Ethereum Financial Report Released: Blockchain as Retail Industry and How to Identify a Real Bull Market

#605

GM,

First, I have two good news to announce. This month, I finally sent my child to a daycare center, giving me full time to work. Therefore, Blocktrend is expected to resume its publication frequency of three updates per week (two articles and one podcast episode) starting in July. Thank you all for your understanding over the past six months. This pace allowed me to have time to experiment with producing video. Videos will continue to be produced, but it will take some time to find the right direction. Hopefully, in the future, Blocktrend's weekly three updates will consist of articles, podcasts, and videos.

Additionally, the OP token rewards that Blocktrend received from RetroPGF3 will be distributed in June. I will announce the process for members to claim their rewards in the coming weeks. Now, let's get into the main topic.

Recently, the first thing I ask my peers in the crypto industry when we meet is how they are doing. It's not just small talk; it's a way to find comfort. Although cryptocurrency prices are hovering around historical highs, Blocktrend's subscription numbers indicate that this round of the crypto bear market hasn't ended yet. Initially, I thought it was just my writing that wasn't good enough, but after asking around, I found out that everyone's traffic is declining, except for investment teachers who promise to help you grasp the secrets of wealth. Now you know how the title came about 😈.

This article discusses the business model of blockchain and the financial performance of Ethereum.

Digital Retail Industry

It's earnings season, and various companies are releasing their operational figures. Gary Gensler, chairman of the U.S. Securities and Exchange Commission (SEC), publicly questioned in a media interview, "Where are the financial reports of these cryptocurrencies?"

Gary Gensler certainly knows that blockchains are not publicly listed companies and are not obligated to produce financial reports or disclose them to investors. He just wanted to take the opportunity to criticize the lack of transparency in the blockchain space, which is full of fraud and market manipulation. However, someone actually compiled an Ethereum financial report based on on-chain data, and the highlight is that in just the first half of 2024, Ethereum has already earned $230 million!

Making money is good news, but what does it mean for Ethereum to make money, and who can benefit from it? To understand this, we need to start with what business Ethereum is in.

If we categorize by industry, blockchain is like the "retail industry," selling digital goods—blockspace.

Talking about blockspace might be confusing, but it becomes clearer when compared to telecom companies selling internet bandwidth. If people want to go online, they must buy bandwidth from a telecom company; similarly, if they want to get on the blockchain, they need to buy blockspace. Blocktrend has previously explained why blockspace is the most competitive scarce resource for the next 10 years1, so I won't repeat that here.

If we look at it as a straightforward buying and selling transaction, blockchain developers create blockspace and sell it to users. Users who want to make transactions on the blockchain must buy blockspace to get their transactions recorded on the chain. In other words, the market demand for blockspace depends on how many applications are on the blockchain; the more applications there are, the more users will be attracted to the blockchain. The more valuable the blockspace is, the more profitable the blockchain becomes.

For example, I created a chain called MingEn Chain and issued MN coins. My business model is very simple. If people want to make transactions on MingEn Chain, they must first buy MN coins because MingEn Chain only accepts MN coins for transactions. My plan is to generate initial funding by selling MN coins. If in the future many people want to use MingEn Chain for transactions, the price of MN coins will rise accordingly.

However, MingEn Chain is not a cost-free business. I have to spend money on research and development, upgrading MingEn Chain to ensure technological leadership, and creating economic incentives to attract miners to help maintain the ledger. Without corresponding revenue, MingEn Chain would eventually shut down, and MN coins could become worthless.

MingEn Chain is a simplified version of Ethereum.

Ethereum Financial Report

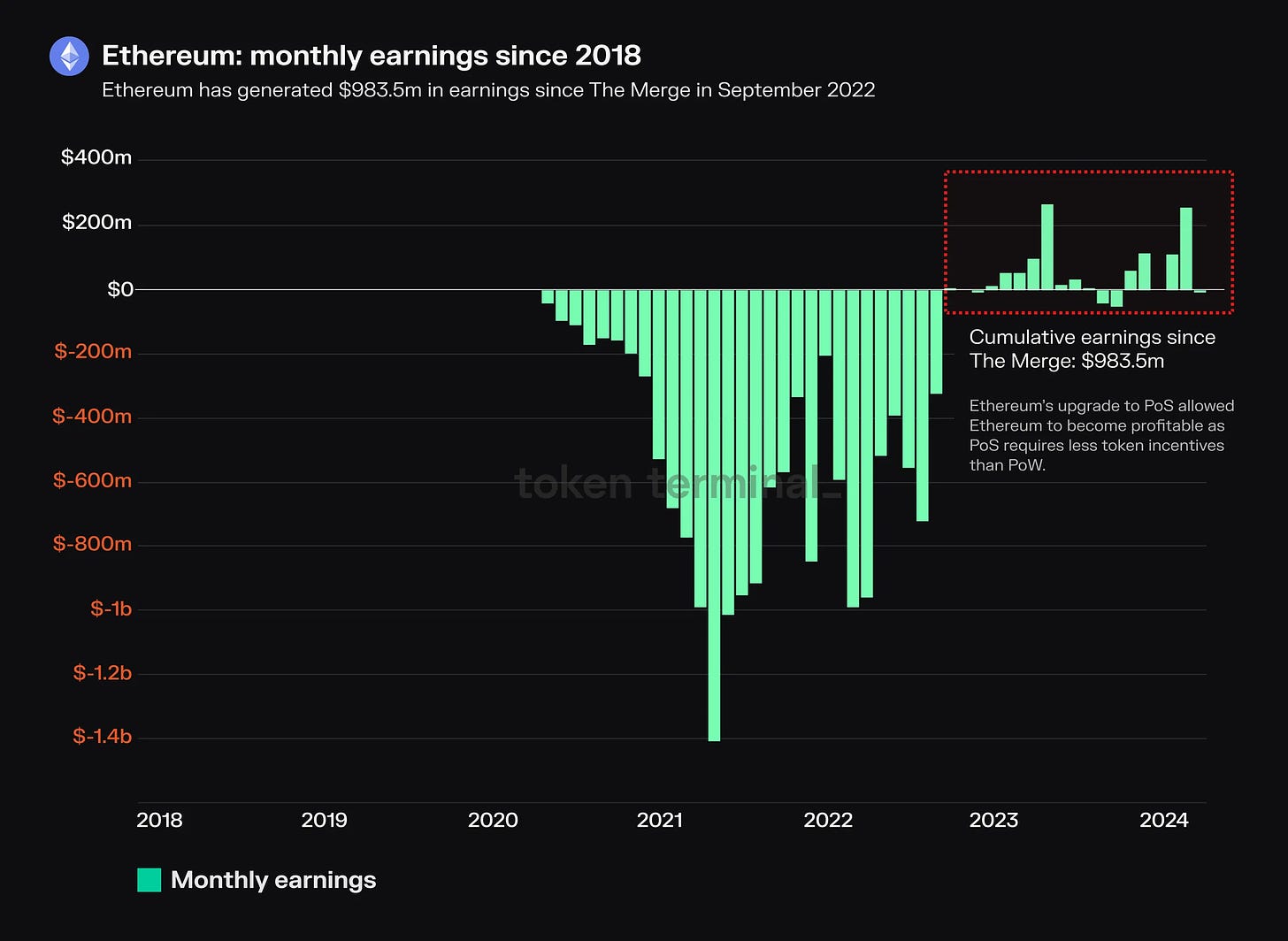

The chart below shows Ethereum's profitability from 2018 to the present. The horizontal axis represents the years, and the vertical axis represents the profit amounts. The chart indicates that Ethereum was in a loss before 2022 and only broke even in 2023, eventually turning profitable.

For startups, breaking even signifies the end of burning money and the beginning of making money. For Ethereum, it means the end of inflation and the beginning of deflation. To put it more simply, it marks the end of declining coin prices and the start of rising prices.

Ethereum's revenue comes from the transaction fees (gas fees) earned by selling blockspace. A common question for those new to blockchain is: who ultimately receives the transaction fees paid during transfers? The answer is that they go into the pockets of miners and Ethereum.

Miners receive transaction fees as their payment, while Ethereum destroys (burns) the received ETH. This step is similar to a company buying back its stock from the market (known as treasury stock) to push up the stock price. By burning ETH, Ethereum reduces the circulating supply in the market, thereby increasing the token's value.

Burning is a more aggressive approach than buybacks, as it permanently removes the tokens from circulation. But does this mean the price will skyrocket?

Ethereum has another faucet injecting new supply into the market, which is the ETH block rewards given to miners. These ETH increase the market supply, diluting the token's price. However, block rewards are a necessary expense, often referred to as the "security expenditure of the blockchain." Without miners around the world, the blockchain could not operate securely.

With the basics of issuance and burning in mind, the financial report numbers become much clearer. Before 2022, Ethereum's issuance rate was faster than its burn rate. During this time, expenses exceeded income, putting Ethereum in a "loss" state, which suppressed the token price. However, after 2023, the situation reversed, with the burn rate surpassing the issuance rate. Income exceeded expenses, turning Ethereum "profitable," and the token price was pushed upward.

The key to turning losses into profits lies in the Ethereum upgrade in September 2022—the Ethereum Merge—which significantly reduced cost expenditures. The Merge replaced proof-of-work mining with proof-of-stake mining, but few noticed that this also changed Ethereum's tokenomics, reducing the issuance rate by 88%.

Miners were the first to be impacted, with their income dropping to only a tenth of what it was before the upgrade. However, this did not lead to an exodus of miners, as they found that even with reduced income, mining remained profitable. Proof-of-stake mining is much less energy-intensive than proof-of-work mining, resulting in substantial savings on operational costs despite the lower income.

From a tokenomics perspective, the upgrade was the biggest factor in Ethereum turning profitable in 2023. Previously, Ethereum had to issue 13,000 ETH daily to miners, but post-upgrade, the daily issuance dropped to around 2,000 ETH. With the faucet turned down, ETH in circulation became relatively scarce. If the burn rate consistently exceeds the issuance rate, a rising token price becomes inevitable.

Inflated Market

Returning to Ethereum's financial performance, we notice that in recent years, Ethereum's transaction fee income has been continuously declining. There are two possible explanations for this. The optimistic view is that people have shifted to layer-2 networks, alleviating Ethereum's congestion issues. The pessimistic view is that on-chain activity on Ethereum has decreased because most people have either exited the crypto space or are only trading on centralized exchanges. I lean towards the pessimistic view, as not many people are currently using layer-2 networks.

Additionally, in the opening of the 600th article, I pointed out the issue of the inflated market2. Data from Token Terminal confirmed this feeling, and I found some solace in this financial report. It finally helped me understand why Blocktrend's subscriptions have been slowly declining since 2022, while investment gurus remain popular.

During this period, whenever I said the crypto market was still in a bear market, it felt like lying with my eyes open. Weren't token prices near historical highs? If this is a bear market, then what counts as a bull market? Now, I finally have more objective numbers to explain it. Simple price increases are a false bull market. When Ethereum earns money and pushes up the token price, it reflects genuine demand, constituting a true bull market.