EigenLayer Restaking: Commercializing the Economic Firewall and Three Unavoidable Layers of Risk

#602

GM,

This discussion focuses on the re-staking of EigenLayer tokens, a topic that has gained increasing importance in recent times. There are three main reasons for this:

Last week, EigenLayer's first application was officially launched.

EigenLayer has become the second-largest Ethereum application after Lido.

Participants in re-staking ETH can enjoy an annual yield of up to 60% (APY).

In an article I wrote two months ago1, I emphasized the systematic risks associated with EigenLayer. However, whether considering specific applications, ecosystem development, or profit opportunities, giving more attention to EigenLayer is worthwhile. After all, where there's profit to be made, there will always be risk-takers.

Here, I'm speaking from personal experience. Recently, I've staked ETH in EigenLayer for re-staking and, through the emerging DeFi service Pendle Finance, boosted the annual yield of ETH to an impressive 60%.

I believe most people are still adopting a wait-and-see approach, so I've decided to take the lead. This article details my hands-on experience, explaining how to participate in EigenLayer re-staking, what the economic barriers are, and the three layers of risk that cannot be ignored.

Getting Started with "Re-staking"

Re-staking may sound abstract, but the process is straightforward. It involves only two steps:

Re-staking (restake)

Delegating (delegate)

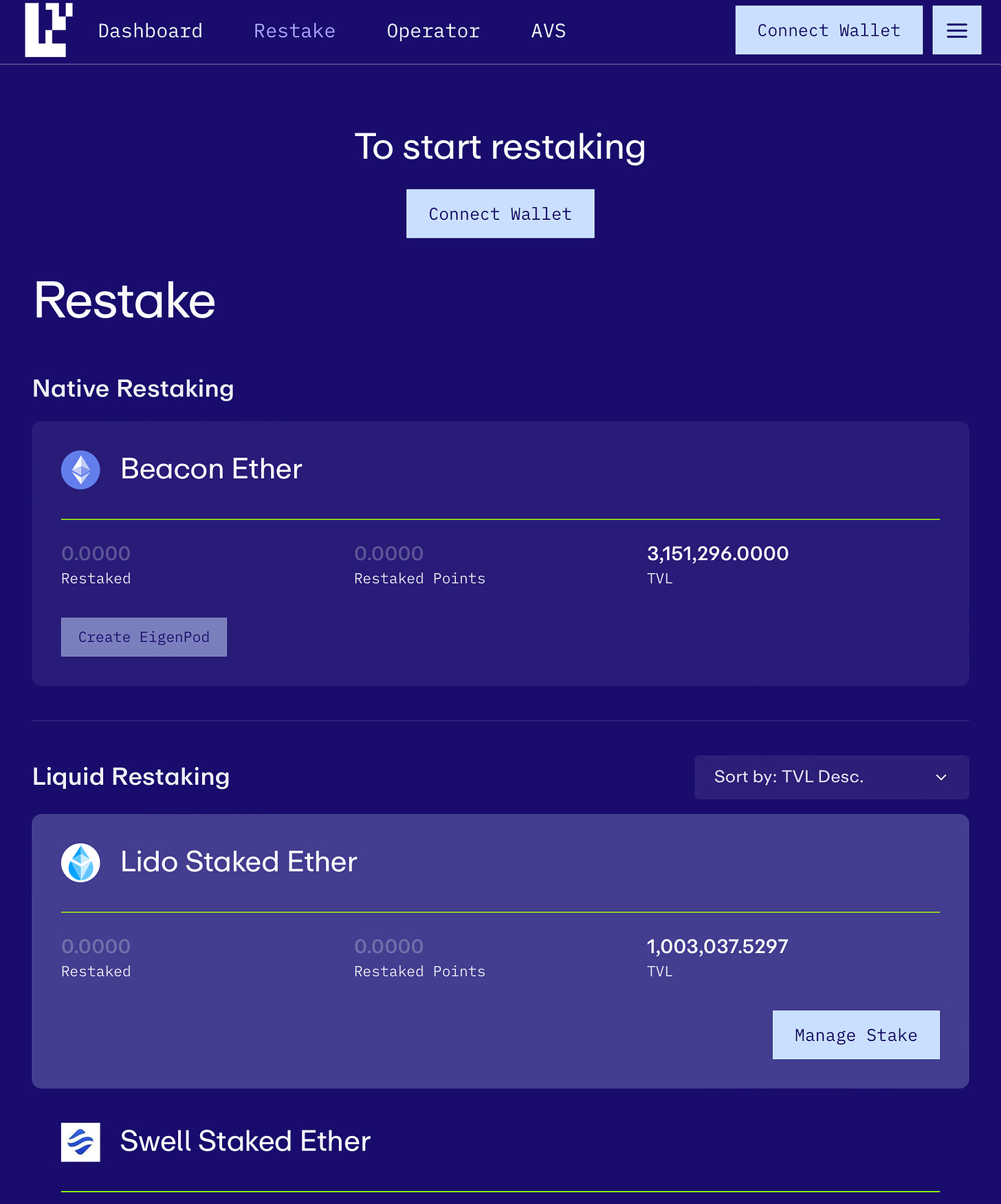

The image below shows the EigenLayer website homepage. Simply connect your wallet and follow the tabs on the top left of the screen (Restake, Operator) to complete the process.

Understanding "Re-staking" literally means taking ETH that was originally used for PoS staking and using it again for another staking purpose to enhance asset utilization efficiency.

If you only have the basic form of ETH in your wallet, you cannot participate in "re" staking. I already had ETH staked with Lido for Ethereum PoS staking, and my wallet contains the staking certificate issued by Lido, called stETH. This meets the eligibility criteria. EigenLayer accepts not only Lido's stETH staking certificates but also RocketPool's rETH, Binance's wBETH, or Coinbase's cbETH.

The second step is to delegate the assets staked with EigenLayer to a reliable operator who will participate in the entire re-staking process on your behalf.

Choosing the operator is crucial as it determines how much additional income your re-staked assets can earn and whether you might incur losses. If the operator is penalized by the system, participants may not only fail to earn money but may also lose their principal. People prefer well-known brands or trusted individuals. If you are unsure whom to choose, you can select based on the number or amount of stakers, considering it a more reliable signal. Personally, I chose Forbole, whom I know and who has extensive node operation experience.

Once delegated, the entire re-staking process is complete, and your money is already working for you. In the future, if EigenLayer distributes token airdrops, you should rightfully receive a share, and any rewards from re-staking will automatically enter your wallet.

However, even after going through a round of operations, many people are still puzzled about re-staking. It's great to earn money, but what is the real significance of re-staking, and where are the risks?

Economic Rampart

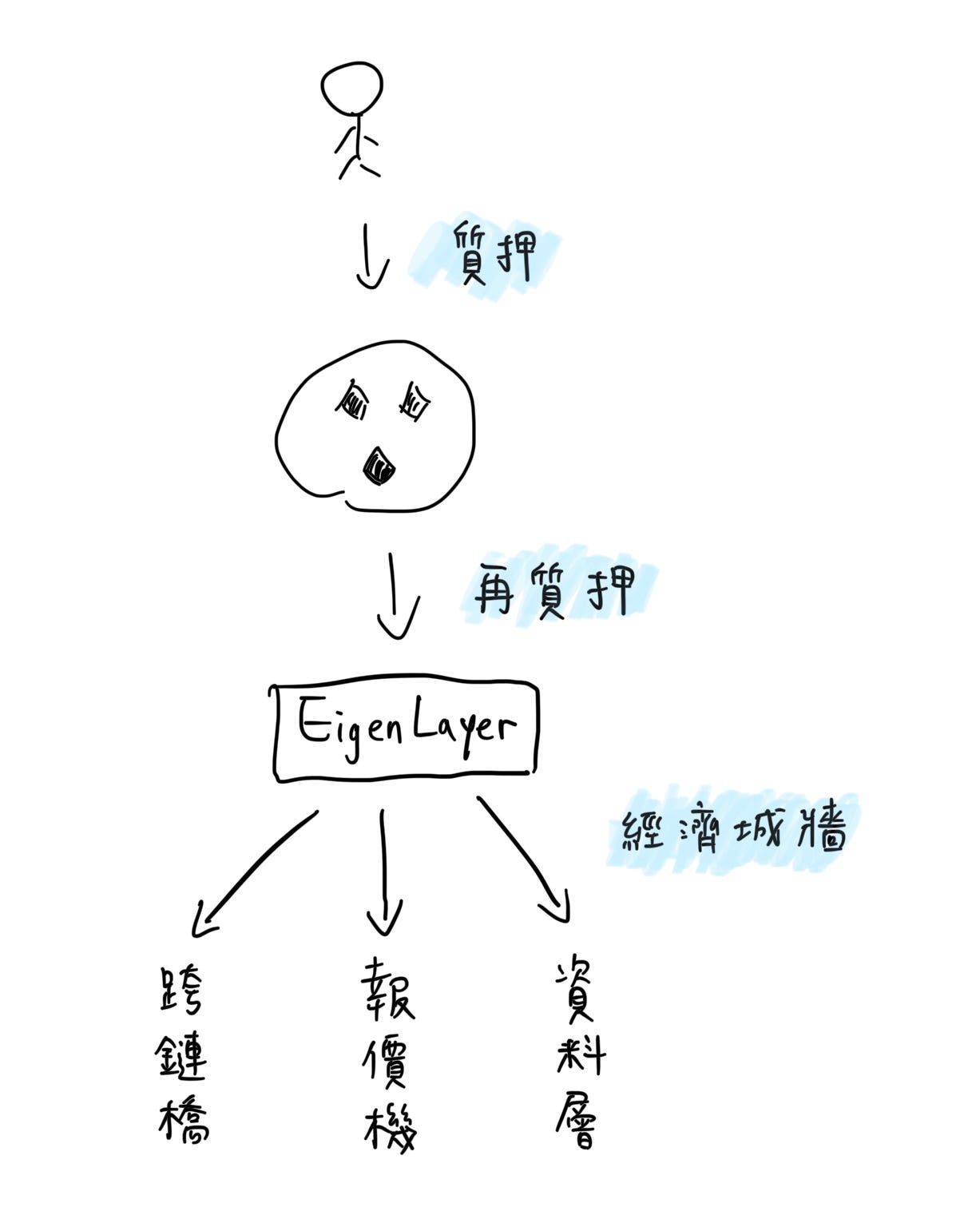

The re-staking proposed by EigenLayer is the commodification of Ethereum's economic rampart. What is an economic rampart?

When people stake their ETH in PoS, it appears to be a passive investment, but in reality, these ETH are protecting the secure operation of Ethereum. If hackers want to alter the transaction records on the chain, they would need to stake more ETH to have a chance to gain absolute accounting rights. After careful calculation, they would realize that launching an attack is simply not cost-effective.

In other words, Ethereum does not ensure security through technology but rather deters hackers economically by making attacks financially unfeasible. When people stake ETH, they are collectively building an "economic rampart." Ironically, even the U.S. Securities and Exchange Commission (SEC) is confused about this concept, viewing ETH staking simply as investment income without recognizing that staking ETH itself is a form of digital labor.

The most robust economic rampart in the world is the Bitcoin blockchain, which has proven this over the past 15 years. However, establishing an economic rampart is not easy; one can easily make mistakes and inadvertently turn it into a worthless coin. Therefore, EigenLayer has turned its attention to Ethereum, commodifying Ethereum's existing economic rampart, allowing services in need to "pay to rent," which is re-staking.

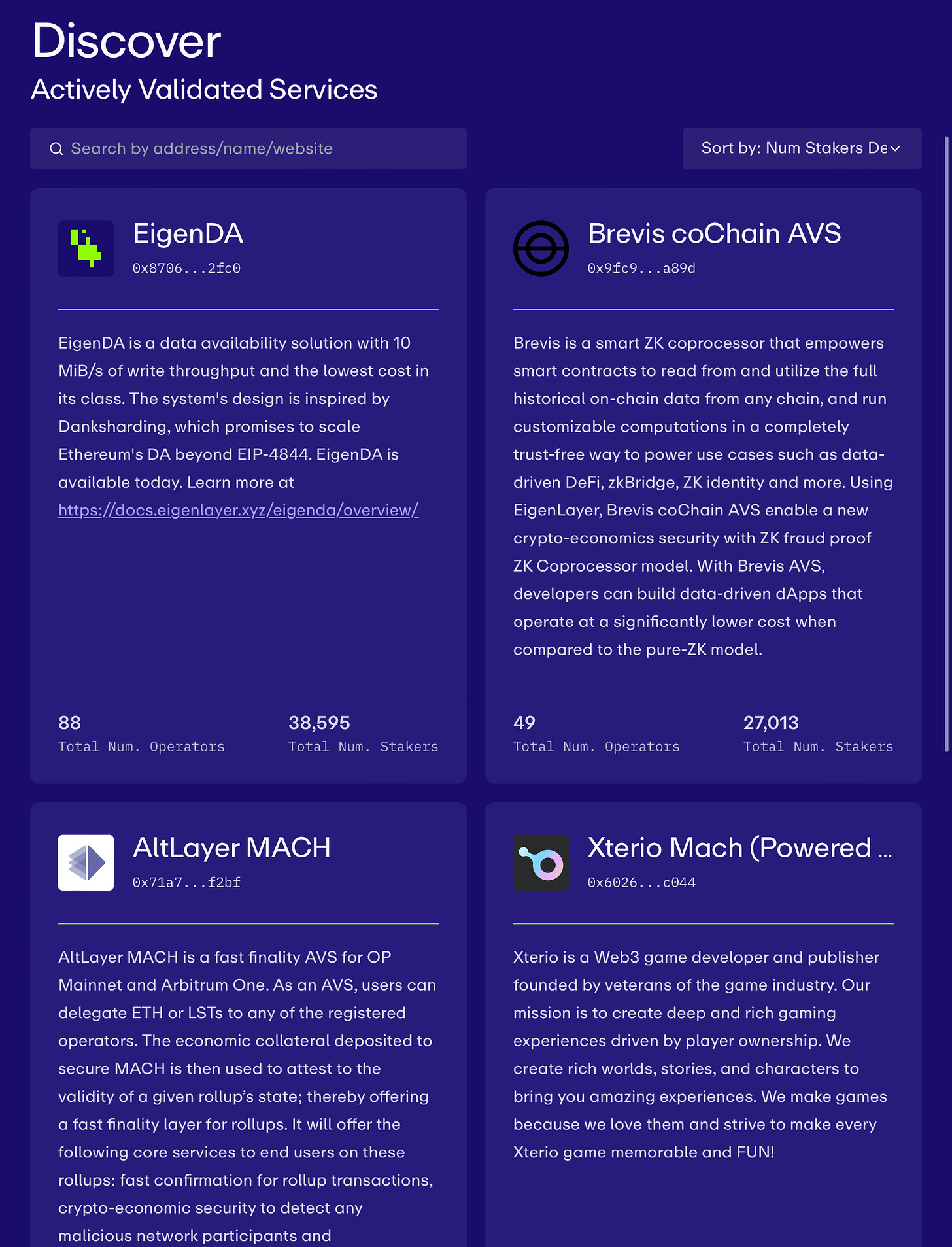

Who needs to pay to rent Ethereum's economic rampart? The image below shows the 8 projects currently available on EigenLayer, all of which hope to obtain Ethereum's economic rampart protection. Originally, these projects had to issue their own tokens and design token economies to build an economic rampart, but now they can simply pay to rent from re-stakers.

How much profit is there? The answer might surprise you—it's currently zero dollars.

In other words, these services are currently renting Ethereum's economic rampart for free. EigenLayer explained in its service launch announcement that this is just a temporary measure, and paid rentals will be activated once the service stabilizes.

Participating in re-staking currently equates to "generating electricity with love." However, because EigenLayer has introduced a point system within the system, people believe these points may be converted into token airdrops at some point in the future, which is why there is discussion in the current market.

The rules for exchanging points and the value of the tokens are still unknown. You might often hear news about re-staking but find that not many people around you are actually participating because of the high level of uncertainty.

However, some see new business opportunities in this. Pendle Finance, mentioned at the beginning of the article, is a DeFi application that has taken off amidst this re-staking craze.

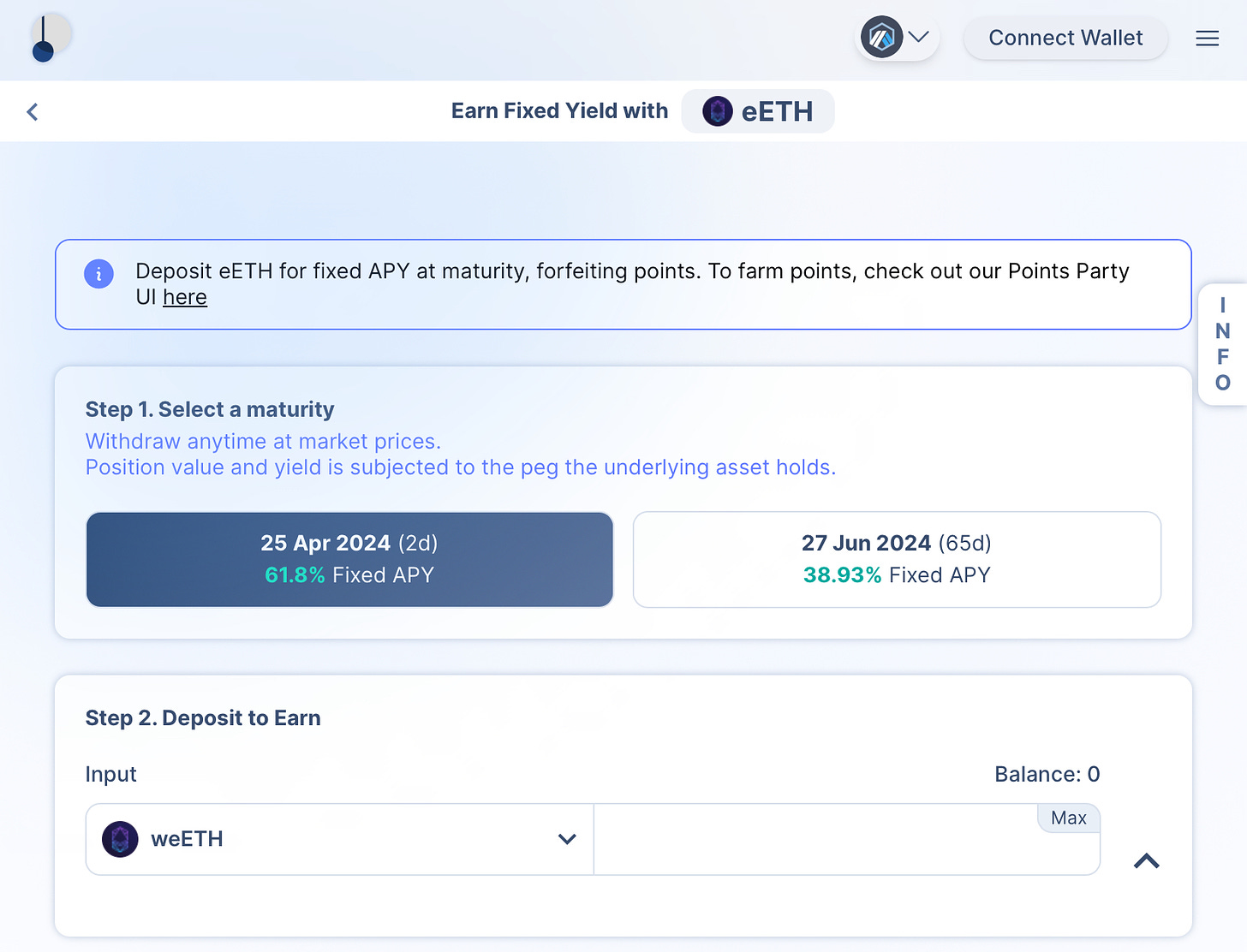

Pendle allows you to sell EigenLayer points to others. Although this means foregoing the opportunity for future airdrops, you can exchange it for an annualized return of up to 60% on ETH staking. This is considered an investment strategy of securing gains in advance. Those with a higher risk tolerance can also engage in reverse operations by buying more points on Pendle, making early reservations to become major recipients of airdrops.

It is precisely because Pendle caters to both radical and conservative investment needs that its fund size has doubled along with EigenLayer in recent months, reaching $50 billion, closely following decentralized exchange Uniswap in scale.

If you are like me, are willing to be a pioneer for token airdrops and a 60% annualized return, my only advice is not to "Ouyin" (all in). Behind these enticing returns, however, lie three layers of risks that cannot be ignored.

Three Layers of Risk

Previously, the article mentioned Ethereum's systemic risk, a concern raised by Vitalik. As a participant in re-staking, the greatest fear is losing the principal. However, returns come with risks, and once assets leave the wallet, risks increase accordingly.

If we consider holding ETH as risk-free, where 1 ETH always equals 1 ETH, participating in re-staking still involves considering the following three layers of risk:

Staking Risk

Re-staking Risk

Liquidity Re-staking Risk

Staking ETH to obtain staking certificates represents the first layer of risk. The stETH issued by Lido outbreak a liquidity crisis in 20222, where stETH, which should have been exchangeable 1:1 with ETH, could only be exchanged for 0.9 ETH at that time, representing a 10% discount. If you hold staking certificates issued by centralized exchanges like Binance or Coinbase, their value may also be affected by the operational conditions of the exchanges.

Furthermore, EigenLayer's re-staking builds on top of ETH staking certificates, adding another layer of risk. EigenLayer's core functionality went live in June 2023, less than a year ago, with 85% of funds flowing in over the past two months, and its features are becoming increasingly complex.

No one can guarantee that EigenLayer will not have vulnerabilities. Early participants earned substantial returns because they also bore the fear of their assets going to zero.

The third layer of risk is for those seeking a 60% annualized return. Many teams have developed liquidity re-staking tokens based on EigenLayer. The most well-known is Ether.fi, offering a one-stop service where depositing ETH can earn you eETH tokens issued by Ether.fi at a 1:1 ratio. Holding eETH not only earns ETH staking rewards but also automatically participates in EigenLayer re-staking. Although eETH is convenient, Ether.fi presents another layer of risk.

Moreover, individuals can take eETH to Pendle Finance to sell points, introducing a fourth layer of risk. To achieve the highest returns, one must assume that the foundations of the previous three layers are secure. Any error in one layer could result in catastrophic losses for participants in Pendle Finance. Even though I claim to be a pioneer, I dare not linger in Pendle Finance for long and only test the waters with investment products that have a few days left until maturity.

Each episode of the air crash documentary series "Air Crash Investigation" tells a real story, explaining the mistakes made by predecessors that have accumulated into today's flight safety manuals. Similarly, in financial markets, especially in decentralized finance lacking regulatory mechanisms, investors are drawn to financial services that maximize profit potential, which also raises risks.

At the time of writing this article, EigenLayer's fund size has officially surpassed $14 billion, skyrocketing sevenfold in two months. Faced with the risks of re-staking, many adopt the mindset that safety in numbers prevails. However, the safety of an airplane and the number of passengers often turn out to be two different matters.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.