GM,

A quick heads-up: Blocktrend will be taking a year-end break for two weeks starting the week after next. I’ll be traveling to India—fingers crossed I don’t end up with an upset stomach. I’ll remind everyone again next week.

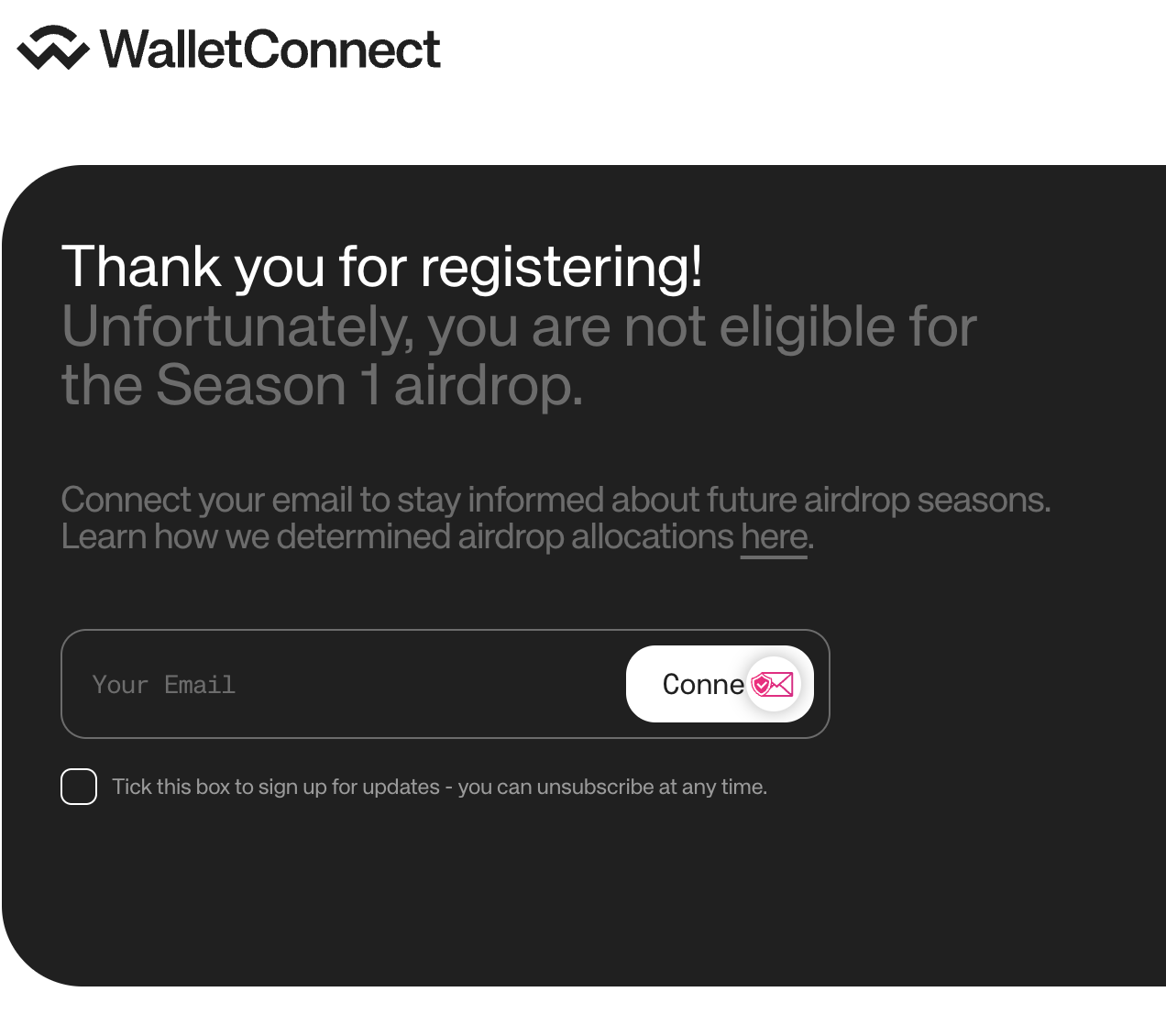

On another note, the WalletConnect airdrop, which Blocktrend once referred to as "textbook-level1," began distribution yesterday. Ironically, I didn’t qualify to claim it. As a seasoned user, it’s clear that there’s still much room for improvement in the accuracy of this airdrop.

Meanwhile, there are still slots available for the 20 annual memberships sponsored by Furucombo. Forms submitted before yesterday have already been processed. Interestingly, over the past few days, the number of new paid members joining Blocktrend has exceeded the number of free recommendations! I sincerely thank everyone for valuing these membership slots so much.

From the reasons provided in the recommendations, a common trait among the suggested friends is their curiosity about applications rather than an interest in speculative trading.

I just hope that after reading today’s article, none of them will cancel their subscriptions in frustration (laughs). This piece introduces the best investment tool for a bull market — the Dollar Cost Averaging (DCA) method — starting with a story about finding money unexpectedly.

An Unexpected Gain

Last week, I opened the MAX exchange as usual and suddenly remembered setting up a new trading bot months ago. In the crypto world, forgetting something and then recalling it often turns out to be a good omen. Sure enough, when I checked, the bot had generated over 40% in profit.

This bot was running an advanced version of the Dollar Cost Averaging (DCA) strategy.

When discussing Dollar Cost Averaging (DCA) online, it’s often divided into two types: basic and advanced. The basic version, which I mentioned in "Buying $100 of Bitcoin Daily," involves simple recurring purchases—it’s all about buying, without selling. Setting it up is straightforward: just tell the bot how often to buy and how much.

However, the basic DCA method has a major drawback: it solves the question of “When to buy?” but doesn’t address “When to sell?”

Selling is often harder than buying. Selling too early feels worse than missing a buying opportunity. Even if you decide in advance to sell when your asset doubles in value, you might hesitate when the moment actually arrives. On top of that, if you believe a bull market is already underway, the basic DCA tool might feel too simplistic. You could watch the price climb from $60,000 to $100,000, while your holding costs steadily increase. By the end of the bull market, you’d be left with a pile of assets purchased at high prices.

Basic DCA investors might encourage you to “Hold on!”

What they don’t tell you is that you’ll need to endure an entire cycle, trusting that the price will eventually recover. This requires a strong belief in the long-term potential of Bitcoin, as well as patience to wait it out. If your confidence in Bitcoin isn’t unwavering, the advanced DCA method might be a better fit.

Buy Low, Sell High

The advanced DCA strategy resembles the behavior of a rational investor: buy low and sell high. It doesn’t aim to catch the market’s lowest lows or highest highs but focuses on buying when prices are low enough and selling when profits are high enough. This is something most humans struggle to do.

Here’s how MAX exchange describes the DCA bot:

"The Dollar Cost Averaging (DCA) strategy is an investment approach where additional funds are invested when market prices drop, and profits are taken when prices rise. Unlike standard recurring investments, DCA adjusts investment amounts based on market volatility and automatically exits when the investor’s target profit is reached, ensuring returns are secured."

After reading this description, one thing stuck with me: it will sell for me.

Setting up the advanced DCA bot involves more parameters. In addition to the amount for each trade, you need to specify how much the price should drop before adding funds, the profit target for selling, and how many times to reinvest. Although I understood the terms individually, I couldn’t picture the combined outcome. So, I decided to wing it.

I set the single investment amount to $100, instructed the bot to add funds every 3% drop, reinvest up to 10 times, and exit at a 30% profit.

Even up until I pressed “Start,” I had no idea how much money the bot would need in total. In the end, it reserved $1,100 from my account. It immediately used $100 to buy BTC at the current market price and placed 10 buy orders for additional investments. Only after seeing the results did I start to get a clearer understanding.

Here’s how my DCA bot is set up: starting at the market price at activation, it places one buy order every 3% drop, up to 10 orders, with each order purchasing $100 worth of Bitcoin. If the price shoots upward immediately after activation, none of the additional orders are executed. But there’s no need to FOMO—I wouldn’t be left empty-handed. Once the $100 worth of Bitcoin I initially bought grows by 30% (to $130), the bot automatically sells it, completing the cycle.

However, the scenario I encountered was the opposite. Right after activating the bot, the price began to plummet—from $68,000 all the way down to $50,000. If I were buying manually, I might have felt excited about “buying the dip” for the first few rounds. But by the fifth, I’d likely start questioning whether this was a bottomless pit.

Fortunately, I didn’t have to experience any of that hesitation. The bot handled everything. Reviewing the transaction records afterward, I saw that it dutifully followed the plan, buying $100 of BTC every 3% drop. It executed each trade with discipline.

With every purchase, my average BTC cost shifted lower. This affected the bot’s exit timing, as it calculates a 30% profit based on the adjusted average cost. Ultimately, the bot sold all the accumulated BTC at $75,632 in one go, completing the cycle and immediately beginning the next.

The second cycle unfolded differently: the market trended upward from the start. The bot set its baseline at $75,000 and placed 10 buy orders spaced 3% below that price, each for $100. However, only the initial order executed, as the price didn’t dip again. The bot eventually sold that BTC at $98,000, still locking in a profit!

Now, I’m in the third cycle. What’s fascinating is that I’ve encountered both extremes—steep declines and steady climbs. This perfectly highlights the magic of the DCA bot: it turns market dips into something to celebrate.

Loss Is Part of the Strategy

When trading manually, I always hope for the ideal scenario: buying in and watching prices rise steadily. Unfortunately, reality often delivers the opposite—buying is frequently followed by a price drop. In the past, my approach to downturns was simple: if I didn’t sell, I wouldn’t realize a loss. However, I also lacked the courage to continue averaging down. I often say I rarely sell, partly because I believe in long-term growth. The truth is, I simply don’t know when to sell. The fear of selling right before a surge or buying just before a dip holds me back. I suspect many people share this dilemma.

Using a DCA bot has not only helped me overcome these psychological barriers—it’s changed my perspective entirely. Now, I actually enjoy seeing the price drop after I buy. Even though this results in paper losses, those losses are a deliberate part of the strategy. Averaging down is based on the expectation of falling prices. The results of my first two DCA cycles illustrate this perfectly.

In the first cycle, the price dropped consistently, allowing the bot to execute all its buy orders. Ultimately, the $1,100 I allocated was fully invested, and I exited with a 30% profit. In the second cycle, prices rose steadily. While this seems ideal, only the initial buy order was executed. Although I still achieved a 30% profit, the total gains were smaller compared to the first cycle.

Looking at the results, there’s no need to time the market when starting a DCA bot. An upward trend is great, but a downward trend is even better. As long as you’re in a bull market, prices will eventually rise. And even if they don’t, it’s no worse than regular dollar-cost averaging. While the timeline may extend, the bot ensures you sell at the right time and seamlessly initiates the next cycle.

Years ago, I closely observed a quantitative trading firm. What impressed me most was the mental discipline of the firm’s discretionary traders. They had honed their mindset to overcome greed. However, over time, money simply became numbers on a screen. Their work focused on increasing those numbers, which no longer felt like “making money” in the traditional sense. From this perspective, the DCA bot is a savior for everyday investors. We don’t need to become robots ourselves to adopt the same discipline and consistency.

Note: If you don’t yet have a MAX Exchange account, feel free to use my referral link or code: 035e77f9.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.