2024 Year-End Review: Misconceptions About $100,000, Early Stages of Applications, and the Content Satisfaction Survey

#658

GM,

First, a reminder for those affected by FTX: remember to complete the latest claim form by January 3, 2025, to ensure you receive repayment in the first distribution wave. If you’re signing up for Kraken, feel free to use Blocktrend’s referral link.

At the end of this piece, I’ll ask for just 10 minutes of your time to complete a content satisfaction survey. Your feedback will help Blocktrend offer content services better tailored to your needs. At the beginning of 2024, I wrote a “Future Letter1” to myself at Blocktrend, capturing my feelings as we entered 2024 and making predictions for the year ahead. Writing that letter was my way of holding myself accountable. Now, it’s time to review it!

Let’s Check the Answers

At the start of 2024, optimism was widespread. I wrote that the darkest times were behind us and highlighted three major positive events on the horizon: the Bitcoin ETF2, the Bitcoin halving3, and the Ethereum Cancun upgrade4. These milestones did indeed occur on schedule. From a prediction standpoint, Blocktrend scored 100% accuracy this year.

At first glance, this seems like a perfect performance. But in reality, 2024 turned out to be more challenging than I expected. I had hoped that rising crypto prices would fuel the growth of on-chain applications, following the familiar bull market script—endless airdrops, overwhelming streams of information. However, as the year unfolded, I learned that price performance and application growth don’t necessarily go hand-in-hand. 2024 was both a banner year for investors and a grueling year for builders.

The $100,000 Misconception

The biggest news of the year, without a doubt, was Bitcoin surpassing $100,000, setting a new all-time high.

For years, the $100K mark was a distant dream, the ultimate milestone in speculative conversations. Bitcoin skeptic Peter Schiff mocked the idea in 2019, claiming, “Investors can keep dreaming; Bitcoin will never reach $100,000.” At the time, Bitcoin had dropped to $8,000, and many investors might have agreed with him. The idea of $100K seemed absurd. Fast forward five years, and the dream came true. That old post has now become a classic example of a bold prediction gone wrong, reminding people never to be overly dismissive.

While Bitcoin reaching $100,000 is worth celebrating, it can also create the illusion of prosperity across the crypto space. Bitcoin, though the oldest and most renowned cryptocurrency, is arguably the "least useful." Those familiar with blockchain operations know that Bitcoin's network hosts almost no applications, incurs high transaction fees, and has a minimal number of active users. Most people simply buy and hold it as an investment. However, to outsiders, rising prices equate to thriving development—making no distinction between investment and utility. Meanwhile, the most widely used blockchain, Ethereum, is jokingly dismissed as "Obsolete Coin" (已汰幣) simply because its price gains fall short of Bitcoin's.

This week, I watched an online interview with Vitalik Buterin, where the host asked when he might consider retiring. Vitalik's response was illuminating: burnout, he said, has less to do with the work itself and more to do with "misunderstanding." He explained that during the Ethereum developer conference (Devcon), he left his hotel at 8 a.m. and returned late at night. Even when traffic forced him to sprint to events on foot, he didn’t feel tired. But the moment he opened social media and read comments like, "The Ethereum Foundation is overly idealistic and disconnected from the market," or, "Ethereum’s best application is just a glorified casino," it sapped his motivation and made him consider stepping back.

Not only does Vitalik feel disheartened, but over the past year, I’ve witnessed several brilliant entrepreneurs and researchers who once worked tirelessly in the crypto space quietly exit the stage to pursue other goals. If the market were truly thriving, I doubt they would choose this moment to leave in such a subdued manner.

I say this with confidence because I’ve also contemplated whether to stay in the crypto space over the past year. In fact, when writing my acceptance speech for the "Top 30 Blockchain Influencers," I half-jokingly said that merely surviving this year was an achievement in itself 😂 (though this part didn’t make it to publication). Fortunately, I had the chance to fly to Bangkok, Thailand, to attend Devcon55, which re-energized me and reignited my passion to keep moving forward.

Beyond the market’s pervasive mindset of "price equals success," blockchain applications over the past year have felt somewhat stagnant. This can be analyzed from three perspectives: technology, regulation, and business.

The Early Days of Applications

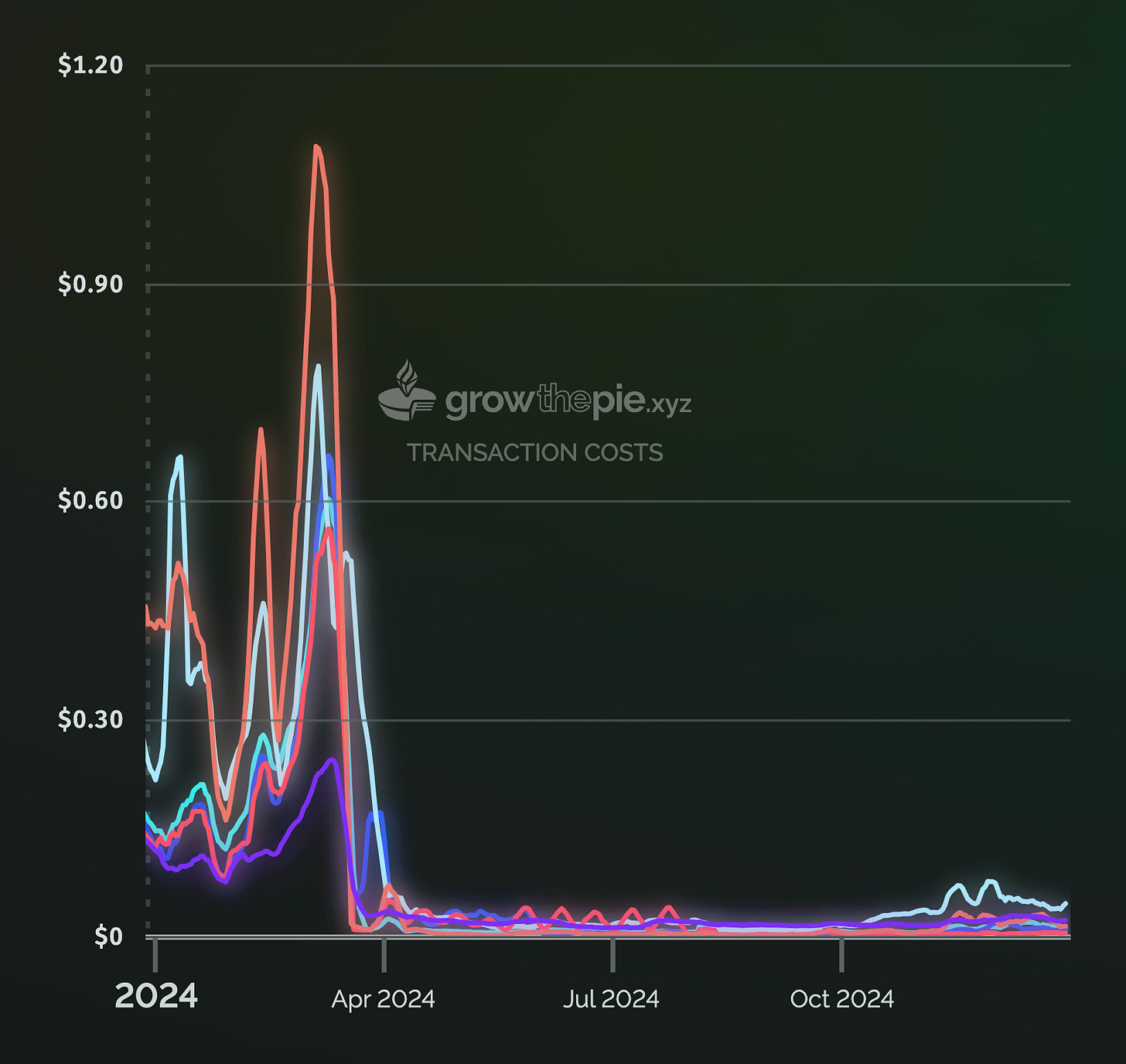

Ethereum’s Cancun upgrade arrived as scheduled, significantly reducing the cost of using the blockchain. As Blocktrend predicted, incremental changes led to a transformative impact: as transaction fees drop to a certain threshold, they begin to reshape business models. Subsidy wars and non-financial applications have started to emerge.

Despite the substantial decrease in Ethereum L2 costs this year, numerous issues remain unresolved. For example, the proliferation of Ethereum L2s has resulted in a fragmented and suboptimal user experience. Wallets still fail to inspire confidence. While private key management technology has improved beyond the rudimentary days of pen-and-paper solutions, it hasn’t yet reached a level where losing access is nearly impossible. Risks such as misdirected transactions, phishing scams, and application hacks persist. This epitomizes the "neither here nor there" state of the technology.

On the regulatory front, the approval of Bitcoin and Ether ETFs marks the most significant progress. Additionally, U.S. courts repeatedly challenged6 government overreach, forcing officials to rethink novel regulatory approaches for cryptocurrencies and smart contracts—an unprecedented shift. Toward the year's end, Federal Reserve Chair Jerome Powell remarked that Bitcoin's primary competitor is gold, a statement that propelled Bitcoin to its historic $100,000 peak.

On the flip side, while many believe that the incoming Trump administration will be more supportive of blockchain, last week the IRS introduced a controversial regulation for DeFi platforms. The proposed rule mandates KYC (Know Your Customer) compliance for DeFi websites to enable tax collection, a move certain to ignite heated debates in the future. Furthermore, questions remain about whether governments will support stablecoins and RWA (Real World Assets) through favorable policies.

The tension between idealists, who struggle to find sustainable business models, and speculators, who solely pursue profit, continues to polarize the market. This polarization manifests in phenomena like the meme coin craze.

The appeal of issuing and trading meme coins lies in their unpredictable potential for massive gains. Ironically, coins with serious visions and clear goals often underperform in price, as overly defined ambitions leave little room for imagination. This further reinforces outsiders' stereotypes about blockchain—that it's merely a space for "pump-and-dump" schemes, where seriousness doesn’t pay off.

Vitalik encapsulated this "neither here nor there" dilemma with a striking observation this year. He stated, "We can no longer say we are in the early stages of blockchain. Instead, we are in the early stages of blockchain usability." This isn’t just wordplay; it highlights a significant milestone—blockchain infrastructure has now become functional.

Vitalik once again referenced his firsthand experience during a 2021 visit to Argentina. At the time, he walked into a café where the owner not only recognized him but also welcomed payment in cryptocurrency. Initially delighted, Vitalik opened his wallet to pay with ETH, only to find the café owner using a Binance exchange account to accept payment. The reason? Binance's internal transfers were fee-free and instant. Vitalik used this example to highlight how blockchain infrastructure, even back then, was already functional.

But why are we still in the early stages of usability? For a café owner to abandon exchange-based transfers, cheaper transaction fees alone aren’t enough. There needs to be on-chain solutions like an "inline reservation system" or an "iCHEF POS system for the restaurant industry" that make wallets more convenient than exchanges. These are untapped entrepreneurial opportunities—and the main reason I’m staying in this space. What I hope to see is not just a group of people becoming wealthy from early Bitcoin investments but rather individuals solving old problems with new blockchain-based solutions.

Over the past year, Blocktrend has published 72 articles, amounting to roughly 200,000 words, and produced 46 podcast episodes totaling 50 hours of engaging conversations. We created 7 videos, hosted 2 film screenings, and—on a personal note—I raised a daughter 😂. I hope everyone has been satisfied with Blocktrend’s content and services this year. If not, what can you do? Fill out the 2024 Content Satisfaction Survey!

Satisfaction Survey

This survey helps me understand my readers better, allowing my articles to feel more like I’m speaking directly to you. It also helps identify what Blocktrend is doing well and what needs improvement so that I can make 2025 even better.