The Top Choice for Lunar New Year Red Envelopes! The “No-Loss Lottery” PoolTogether

GM,

This is the last article of the Year of the Dragon—wishing everyone a Happy Year of the Snake! Don’t forget to fill out the 2024 Member Satisfaction Survey to help Blocktrend improve in 2025. Let’s dive into today’s topic.

Buying a lottery ticket to test your luck is a common New Year tradition. Even if you don’t win, people often console themselves by saying, “It’s for a good cause.” Today, I want to introduce PoolTogether, a "no-loss" lottery. Blocktrend has previously covered this project, but the newly upgraded version is simpler to use, with lower fees. Looking for a unique red envelope idea this year? Consider putting a few no-loss lottery tickets in a wallet, writing the private key on a slip of paper, and placing it in a red envelope—guaranteed to be a memorable gift!

In this article, I’ll first explain how to purchase tickets and claim prizes, then dive into the mechanics behind this innovative system.

A No-Loss Lottery Ticket

A no-loss lottery ticket costs just $1. You can buy 10 tickets for $10, or even fractional amounts like 7.3 or 0.2 tickets—there’s no need for whole numbers. Tickets that don’t win in the current round automatically roll over to the next, and they never expire. You can also redeem your tickets for the principal at any time. If you’re lucky enough to win, the prize is automatically transferred to your wallet in WETH tokens, making the process incredibly convenient. Sounds too good to be true? Let me show you how to buy these tickets.

PoolTogether offers multiple ways to purchase tickets, similar to how lottery tickets in Taiwan can be bought at various locations. Using multiple front-end websites ensures decentralization—if one site goes down, it won’t disrupt purchasing or redeeming tickets. My go-to platforms are Cabana and PoolTime. While they have different interface designs, they provide the same functionality.

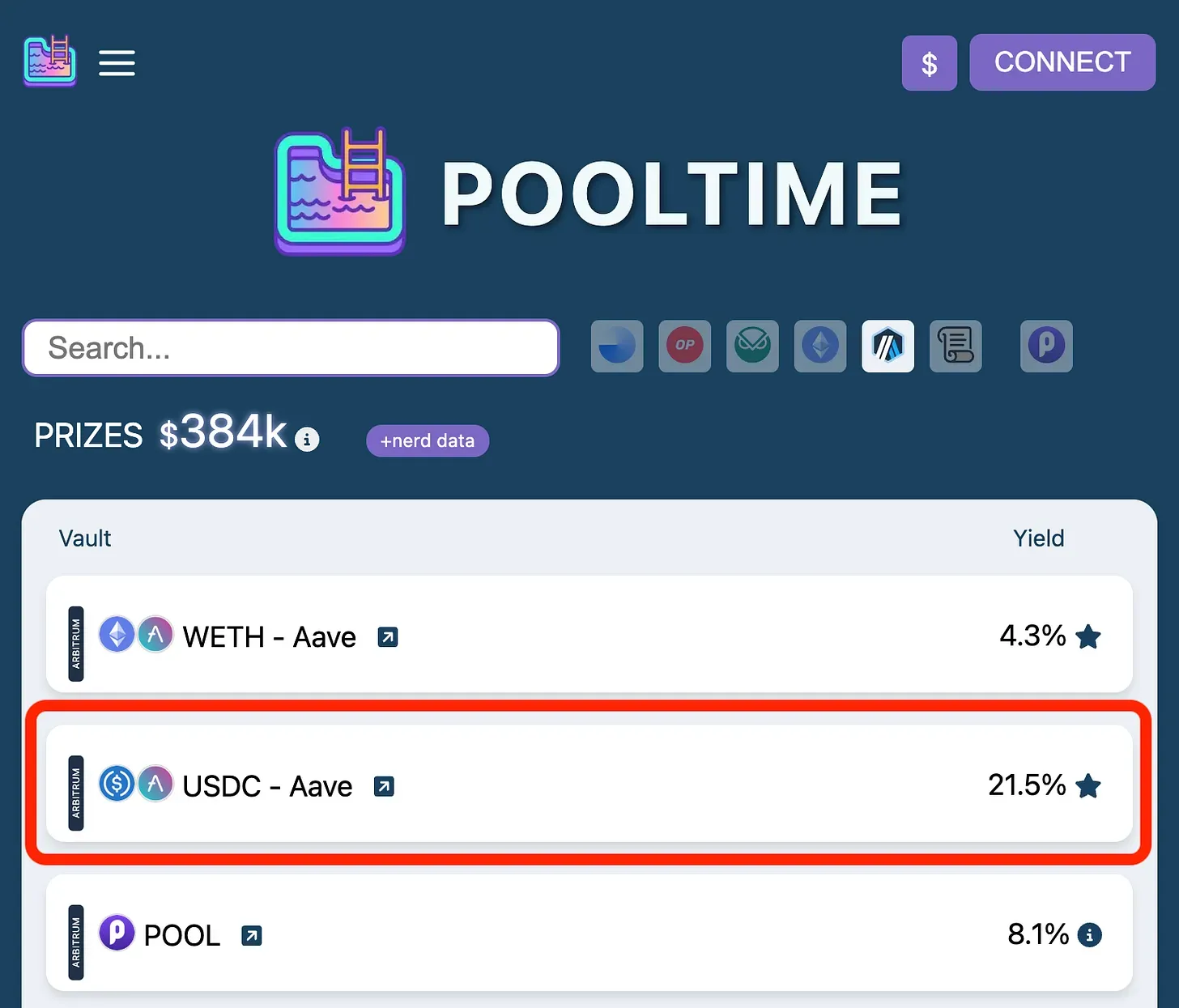

Below is the interface of PoolTime. The first step is to connect your wallet, then select the blockchain. When I select Arbitrum, the screen displays the different lottery options available on the chain. Similar to how scratch cards come in various designs, each lottery option has a reward rate that updates in real-time based on the prize pool size and number of participants.

On the interface, you’ll see three options: WETH, USDC, and POOL. Take the USDC - Aave lottery as an example. This ticket requires USDC to purchase, and the prize pool is funded by the decentralized lending platform Aave. Draws are held four times daily, with a single prize of $1 per draw. Additionally, a grand prize of $564 is awarded quarterly. Based on the current setup, the annual expected return for purchasing this ticket is 7.4%.

PoolTogether is not like traditional multi-million-dollar lotteries—it won’t make you an overnight millionaire. Instead, it offers small, consistent rewards with its standout feature: “no loss.” For example, depositing 1 USDC will give you one przUSDC ticket. As long as you hold it, you’ll be entered into every draw, and you can redeem the entire principal at any time. Even better, aside from the chance of winning, you’ll also earn an annual yield of 14.1% in POOL tokens. So, even if you never win a draw, it’s essentially like depositing your money into a savings account with a 14.1% annual interest rate. Adding the prize yield (7.4%) and token rewards (14.1%) together, you get the displayed total return rate of 21.5%.

Different blockchains offer lottery tickets in various tokens. For beginners, it’s recommended to start with USDC, as it’s easier to understand. If you’re still unsure about the mechanism, let’s dive deeper into how PoolTogether operates.

Prize-Linked Savings

The concept behind PoolTogether isn’t entirely new. Taiwan’s Ministry of National Defense has a system called the “Military Savings Bond,” which is quite similar to the prize-linked savings model employed by PoolTogether.

The bonds are available in two denominations, NT$10,000 and NT$100,000, with a maximum purchase limit per individual. Once purchased, the funds are automatically deposited into Taiwan Bank, earning a preferential interest rate of approximately 2.5%. A draw is held once a month, and participants must hold their funds for at least a year. The top prize is NT$300,000, with smaller prizes ranging from NT$30 to NT$50,000. Even if you don’t win anything throughout the year, you can still reclaim your entire principal, with the only loss being the interest you could have earned from other savings accounts.

Currently, the Military Savings Bond has a total deposit scale exceeding NT$20 billion, though its biggest limitation is that it’s only available to military personnel. In comparison, PoolTogether offers more favorable conditions, greater flexibility, no purchase limit, and—most importantly—is open to everyone.

This type of prize-linked savings mechanism was widely adopted by governments during both World Wars as a tool for raising military funds. Rather than directly borrowing money from citizens, governments would wrap the idea in a lottery format—allocating a portion of the interest as prizes—to incentivize public participation. Whether the funds were used for military expenses or public infrastructure, prize-linked savings created a compelling incentive for people to get involved.

Taiwan’s Uniform Invoice Lottery adopts a similar concept. The government incentivizes consumers to request receipts from merchants by offering prize money, which indirectly increases business tax revenue. This added layer of economic incentive even prompts consumers to report merchants who fail to issue receipts. The more enticing the prizes, the higher the public’s willingness to assist in tax enforcement, creating a virtuous cycle. Lotteries are the magician of economic incentives, transforming national matters into personal interests.

PoolTogether serves as the on-chain equivalent of this economic incentive magician. Take the USDC - Aave pool as an example: depositing USDC directly into Aave might yield a 7.4% deposit return rate. However, the lottery aspect adds an element of surprise. Participant funds are still deposited into Aave for savings, but PoolTogether redistributes all the interest generated among the participants as prizes. Because the prize pool is sourced from interest rather than principal, the winnings are modest, but participants “cannot lose” as they can withdraw their principal at any time.

PoolTogether is one of the classic application examples I showcase in almost every presentation, and I’ve been a long-term user myself. Unfortunately, it has yet to find a sustainable business model. The development team has already handed governance rights over to the community, and the treasury contains only a few million NT dollars worth of POOL tokens. At the current rate of expenditure, the treasury will likely be depleted in about two years. Its financial situation is concerning.

Treasury Running Dry

At the beginning of 2021, PoolTogether airdropped POOL governance tokens to its users. At the time, the market held high expectations for governance tokens, and the price of POOL once soared to $54. However, over the past few years, people have come to realize that governance tokens might really just be for governance—with no profit-sharing involved. Most people are too busy trying to make money to have time for governance participation. As enthusiasm waned, the token's price plummeted. The lower the token price, the faster the treasury's POOL tokens were spent.

In late 2024, a post titled "The Future of Governance" appeared on the community forum, addressing PoolTogether’s governance challenges. Most members supported streamlining or even abolishing governance altogether. Over the years and through multiple upgrades, PoolTogether had become capable of autonomous operation, rendering governance proposals few and far between. Retaining POOL’s governance functionality had ironically become a potential liability.

While many applications have issued governance tokens, PoolTogether might soon make history as the first to proactively eliminate its governance token. I welcome such an innovative move, and it further deepens my admiration for this small yet resilient community. Their concern isn’t about running out of funds but rather how to responsibly allocate the remaining POOL tokens, valued at several million dollars.

I hope PoolTogether can endure for the long haul, becoming a tool I use to send red envelopes every New Year. Or perhaps it could be a way to turn the red envelopes kids receive into savings by buying tickets with them. Who knows? The winnings from those tickets might even be enough to support them as they embark on the next stage of their lives. Wishing everyone a Happy New Year!

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.