Turning Stocks into Tokens! The NYSE’s New Battlefield and Wall Street’s Accelerated Shift On-Chain

GM,

Do you invest in U.S. stocks? The U.S. financial markets are accelerating their move on-chain.

The Depository Trust & Clearing Corporation (DTCC) has recently been approved to tokenize the shares of the top 1,000 publicly listed companies. Last week, the heavyweight of global capital markets—the New York Stock Exchange (NYSE)—also announced plans to follow suit by building an entirely new trading market for tokenized stocks. Even the long-established brokerage Interactive Brokers has begun supporting U.S. users funding their accounts with stablecoins to invest in U.S. equities.

What are the benefits of stock tokenization? For Asian investors, the biggest difference is that U.S. stocks could eventually be traded 24/7, year-round. In addition, settlement cycles that currently take T+1 or T+2 could be shortened to near-instant settlement, and trading could even be done directly with stablecoins. Skeptical investors might respond: “Aren’t trades already executed instantly on my phone?” To understand the significance of tokenization, we need to start with the most fundamental stock trading process.

T+2

Settlement failure is one of the biggest risks for novice stock investors. Take Taiwanese equities as an example: the settlement cycle is T+2. This means that after a stock trade is executed today, you must have the funds in place by 10 a.m. two business days later; otherwise, the broker will report a settlement default.

Stock trading can roughly be divided into two stages: execution and settlement. Execution means that both buyer and seller agree to exchange one share of NVDA for USD 190. Settlement is when I actually give you the USD 190, and you transfer the NVDA share to me. If physical stock certificates still existed, the two parties would simply meet in person—cash in one hand, stock in the other.

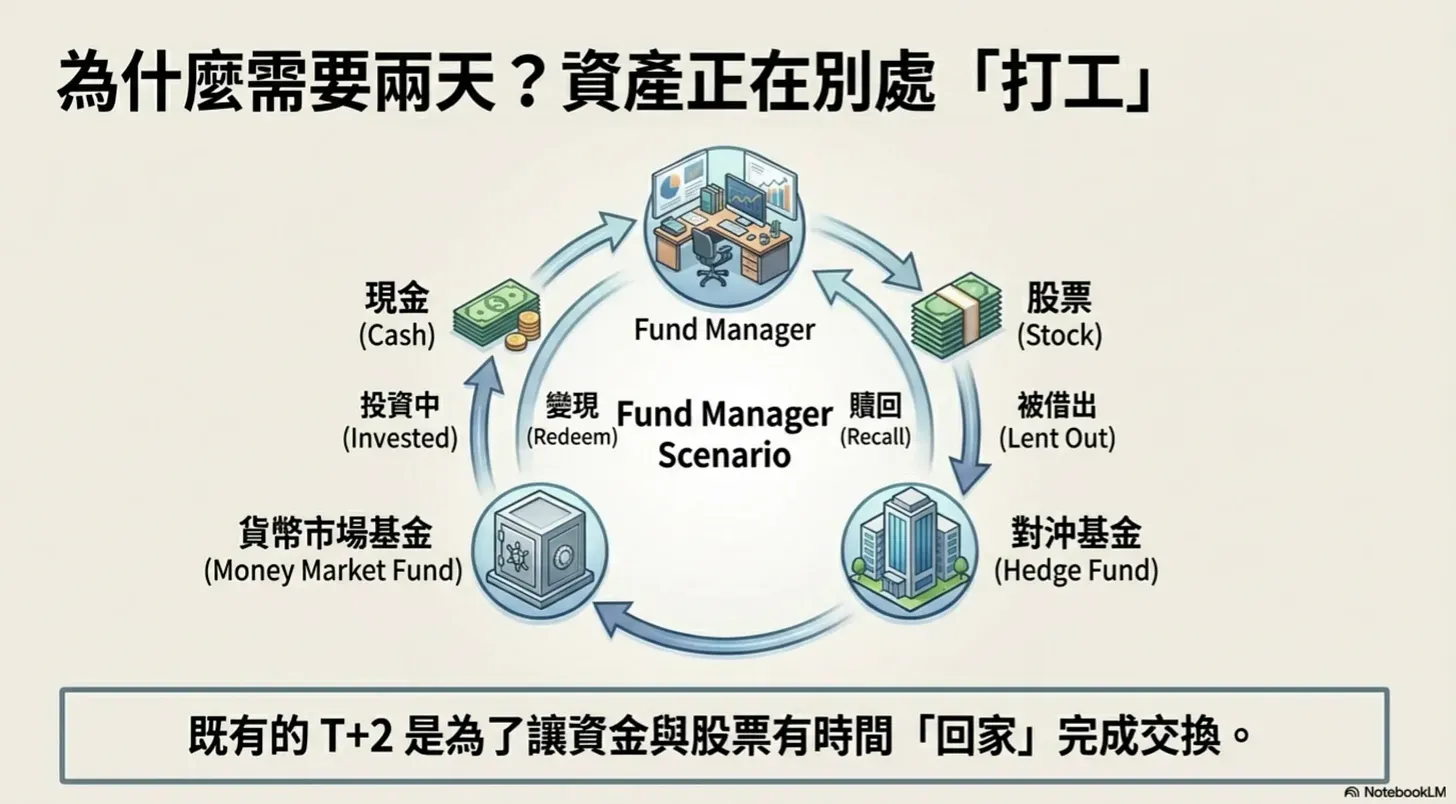

But deposits and shares have long since been digitized, and the trading process has naturally evolved into bank debits and transfers by custodians. If all that’s happening is an extra line added to a ledger, why does settlement still take two business days for Taiwanese stocks and one business day for U.S. stocks? The key reason is that the cash and shares being traded may still be “working” elsewhere at the time of execution, and it takes time to call them back.

It’s easier to imagine this in the context of physical trading. Suppose you manage a large mutual fund and plan to sell a position to a pension fund. Even though you’ve agreed on the price over the phone (execution), the shares might not actually be in your possession. Months earlier, a hedge fund may have borrowed those shares from you for its own use. What you hold is essentially an IOU from the hedge fund, and you now need time to recall the shares before selling them.

On the other side, the pension fund manager is pleased to hear that your shares aren’t immediately available—because their cash has also been parked in low-risk money market funds earning yield, and they need time to redeem it. In the end, both parties agree to complete the exchange two days later. That’s what T+2 settlement looks like.

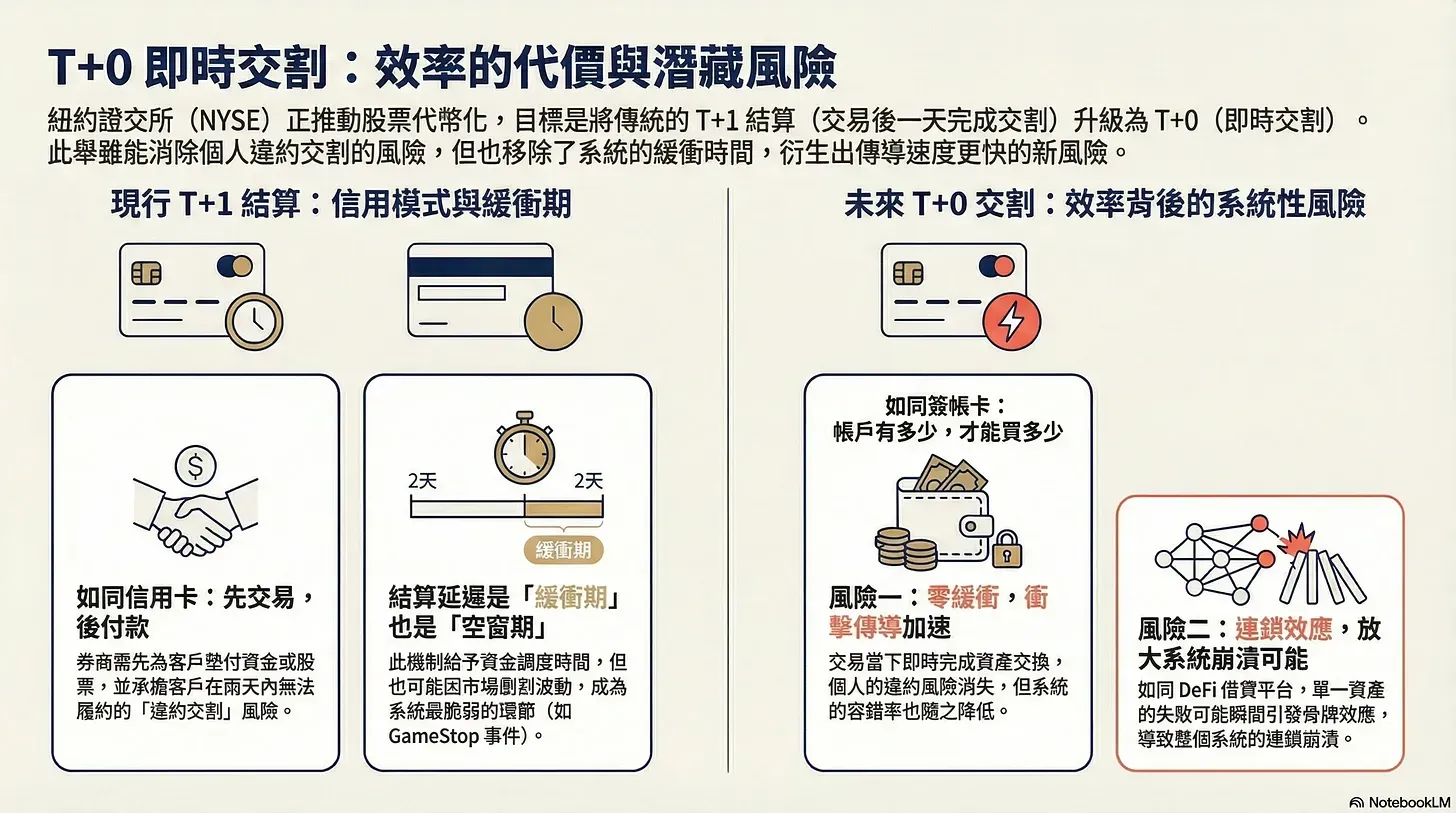

But why not agree to settle seven days later—or even a month later? Because the longer the settlement window, the higher the risk of a settlement default. The GameStop saga in 2021 was a vivid example. As GameStop’s share price swung violently, the T+2 settlement period—originally designed to give both sides time to get their assets in order—became the market’s most fragile gap. What if one party simply couldn’t hold on during those two days?

To reduce settlement risk, the U.S. announced in 2023 that it would shorten the settlement cycle for U.S. equities from T+2 to T+1. Cutting the time needed for funding in half has already put significant pressure on many financial professionals. But last week, the New York Stock Exchange went even further: its newly announced tokenized stocktrading platform compresses settlement all the way to T+0—instant settlement.

Instant Settlement

Banks operate within business hours, financial institutions need time to reconcile accounts, and cross-border fund transfers also take time. No matter how optimized the system is, instant settlement is impossible within today’s traditional financial infrastructure. The NYSE understands this perfectly. That’s why it chose to open a new battlefield on the blockchain by launching an entirely new market for tokenized stocks. According to the NYSE’s press release:

The New York Stock Exchange (NYSE) is developing a blockchain-based, on-chain settlement platform for tokenized securities. The platform will support tokenized trading of U.S.-listed stocks and ETFs, enabling real-time settlement. It will offer 24/7, year-round trading, support fractional shares, and allow settlement using stablecoins and tokenized deposits—freeing transactions from the constraints of banking hours. The platform will leverage NYSE’s existing matching engine while integrating blockchain-based settlement, supporting multi-chain clearing and custody. Investors holding tokenized securities will retain full rights to dividends and corporate governance.

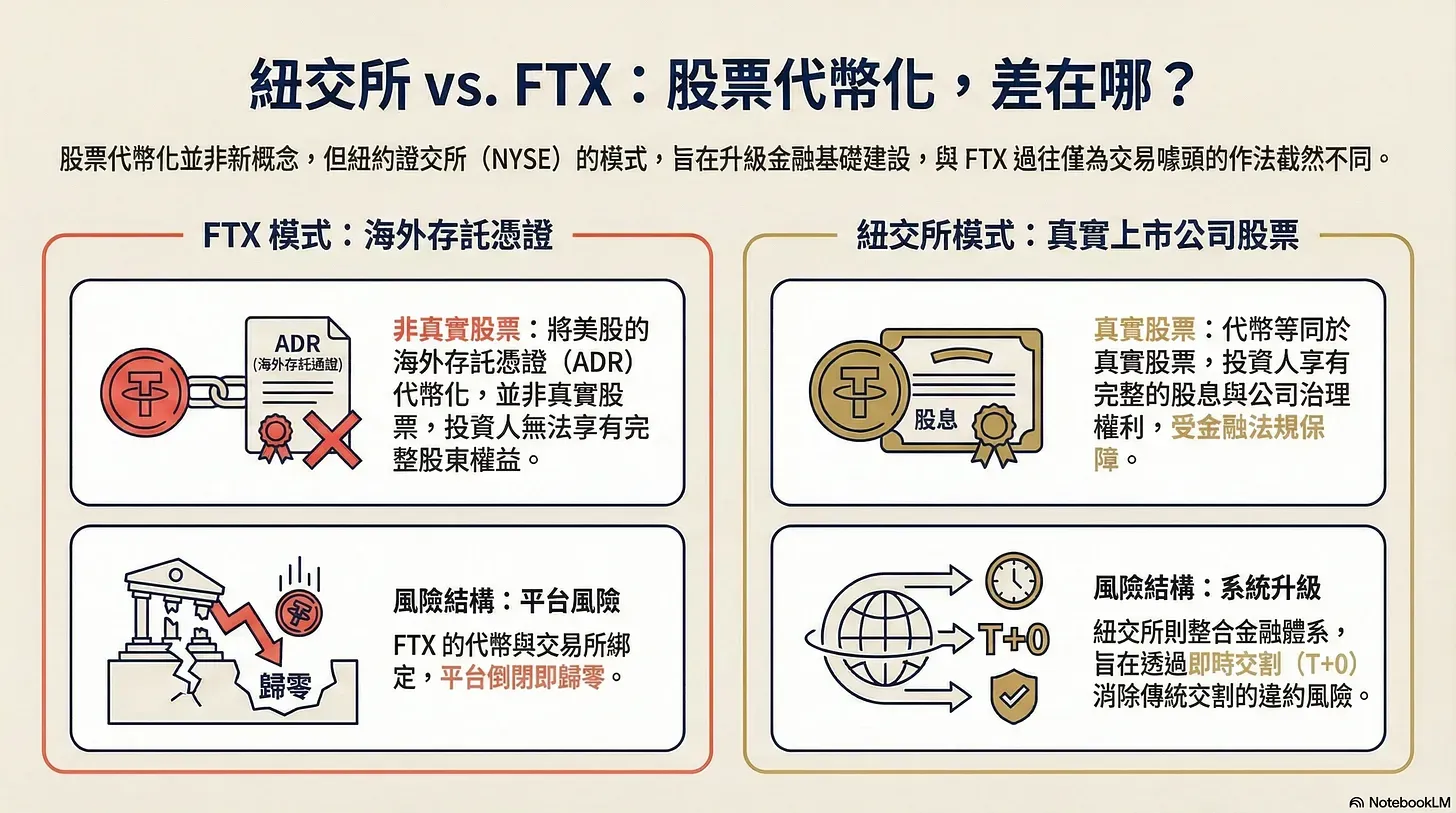

In fact, the tokenization of U.S. stocks isn’t a new idea.

As early as 2020, the FTX exchange listed tokenized U.S. stocks¹, allowing investors to trade NVDA, TSLA, or QQQ using cryptocurrencies. At the time, FTX operated across multiple jurisdictions, forcibly tokenizing American Depositary Receipts (ADRs) of U.S. equities. However, these tokens did not represent real share ownership, suffered from poor liquidity, and couldn’t even be withdrawn from the exchange. When FTX collapsed, all of those tokenized stocks turned into nothing more than digital wallpaper.

This time, the NYSE’s push for tokenized U.S. stocks is fundamentally different. It aims to make stock tokens truly equivalent to stocks themselves, with investors enjoying the same rights and protections—much like the transition from paper certificates to electronic book-entry shares. That’s what most people have been waiting for.

But the financial system is like a string of zongzi—each piece tightly bound and interconnected. If other market participants fail to upgrade the components that currently support T+2 or T+1 settlement—such as liquidity management, securities lending mechanisms, and money market funds—into the new architecture, then even if the New York Stock Exchange wants to tokenize stocks, achieving instant settlement will be extremely difficult.

No wonder the NYSE specifically emphasized in its press release that the new platform will use stablecoins (or tokenized deposits) as the settlement foundation, attempting to solve the problem of funds being constrained by banking hours at the source. But enabling money to move at any time is still not enough. If institutional investors have no way to earn yield on their idle stablecoins, the tokenized stocks traded on exchanges may still struggle to attract interest.

The world’s largest asset manager, BlackRock, laid the groundwork as early as 2024 by launching the tokenized money market fund BUIDL². At the time, many people couldn’t understand who the $5 million minimum investment threshold was meant for. Looking back now, it’s clear that BlackRock never intended this product for retail investors. Instead, it was preparing an “on-chain parking place for capital” for Wall Street institutions—allowing them to park funds in BUIDL to earn U.S. Treasury yields, then convert them into stablecoins when settlement is needed.

BlackRock CEO Larry Fink had already seen this direction back in 2024, and in his 2025 annual letter to investors, he explicitly pointed out that financial markets may move toward full-scale tokenization:

Stocks, bonds, and funds are essentially just assets recorded on ledgers. If they can all be tokenized, markets would no longer need to close, and transactions that currently take days to complete could be settled in seconds. Capital that is now tied up by settlement processes would be able to return to productive use more quickly.

At the same time, Larry Fink cautioned that putting assets on-chain is only the first step. For trades to truly achieve instant settlement, identity verification and risk management systems must be upgraded in parallel. In other words, the NYSE’s push for stock tokenization will affect far more than a single exchange, and far beyond the financial markets alone—every system connected to finance will be forced to upgrade together.

As the entire financial market moves toward a new model of “exchange completed in the moment,” new risks will inevitably emerge.

Emerging Risks

For retail investors, the most direct changes are 24-hour trading and the near-total elimination of "default on delivery" (failed settlement) risks in the future. Since every transaction is an instantaneous exchange of assets, the practice of "executing the trade first and topping up funds later" will no longer exist. If the necessary funds or stocks are not in place, the trade simply won't execute—naturally preventing the issue of failing to settle because one "realized there wasn't enough money two days later."

However, for most retail investors, whether stocks are tokenized or not won't feel significantly different in their day-to-day experience. The real beneficiaries are the brokerages standing between the investors and the market.

Under the current T+2 or T+1 systems, brokerages must advance funds or stocks on behalf of their clients and provide margins to guarantee that both parties will complete the settlement. If a client defaults, the risk falls back on the broker. This model is akin to a credit card: transact first, pay later.

But if the trading system is upgraded to T+0 (instant settlement), the model becomes more like a debit card: you can only buy as many stocks as you have money in your account. Since transactions no longer involve credit issues, brokerages no longer need to lock up massive amounts of margin to support the settlement process. This effectively frees up capital that can be used more flexibly.

Yet, this is precisely where the risk lies. Instant settlement removes the "buffer time," which in turn lowers the margin for error at every stage of the transaction. If something goes wrong, the risk propagates to other areas much faster. A prime example is the 2025 DeFi Tsunami: after Stream Finance’s xUSD reportedly suspended redemptions, other lending platforms that accepted xUSD as collateral were drained of liquidity almost instantly. In the end, the losses were borne by the depositors—those furthest from xUSD who were the least willing to take risks.

Market efficiency is a double-edged sword. If regulatory systems and risk-isolation mechanisms are not upgraded in tandem, increasing efficiency may instead amplify shocks. Fortunately, the NYSE chose to open a new battlefield this time rather than directly upgrading the existing T+1 to T+0. Otherwise, would you dare to use it?

1 FTX Beats Nasdaq to the Punch, Lists Airbnb Tokenized Stocks