, the substantial reduction in L2 transaction fees is attributed to the introduction of the blobspace concept (EIP-4844) for Ethereum in this upgrade. This involves creating a new space for L2 data by temporarily storing it off-chain in L1. It's like setting aside a separate chain solely for data storage, eliminating the competition for the same resources. This decouples L2 transaction fees from L1 congestion, ultimately reducing overall costs.

Even though these technical details will remain clear for many years to come, I believe people will soon start to forget the current meticulous consideration of on-chain transaction fees and the hesitation to act without seizing the right moment. Looking at the history of blockchain development, the Cancun upgrade signifies the end of (block space) scarcity and the beginning of abundance.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.