GM,

The Blocktrend 2025 publishing schedule is now available. There will be a total of 14 non-publication days, including national holidays, along with 5 reserved days for personal or sick leave. For the first article of the year, I’ve compiled a list of major upcoming events and their potential impacts.

I emphasize "upcoming" because while there are already many predictions circulating online, only DHK dao clearly labels the probability of each event occurring. The more you read from other sources, the harder it becomes to distinguish between facts and speculation. In this article, I outline the most likely events of the year and sketch out what the blockchain landscape might look like in the coming months. At the end of the year, we’ll revisit these predictions to see what turned out to be accurate and what didn’t.

Before diving in, I’d like to ask for your help in filling out the 2024 Content Satisfaction Survey. Your feedback will help me fine-tune the direction of content for the new year.

Here’s an interesting data point to start with: Do you think the majority of Blocktrend members work in Web3, or are most of them in unrelated fields? What do you think the approximate ratio is?

According to the responses so far, 85% of Blocktrend members work in fields unrelated to Web3. However, nearly 80% have used advanced DeFi applications. In other words, Blocktrend members are practitioners from diverse professional backgrounds, rather than merely industry observers.

This data is highly valuable for Blocktrend's content selection, allowing me to explore concrete applications more boldly without worrying that the topics are too distant from readers. However, if you're among those who haven’t yet interacted with DeFi, it's even more important for you to fill out the survey so I can better understand your needs. In short, please take a moment to respond.

At the beginning of 2025, the market sentiment I’m sensing is cautious optimism—different from last year’s overwhelming sense of "a bright future ahead." Let’s talk about the optimism. Three major events are set to take place this year: token prices, applications, and regulations, respectively.

FTX Repayments

FTX repayments are the most promising reason for optimism in 2025. Once the world’s second-largest cryptocurrency exchange, FTX collapsed1 without warning in late 2022, leaving hundreds of thousands of users unable to access their funds. The fallout triggered a domino effect, leading to major crackdowns by U.S. authorities and plunging the crypto industry into a deep winter. Now, after more than two years of bankruptcy proceedings, affected users can finally see a glimmer of hope at the end of the tunnel.

Former FTX executives have been sentenced to prison, and the company’s bankruptcy liquidation is in its final stages. The first batch of repayments is set to be distributed within 60 days starting January 3, 2025. In other words, some FTX users should receive their funds around late February, just before the 228 long weekend.

The bankruptcy process has moved much faster than expected. When FTX first collapsed, I advised people to consider their lost funds as gone forever to ease the emotional burden. At the time, no one knew how chaotic FTX’s books were, whether the exchange had been completely drained, or how users could reclaim their assets. Most people expected a waiting period of at least 5 to 10 years before seeing any possibility of repayment.

However, over the past two years, those uncertainties have been gradually resolved. It turns out that FTX wasn’t completely out of money—it just couldn’t find the money. That may sound absurd, but as Michael Lewis reveals in his book Going Infinite: The Rise and Fall of a New Tycoon23, FTX founder Sam Bankman-Fried (SBF) had a history of reckless financial mismanagement.

Fear stems from the unknown. If people had known back then that the worst-case scenario was simply a forced asset liquidation, followed by a two-year "lock-up period," with FTX compensating users with a 19% lock-up interest, perhaps the panic wouldn’t have been as intense. After all, you could just buy back the tokens! While I sincerely hope there won’t be a next time, this experience highlights an important lesson: even an event as catastrophic as FTX’s collapse could be resolved within two years. More recent failures, such as BlockFi and Celsius, were handled even more quickly due to their less complicated cases. Now that we have a benchmark for worst-case scenarios, and with stricter regulations coming into play, it should be increasingly rare to encounter an exchange more chaotic than FTX.

FTX is set to distribute a staggering $16.5 billion in repayments—no small sum. Personally, I plan to set aside a portion of the funds for travel, or you could call it revenge spending. After all, FTX collapsed while I was on my honeymoon, completely ruining the trip. Now, a symbolic gesture feels necessary—something to mark the end of this chapter and remind myself that I've finally moved on.

But I’m also curious—will people reinvest in crypto after getting their money back? Let’s take a poll!

Aside from setting aside money for travel, I’ll keep the remaining funds in crypto—because another Ethereum upgradeis on the horizon!

Ethereum Upgrade

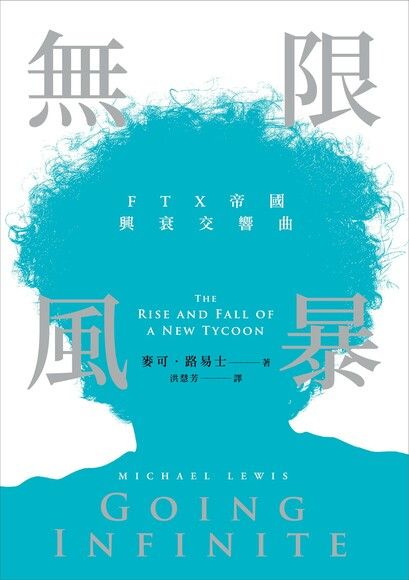

Why does Blocktrend keep talking about Ethereum? Because real-world usage matters more to me than price movements. The chart below shows the distribution of capital across different blockchains, and Ethereum still holds the largest share. While Solana and Sui have performed well over the past year—even hitting all-time highs—investors seem to be betting on their future potential rather than reacting to widespread actual usage of these blockchains.

Back to Ethereum—if everything goes as planned, we should see Ethereum’s largest-ever upgrade, Pectra, completed in the first half of 2025.

As always, Ethereum’s upgrade names follow a city + star naming convention. Pectra is a combination of Prague (the capital of the Czech Republic) and Electra (a star in the Taurus constellation). This upgrade includes a record-breaking 20 updates, making it the most extensive and ambitious Ethereum upgrade to date. Just like an iPhone updating to iOS 18, Ethereum will gain new functionalities after Pectra is implemented.

One of the most significant changes for users is EIP-7702, which upgrades existing private key wallets into smart wallets. This means users will no longer have to worry about gas fees. Soon, you’ll see MetaMask and other wallet apps rolling out a new feature that allows you to pay gas fees with any cryptocurrency (such as stablecoins)—eliminating the need to preload ETH before making a transaction.

Technically, Ethereum isn’t actually accepting any token as gas fees. Instead, wallets will become smarter—automatically converting a small amount of crypto into ETH when needed or allowing third-party sponsors to cover gas fees. While some smart wallets already offer these features, most users still rely on traditional private key wallets. Moving assets between wallets can be risky, and even migrating data feels like a hassle for many users.

The biggest value of EIP-7702 is that it brings new functionality to old wallets. Crypto veterans may not feel a huge impact—after all, they’re already used to keeping spare ETH for gas fees. However, first-time wallet users have all faced gas fee frustrations, making this upgrade a game-changer for onboarding new users.

With Pectra, one more "too complicated to use" excuse disappears—just in time to welcome a wave of new users in 2025.

Regulatory Easing

The final major event of 2025 is the departure of U.S. SEC Chairman Gary Gensler on January 20. Gensler, who previously taught a crypto course at MIT, was initially seen as a regulator well-versed in blockchain technology. However, after taking over as SEC Chairman in 2021, he became notoriously hostile toward the industry, going as far as to claim that most cryptocurrencies should be classified as securities.

Over the past few years, Gensler spearheaded multiple SEC enforcement actions, targeting exchanges, token issuers, and asset service providers, all under the guise of consumer protection. Even SEC Commissioner Hester Peirce criticized his approach4, stating that suing companies instead of creating clear regulations was lazy oversight. Yet, Gensler’s infamous stance remained: "If we haven't lost a case in court, it just means we haven't filed enough lawsuits yet."

The industry, while frustrated, could do little but wait for his departure. During the 2024 U.S. presidential campaign, Donald Trump vowed to fire Gensler on his first day in office. Following Trump's election victory, Gensler preemptively announced his resignation. His replacement, Paul Atkins, is also well-versed in crypto but favors a more relaxed regulatory approach. The general consensus is that Atkins will shift the SEC’s stance from restrictive enforcement to fostering regulated innovation.

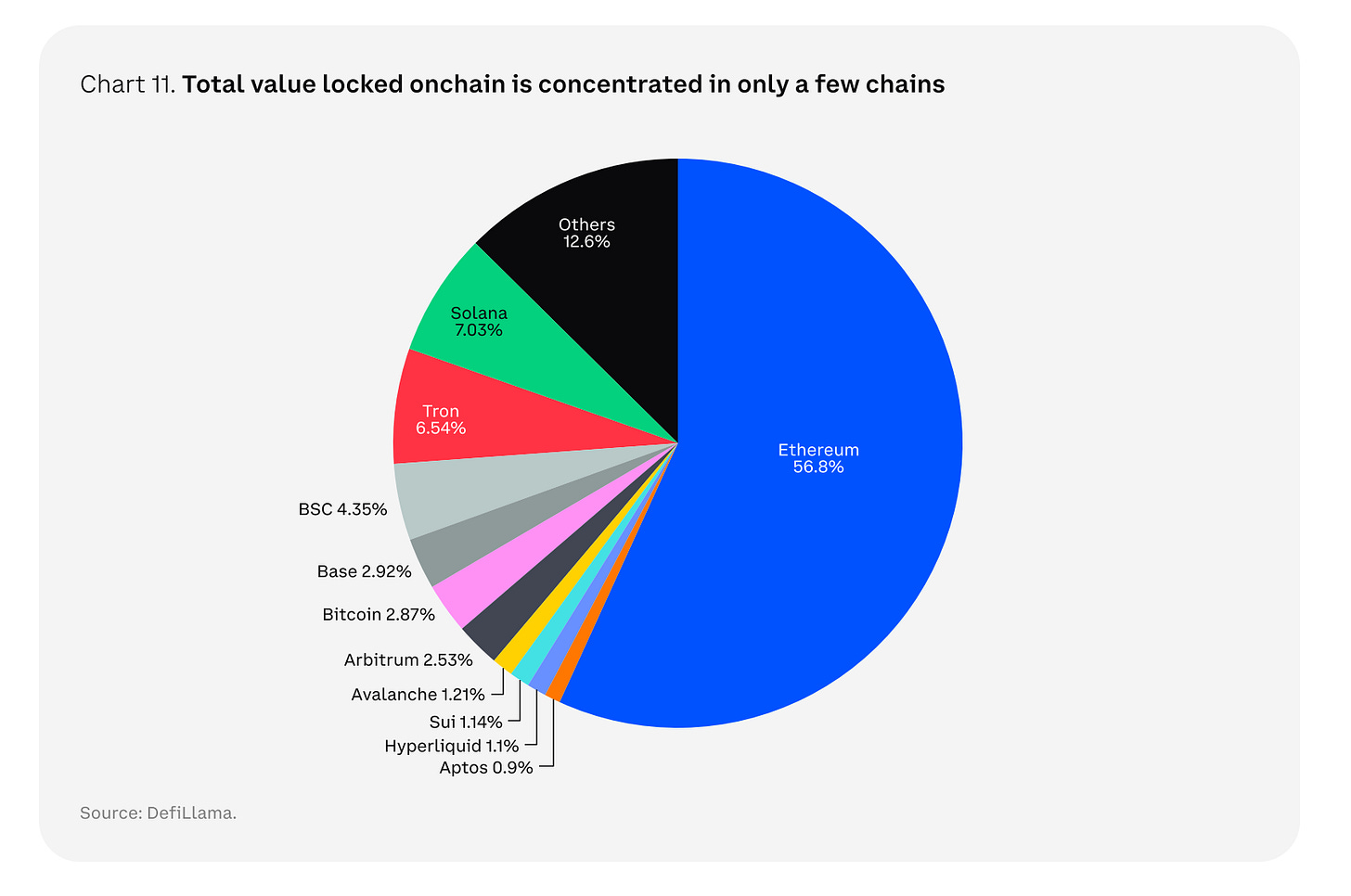

Below is a chart from Coinbase’s 2025 Market Outlook Report, illustrating U.S. Congress members' stance on crypto. The left side represents the Senate, and the right side represents the House of Representatives. From the chart, it's evident that pro-crypto lawmakers significantly outnumber their opponents in both chambers. This signals a new era for crypto legislation and regulatory oversight, with the U.S. leading the way in shaping a more favorable environment.

Back in Taiwan, the Financial Supervisory Commission (FSC) has launched a pilot program for "virtual asset custody" starting January 1, 2025. In simple terms, this means banks are now allowed to hold cryptocurrencies and conduct small-scale trials of crypto-related financial services. While I personally hope to see banks facilitating crypto trading, the first real-world application will likely be crypto-backed lending, as it meets market demand and presents a profitable opportunity for banks.

Many high-net-worth crypto holders prefer not to sell their assets but still require New Taiwan Dollars (NTD) for daily expenses. Previously, they could only borrow stablecoins from exchanges and then sell them for NTD. In the future, they will have another option: directly collateralizing BTC with banks to borrow NTD. Last year, five banks had already expressed interest in offering crypto-related services. Seeing Taiwanese banks officially enter the crypto space in 2025 is no longer just speculation—it’s becoming a reality.

If everything seems promising, why did I mention a hint of concern at the beginning of this article? Because so far, we haven't seen a clear driving narrative for this bull market, like we did with DeFi in 2020 or NFTs in 2021. Even with capital, technology, and regulations all in place, the ultimate test is whether blockchain can deliver real-world applications that integrate into everyday life. Entering crypto requires a bit of faith, but my belief is not in meme coins and speculative bubbles. Instead, I trust that blockchain will eventually solve real problems for people—beyond just hype and speculation.

Blocktrend is an independent media outlet that operates through reader-paid subscriptions. If you enjoy Blocktrend's articles, feel free to share this article or join the discussion on our Discord, which is exclusive to members. Additionally, we encourage you to recommend Blocktrend to your friends and family. If you successfully refer someone who subscribes, you will receive a free one-month membership extension. You can find past articles in our article list. Since we often receive requests for referral codes, I’ve compiled them all on one page. Feel free to use them!