GM,

Recently, the crypto media outlet Web3+ has been holding a vote for the "Top 30 Figures in Blockchain." The voting method follows a "one wallet, one vote" system, and anyone who participates in the voting is eligible for a prize draw. The prizes include CoolWallet hardware wallets and merchandise from various exchanges. In my personal experience, I didn’t see any mechanism to prevent Sybil attacks, and there’s no need to pay any gas fees to vote. If you want to increase your chances of winning, you can create multiple wallets. The more wallets you have, the higher your chances of winning. There's a tutorial with images and text inside, and I recommend everyone take some time to participate. Of course, feel free to cast your vote for me!

Let’s get to the main topic. In the crypto world, there’s a popular saying: "Don’t trust, verify." Some people treat this as a guiding principle. However, I find it overly idealistic since very few people can actually do this. Trust is the foundation of social operations. Without trust, it becomes significantly harder for people to get things done. So, my interpretation of this saying is more relaxed: "Don’t trust blindly, but be able to verify independently." This article discusses the magic of trust.

Coinbase's Ambition

Recently, Coinbase, a cryptocurrency exchange with a high reputation, announced the launch of Coinbase Wrapped BTC(abbreviated as cbBTC) within the Ethereum ecosystem:

cbBTC is an ERC-20 token backed 1:1 by Bitcoin (BTC) held by Coinbase in reserve... cbBTC is a transferable token that represents ownership of the underlying asset (BTC) and can be freely redeemed. Coinbase users only need to deposit cbBTC into their Coinbase account to "unwrap" and exchange it for the corresponding amount of the underlying BTC. Currently, cbBTC is circulating on both Ethereum and the Base chain.

Coinbase's main slogan for cbBTC is: "Do more with on-chain BTC!"

Bitcoin and Ethereum are two different blockchains, each excelling in its own right but not interoperable. BTC surpasses national sovereignty and has the highest recognition, but its blockchain technology is limited and unsuitable for developing complex applications. Fewer people have heard of ETH, but Ethereum has the support of the largest global developer community and boasts the richest infrastructure and application scenarios.

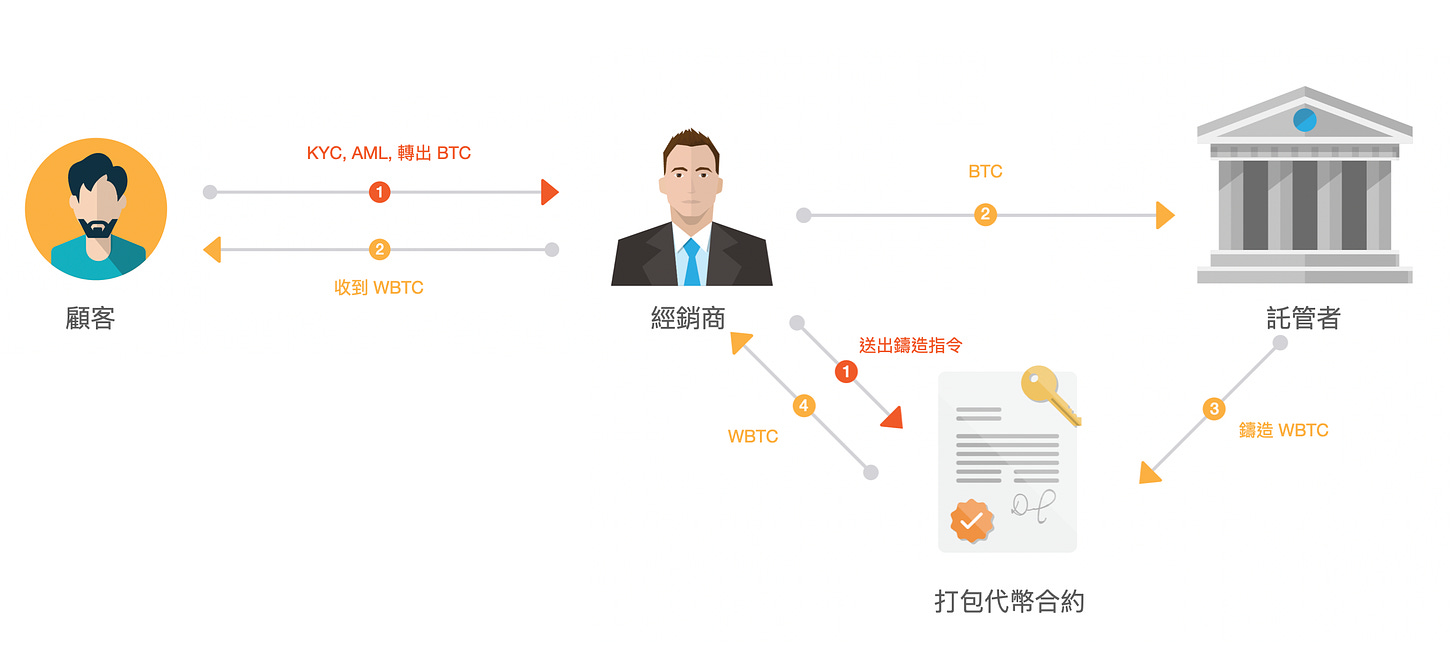

The more a currency circulates, the more valuable it becomes. Ideally, Bitcoin and Ethereum’s respective strengths could be combined. In fact, as early as 2019, BTC was brought to Ethereum through the issuance of Wrapped Bitcoin1 (wBTC), which is the largest wrapped Bitcoin. Currently, as many as 150,000 BTC are circulating on Ethereum in the form of wBTC.

Although Coinbase’s cbBTC is a latecomer, it has quickly risen to become the third-largest wrapped Bitcoin by market capitalization in less than a month, with 3,300 cbBTC minted. That’s a pretty good start. Coinbase has done at least two things right:

Subsidizing gas fees to attract users

Gaining widespread support from DeFi applications

The miner fees for transferring BTC fluctuate greatly—sometimes less than $1, other times it can be dozens of dollars, depending on how congested the network is. To attract users, Coinbase offered subsidies, announcing, “I’ll cover all the miner fees!” However, this benefit is only available for those holding cbBTC on the Base chain and who transfer using Coinbase Wallet.

Secondly, cbBTC emphasizes practicality. Most people’s BTC just sits on exchanges or in wallets gathering dust, much like gold. However, cbBTC already has several use cases. For example, the decentralized lending service Aave accepts cbBTC as collateral, allowing users to borrow stablecoins like USDT or USDC. This is similar to a mortgage—using real estate as collateral to borrow local currency. In the future, cbBTC will have even more applications, enabling people to do more with their BTC.

However, cbBTC hasn’t received universal praise. Critics mainly question its transparency and asset autonomy. 0xngmi, the founder of DefiLlama, bluntly stated that cbBTC’s transparency falls below industry standards. The implication is that Coinbase has not provided proof of reserves. While it’s visible that 3,300 cbBTC are circulating on-chain, who knows if Coinbase actually has 3,300 BTC in reserve or if they are printing money out of thin air?

Additionally, people have found in the terms of service and whitepaper that Coinbase does not guarantee that all cbBTC can be redeemed for BTC, and the assets could be frozen at any time. If Coinbase determines that a user’s cbBTC was obtained illegally, it has the right to refuse redemption. This is something that wouldn’t happen if you held BTC directly.

In response to online skepticism, Coinbase immediately replied that they take transparency very seriously and emphasized that proof of reserves for cbBTC is already under development. But this raises a question: Coinbase is a veteran in the crypto space—how could they not know that lack of transparency is a major taboo? The reason Coinbase rushed cbBTC to market, despite being unprepared, is that the leading wrapped Bitcoin, wBTC, has recently fallen into a reputational crisis.

This gives cbBTC a chance to capture some of wBTC’s market share.

wBTC's Image Crisis

Last month, wBTC’s asset custodian, BitGo, issued a press release announcing a business "upgrade":

BitGo is pleased to announce that we are establishing a joint venture with BiT Global to diversify our custodial and cold storage services across multiple jurisdictions. This upgrade will be a seamless and fully transparent process for the wBTC community... BiT Global is a regulated asset custodial platform based in Hong Kong... This is a strategic partnership between BitGo, Justin Sun, and the Tron ecosystem.

Most people, after reading the entire press release, still had no idea what BitGo was upgrading—except they recognized three words: "Justin Sun."

Justin Sun, a well-known figure in the crypto space, is certainly a sharp businessman, but his reputation is as questionable as that of Jeff Huang, also known as “Machi Big Brother” (notorious for bad practices). You may have used the Tron blockchain, led by Sun, to transfer USDT. At first glance, he seems to have contributed to the development of cryptocurrencies, but within the crypto world, he’s infamous.

Sun's business deals are always big, including buying BitTorrent, acquiring the decentralized community Steemit, and taking over the stablecoin issuer TUSD and the Huobi exchange. In 2020, tech media outlet The Verge published a feature story on Justin Sun, calling him the "King of Hype."

To be clear, Justin Sun hasn’t been involved in any illegal activities. However, he is often labeled as someone who “harvests” retail investors, has poor character, and lacks integrity. Therefore, when BitGo became associated with Justin Sun, people wanted to keep their distance. Some began redeeming their wBTC in batches, and others proposed removing wBTC from the MakerDAO platform to mitigate risks.

You may ask, what are the specific risks? Originally, the BTC reserves backing wBTC were held by BitGo, the asset custodian, in a 2-of-3 multisignature wallet. If someone wanted to redeem their wBTC for BTC, BitGo would need to approve the transaction with 2 out of 3 keys. Once the wBTC is burned, the corresponding BTC is released from the vault. Initially, all 3 keys were held by BitGo and stored in the U.S., but after this “upgrade,” 2 of the keys would be handed over to BiT Global, the new joint venture with Justin Sun.

The original plan was for BitGo to geographically diversify the BTC vault keys by moving them from the U.S. to Hong Kong and Singapore, which was supposed to reduce geographic and political risks. In theory, this is a good thing—you don’t want to put all your eggs in the U.S. basket. However, what people disliked about the upgrade was that, in practice, it meant Justin Sun could control 2 of the 3 vault keys, effectively putting them in his pocket.

Even though Justin Sun claimed that wBTC’s system is transparent, can be publicly audited online, and has no blacklist mechanism, he also made a public commitment to maintaining the wBTC system unchanged for the next 50 years, saying, “The show will go on as usual.” But as the saying goes, when a person’s reputation is tarnished, everything they do looks suspicious. People were worried that Sun would taint wBTC, and many started to jump ship.

Eventually, BitGo listened to public concerns and announced a revision to the original plan. Instead of the proposed 1 key for BitGo and 2 keys for Justin Sun, the new arrangement gave BitGo control over 2 keys, with one key in the U.S. and the other in Singapore, while Justin Sun would hold only 1 key. This change alleviated most people's concerns.

The Magic of Trust

Looking at the cbBTC and wBTC incidents together, it becomes clear that the core issue is trust. These events have given me three insights:

Business

Technology

Trust

In recent years, Coinbase has been advocating for "making on-chain the next online2," not only leading the operation of the Base chain3 but also offering various subsidies to bring users on-chain. Typically, centralized exchanges wouldn’t do this—after all, once users leave the exchange, they no longer contribute transaction fee revenue. However, Coinbase believes that running the Base chain can also generate alternative MEV (Maximal Extractable Value) arbitrage income4. By overcoming the initial "maximum static friction" and guiding users to the Base chain, revenue can flow in through other channels.

To make Base chain the preferred choice, it’s essential to introduce more assets, attract developers to build applications, and subsidize user transaction fees. But Coinbase’s ability to wage this subsidy battle is a result of blockchain technology upgrades. Only because Ethereum Layer 2 has matured can Coinbase afford these subsidies. With smart wallet technology ready, users no longer need to create new wallets to enjoy these benefits.

Finally, why can companies like Coinbase and BitGo independently custody BTC, but not Justin Sun? It boils down to trust. People trust Coinbase and BitGo to handle things responsibly but do not trust Justin Sun.

This brings us back to the classic saying in the crypto world: "Don’t trust, verify." If you believe that everyone has bad intentions and there is no trust, then a 2-of-3 multisig wallet for managing BTC reserves will certainly not be enough. However, increasing the number of signatures would slow down the wBTC redemption process. The compromise people have made is not a zero-trust approach, but rather: "Don’t blindly trust, but be able to verify independently."

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.

voted for you, good luck ~