The Stablecoin Distribution Wars Begin! Hyperliquid Forces Out U.S. Treasury Reserve Profits

GM,

Issuing stablecoins was once the most profitable business in the world. All an issuer had to do was deposit U.S. dollars in a bank, mint stablecoins for users, and then sit back collecting U.S. Treasury yields—true “sleep income.” With this model, Tether and Circle have effortlessly raked in billions of dollars annually. But last week, this “money for nothing” business hit a turning point: Hyperliquid, the world’s largest on-chain perpetuals trading platform, announced it would host a “stablecoin issuer selection,” opening up competition for the rights to issue the white-label stablecoin USDH.

As soon as the news broke, all the major global stablecoin issuers showed up. To secure the rights to issue USDH, participants were willing to give up their original reserve income—offering as much as a 95% revenue share was just the baseline requirement. This marks the most critical watershed moment in the history of stablecoins: issuers, who once kept all reserve earnings for themselves, must now surrender nearly all interest income just to gain access to a distribution channel. To understand this cutthroat battle, we first need to look at Hyperliquid’s position in the industry.

The Largest On-Chain Futures Market

Hyperliquid is the world’s largest on-chain perpetuals trading platform, capturing around 70% of the on-chain market’s trading volume, and at times even surpassing Binance—dominating both on-chain and off-chain markets. Its annual revenue is estimated at $1.1 billion, yet the team has only 11 members, making its per capita output the highest in the world. Its native token, HYPE, currently ranks 11th in global market capitalization, surpassing many well-known cryptocurrencies.

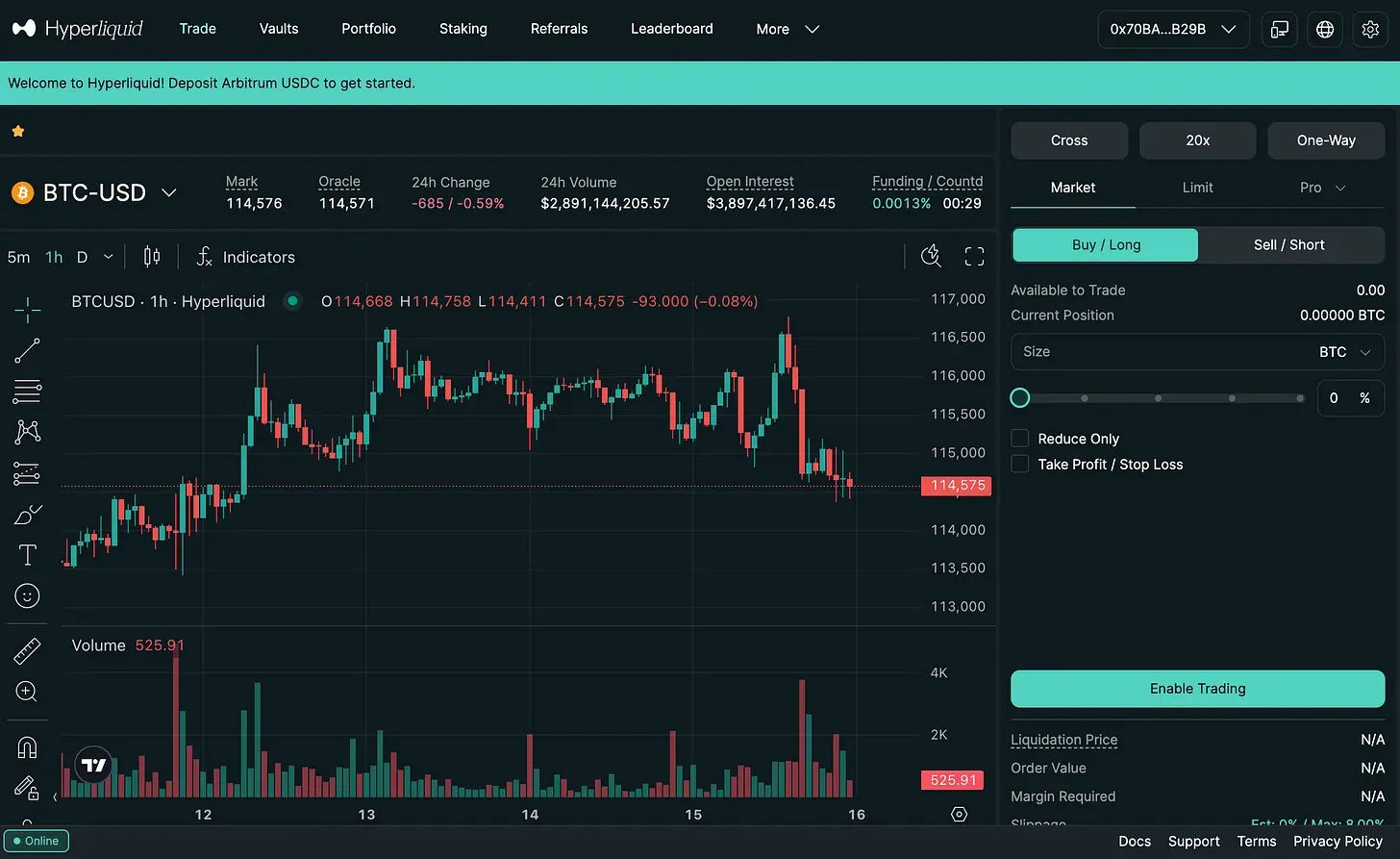

Hyperliquid is, at its core, in the casino business. What users trade there isn’t spot crypto but perpetual contracts¹—futures without an expiry date. Investors only need to deposit stablecoins as collateral, then bet on price movements by going long or short. Spot markets only allow long positions, but perpetual contracts not only allow shorts, they also offer leverage to amplify gains (and risks). That’s why they’ve become a popular tool for chasing windfall profits—while Hyperliquid pockets hefty revenues from transaction fees.

Although Hyperliquid supports dozens of cryptocurrencies, there is really only one true asset circulating on the platform: U.S. dollar stablecoins. Other cryptocurrencies serve only as price references—there’s no actual spot trading, and users can neither deposit nor withdraw them. In other words, stablecoins are the casino chips of Hyperliquid—without them, you can’t even sit at the table. This is exactly why issuing stablecoins on Hyperliquid is so lucrative.

Currently, around $5.8 billion in stablecoins circulate on the platform, of which 95% is USDC. But this creates two major concerns:

- Overreliance on a single stablecoin

- Massive interest income flowing out

If USDC runs into trouble, Hyperliquid would be dragged down with it. On top of that, the $5.5 billion in reserves generates over $220 million in annual interest income—none of which goes to Hyperliquid. Despite running a “blockchain casino” with enormous trading demand, Hyperliquid has realized it not only lacks security guarantees, but also watches stablecoin profits flow into someone else’s pocket. That’s why the platform is launching its own stablecoin, USDH, and holding an “issuer selection” to let outside firms compete for the right to issue it. Whoever makes the most compelling proposal for Hyperliquid’s ecosystem will earn the right to carry the USDH banner.

Giving Up 95% to Win Distribution

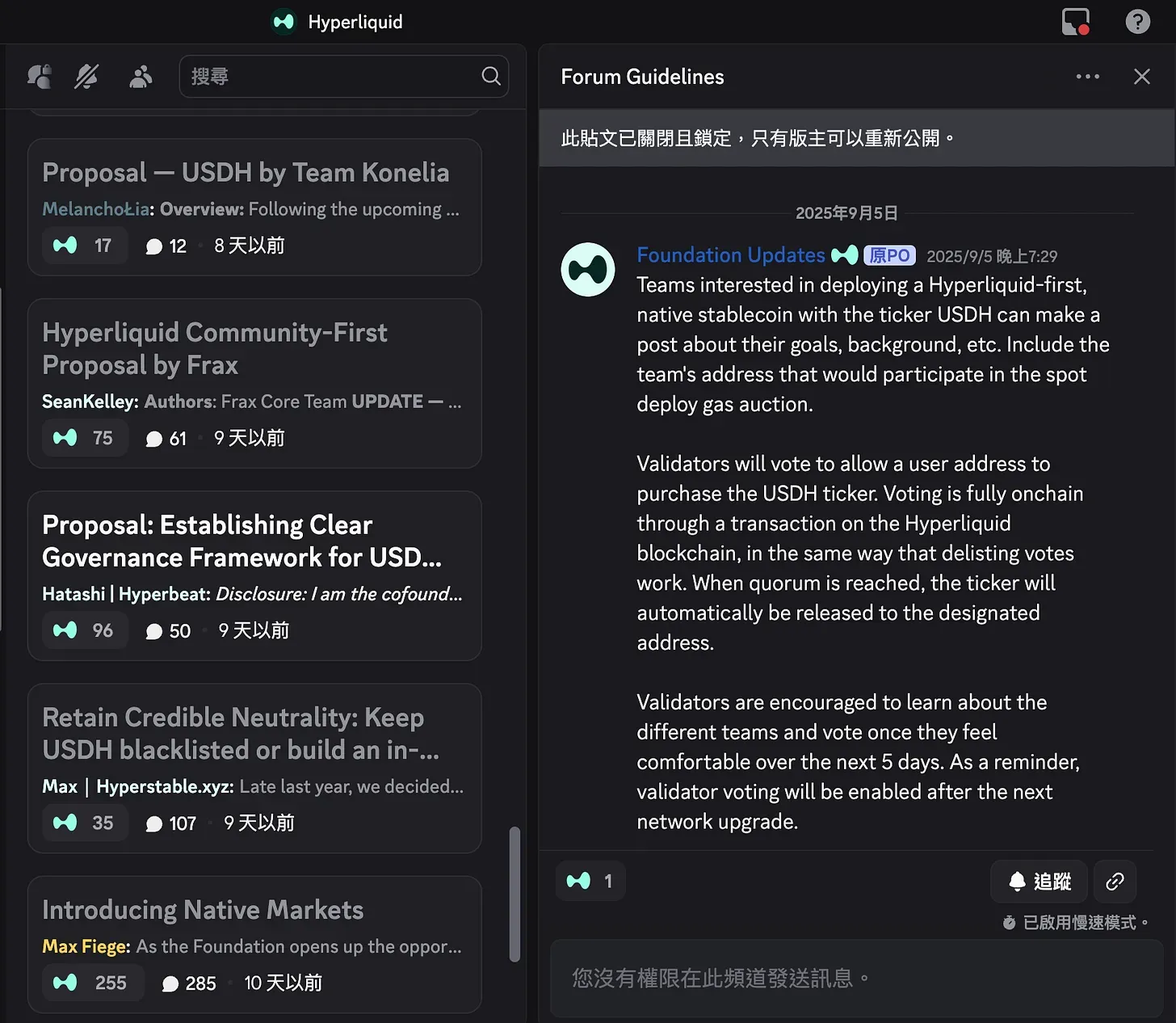

As soon as the news broke, nearly all of the world’s most renowned stablecoin issuers showed up! Prediction market Polymarket even opened odds to track each contender’s chances in real time. According to Hyperliquid’s announcement:

Any team interested in issuing the “Hyperliquid native stablecoin USDH” can publicly present their plan and background. Validators will then vote on-chain to decide which team gets the right to issue USDH. The voting process will be entirely on-chain … Multiple stablecoins will continue to coexist on Hyperliquid, with USDH being just one of them … Teams must submit proposals by September 10; validators must publicly state their positions by September 11; and the final vote results will be announced on September 14.

Hyperliquid’s issuer selection was lightning-fast—just 5 days from announcement to deadline. Initially, observers expected that the tight schedule would deter many applicants. Yet within just 90 minutes, the first proposal appeared. Over the next five days, more than 20 issuers entered the race, making it a truly unprecedented spectacle.

The competition turned out to be far fiercer than expected. At first, everyone thought the key factor would be how much profit issuers were willing to give up. But it quickly became clear that 95% revenue sharing was merely the ticket to entry. Many issuers pledged to return virtually all interest income to Hyperliquid—some even offered “100% revenue sharing + tens of millions of dollars in subsidies.” To stand out, issuers not only had to showcase attractive revenue splits but also flaunt their “special talents”: some highlighted global payment networks, others touted partnerships with major exchanges, and some simply poured in cash incentives.

The most representative cases were Paxos, Ethena, and Native Markets:

- Paxos leaned on regulatory compliance and institutional credibility. As the issuer of PayPal’s stablecoin PYUSDand the former issuer of Binance’s BUSD, Paxos offered a 95% revenue share for HYPE token buybacks, plus a $20 million subsidy commitment from PayPal—a bombshell on day one.

- Ethena, riding the momentum of its stablecoin USDe (the world’s third-largest), also pledged 95% revenue sharing along with a nine-figure rewards pool. With reserves managed by BlackRock and plans to integrate Pendle for expanded DeFi use, Ethena brought massive firepower.

- Native Markets emphasized alignment with Hyperliquid itself. Formed spontaneously by Hyperliquid advisor Max Fiege, the team had zero prior experience issuing coins but was the first to submit a proposal. Their terms: 100% revenue sharing, no subsidies, but full alignment with Hyperliquid’s interests—a stance that won strong community support.

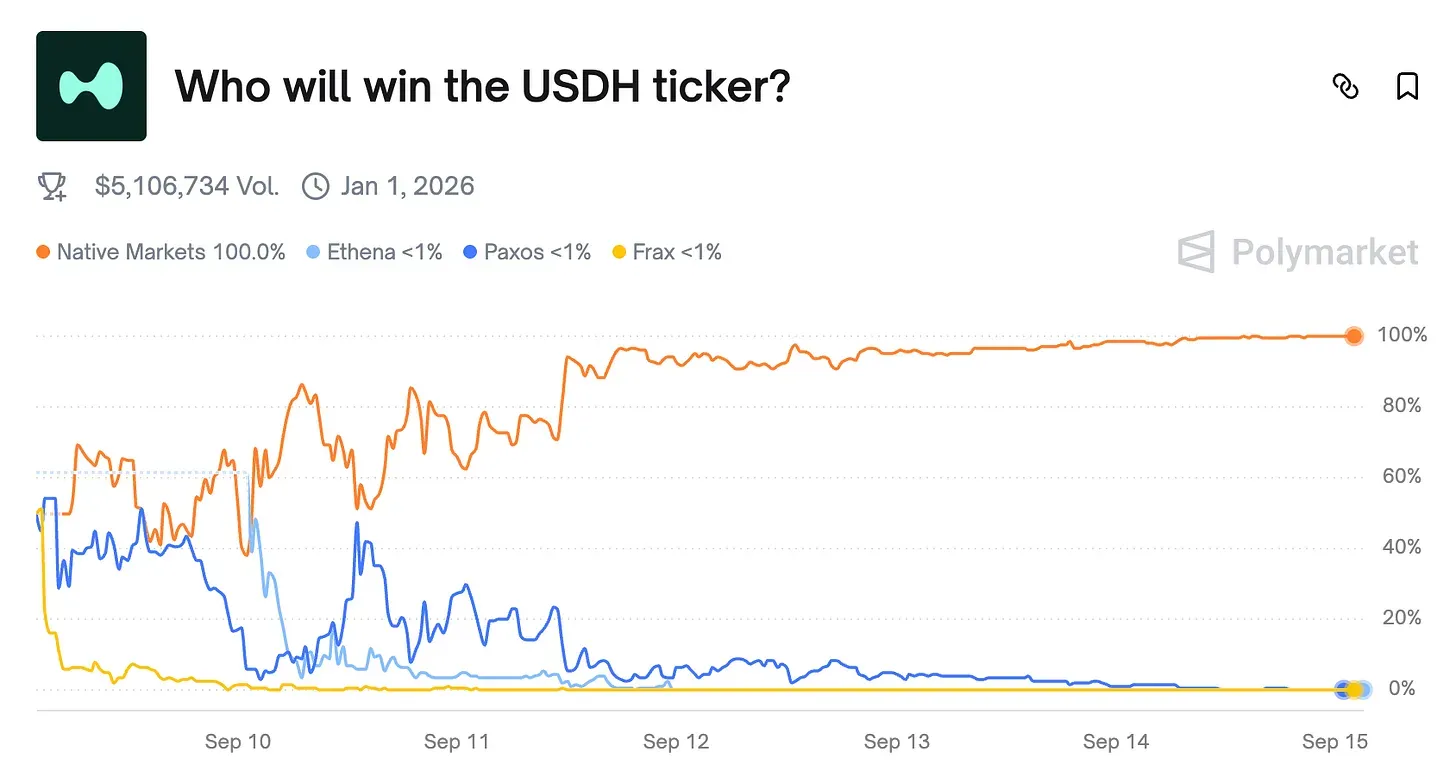

Other participants included Curve, BitGo, Frax, and Sky (formerly MakerDAO, issuer of DAI). But guess who came out on top? In both the prediction markets and the validator vote, Native Markets led all the way—and ultimately secured the right to issue USDH.

That a team with no prior experience in stablecoins managed to win amid such fierce competition naturally sparked controversy. Some critics argued that Hyperliquid had already favored its “own people” and that the open competition was merely for show. Others countered that the outcome underscored the importance of incentive alignment, which could matter even more than professional experience. For most observers, however, the process was more meaningful than the result—after all, many of the proposals were little more than blueprints.

The most intriguing reaction came from Circle. After Hyperliquid announced its open selection process, Circle CEO Jeremy Allaire merely reposted a late-July statement claiming that Circle was “about to” issue native USDC on Hyperliquid. Yet more than a month later, nothing had materialized, nor did Circle offer subsidies or revenue sharing. Compared with other issuers’ aggressive jockeying, Circle appeared far more passive. This contrast highlighted a dramatic shift in the market: stablecoins have moved from being “product-scarce” to “distribution-scarce.” In the past, exchanges would beg Circle to issue USDC—sometimes dragging their feet. Now, issuers line up, competing fiercely and giving up profits just to gain entry into Hyperliquid.

Why has competition suddenly intensified? The answer lies in regulation.

Unlocking Reserve Profits

Issuing stablecoins used to be a high-risk business. With no clear rules, compliance costs were a bottomless pit. That changed when the U.S. passed the Clarity Act 2, which set clear standards and significantly lowered barriers to entry. As a result, platforms like Hyperliquid—capable of generating massive stablecoin demand—naturally became strategic battlegrounds, forcing issuers to “push their product” proactively.

Tether and Circle once dominated thanks to their first-mover advantage. Without USDT or USDC, exchanges and DeFi apps had no access to dollar-pegged assets. Issuers didn’t need to spend much on promotion; they simply pocketed the interest income. But now the tables have turned. If Circle doesn’t respond aggressively, other issuers offering better terms will quickly replace it. To defend its position, Circle has been forced to share profits or deepen ecosystem ties—from subsidizing Binance users 3, to launching the CCTP protocol to lock in DeFi integration 4, to expanding into payments to challenge SWIFT 5.

For challengers, the incumbents’ profits represent opportunity. Hyperliquid’s USDH selection process was a perfect microcosm: 95% profit-sharing was just the entry requirement. To win, issuers had to showcase their edge—whether regulatory compliance, DeFi integration, or capital subsidies. Through this open process, Hyperliquid not only freed itself from dependence on USDC and prevented Circle from siphoning away all the profits, but also reversed the balance of power, reclaiming control for itself. Brilliant!

At the same time, stablecoin profits are being democratized. In the past, issuers captured all of the revenue, leaving nothing for others. But as issuance risks fall, profits are flowing to those who create demand and control customer relationships—the distribution channels. If competition among channels intensifies, platforms will need to retain users by passing profits further downstream—through trading rebates, airdrop subsidies, and liquidity rewards. Ultimately, the winners in the stablecoin race will be:

- Distinctive issuers with a unique value proposition,

- Distribution platforms that command user relationships, and

- Users savvy enough to switch providers when opportunities arise.

- Perpetual Futures: How Derivatives Can Earn You Steady Interest

- U.S. Passes Stablecoin Act! Why Skip CBDCs—and Still Win?

- MetaMask Issues a Token! Stripe Becomes a Stablecoin Arms Dealer—What Does This Mean for USDC?

- Circle Launches Cross-Chain Transfer Protocol: Becoming the On-Chain Visa and Ending Bridge Hacks

- Circle Builds a Payment Network: Challenging SWIFT and Disrupting the Old “Money Doesn’t Move” Paradigm