GM,

The 2024 member satisfaction survey is now underway. Please take 10 minutes to fill it out and help Blocktrend improve. Now, let's get to the main topic.

I boldly predict that the central theme of 2025 will be connectivity. This year, we will witness different blockchains becoming more interconnected1, old and new wallets achieving greater compatibility2, and traditional finance moving closer to cryptocurrency. These trends are already in motion!

Last week, Coinbase Wallet introduced a groundbreaking new feature—bank accounts for wallets. In other words, wallets can now hold not only cryptocurrencies but also fiat currencies. I have already tested this new feature for you, and in this article, I will explain how it will shape the future of blockchain development.

Wallets Can Now Receive USD

Imagine a future where you log into your banking app, transfer New Taiwan Dollars (TWD) to a designated bank account, and within seconds, your MetaMask wallet receives an equivalent amount in USDT, a U.S. dollar stablecoin. This future is closer than you think—last week, Coinbase Wallet introduced a groundbreaking new feature:

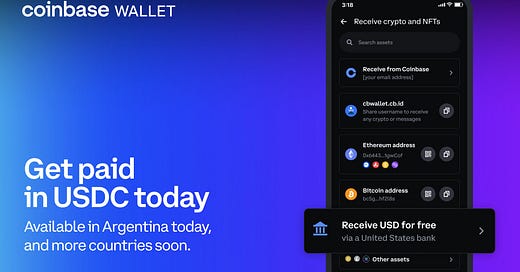

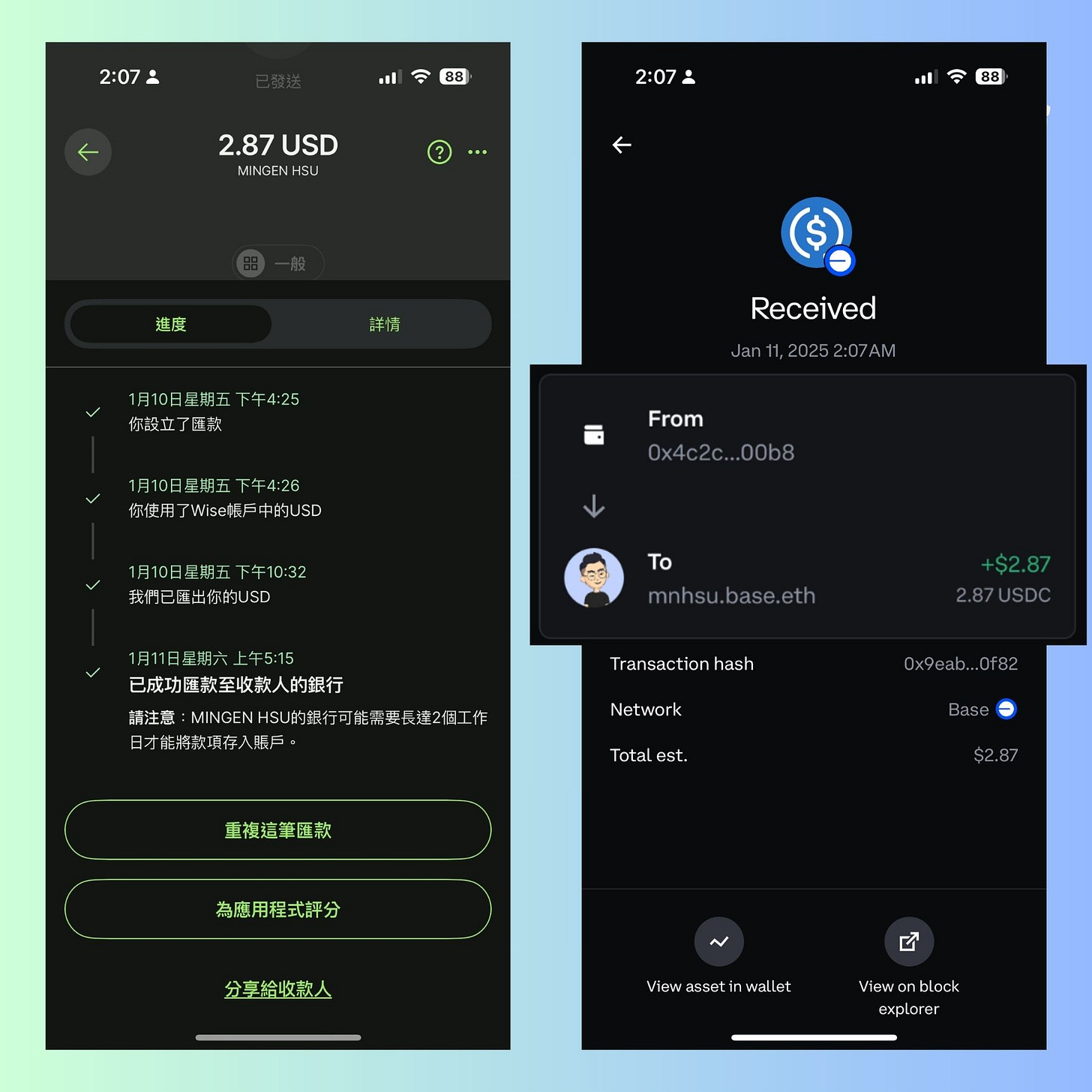

Receive bank transfers directly in Coinbase Wallet. Mobile wallet users can now create virtual bank accounts, seamlessly receive USD deposits, and automatically convert them into USDC with zero fees. Starting today, this feature is available to most users worldwide.

Many people confuse Coinbase Exchange with Coinbase Wallet—understandable, given their similar names. The exchange functions like a bank account, requiring identity verification, while the wallet is more like a personal pocketbook, allowing anyone to create one but requiring self-custody of private keys. In other words, Coinbase offers both a centralized exchange and a decentralized wallet product. This article focuses on the latter, which is also accessible to users in Taiwan.

To grasp the significance of this new feature, we first need to look at how cumbersome the traditional process of converting bank USD into wallet-held USDC has been:

Deposit USD into a centralized exchange

Convert USD into USDC

Withdraw USDC to a personal wallet

Now, it’s all streamlined into a single step. Simply transfer USD to a designated bank account, and USDC magically appears in your wallet. The image below shows my Coinbase Wallet receiving page, along with the linked U.S. bank account. If you want to test it out, feel free to send USD to this account—I’ll receive the equivalent amount in USDC in my wallet! 😂

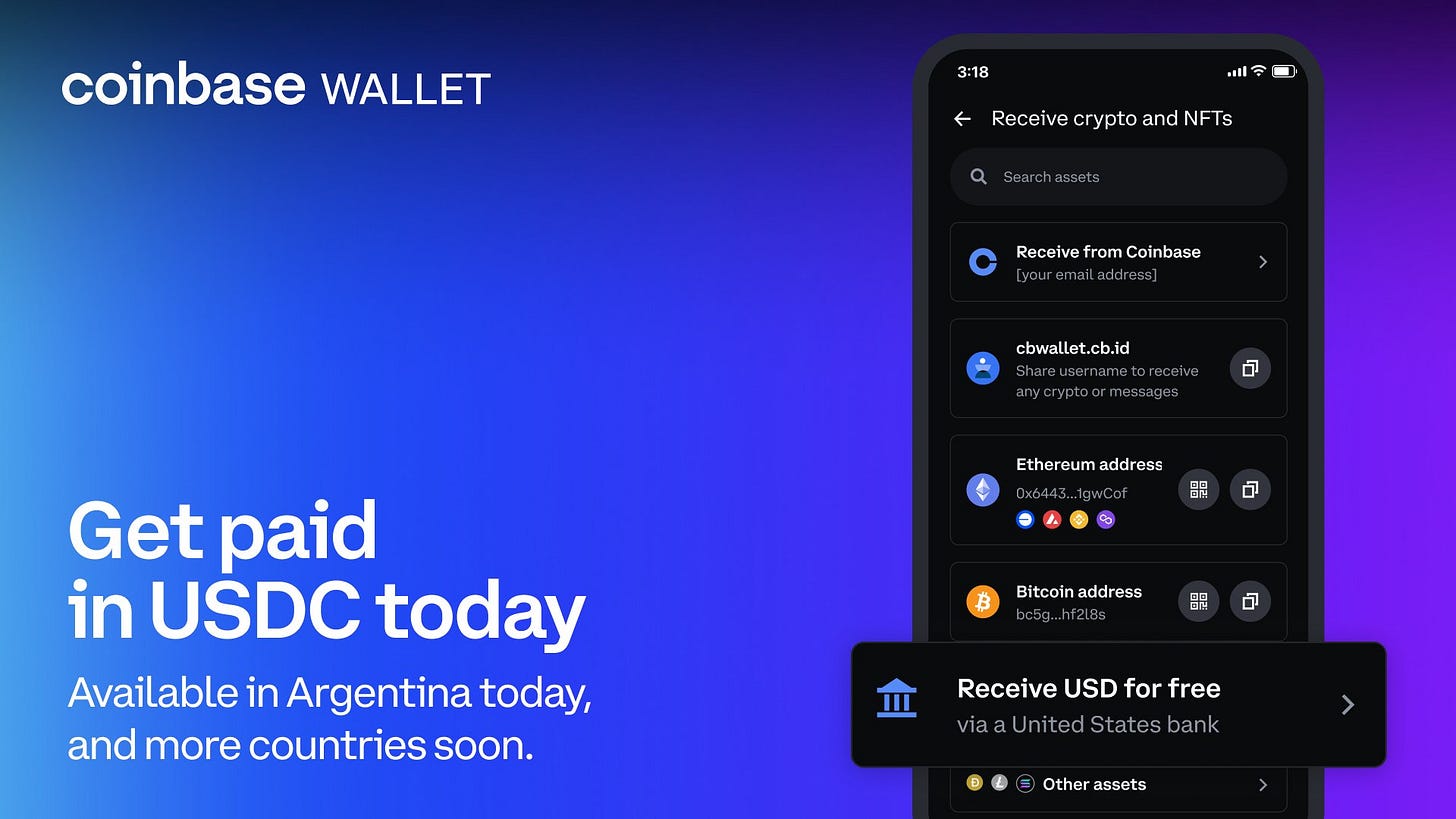

To confirm that this method works, I personally opened a U.S. bank account and transferred money to myself. I used Wise and Payoneer, two payment service providers that allow users to quickly obtain U.S. bank accounts online—no need to travel to the U.S.—and facilitate receiving and sending payments.

Experiment Steps:

Deposit USD into a Wise or Payoneer receiving account.

Transfer the funds from this account to the bank account linked to my wallet.

Verify whether USDC is received in the wallet, how long it takes, and the exact amount received.

The image below shows my test results: I sent $4 USD from Wise to the bank account linked to my wallet. After deducting a $1.13 USD platform fee, the actual amount transferred was $2.87 USD. After 10 hours, my wallet successfully received 2.87 USDC—proving that the experiment worked! 🎉

It's important to clarify that the high fees and slow transaction speed are entirely due to traditional finance. The $1.13 USD fee was charged by Wise as a platform service fee. Additionally, after receiving my transfer request, Wise took six hours to process and send the payment. Then, the banking system took another four hours to finalize the transaction. After waiting ten hours, I gained two key benefits:

Direct bank-to-wallet transfers

USD stablecoins with no price premium

The ability to transfer money directly from a bank to a crypto wallet significantly reduces the barrier to entry for new users. If you know how to make a bank transfer, you now also know how to convert fiat into crypto and store it in a wallet.

For example, in future blockchain introductory workshops, I might no longer need to send small amounts of crypto to participants. Instead, I could simply ask them to transfer $100 USD from their bank accounts to their wallets. This feature also benefits advanced users. If you're a crypto-native professional working in the U.S., you can deposit your salary into a linked bank account, seamlessly converting it into stablecoins while saving on exchange fees.

The innovation is obvious—but not everyone will immediately grasp its significance.

The Curse of Taiwanese Crypto Users

Last week, I shared Coinbase Wallet’s new feature on social media, and it sparked a lot of discussion. However, a few comments stood out—some users claimed that FTX had already implemented this before its collapse3, questioning whether there was anything truly innovative about it.

I later realized that these users were confusing wallets with exchanges.

FTX once allowed users to deposit USD into designated accounts and automatically convert it into USDC. Many people took advantage of this for arbitrage trading—buying USD from their bank, wiring it to their FTX account to convert into USDC, then selling USDC for New Taiwan Dollars (TWD). As long as there was a price discrepancy between USD/TWD and USD stablecoins, they could make a profit.

I call this “the curse of Taiwanese crypto users.” Taiwan has an efficient financial system, making cryptocurrency just another tool for making money. To arbitrage traders, Coinbase’s direct bank-to-wallet feature is nothing new—just another way to buy stablecoins at a 1:1 USD exchange rate. Whether the stablecoins end up in a centralized exchange or a personal wallet makes little difference to them.

However, outside Taiwan, the significance of this feature is completely different. In Argentina, it’s not an arbitrage tool—it’s a lifeline. This feature is designed for Argentinians working for overseas companies. The chart below shows the exchange rate between the Argentine peso (ARS) and the US dollar (USD). Over the past 20 years, the peso has lost 99.41% of its value against the dollar. If you didn’t know better, you might mistake this for a meme coin—its price keeps plummeting with no recovery in sight. Even Argentina’s president has proposed abolishing the peso entirely and adopting the US dollar as the country’s official currency.

For Argentinians, holding U.S. dollars is simply the smarter choice. However, they don’t trust banks—they’d rather stash cash under their mattresses because, to them, physical banknotes are the only real money. In a way, Argentinians deeply understand the self-custody principle of cryptocurrency. Recognizing this, Coinbase aims to make its wallet the go-to payment account for Argentinians. Not only does it allow users to self-custody their USD stablecoins, but holding USDC also earns a 4.7% annual yield4—a better dealthan what banks offer!

However, "opening a bank account for a wallet" isn't Coinbase’s own innovation. Instead, it’s entirely powered by its partner—Bridge5, a stablecoin startup that was acquired by Stripe last year for a staggering $1.1 billion. Bridge specializes in building financial bridges.

The Unsung Hero

Bridge is a hero in times of financial chaos, identifying the lack of standardization in financial markets as a massive business opportunity.

After the rise of cryptocurrency, the financial market has become even more fragmented. Consumers want to pay with crypto, but merchants prefer to receive U.S. dollars. Bridge acts as a translator—just like how a language translator allows people speaking different languages to communicate, Bridge enables seamless transactions between crypto and traditional currencies. It doesn’t just understand two financial languages; it’s fluent in multiple payment systems.

This time, Coinbase Wallet has integrated Bridge’s services, and the virtual bank accounts inside the wallet are provided by Bridge. First-time users must complete a KYC process to link their wallet address to a bank account. On the surface, it looks like Coinbase Wallet now has built-in banking features, but in reality, Bridge is the hidden force handling the transactions. Bridge chooses to remain behind the scenes because it sees APIs as the ultimate interoperability standard—a way to connect blockchains, banks, and payment networks.

Another smart wallet, Fuse, has taken things even further. Not only does it accept U.S. dollar deposits, but it also offers a payment card that allows users to spend their crypto directly—again, powered by Bridge’s technology.

Crypto wallets were once like isolated islands, rarely visited. To move money into a wallet, users first had to deposit funds into a centralized exchange, then withdraw it manually. Bridge has built the first direct flight between banks and wallets, dramatically shortening this process. In the past, no one would have thought to compare wallets and banks, but Bridge has transformed wallets into decentralized bank accounts. In theory, the same process could work in reverse, linking a bank account to a blockchain address—effectively making it a centralized crypto wallet. But as I write this, I can’t help but feel uneasy about that idea.

As money moves faster and more freely, governments are the first to push back, fearing that it will fuel scams and fraud. Recently, Far Eastern Bank in Taiwan issued a notice stating that if a user’s designated transfer recipient is a crypto exchange, the usual 1-day processing time will be extended to 2 days—and now, it’s even been lengthened to 7 days. Their reasoning? To force users to think twice before investing, reducing the chances of falling victim to scams. But does slowing down financial transactions really make people more cautious?

This brings us back to the age-old question: What’s the real purpose of crypto and blockchain? If bank deposits can be seamlessly converted into on-chain assets, there must be a rich ecosystem of secure on-chain applications for users to engage with. Otherwise, from the government’s perspective, Bridge is nothing more than a high-speed highway leading straight to financial fraud.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.