Celebrating a Baseball Championship | MicroStrategy’s Tenfold Surge! Leveraging Bitcoin and the Risk of a Death Spiral

#651

To celebrate Taiwan's victory in the World Baseball Classic (WBSC) Premier12 championship, the DeFi development team Furucombo is sponsoring 20 annual Blocktrend memberships. They hope Taiwan can also achieve more world championships in the blockchain field!

But who are the 20 lucky recipients of this sponsorship? I believe paying members best understand the value of Blocktrend and know who deserves these spots the most. Therefore, I’ve created a recommendation form. Each member can recommend one person, and lifetime members can recommend two people (by filling out the form again).

My suggested selection criteria: If Blocktrend were to host a members' meetup next month, who would you most want to invite along? That person is your ideal recommendation.

Bitcoin's price has been stirring recently. I’m no expert on when it might hit $100,000. However, as I mentioned in my experiment detailed in "Buying 100 TWD of Bitcoin Daily1", I plan to shift from buying to selling if Bitcoin consistently breaks its historical highs. Last week, I began using the Kraken exchange to execute a daily sell strategy, offloading $100 worth of BTC regularly. The goal isn’t to profit but to see if I can "sell and forget" just like buying. By the way, I’m still applying for my Kraken referral code—more on that later. Let’s get to the main topic.

Have you heard of MicroStrategy (MSTR), a U.S.-based company? Since 2020, it has been purchasing Bitcoin and has become the largest publicly traded holder of BTC worldwide. The company owns a staggering 331,200 BTC, with a market value of $32.2 billion. In second place globally is Marathon Digital, a Bitcoin mining company that holds significantly less—“only” 26,000 BTC. This stark difference underscores just how audacious MicroStrategy is.

As Bitcoin’s price repeatedly hits new all-time highs, MicroStrategy’s stock price and trading volume have also set new records. The share price has skyrocketed from $50 at the start of the year to nearly $500 last week—a tenfold increase. At one point, its trading activity even surpassed Nvidia and Tesla, making it the most traded individual stock. While Taiwanese investors currently can’t use brokerage services to buy U.S.-based Bitcoin ETFs, MicroStrategy has become the go-to choice for entering the market. But what exactly does MicroStrategy do as a business? After reading this article, I’m confident you’ll stop thinking of them as simply “mindlessly buying Bitcoin.” Let’s start with the history of this company.

A Faded Aristocrat

MicroStrategy is a faded aristocrat. Founded in 1989 by two MIT graduates, Michael Saylor and Sanju Bansal, the company was ahead of its time. Back then, Bitcoin hadn’t been invented, and the World Wide Web was only launched the following year. Yet MicroStrategy was already leveraging computers to make money.

The company specialized in data mining for business decision-making analysis—essentially handing data over to computers to run simulations and uncover hidden business value. Even McDonald’s was one of its major clients. In 1998, MicroStrategy went public on NASDAQ, and by 2000, its stock price had soared to $313 per share. Founder Michael Saylor’s net worth reached $7 billion, earning him the title of Washington’s richest person in the media.

MicroStrategy’s stock price once plummeted and never recovered after an accounting scandal. For over two decades, its stock lingered around $10, with minimal presence in the market. That changed four years ago when the company made an unprecedented move, investing $250 million to purchase 21,454 BTC, capturing the market’s attention once again.

Why did MicroStrategy buy Bitcoin? Then-CEO Michael Saylor explained that it was part of the company’s digital transformation. He frequently reiterated this concept in interviews:

Essentially, MicroStrategy used digital assets to reshape its capital structure, transitioning from a stable but overlooked software company into a "Bitcoin real estate developer."

This shift introduced a brand-new business model for the company—leveraging Bitcoin’s high volatility to raise funds in the market. This allowed MicroStrategy to issue convertible bonds at extremely low costs, creating a positive feedback loop.

"MicroStrategy Buys Bitcoin Again"

Headlines like this have repeatedly surfaced over the past few years. Many assumed MicroStrategy was simply a "mindless Bitcoin buyer," but the reality couldn’t be more different. The company’s journey into Bitcoin was driven by Michael Saylor’s strategic effort to find a new path for the business, using digital transformation to make MicroStrategy "great again."

Leveraged Bitcoin

As a publicly listed company, MicroStrategy had to convince its shareholders before buying Bitcoin. Michael Saylor clearly outlined the company’s predicament: while MicroStrategy generates $500 million in annual software revenue and $75 million in cash flow, the capital markets showed little interest in its stock. Despite stable revenue and high customer loyalty, the company struggled with the problem of having "too much money."

Imagine running a company that earns $75 million annually. The first question from shareholders would likely be: "How do you plan to spend that money?" Because cash loses value due to inflation, it must be allocated effectively. Some companies distribute dividends, buy back shares, or invest in government bonds. However, Michael believed that buying Bitcoin was the best choice.

MicroStrategy didn’t purchase Bitcoin with cash directly. Instead, it leveraged funds by issuing convertible bonds, effectively borrowing money from the market to buy Bitcoin. Last week, MicroStrategy provided another demonstration of this strategy. Here are the key figures from their latest press release:

MicroStrategy completed a $3 billion issuance of convertible bonds.

These bonds carry a 0% coupon rate and mature in December 2029.

In plain terms, MicroStrategy borrowed $3 billion from the market. Not only is this a zero-interest loan, but the company doesn’t have to repay the principal until December 2029—five years from now. Borrowing for five years without paying a cent in interest is an incredible deal!

How was MicroStrategy able to secure such favorable terms? This is where Michael’s clever strategy comes into play—the magic of convertible bonds.

The most distinctive feature of convertible bonds is that holders can convert them into company stock in the future. If you purchase MicroStrategy’s convertible bonds maturing in five years, it means you’re betting that MicroStrategy’s stock price will be higher then. You can convert the bonds into shares at a predetermined ratio, sell the stock, and profit. If the stock underperforms, you can still redeem the principal and interest, ensuring bondholders don’t incur a loss.

MicroStrategy initially bought Bitcoin with the goal of creating stock price volatility. The greater the volatility, the higher the potential profit from convertible bonds. Those subscribing to these bonds aren’t looking for bond interest—they’re chasing significant gains from stock price increases. This enables MicroStrategy to lower the interest rate on its convertible bonds, which is how it managed to borrow $3 billion at a 0% interest rate.

Everyone knows that MicroStrategy issues convertible bonds to buy Bitcoin. Subscribing to these bonds is essentially an indirect Bitcoin investment. Compared to directly buying Bitcoin, it’s a more balanced strategy: if Bitcoin’s price rises, the bonds can be converted into MicroStrategy stock. If the price drops, at least the principal is preserved.

This explains why, even with a 55% premium on MicroStrategy’s convertible bonds, financial institutions eagerly snap them up. Taiwanese institutions like Fubon, CTBC, and Cathay have also participated. MicroStrategy’s simple strategy ties its stock price to Bitcoin’s price, enabling it to issue low-interest convertible bonds continuously, raising maximum funds at minimum cost to buy more Bitcoin.

Now, shareholders are well aware that the company’s cash flow is entirely allocated to paying the interest on these bonds, supporting MicroStrategy’s continued holding of 331,000 BTC. These Bitcoins are the key to reviving MicroStrategy’s stock price and trading volume. Seeing Michael’s transformation strategy succeed, several other publicly listed companies have followed suit, purchasing Bitcoin as a reserve asset. If Bitcoin reaches $100,000, these companies will have played a significant role in pushing it there.

However, the more I understand how MicroStrategy accumulates Bitcoin and ascends to the top, the less inclined I am to buy its stock. It reminds me of the death spiral2 of LUNA and UST over two years ago, where confidence was the critical factor.

The Death Spiral

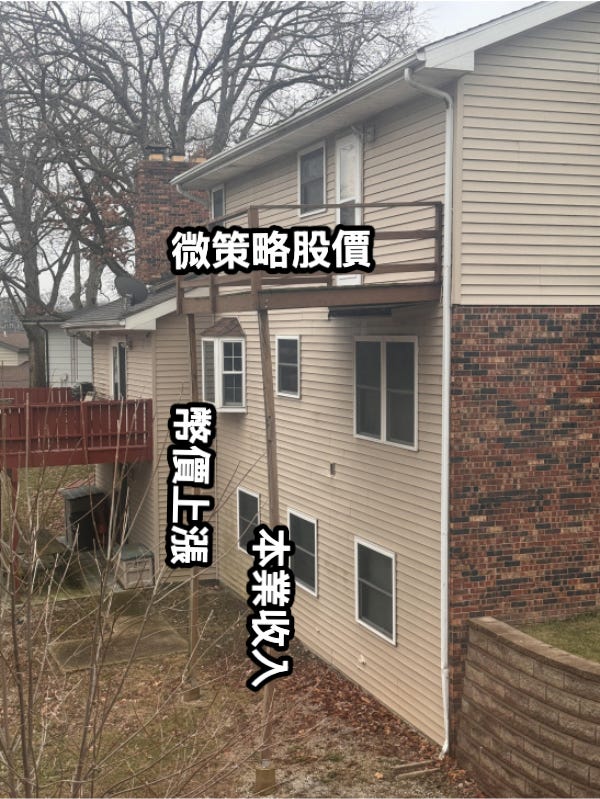

On the surface, MicroStrategy seems to be thriving, but I believe it resembles this meme below, with its foundations looking rather shaky.

Borrowing to Buy Bitcoin: The Two Weaknesses of MicroStrategy

MicroStrategy’s strategy of borrowing to buy Bitcoin works well in a bull market, but it has two major vulnerabilities:

Core business revenue

Bitcoin price performance

If core business revenue becomes insufficient to cover convertible bond interest, or if Bitcoin’s price underperforms, this model becomes unsustainable.

To draw an analogy with real estate, MicroStrategy is like a property investor who relies on grace periods from banks. While it has some business income, it never pays the principal on its loans—only the interest. Once the grace period expires, the investor refinances with another bank. With minimal capital, it holds as much property as possible. This model works as long as the real estate market rises, as banks are always willing to offer better loan terms, even at zero interest. And when the investor owns so many properties, their core business income becomes insignificant.

However, when the market reverses, problems pile up. If Bitcoin’s price crashes, MicroStrategy’s stock price will inevitably follow. If investors lose confidence in the company’s future stock price, MicroStrategy will have to pay higher interest rates to borrow. If no one is willing to lend, the worst-case scenario is that MicroStrategy will be forced to sell Bitcoin to repay debt. This would further drive Bitcoin’s price down, lowering the stock price, and making borrowing even harder—creating a death spiral.

Ultimately, MicroStrategy is operating on leverage. Shareholders who invest in MicroStrategy are essentially leveraging their Bitcoin investment. As of the time of writing, MicroStrategy’s market cap is $85.5 billion, while the value of its Bitcoin holdings is only $32.2 billion. The $53.3 billion difference—how much of that is supported by MicroStrategy’s core business, and how much is just market hype? Everyone knows the answer.

This highlights the current frenzy around Bitcoin. Buying MicroStrategy stock at market price already involves a layer of premium; subscribing to its convertible bonds adds a second layer of premium. Yet market enthusiasm remains undiminished, with the $3 billion in bonds fully subscribed.

If you’re looking for the ultimate crypto casino experience, MicroStrategy is a great choice. But if you’re planning to hold Bitcoin long-term, I suggest buying real Bitcoin or a Bitcoin ETF. After all, the crypto world is never short of volatility, and MicroStrategy is the crypto of the crypto world.

P.S. The craziest part is that right after I finished writing this article, MicroStrategy announced it bought another $5.4 billion worth of Bitcoin, adding 55,000 BTC to its holdings. Its total now stands at 386,700 BTC. It’s almost impossible to keep up with their buying spree!

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.