GM,

This week marks the arrival of the Chinese New Year, and I'd like to wish everyone a happy Lunar New Year! The result of the membership lucky draw is below, and congratulations to the following five lucky winners who have won CoolWallet cold wallets (S and Pro versions will be randomly assigned). We also appreciate the encouragement and suggestions from many members in the survey, helping us improve.

Additionally, the RetroPGF grant from Optimism is expected to be received after the New Year. I have already completed the real-name verification process for the recipients, and any further updates will be provided promptly. The investigation of wallet addresses will commence only after confirming the receipt of OP tokens. Now, let's get to the main topic.

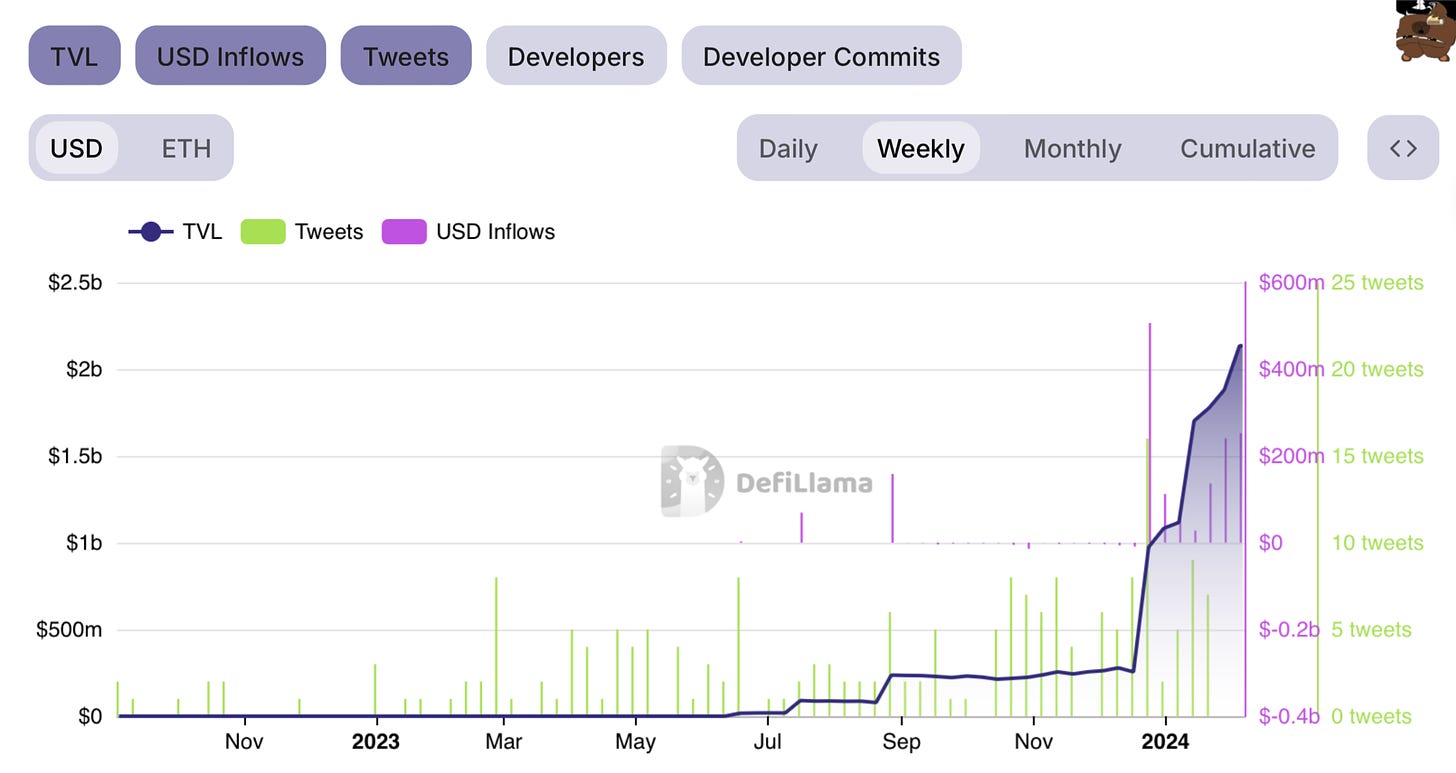

In the last article before the New Year, we discussed the rapidly emerging re-staking protocol, EigenLayer. Despite being a work in progress, EigenLayer has already amassed a Total Value Lock of $2 billion, ranking globally at the tenth position, on par with well-known DeFi applications such as Curve and Compound. If you are concerned about missing out on the EigenLayer trend, the image below can alleviate your information anxiety. Although EigenLayer has been a topic of discussion online for the past year, actual capital inflow has only occurred in the last month.

The key lies in the FOMO (Fear of Missing Out) sentiment deliberately created by foreign media, announcing a large-scale airdrop for EigenLayer, which led people to rush in fear of missing out. I have a sense of foreboding about suddenly popular projects, but EigenLayer's concept of re-staking does indeed bring innovation. To understand EigenLayer, we need to start with Bitcoin.

Decentralized Trust

Bitcoin introduced decentralized trust to the digital world. This concept is already familiar in the physical world, with marriage being the best example.

When getting married, in addition to legal marriage registration, there is also the custom of holding a public wedding to announce to friends and family. The former is centralized, while the latter is decentralized trust. Those who have organized weddings know the hardships of the preparation process, and registration is simpler. However, elders believe that mere registration is not enough; a wedding ceremony must be held to make it count.

At the moment of completing my wedding last year, I deeply realized that establishing decentralized trust incurs a high cost and is not easily tampered with in the future. This is commitment. Bitcoin introduced the same concept to the digital world by bringing together a large group of miners as "witnesses" on the network. Hackers are like the "home-wrecker" in marriage; even if they tamper with the centralized marriage registration, changing the perception of friends and family towards the spouse one by one is extremely difficult. The higher the tampering difficulty, the more secure the system.

The limited capacity of human memory makes it challenging to keep up with frequent updates to marital status, potentially causing confusion among friends and family. However, Bitcoin operates in the digital realm, allowing updates every 10 minutes without the risk of incorrect data retention. While the frequency is high, the data remains accurate. Bitcoin establishes decentralized trust in the digital world, despite being expensive and less efficient than centralized systems, but it holds more value. Otherwise, elders wouldn't insist on wedding ceremonies.

Soon, people discovered that Bitcoin could not only witness the transfer of BTC assets but also attest to more complex information. However, the functionalities of the Bitcoin system are limited. If developers want to create new applications, they usually have to build a new blockchain from scratch and recruit miners. Ethereum changed this when it was introduced, opening a new chapter for on-chain applications.

In theory, if all application developers use Ethereum together, everything should be harmonious. However, many blockchain ecosystems, such as Solana, Cosmos, and Avalanche, operate independently, with technological innovations incompatible with Ethereum, requiring their own set of miners.

EigenLayer, the focus of this article, considers this as repetitive investment. If Ethereum miners could be modularized into a Trust-as-a-Service (TaaS), allowing other applications to share Ethereum's security, it could be a win-win for the industry.

Trust-as-a-Service

EigenLayer's core idea is simple. Since the cost of establishing decentralized trust is high, why not introduce an existing trust foundation? According to EigenLayer:

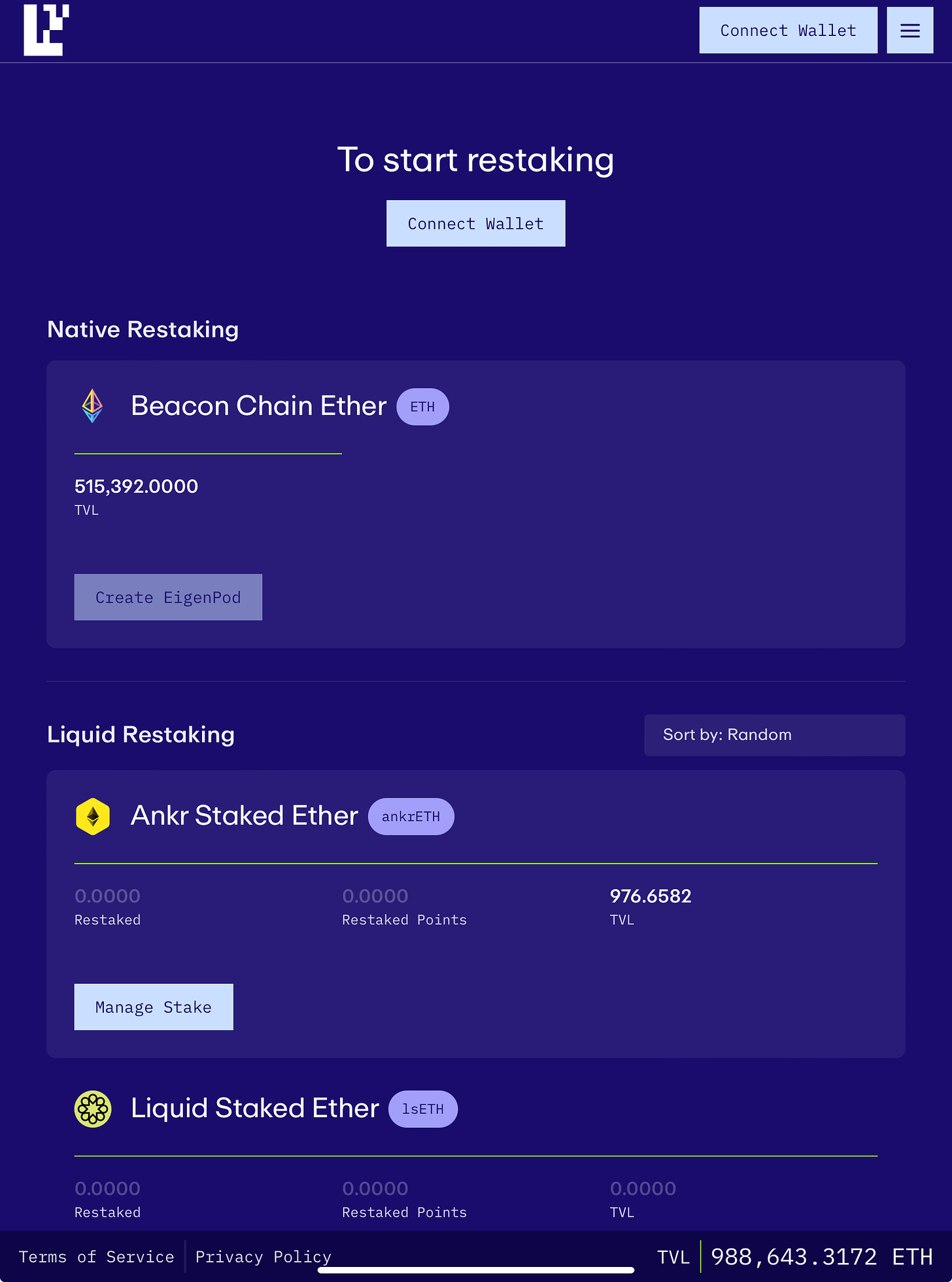

EigenLayer is a protocol on Ethereum that introduces a new concept in crypto-economic security called restake. It enables people to reuse ETH at the consensus layer. Whether users are using native staking or liquidity staking with ETH, they can restake ETH or liquidity staking tokens to EigenLayer's smart contracts, expanding crypto-economic security to other applications on the network and earning additional rewards.

Ethereum acts like a globally trusted group of wedding witnesses (ETH stakers), responsible for "toasting" and witnessing all on-chain activities on Ethereum. In case someone tries to reverse time and change things, these witnesses step in to uphold justice.

EigenLayer advocates that if these witnesses can operate independently to serve more applications, they can not only earn extra income but also allow other applications to share security with Ethereum, creating a dual benefit.

The actual operation process is straightforward, even for those unfamiliar with EigenLayer's activities. If you already have ETH on an exchange or participate in staking with Lido, simply withdraw your ETH or stETH and move it to EigenLayer. These ETH will continue to earn their original staking rewards, with EigenLayer generating additional income for you in the future.

There's no free lunch in this world. When people entrust their ETH to EigenLayer, it takes your ETH to ensure the security of other applications, adding an extra layer of risk. Taking the Ethereum node paralysis incident discussed in last week's article as an example, nodes that unexpectedly go down are penalized by the system, resulting in ETH being cut as a punishment. If, in the future, your ETH is used by EigenLayer to secure other applications, although you may earn extra income under normal circumstances, you also bear more risk in extreme situations.

Most people have no intention of becoming hackers to disrupt systems, so they are willing to hand over their ETH to EigenLayer for additional earnings. This not only increases the capital efficiency of ETH but also lowers the threshold for innovation.

In the case of on-chain price oracles, ChainLink operates based on the token economy of LINK1. Each data provider has to stake LINK tokens as collateral. If operations run smoothly, they earn income. However, if someone provides false data, the collateral is confiscated. ChainLink's token economic design has been quite successful, with a total market value exceeding $10 billion, ensuring stable operation of the service.

However, EigenLayer believes that an oracle might not need to create its own token and that it's simpler to introduce ETH directly through EigenLayer. The oracle can still design a reward and punishment system, using economic incentives to encourage data providers to operate honestly. ETH placed in EigenLayer would serve as collateral, exposing participants to higher income and risk.

In theory, as long as risk is well controlled, EigenLayer could bring in additional income, attracting people to participate in ETH staking, benefiting investors, developers, and Ethereum itself. The challenge is that people often have a strong gambling tendency, and risk control is akin to the health warnings on cigarette packs. Moreover, EigenLayer has no precedent of failure to guide investors, making it akin to a time bomb.

Time Bomb

Ethereum founder Vitalik Buterin wrote an article in 2023 titled "Don't overload Ethereum's consensus," discussing the risks introduced by EigenLayer:

Ethereum's consensus mechanism is currently one of the most secure cryptographic economic systems. Validators stake a total of 18 million ETH (valued at approximately $34 billion), producing a block every 6.4 minutes and running various node software redundancies. Over the years, there have been many ideas to utilize Ethereum's consensus mechanism for other purposes.

Represented by EigenLayer, re-staking allows Ethereum stakers to simultaneously use their ETH as collateral for another protocol. In certain situations, if their collateral is slashed due to improper behavior according to the rules of another protocol, risks are incurred. ... While reusing staked ETH introduces some risks, it is generally acceptable. However, if the intention is to change Ethereum's social consensus for the benefit of the application itself, problems arise.

The article is somewhat abstract as these are hypothetical scenarios. Still, EigenLayer's founder, Sreeram Kannan, retweeted the article on Twitter and added several warnings:

Do not build complex financial applications on the basis of re-staking.

Do not expect to resolve application errors through Ethereum forks.

Both are warning against the same thing—EigenLayer is not suitable for fundamental financial applications. Once an incident occurs, it will be challenging to handle. Suppose someone uses EigenLayer to create an on-chain price oracle, and many developers build more complex DeFi applications based on it. In that case, risks arise!

If the price oracle malfunctions, all DeFi applications built on top of it will be impacted. If the losses are substantial, the last resort may be resorting to time reversal. Victims would hope to recover losses through an Ethereum hard fork, similar to the 2016 DAO hack incident2, causing a split in the Ethereum community. Ethereum itself might not have a problem, but it ends up cleaning up the mess for other projects.

The more projects use EigenLayer, although it may temporarily boost ETH, the risk of the Ethereum community splitting is rapidly accumulating. The critical threshold is unknown. It's like sports lottery and sports betting. The sports lottery adds excitement to matches, attracting more viewers. However, underground betting with large sums often influences match outcomes, prompting players to engage in match-fixing to win money.

If EigenLayer lacks a management mechanism, it becomes a systemic risk for Ethereum. Ideally, EigenLayer encourages users to stake assets on less-known, less critical decentralized applications to prevent potential issues. However, this contradicts human nature. If you are an ETH staker, would you choose to stake ETH in the most well-known DeFi applications or in DeFi applications you've never heard of?

System resilience requires creating redundancy. While EigenLayer improves capital efficiency and reduces redundancy, it also weakens system resilience. In essence, it is exchanging personal benefits for system risks. EigenLayer attracted over $2 billion in funds within just one month, and many participated in anticipation of airdrops rather than the potential returns from staking ETH.

Chasing profits is human nature but has turned EigenLayer into a time bomb for Ethereum.

Blocktrend is an independent media sustained by reader subscriptions. If you find Blocktrend articles valuable, feel free to share this piece. You can also join discussions on the member-established Discord or save this Writing NFT to add this article to your Web3 records.

Furthermore, please recommend Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a one-month membership extension for free. You can check the article list for past publications. In response to frequent inquiries about referral codes, I have compiled them on one page. Feel free to use them.