Vitalik Warns There Are Only 3 Years Left! Quantum Threat Accelerates, Wallet Private Keys Could Be at Risk by 2030

GM,

It feels great to be back at work. I spent the past two weeks traveling in Europe, and since I was traveling with my wife, I tried my best not to look at work during the trip. The only exception was keeping an eye on today’s topic.

During the “Ethereum World Expo” Devconnect, Vitalik Buterin issued a warning. Citing results from the prediction market Metaculus, he noted that a quantum computer capable of threatening modern cryptography has a 20% chance of appearing before 2030. Because of this, he argued that Ethereum’s quantum-resistance upgrade must be completed by 2028. But even if development starts immediately, that leaves only three years to prepare — an urgent crisis.

My mind was instantly flooded with questions: “How is that possible? Didn’t everyone say we had more than a decade to prepare? Why is the timeline suddenly moving up? Who exactly is threatened by quantum attacks? And why 2028?”

This article explains what I found after digging into the topic.

Front Row to the Tsunami

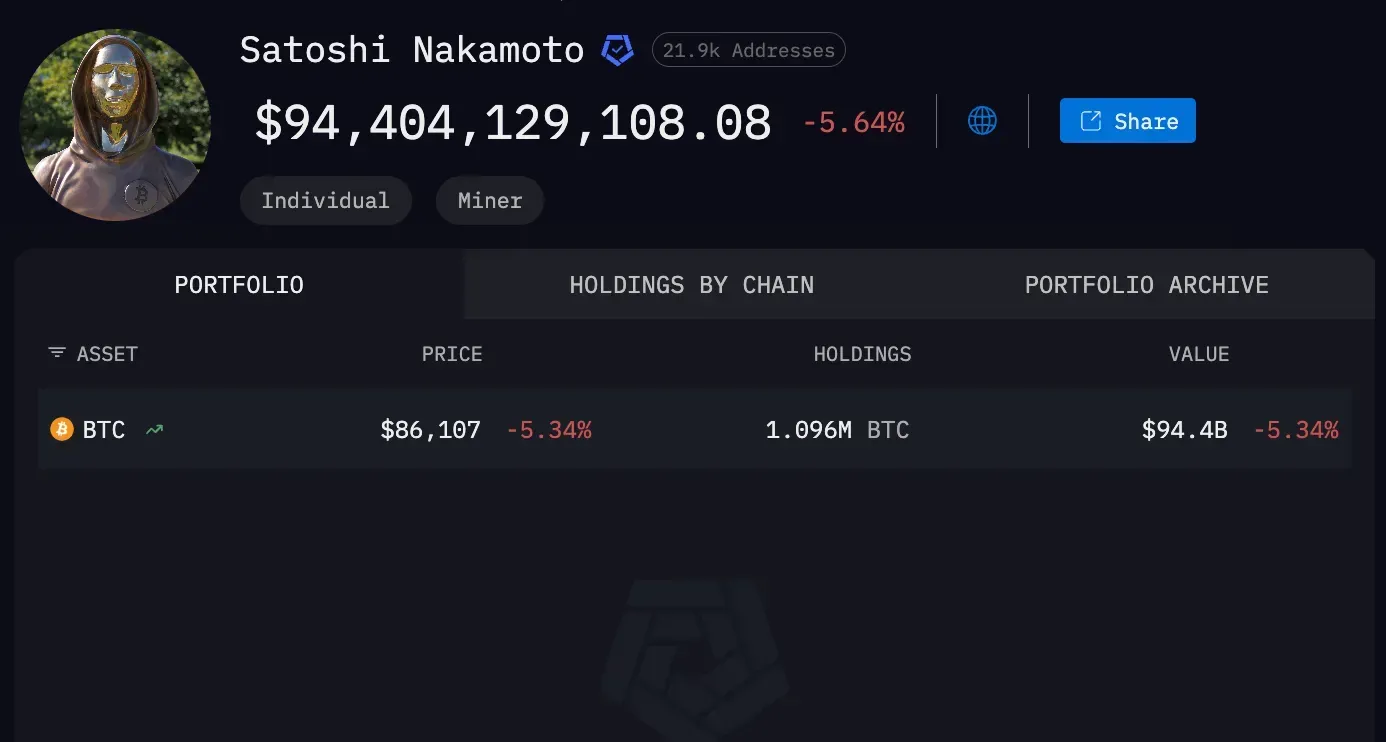

If a quantum computer capable of breaking cryptography were to appear tomorrow, the first target would likely be the wallet belonging to Bitcoin’s creator, Satoshi Nakamoto.

Satoshi’s wallet holds over 1 million BTC, worth nearly $100 billion USD. If a nation with a quantum computer managed to transfer even 0.1 BTC from that wallet, it would send Bitcoin’s price into a cliff-drop collapse — because that single transfer would prove that the cryptographic foundations of Bitcoin had been cracked. From that moment on, no one’s wallet would be safe.

The security of cryptocurrencies is built on cryptography that ensures “private keys cannot be reverse-engineered.”

Using a card-game analogy: imagine a brand-new deck of cards on the table. I shuffle it using a specific, fixed method. You look only at the final shuffled deck and must figure out how many times and in what pattern I shuffled it.

The number of possible combinations is astronomical, so the task is essentially impossible. You would have to guess my shuffle pattern, but trying every possibility is beyond human capability — and even if you handed the task to the world’s fastest supercomputer, it might still not finish before the universe ends.

That’s the principle behind private keys being irreversible.

On the blockchain, a publicly visible wallet address (and its public key) is that fully shuffled deck, while the wallet’s private key is the number of shuffles only I know. Even if a hacker knows the address and the public key, they still cannot derive the private key within a human lifetime — unless they have a quantum computer.

The Quantum Leap

“Private keys cannot be reverse-engineered” doesn’t mean they are unbreakable forever — it means that with today’s computers, they cannot be cracked in any meaningful timeframe. But technology evolves, and quantum computing is cryptography’s number-one nemesis.

Quantum computers aren’t “faster supercomputers.” Their strength lies in finding patterns. By leveraging quantum superposition and interference, quantum computers can explore vast numbers of possibilities at the same time, causing the correct pattern to naturally emerge. This directly strikes at the heart of modern cryptography: once the pattern becomes detectable, private keys are no longer safe.

Although quantum computing theory has been mature for years, building a stable quantum computer is extremely difficult. Think of a quantum computer as a wise old sage with extraordinary intelligence — but terrible hearing, easily disturbed by noise. To make him understand a single sentence, you must repeat it many times, yet repeating it too much introduces more noise, making him even more confused.

Today’s quantum computers behave like a brilliant but senile prankster 😂.

To unlock their true potential, scientists focus on two major metrics:

- Talk more clearly: increase the number of qubits

- Hear fewer mistakes: reduce the error rate

In the past, these two goals conflicted with each other. Academia widely believed that practical quantum computers wouldn’t arrive until around 2040. For blockchain developers, the quantum threat was a distant storm cloud — important, but not urgent.

That changed recently, when two breakthroughs from Google accelerated progress dramatically. The first is the Willow quantum chip. Traditional quantum computers make more errors as qubits increase, but Willow works like a “smart autocorrect system”: the more it hears, the more accurately it can refine the signal, causing error rates to decrease as the number of qubits grows.

Another breakthrough is the freshly announced Echoes quantum algorithm. Echoes makes quantum computers far more efficient at detecting complex patterns. It’s like software that previously required a laptop to run suddenly becoming runnable on a smartphone. But that also means future quantum attacks may become much more lightweight.

Willow represents a major leap in hardware capability, while Echoes lowers the computational threshold via algorithms. Together, they significantly accelerate the timeline of quantum threats to blockchain.

Nic Carter, founder of the venture firm Castle Island Ventures, recently outlined three scenarios imagining how cryptocurrencies might be affected depending on whether North Korea, China, or the United States is first to build a practical quantum computer.

Carter believes North Korea is unlikely to destroy Bitcoin — it’s their “ATM machine.” He speculates that North Korea would instead use a quantum computer to hack exchanges and siphon stolen funds to sustain its regime.

But if China or the U.S. were the first to obtain such a machine, they might directly drain Satoshi Nakamoto’s wallet, triggering violent market chaos.

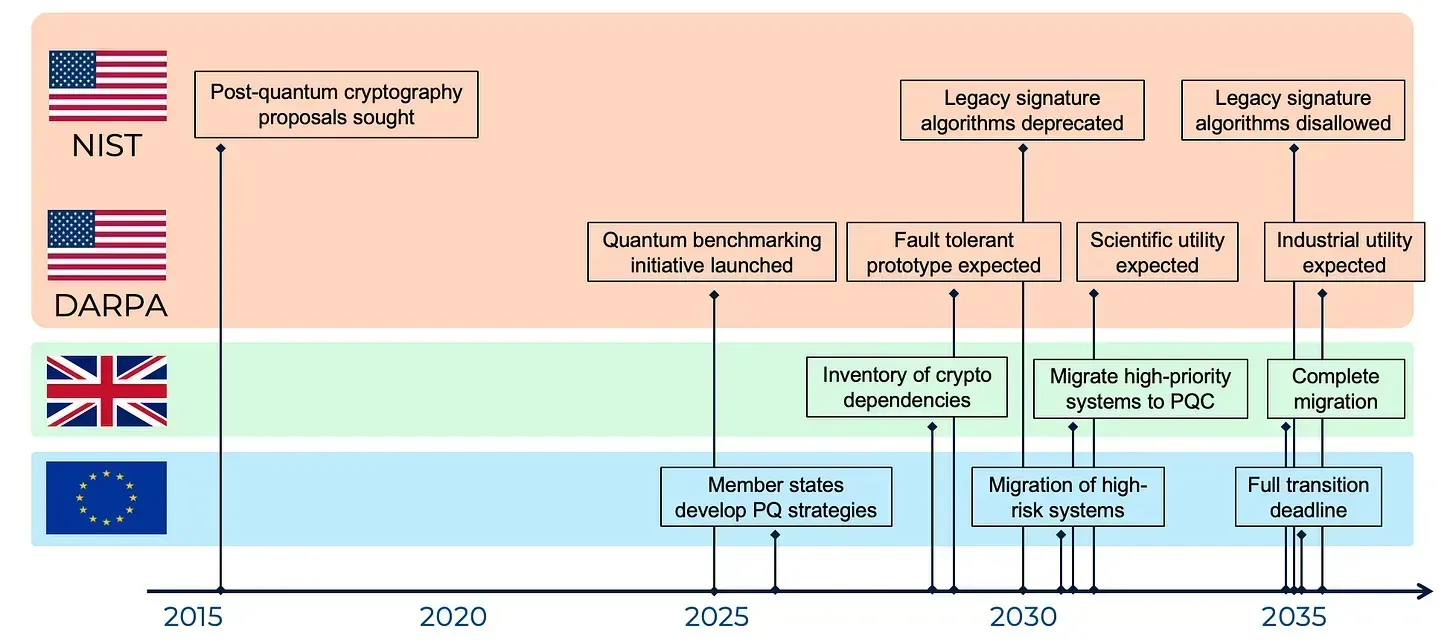

The quantum threat extends beyond cryptocurrencies. Governments fear that quantum attacks could cripple critical sectors such as finance, national defense, and aerospace. Many countries plan to upgrade all core infrastructure to post-quantum cryptography between 2030 and 2035. Against this backdrop, Vitalik’s proposal to complete Ethereum’s quantum-resistant upgrade by 2028 is, technically speaking, a form of early deployment.

But this conclusion reflects Vitalik’s assessment of both market and political pressures.

The 2028 Deadline

Financial markets trade on expectations. If experts believe cryptography might be broken by 2030, markets won’t wait until the day a quantum computer launches to crash. Panic selling could erupt years earlier. Every time quantum tech makes a breakthrough — or Google unveils another piece of black magic — confidence in crypto takes another hit.

Politics amplifies this anxiety. The year 2028 coincides with the U.S. presidential election. Politicians may frame the quantum threat as a matter of national security. Once a nation treats “breaking cryptography” as an arms race, cryptocurrencies that rely purely on cryptographic guarantees become even more vulnerable.

You might ask: Why not push the blockchain upgrade deadline even earlier?

That’s extremely difficult. Take Ethereum’s biggest upgrade in history — The Merge. From proposal to deployment, it took the community seven full years. The quantum-resistant upgrade (The Splurge) involves replacing foundational cryptography and may be even harder. Even if developers start immediately, finishing a full upgrade within three years is already a race against time.

Worst-Case Scenario

If quantum computers advance far faster than expected, blockchains may not finish upgrading in time — and individuals have very few defensive options. If your public key has ever appeared on-chain — which happens the moment you send a transaction — a quantum computer could instantly derive your private key. The only fully safe practice would be:

- Move assets to a brand-new, never-used address

- Do zero on-chain actions afterward

In extreme cases, Vitalik Buterin has proposed a last-resort emergency hard fork to protect users. The idea: Roll back the blockchain to before the quantum attack → let users prove ownership of old private keys using zero-knowledge proofs → migrate their assets to new quantum-safe accounts. This remains purely theoretical. Only real implementation will reveal the obstacles.

Three months ago, quantum attacks were something to worry about in 2040.

Facing a sudden acceleration in risk, the first step is accepting reality.

The second is recognizing that Ethereum’s quantum-resistant upgrade is not starting from scratch. It follows a long-planned path: upgrading from **“private key wallets” to “smart wallets.”¹

Finally, I’m reminded of something quantum computing expert Tseng Ko-Wei said earlier this year when recording with Blocktrend² : “Quantum computing is physical science, unlike OpenAI or Tesla’s self-driving tech, which are information science. Information science can go from idea to product in three months. Quantum computing still needs at least ten years.”

The bad news: ten years may now be too optimistic. The good news: we don’t have to worry about quantum computers improving like AI, shocking us every few months and making us wonder if we should just lie flat and give up on life 😂