Why Are Stablecoin Visa Cards Doubling in Growth? Redefining Bitcoin Pizza Day

GM,

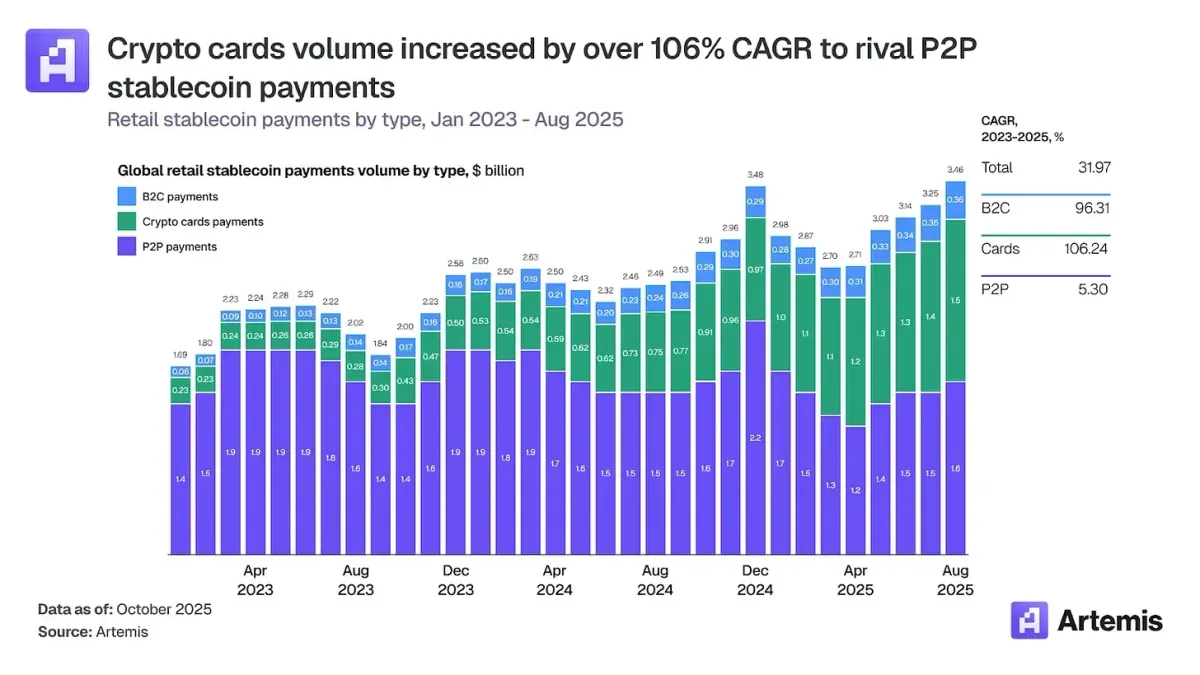

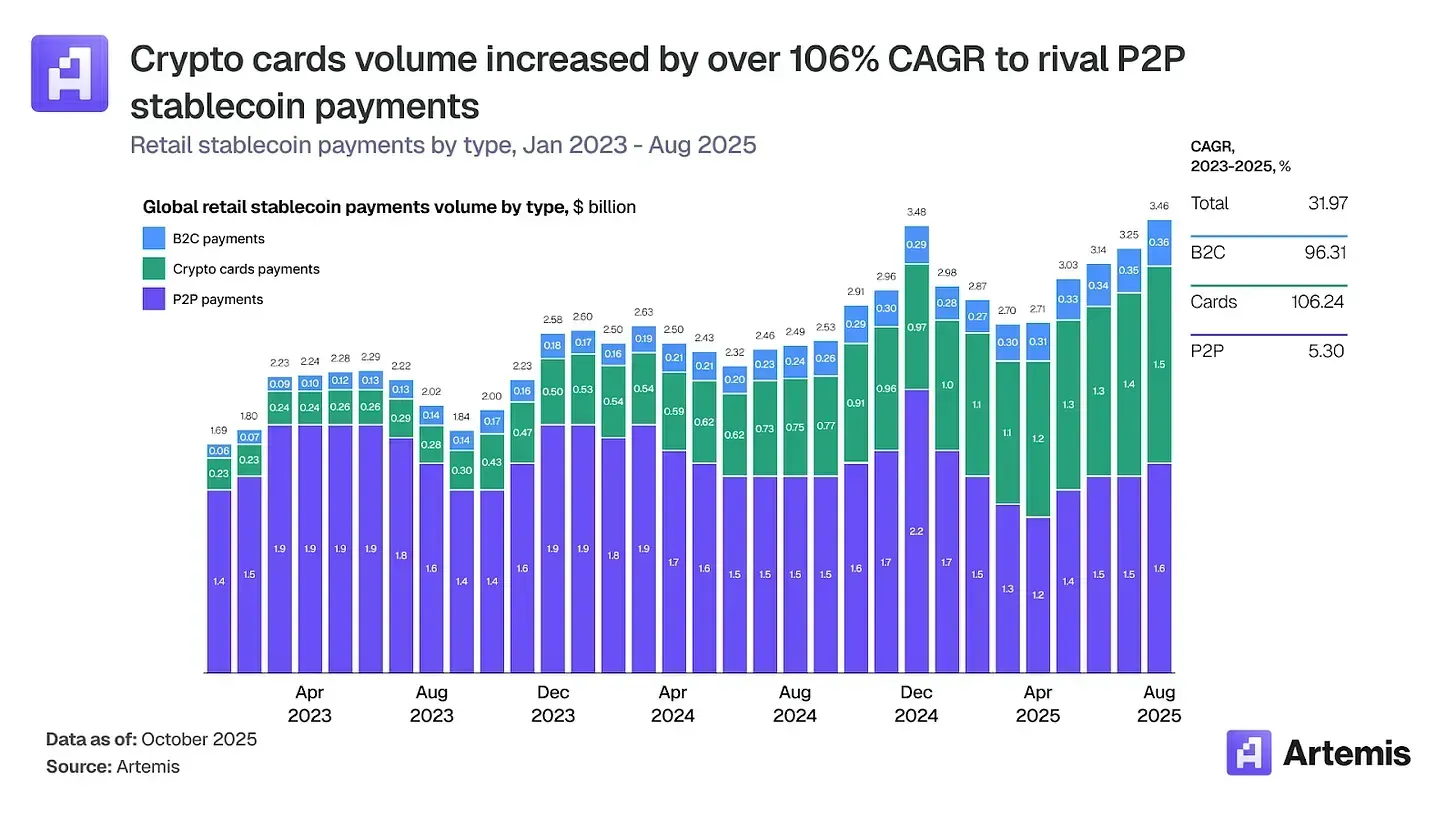

What are stablecoins actually used for? Last week, on-chain data analytics firm Artemis pointed out that the market for stablecoin Visa cards is booming. Their compound annual growth rate (CAGR) has doubled to 106%, and total payment volume has already caught up with wallet-to-wallet transfers. After investment use cases, Visa cards have now become the largest stablecoin application scenario.

The Visa card issued by EtherFi currently ranks first globally in terms of transaction volume among stablecoin payment cards. Blocktrend introduced it back in June 2025¹, and it remains my go-to choice for everyday spending. A flat 3% cashback with no restrictions on merchants and no spending cap is simply too good—other cards don’t even come close.

Last week, I was invited to share at the student tech community XueDAO, where they asked me to introduce this product. I didn’t want to turn the event into a product review—besides, most people have probably already used it. What’s discussed far less is why stablecoin Visa cards exploded in 2025, and what EtherFi did right to secure its position as the market leader. The story starts with Bitcoin Pizza Day in 2010.²

Redefining Pizza Day

Today, when people pay with an EtherFi card, their wallets hold crypto—but there’s no need to ask whether a merchant supports wallets. As long as the Visa logo is accepted, you can tap with Apple Pay and the payment goes through. Merchants have no idea the customer paid with crypto. This seamless, intuitive experience took a full 15 years to materialize.

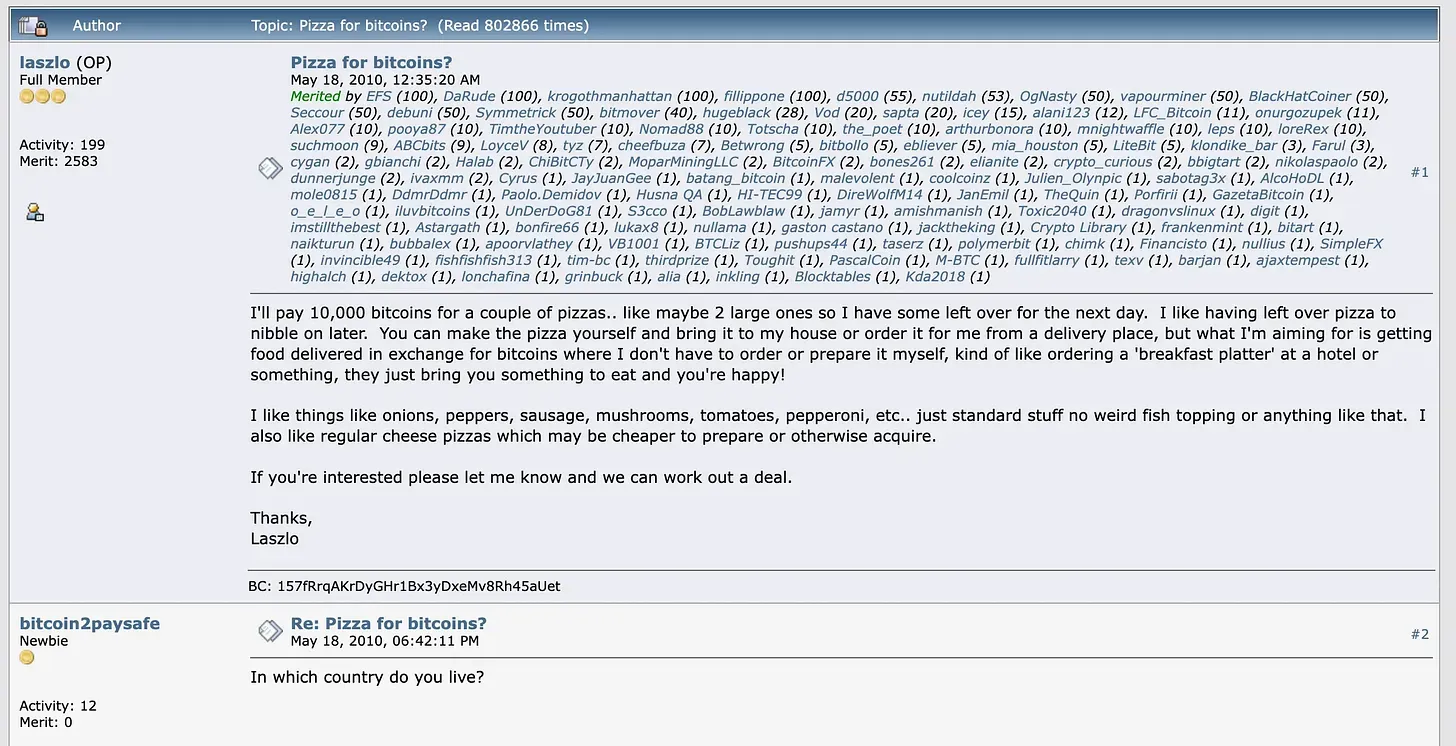

Let’s rewind to Bitcoin Pizza Day 15 years ago. Laszlo Hanyecz traded 10,000 BTC for two large pizzas. Most people focus on today’s price, which—when back-calculated—comes out to roughly USD 460 million per pizza. Laszlo is often mocked as the guy who bought the most expensive pizzas in history.

In reality, plenty of people spent their bitcoins just like Laszlo did.³ In 2010, prices were low and liquidity was poor; being able to exchange Bitcoin for anything at all was already worth celebrating. It wasn’t an outrageous decision. Those who laugh at Laszlo are mostly engaging in hindsight bias.

What many people overlook, however, is another layer of meaning behind Bitcoin Pizza Day: in order to pay with Bitcoin, Laszlo voluntarily absorbed a payment premium of as much as 64%.

According to posts on the BitcoinTalk forum, after Laszlo put out his bounty, some users calculated that 10,000 BTC was worth about USD 41 at the time—far more than two large pizzas cost. Well-meaning commenters advised him to convert his bitcoins to dollars and buy the pizzas that way. Laszlo, however, “stubbornly” refused and insisted on paying with Bitcoin.

The user who ultimately took the order, Jercos, later confirmed that the credit-card charge for the two large pizzas was only USD 25. In other words, Jercos had already arbitraged USD 16 at the moment the transaction was completed.

That 64% premium marked the very first time in human history that cryptocurrency was used to buy something. From a payments perspective, every subsequent improvement has been about reducing that 64% friction and shortening the time it takes to complete a transaction.

A 15-Year Milestone

Back then, Laszlo waited a full four days before Jercos finally stepped forward to swipe his card and buy the pizzas for him. Why was it so difficult? Because Jercos had to bear extremely high uncertainty. At its core, there were three major problems: opaque pricing, lack of merchant acceptance, and insufficient infrastructure.

Opaque Pricing

In May 2010, most people were still buying and selling Bitcoin through forum posts.

Some offered to sell 1,000 BTC, others 300 BTC, all at different prices. Even when forum users claimed that 10,000 BTC had a “market value of around USD 41,” this was likely extrapolated from a handful of scattered trades. There was no transparent market price to reference.

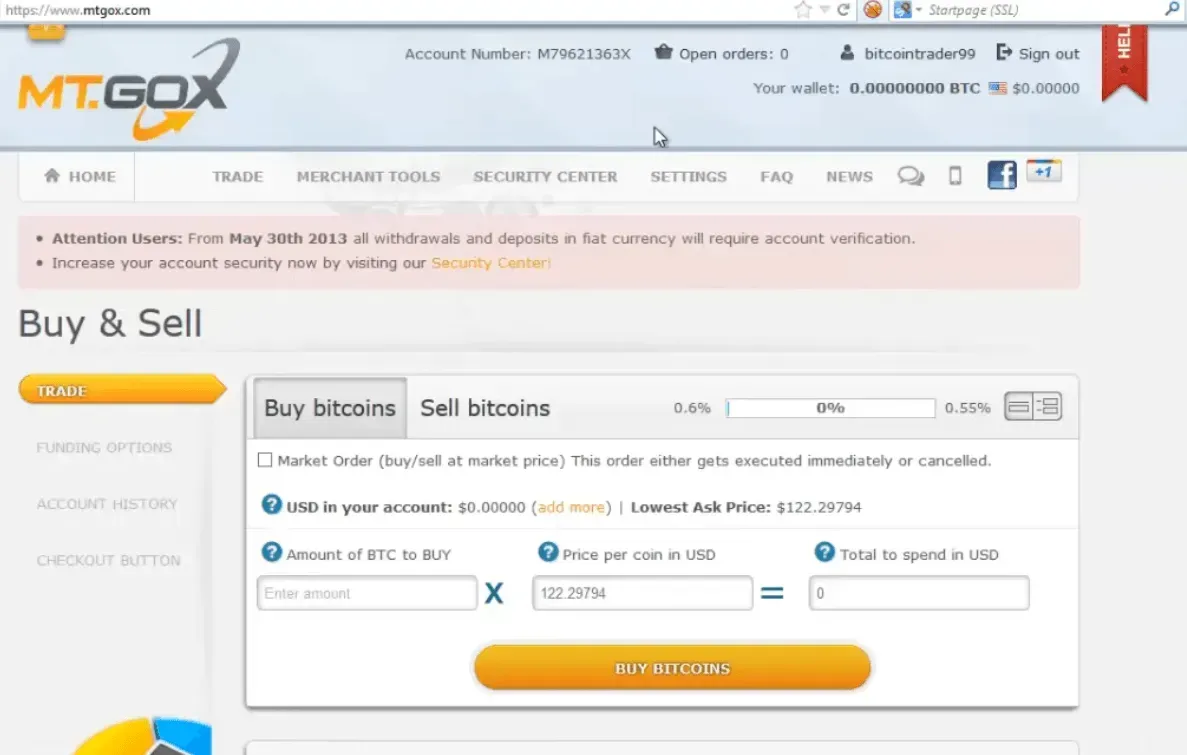

Two months later, the world’s first centralized exchange, Mt. Gox, was founded. Once people began trading Bitcoin in the same place and liquidity concentrated, a unified and transparent market price gradually emerged. From that point on, people finally had a rough idea of “how much one bitcoin is worth.”

The user who ultimately took the order, Jercos, later confirmed that the credit-card charge for the two large pizzas was only USD 25. In other words, Jercos had already arbitraged USD 16 at the moment the transaction was completed.

That 64% premium marked the very first time in human history that cryptocurrency was used to buy something. From a payments perspective, every subsequent improvement has been about reducing that 64% friction and shortening the time it takes to complete a transaction.

A 15-Year Milestone

Back then, Laszlo waited a full four days before Jercos finally stepped forward to swipe his card and buy the pizzas for him. Why was it so difficult? Because Jercos had to bear extremely high uncertainty. At its core, there were three major problems: opaque pricing, lack of merchant acceptance, and insufficient infrastructure.

Opaque Pricing

In May 2010, most people were still buying and selling Bitcoin through forum posts.

Some offered to sell 1,000 BTC, others 300 BTC, all at different prices. Even when forum users claimed that 10,000 BTC had a “market value of around USD 41,” this was likely extrapolated from a handful of scattered trades. There was no transparent market price to reference.

Two months later, the world’s first centralized exchange, Mt. Gox, was founded. Once people began trading Bitcoin in the same place and liquidity concentrated, a unified and transparent market price gradually emerged. From that point on, people finally had a rough idea of “how much one bitcoin is worth.”

The user who ultimately took the order, Jercos, later confirmed that the credit-card charge for the two large pizzas was only USD 25. In other words, Jercos had already arbitraged USD 16 at the moment the transaction was completed. Had Laszlo posted his request at that point, he likely wouldn’t have had to wait four days. But even with transparent pricing, buying pizza with bitcoin was still difficult—Laszlo still needed to find a “brave soul” willing to accept bitcoin.

No One Wanted to Accept It

Most people weren’t as open-minded as Laszlo, nor were they willing to bear a 64% premium. For merchants, bitcoin was hard to cash out, highly volatile, and offered little incentive to accept.

It wasn’t until 2013 that a handful of e-commerce platforms began experimenting with bitcoin payments. Overstock, WordPress, and Newegg all publicly stated their willingness to accept BTC. From then on, “someone willing to accept crypto” no longer depended purely on chance.

Even so, the early payment experience was extremely primitive. After paying, consumers had to wait about 10 minutes for the transaction to confirm. Merchants not only bore price volatility risk, but also had to figure out how to convert bitcoin into fiat on their own.

Where there is demand, there is opportunity. Payment processor BitPay was among the first to step in and accept bitcoin on behalf of merchants. After a customer paid with crypto, the merchant could receive fiat instantly, with price volatility absorbed by the platform. This finally gave more businesses the confidence to add “accepts bitcoin” to their checkout pages.

Still, very few people actually paid with bitcoin. In the end, volatility risk was baked into exchange rates and fees and passed on to consumers. Paying with bitcoin often meant paying more. Merchants that accepted crypto payments also remained few and far between.

It wasn’t until 2019, when Crypto.com launched its CRO Visa card, that the stalemate was broken. From then on, as long as people saw the Visa logo, they could swipe to pay. While this solved the acceptance problem, users had to keep their assets on an exchange—the card was essentially just an extension of an exchange account.

After the collapse of FTX in 2022, people came to realize that the biggest risk of such payment cards lay in centralized custody itself.

Insufficient Infrastructure

As early as 2018, some attempted to take a different path.

The Visa card launched by Monolith emphasized direct debits from users’ personal wallets, without having to deposit funds on an exchange 4. This approach was much closer to crypto’s original ideals.

Unfortunately, infrastructure at the time was still extremely limited. The network could only process around 15 transactions per second, and on-chain congestion was frequent. Around 2020 in particular, gas fees on Ethereum mainnet often exceeded USD 15 per transaction—completely unsustainable for everyday spending. Monolith eventually shut down.

By 2025, Ethereum had undergone multiple upgrades, with Layer 2 fees dropping significantly. At the same time, smart contract wallets had matured, integrating modern login methods such as passkeys. Only then did all the technical pieces finally fall into place.

The Puzzle Comes Together

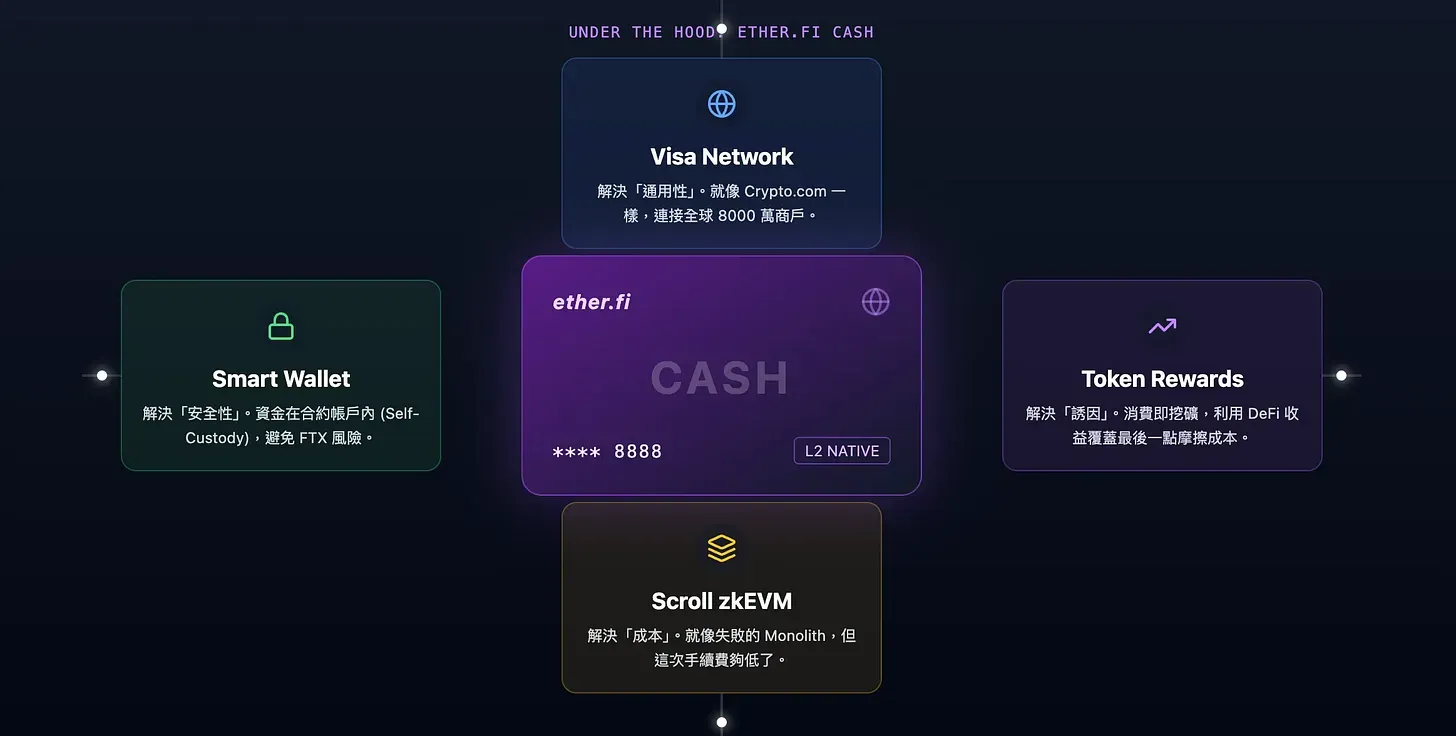

The Visa card issued by EtherFi is representative precisely because it is the first product to assemble all of these pieces into a complete solution—one that people in Taiwan can genuinely use for everyday spending.

Many people apply for this card not out of curiosity, but because it can genuinely serve as their primary payment method for everyday spending. Just tap, and the transaction is done. Ironically, users who were once “traumatized” by other Web3 products are more likely to worry: Do I need to create a wallet? What if I lose my private keys? Doesn’t paying by card still require a wallet signature?

It does sound strange. How exactly does cryptocurrency, via Visa, turn into fiat currency in a merchant’s account? Why don’t card payments require a wallet signature—is it really safe? Why don’t on-chain transfers require gas fees—does that mean the transaction never actually goes on-chain? Each of these questions is a field of expertise in its own right. Yet most people don’t even fully understand why water flows when they turn on the tap at home. Those who are curious can go back and study the details on Blocktrend; everyone else can simply accept reality and start using it first.

This is a scenario that would have been almost unimaginable 15 years ago, when Laszlo paid a 64% premium for pizza. Cryptocurrency can now be seamlessly embedded into existing payment rails, allowing both sides of a transaction to use their own money, with friction reduced to nearly zero. But is this the end of the road?

Two years ago, Vitalik mentioned two numbers at an event 5: 2015 and 2029. His hope was that by 2029, Ethereum could return to the simplicity of 2015, while simultaneously achieving the operational efficiency and user experience of 2029.

Today, spending cryptocurrency comes with no premium, no need to check whether a merchant accepts it, and no requirement to leave funds on an exchange. The reason the stablecoin Visa card market is set to double in size in 2025 is simple: payment friction in crypto has fallen below a critical threshold—finally allowing the market to take off organically.

2 Bitcoin Pizza Day: The Father of GPU Mining—and How to Become a BTC Millionaire

3 Bitcoin Pizza Day: Spending It Is How You Truly Keep It

4 From Monolith to OurSong: Choosing Between Centralization and Decentralization