GM,

The Bitcoin ETF approved by the U.S. government last week has started trading. In my initial post, I explained the three types of people preparing to enter the market and highlighted the three layers of significance worth celebrating. In essence, the Bitcoin ETF allows individuals to buy BTC directly on the U.S. stock market without the need to create new wallets, register on exchanges, or worry about security issues such as losing private keys or exchange closures. This significantly lowers the barriers for people to invest in BTC.

Back in 2021, Bitcoin spot ETFs had already been listed in Canada, with the United States lagging behind. However, on the first day of trading in the U.S., the Bitcoin ETF achieved a trading volume of $4.6 billion, comparable to the 24-hour trading volume of the largest global exchange, Binance. This achievement surpassed many expectations. The addition of another "Binance" has also improved the liquidity of BTC.

Now, everyone can track the latest developments of the Bitcoin ETF through public data. Taking the example of the iShares Bitcoin Trust launched by BlackRock, this ETF currently holds over 11,000 BTC for clients, with a market value approaching $500 million. Since spot trading can only be long, the market generally expects a bullish trend in the future coin price.

While opinions supporting the ETF approval have been widely discussed, this article will focus on the thoughts of opponents. Last week, Gary Gensler, the Chairman of the U.S. SEC, expressed resentment between the lines when announcing the approval of the Bitcoin ETF.

Significance of Approval

Gary Gensler posted an announcement on the SEC website:

"Today, the SEC approved the listing and trading of some Bitcoin ETFs. From 2018 to the present, we have rejected more than 20 applications for Bitcoin spot ETFs. The application submitted by Grayscale...was similar to those we rejected in the past... However, the U.S. court deemed that the SEC had insufficient grounds for rejection, overturned the SEC's order, and requested a reevaluation... Given the current situation, I believe the most viable approach is to approve these Bitcoin spot ETF applications... Although we are neutral, I must point out that the underlying assets in metal ETFs have consumer and industrial uses. In contrast, Bitcoin is primarily a speculative and volatile asset, used for ransomware, money laundering, evading sanctions, and funding terrorist organizations."

Blocktrend has previously discussed Grayscale's judgment1, so we won't dwell on it here. However, the last two sentences are hard to ignore. In each speech, I use the history of currency development as a starting point, explaining how currency has evolved from the earliest forms such as cattle, metals, and paper money to electronic payments. Currency is a vessel of value, and the vessel evolves with technological development. From a long-term perspective, the value of the vessel itself becomes increasingly "useless"—from initially focusing on being edible, usable, and tangible to now prioritizing convenience in transactions.

In every period of history, there is probably a "Gary Gensler" who, when people want to transition to using metals as a medium of exchange, would loudly proclaim, "Metals cannot be eaten! How can they replace cattle as currency?" He might even say, "The primary use of metals is to manufacture weapons, leading to slaughter; this is not suitable as currency." If this person appeared in 2024, everyone would surely think he's crazy. But the same scenario is playing out now.

As early as 2013, someone applied to the U.S. government for a Bitcoin ETF. The applicants were the Winklevoss twins, who were the protagonists in the legal battle with Zuckerberg over Facebook's intellectual property rights in the 2010 film "The Social Network." After 10 years, the U.S. government officially approved the Bitcoin ETF. At first glance, it may seem like the Bitcoin ETF took a long time. However, when compared to gold, the speed is astonishing.

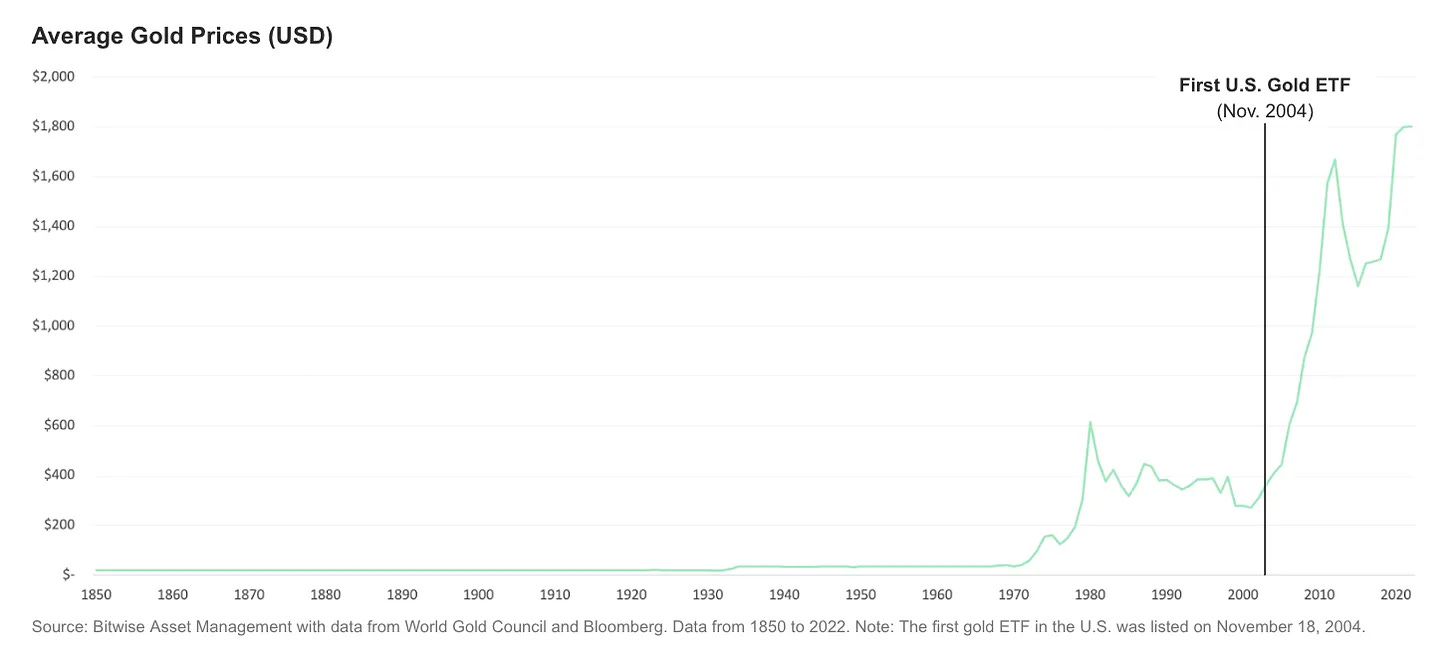

Gold's history is longer than human civilization, but gold ETFs only emerged as financial products in the last 20 years. In contrast, Bitcoin emerged in 2009, independent of government, military, or taxation. Within just 15 years, it has become a natural digital asset accepted in value by people. It has now become an asset target for ETFs in the U.S. securities trading market, a remarkable achievement. There are already many articles on the internet comparing Bitcoin ETFs to gold ETFs2. The horizontal axis of the graph below represents time, and the vertical axis represents the price of gold.

As shown in the chart, after the launch of the first gold ETF in the United States in 2004, the price of gold continuously rose for nine years. However, the surge in gold prices did not happen immediately after the introduction of the gold ETF; it required time to mature. People needed to understand this new investment method, and investment companies gradually incorporated gold ETFs into their portfolios after thorough evaluation.

Yet, nobody knows if the development of a Bitcoin ETF will follow a similar script. Even Wall Street, the most knowledgeable about financial markets, has become embroiled in a heated debate, split into two camps of supporters and opponents. The CEO of the largest U.S. bank, JP Morgan, insists that Bitcoin has no value. Vanguard, a leading index fund, has announced that it will not allow users to invest, and even Bitcoin futures ETFs that were previously listed are being delisted. However, firms like BlackRock and Fidelity stand on the supportive side, believing that the opponents fail to see the future.

Among the numerous opposing views, I believe the arguments and concerns of SEC Commissioner Caroline Crenshaw are the most worth considering.

Reasons for Opposition

The SEC's decision this time was actually made by a vote of five commissioners, resulting in a 3:2 split. Four commissioners publicly disclosed their positions afterward, with Crenshaw being among the opposition. Some might think that the opposition simply comes from a lack of understanding or a resistance to Bitcoin. However, after reading Crenshaw's discourse, I find her arguments reasonable. Her first reason for opposition is the SEC's inability to effectively regulate the Bitcoin market:

"Today, the SEC approved the listing of Bitcoin ETFs on stock exchanges... But I do not agree with today's decision... The Securities Exchange Act requires the SEC to prevent fraud, market manipulation, and protect the interests of investors and the public. However, the Bitcoin spot trading market is spread worldwide, and the SEC has limited understanding of these spot markets... In addition, spot markets are susceptible to fraud and manipulation... For example, yesterday, before we issued the approval order, the SEC's social media account was hacked, and a post was made announcing that we had approved the Bitcoin ETF. Within minutes of the false tweet, the price of Bitcoin experienced drastic fluctuations."

Crenshaw's assumption is that, besides playing a prank, the hacker3 might have opened a leveraged position in the trading market to profit illegally. If this incident had occurred in the securities market, the SEC could collaborate with law enforcement to expose the hacker and list all traders who profited during this time, investigating who might be a suspect. However, with Bitcoin trading dispersed globally, finding the profiteer is like finding a needle in a haystack for the SEC. From the perspective of protecting investors, I can understand her opposition.

Secondly, she challenges the very purpose of issuing a Bitcoin ETF:

"I understand the great vision proposed by cryptocurrency supporters. They aim to decentralize finance and provide financial services to those without bank accounts. When I read the white paper, I also felt that many goals of the cryptocurrency ecosystem align with my support. Who would oppose freedom and prosperity? However, I have a simple doubt about the Bitcoin ETF: Isn't this the problem that Bitcoin seeks to solve?"

Bitcoin is a peer-to-peer system. Americans who want to invest in it could have done so already, either by mining or creating a wallet to buy from others. They could easily do it from the comfort of their living room, creating a brand new, censorship-resistant digital currency. But why go through the trouble of integrating it into the existing financial system? I am concerned that the purpose of launching a Bitcoin ETF is not to provide investors with a new investment channel but to attract new investors to the investment product itself, thereby driving up the price. While this aligns with the interests of ETF initiators, it may not necessarily align with the public interest.

This passage gets straight to the core. Why should there be a Bitcoin ETF in the world? The answer depends on each person's understanding of Bitcoin. If Bitcoin is considered a digital natural asset without a specific purpose, then the reason for issuing a Bitcoin ETF is similar to that of issuing a gold ETF. Why not?

However, Crenshaw invokes the title of the Bitcoin white paper, stating that its purpose is to create a peer-to-peer electronic cash system. Repackaging Bitcoin as an ETF and integrating it back into the financial system seems contrary to the original purpose of Bitcoin, preventing people from enjoying the benefits of decentralization.

I find it challenging to counter her arguments. Just last week, I pointed out at the beginning of the article that, from the perspective of financial innovation, a Bitcoin ETF is a "backsliding" product. It transforms a digital asset that could be traded peer-to-peer, without the need for admission, into stocks that can only be bought and sold on stock exchanges. Investors indirectly hold Bitcoin through stocks.

Lastly, Crenshaw has many reservations about how a Bitcoin ETF would operate in practice. She terms these concerns as "Tomorrow's Problems":

"I have many concerns about how a Bitcoin ETF will operate after approval. For example, how are the assets behind the Bitcoin ETF custodied? Bitcoin prices often experience drastic fluctuations. What happens if the Bitcoin spot ETF triggers circuit breakers? The spot market will certainly not be affected by a trading halt, but how can ETF investors avoid equity damage when prices deviate? These are issues that the SEC may encounter in the coming days, weeks, or years. I do not know if we are prepared."

Those who have experienced bull markets in the crypto space know that prices have fluctuated by 50% in a single day. Not to mention stock exchange circuit breakers, many cryptocurrency exchanges have suspended services during such times, even resorting to "pulling the plug." In the past, people could only accept their bad luck in such situations, but now all of these fall under the jurisdiction of the SEC.

If you were an SEC commissioner and saw Crenshaw present the above three reasons, would you vote in favor or against? At least, you wouldn't think those who cast opposing votes simply don't understand Bitcoin.

Centralized Risks

Among the various concerns raised by Crenshaw, the most worrisome for many is the risk of centralization. The reason is straightforward – cryptocurrency hacking incidents are not uncommon. The more familiar one is with cybersecurity, the more cautious they become. Who can guarantee that their vault won't be hacked? This is a problem that companies' stocks and gold ETFs have never encountered.

Take the example of the Taiwan stock market, where investors' stocks are centrally stored in the Taiwan Central Depository & Clearing Corporation. However, hackers wouldn't be foolish enough to steal stocks from the depository, as the government can promptly rectify any stolen numbers. Hackers essentially can't take away any assets. Both Bitcoin and gold are anonymous assets. However, while there are already many experiences in ensuring the safety of gold, ensuring the security of Bitcoin is not as mature.

According to publicly available information, among the 11 approved Bitcoin ETF issuers, nine have chosen to custody their BTC with Coinbase. Coinbase is indeed a popular choice, with no record of losses in the past, making it an exemplary player in the industry. But what if something happens? Although Coinbase has theft insurance, they also admit that if the amount exceeds the coverage limit, losses will still occur. Moreover, human errors are not within the scope of coverage of theft insurance. If, during the transfer process, assets are accidentally sent to the wrong address, there might be no way to recover them.

As the scale of ETFs expands, the risk of centralization increases. The ultimate solution is not technological but rather the concept of "legitimacy" proposed by Vitalik in 2021. In essence, it involves a hard fork.

After the 2016 The DAO hack4, the Ethereum blockchain split into two. However, why did people ultimately choose Ethereum and not Ethereum Classic, which had identical technology? Similarly, in early 2020, when Justin Sun acquired Steemit and 20% of the total STEEM tokens, attempting to control the decentralized Steem community, it led to dissatisfaction within the Steem community, resulting in a hard fork. Ultimately, everyone migrated to the new blockchain, Hive, leaving Justin Sun with a "ghost town."

Vitalik believes that assets that appear valuable now are not actually controlled by private keys but are owned by a social contract. This goes beyond technology and enters the realm of human nature. Technically, holding the private key should control the assets. Whether it's The DAO hacker or Justin Sun, they approached it from a technical perspective but failed to anticipate that people would just log out and create a new territory.

This is akin to a criminal breaking into the presidential palace. Even if they manage to sit in the presidential seat, no one would consider them the president because they lack "legitimacy." I believe the same concept can be applied to extreme scenarios that may arise with the future appearance of Bitcoin ETFs.

While asset custodians should certainly minimize risks, hackers should also be mentally prepared. Technically, assets are controlled by private keys, but to take away genuine control, technology alone is insufficient. The social contract in the minds of all participants is the final line of defense for the entire Bitcoin system.

Blocktrend is an independent media sustained by reader subscriptions. If you find Blocktrend articles valuable, feel free to share this piece. You can also join discussions on the member-established Discord or save this Writing NFT to add this article to your Web3 records.

Furthermore, please recommend Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a one-month membership extension for free. You can check the article list for past publications. In response to frequent inquiries about referral codes, I have compiled them on one page. Feel free to use them.