WWDC 2025’s Hidden Highlight: How Apple Could End the Era of Scanned IDs in Just 10 Seconds

GM,

Apple’s annual Worldwide Developers Conference (WWDC) took place this week. Most media coverage focused on AI features, but Apple’s progress in AI remains limited this year, and a smarter Siri still seems far off. It’s no wonder that many outlets are calling this year’s event underwhelming.

However, WWDC actually includes dozens of technical sessions that cover various aspects of development. Back in 2019, I wrote about Apple's “Sign in with Apple” 1 privacy feature, and in 2022, I covered passkeys—now the preferred login method for major exchanges and wallets. This year, Apple introduced a new feature for Apple Wallet that could potentially serve as the foundational infrastructure for decentralized digital identity. Let’s begin with the most familiar concept: identity verification.

The Pain of Document Scanning

Last week, I recommended signing up for the Ether.fi Cash crypto payment card 2, and to my surprise, over 300 people have already used my referral link. From now on, I’ll say this: signing up for a crypto card is the best way to promote cryptocurrency.

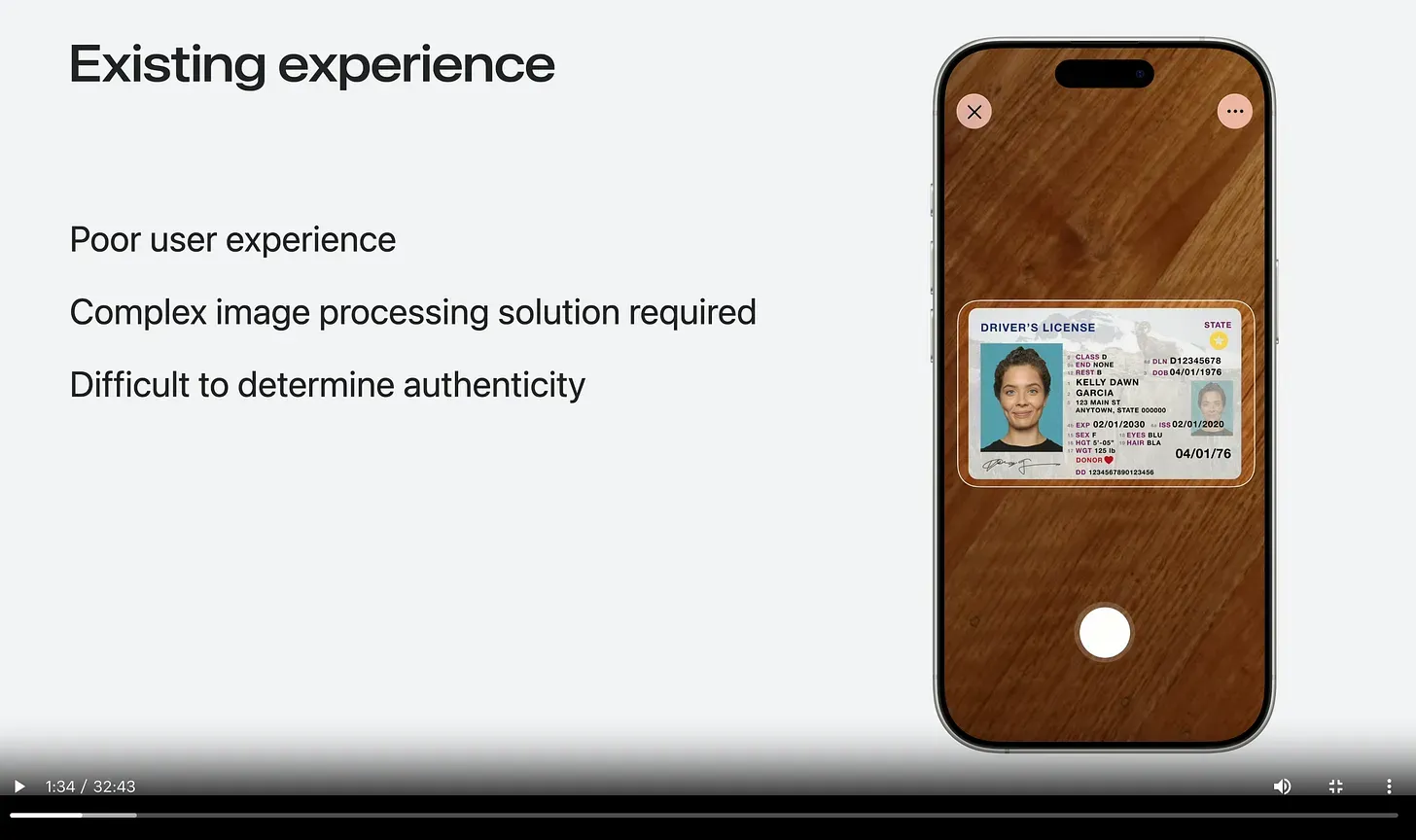

Getting a card requires Know Your Customer (KYC) identity verification. In the past, this had to be done in person, but now you can simply scan your ID and take a selfie with your phone to complete the process quickly. While this seems convenient, the process is still rooted in a paper-based mindset. Just try helping an older family member go through it once, and you’ll see how many potential pitfalls there are.

First, when photographing an ID, the background must be clean, glare must be avoided, and the image must be in focus. Taking a selfie might seem easy, but even granting camera access to the browser can trip up many users. The selfie itself requires you to maintain the right distance and precisely align your face within the detection frame. You also need to make sure you’re not shirtless, and might even find yourself wondering if the room behind you is too messy—should you tidy up before taking the photo? On top of all this, scanned documents can be forged, personal data can be leaked, and there's no way to selectively disclose only what's necessary. These are all issues that stem from the scanned-ID verification process.

Is there a better solution? Yes—and the standard has already been established.

In recent years, a global standard for digital credentials has been developed: mDocs (ISO 18013-5). Similar to how PDF defines the structure of documents, mDocs specifies the format and required fields for digital credentials. Just as different apps and devices can open the same PDF file, any wallet that supports mDocs can read a compliant digital credential.

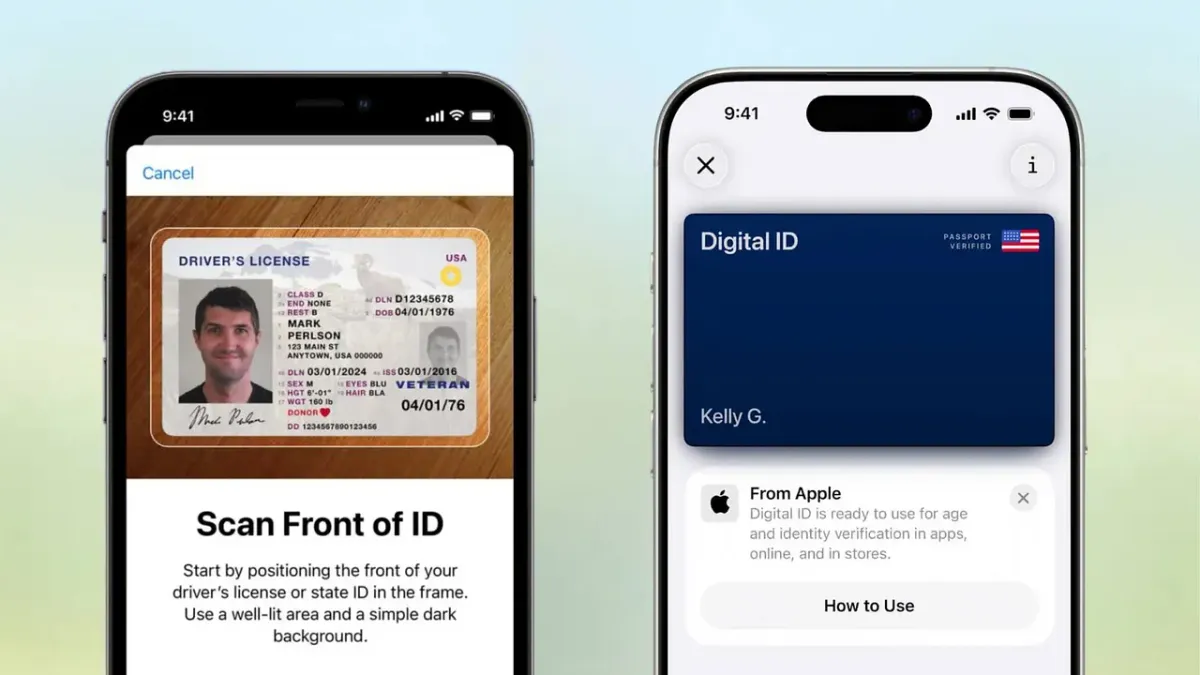

Until now, the use cases for digital credentials have been few and far between. Many people, including myself, have questioned the point of storing an ID in Apple Wallet. But now, that doubt is finally resolved. At WWDC, Apple announced that Apple Wallet will support the W3C Verifiable Credentials API, allowing users to present digital credentials stored in their wallet directly via a web browser. This opens the door to a wide range of applications for digital IDs. Scanning paper documents may soon become a thing of the past.

Renting a Spaceship in 10 Seconds

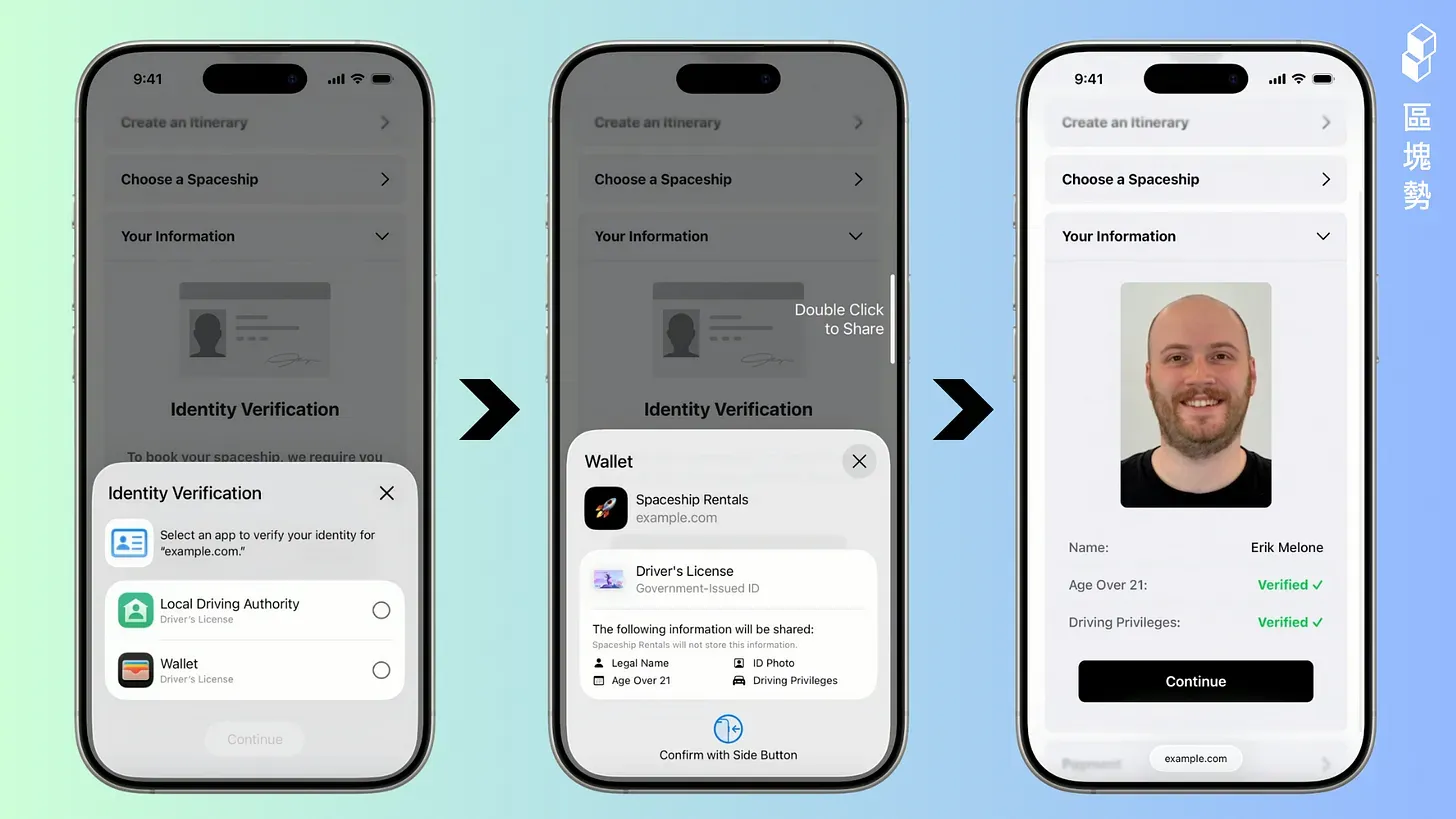

Apple used the example of renting a spaceship to demonstrate how, in the future, people can present their digital credentials using the Apple Wallet on their iPhone. I only learned from the demo video that renting a spaceship works much like renting a car—you still need to register an account and present a driver’s license before boarding.

During registration, there’s a field for identity verification. In the past, we would upload a scanned photo of our driver’s license. In the future, tapping this field will prompt the iPhone to display a selection of wallets containing your personal credentials. If I choose Apple Wallet, it will then display the name and data fields of the credential about to be shared. Finally, just like using Apple Pay, a Face ID scan confirms the action. Ding!—the photo and data from the credential are automatically filled into the website. The user doesn’t have to upload anything or manually input a single detail. The whole process takes just 10 seconds. Besides being fast, it also solves many existing problems!

Since the credential is already stored on your phone, there’s no risk of misplacing it, capturing poor-quality photos, or entering incorrect information. What’s more, it greatly enhances privacy protection. When scanning an ID, you're essentially disclosing all your personal information. If you try to redact certain fields, the submission may be rejected by the reviewer. In the future, Apple Wallet will finally allow selective disclosure. While in practice, verifiers may still request all available data, at least users will have clarity and control over exactly which details are being shared.

The most crucial aspect is data control. Traditionally, once a company suffers a data breach, users’ personal data is often compromised as well. If a hacker obtains an image of your ID, you have no control over where or how it might be used in the future. But with digital credentials presented via Apple Wallet, the data isn’t a complete document to begin with. Companies can’t access the original photo file, and even if a hacker manages to intercept it, all they get is a partial record—hardly useful elsewhere.

Hackers fear digital credentials becoming the industry standard. If websites stop accepting scanned IDs and no longer allow manual form entry, hackers would find themselves in a bind—holding troves of stolen data with nowhere to use it. It’s like a thief sitting on piles of cash while every store only accepts mobile payments. When data becomes unusable, the incentive to steal it drops. Now that Apple Wallet can interface directly with browsers and makes it easier to present digital credentials, people’s next question will be: What if I don’t have any digital credentials yet? Fortunately, Taiwan’s Digital Wallet 3 initiative is already ahead of the curve.

Digital Wallet

Last week, Taiwan’s Premier Cho Jung-tai announced at the Youth Advisory Council that the government will actively promote the inclusion of digital driver’s licenses and diplomas in the Digital Wallet, with system testing targeted for completion by 2025. If all goes as planned, we’ll likely see more and more government agencies in Taiwan digitizing physical credentials.

The government excels at issuing credentials, while Apple excels at presenting them—complementing each other perfectly. In theory, as long as government-issued IDs support the mDocs format, people should be able to add them directly into Apple Wallet, eliminating the need for the government to develop its own standalone “digital wallet.” But with convenience often comes hidden costs.

Taipei Metro’s upcoming support for Apple Pay’s tap-and-go functionality is a prime example. By the end of this year, Taipei Metro will allow riders to tap in and out using their iPhones—just like Japan’s Suica card—even without unlocking the phone. Previously, due to incompatibilities between EasyCard’s hardware specs and Apple’s requirements, negotiations repeatedly fell through. Now, Taipei Metro plans to bypass the EasyCard company altogether by launching a “fast mode” using Apple Pay linked to credit cards. This will allow users to enter and exit gates simply by holding their phone near the scanner—no need to unlock via Face ID or Touch ID.

From a user’s perspective, not needing to carry one more card when heading out is incredibly convenient. However, the original EasyCard offered benefits like student and senior discounts, transfer rebates, and support for the TPASS monthly commuter pass. If you switch to using Apple Pay with a credit card, all these perks disappear—because in Apple’s design, Taipei Metro is treated just like any other retail merchant. A tap is a standard transaction, with no discount logic built-in.

In the past, the government could leverage the EasyCard system to implement transportation policies and adjust fare structures. Going forward, these decisions will also need to align with the rules set by Apple and credit card companies. While the public enjoys greater technological convenience, the Taiwanese government’s autonomy in transportation policy is being reduced.

The technical incompatibility between EasyCard and Apple Pay eventually led to political and commercial complications. When it comes to digital identity, the stakes are even higher. To avoid repeating the same mistakes, Taiwan’s Digital Wallet must not only align with international standards and mainstream operating systems at the technical level—it may also require its own digital identity framework. Even basic rules like who can issue or verify credentials could differ drastically.

Currently, the Digital Wallet is open for public testing—even my own organization, the “Web3 Badminton Club 4,” can issue member cards. But Apple Wallet, due to security or commercial considerations, may not be nearly as open.

In the Web2 era, our digital identities were scattered across the databases of tech giants like Facebook and Google. The only things we truly controlled were the physical documents in our wallets and the diplomas tucked away in a drawer. Web3’s core principle is digital autonomy. Apple Wallet’s integration with browsers for presenting digital credentials could help spark demand, encouraging a gradual shift toward self-managed digital identity.

Apple doesn’t like to follow trends. Even when embracing AI, it insists on calling it “Apple Intelligence.” So of course, it won’t say it’s doing Web3. But digital autonomy is Web3. The ultimate goal of decentralization isn’t to eliminate central authorities—it’s to put the user at the center.

P.S. This is the 698th article. Blocktrend plans to adjust its subscription pricing after publishing the 700th article. The new rates will be $10 per month or $100 per year. These updated prices will only apply to new subscribers or members who cancel and later re-subscribe. Existing subscribers will continue to enjoy the current pricing.

- The Ultimate One-Time Address Manager!

Fluidkey makes on-chain payments private and identity-safe. - 4% Cashback Everywhere!

Ether.fi Cash: The world’s first crypto credit card that directly debits your wallet. - Taiwan’s Version of DID by the Ministry of Digital Affairs:

No new ID needed—build verified identities using your existing cards and wallet. - Playing with Vitalik:

Why I Started the Web3 Badminton Club.