The Fading Halo of Bitcoin Reserves: Magic Beans and Stablecoin Treasury Companies

GM,

Recently, all kinds of Digital Asset Treasury companies have been emerging in the market. Even TNL Mediagene, the parent group of well-known media platform The News Lens, has set up a digital asset committee to prepare for purchases of BTC, ETH, and SOL. But this party already seems to be nearing its end.

Magic Beans

Imagine I start a company and issue 100 shares, each worth $1. Recently, a new kind of “magic bean” appeared on the market, priced at $1 each at the source. I spend $100 to buy them, so the company now holds $100 worth of magic beans. Since stock market investors are very interested in magic beans, they drive the company’s share price up to $2, pushing its market capitalization to $200.

I quickly realize this is a great business. So I issue another 100 shares at $2 each, raising $200 to buy even more magic beans. At this point, my company holds $300 worth of magic beans, with 200 total shares outstanding. That means the net asset value per share is $1.50. But investors remain enthusiastic, pushing the share price up again to $3, which brings the company’s market capitalization to $600.

By repeating the cycle—issue shares → buy magic beans → wait for the market to push up the stock price → issue more shares—the company’s market value grows geometrically. The critical step, of course, is “waiting for the market to push up the stock price.”

As long as the market continues to believe in the value of magic beans and is willing to price the company’s shares above net asset value, eventually my company won’t just hold the largest supply of magic beans in the world—investors will also see buying my stock as a better deal than buying beans directly. Why? Because the beans held by the company will always be valued at a premium compared to the source price.

If you spend $1 at the source, you can only buy one bean. But if you spend $1 to buy my company’s stock, and the market values beans at $2 or even $3, then the company can use that leverage to acquire more beans. Investors thus expect that the beans inside the company will always be worth more than beans bought directly. In other words, each share represents a higher “bean content” than simply buying them at the source.

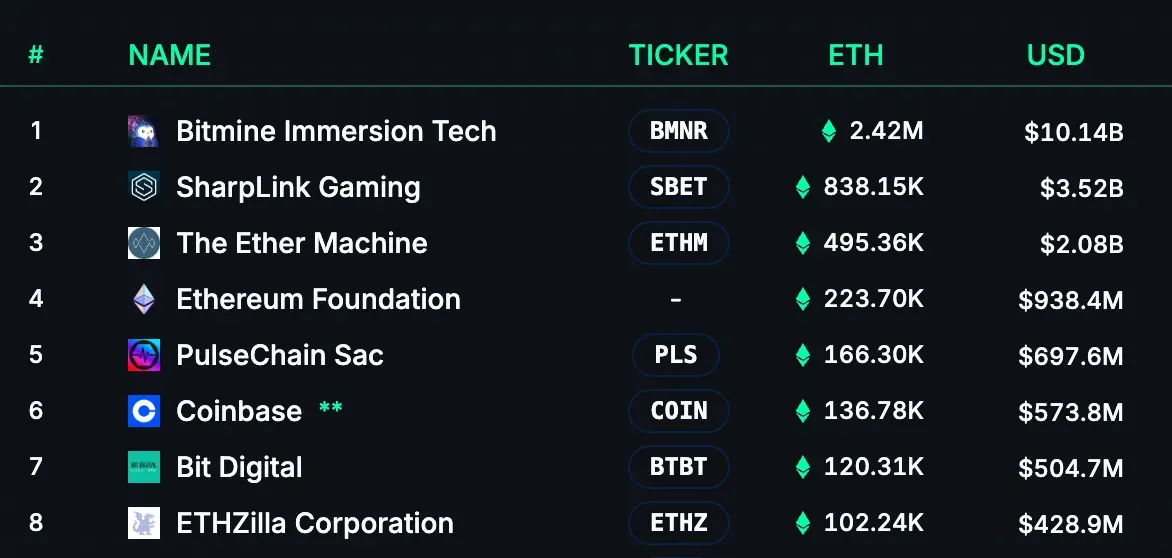

This is the “magic bean formula” behind every Digital Asset Treasury company. BTC is the magic bean for MicroStrategy 1 2. ETH serves as the magic bean for companies like SBET 3 and BMNR. Others treat BNB, SOL, DOGE, and even TRUMP as their magic beans, spawning one Digital Asset Treasury company after another.

This playbook still made sense back in 2020, when stock market investors who wanted Bitcoin had no easy way to buy it directly and could only participate indirectly through company shares. But by 2025, with Bitcoin and Ethereum ETFs already available on the market, that story no longer works. Companies had to switch narratives, pitching “buying stock” as more efficient than “buying beans.” In other words: convincing you it’s better to buy shares than beans.

And sometimes the market really does buy it! Two weeks ago, Nasdaq-listed Eightco announced it had purchased WLD, the token issued by the iris-scanning project Worldcoin. Its stock price skyrocketed 5,200%, while WLD itself doubled in price. But not every attempt succeeds. Just this week, two Bitcoin reserve companies announced a stock-for-stock merger, suggesting the magic bean halo may be fading.

The Fading Halo

Strive, a company co-founded by former U.S. presidential candidate Vivek Ramaswamy, announced a few weeks ago that it was transforming into a Bitcoin reserve company, holding 5,886 BTC. In the past two days, Strive also announced it would acquire another company, Semler Scientific, which holds 5,021 BTC, through a stock swap at a 210% premium. After the merger, the two firms together would hold about 11,000 BTC. According to Bloomberg:

Strive announced the acquisition of Semler Scientific via a stock-for-stock transaction, signaling a new phase of consolidation among Bitcoin reserve companies. The deal values Semler’s shares at $90.52 each, a 210% premium over its Friday closing price of $29.18. The official statement noted that the merged company will hold nearly 11,000 Bitcoin.

Most people reading this news might mistakenly believe that a Bitcoin reserve company not only used the “magic bean formula” to sell $1 beans for $2, but now can even sell them to another company at a 210% premium. But in reality, the post-merger ownership split (Strive taking 54%, Semler taking 46%) exactly matches the amount of Bitcoin each company originally held. In other words, this was an “equal merger based on Bitcoin holdings”—no one actually received a premium.

Before being acquired, Semler’s financial position was quite awkward. Although it held $567 million worth of Bitcoin, the company’s market value had already fallen to $532 million. In other words, Semler’s Bitcoin holdings had slipped below the “magic bean formula.” Holding Bitcoin not only failed to generate a premium for the company, it was actually trading at a discount. What should a company do when it holds $100 worth of beans, but the market only values it at $90? The best strategy is to merge with another firm that can still sustain the “magic bean formula.”

As for why the magic beans “work” for some companies but not for others? No one really knows. The “magic bean formula” originally held up because beans were difficult to acquire and the market was buoyed by inexplicable optimism. Today, the barriers to acquiring magic beans are much lower, and more and more companies are holding them. That means sustaining a premium now requires much stronger market optimism (aka fresh retail inflows) to keep all “magic bean companies” trading above net asset value.

Retail money grows quickly, but the scythe swings just as fast. When the golden crossover day comes, these companies will need to invent yet another narrative to justify themselves. Take the Ethereum reserve company SharpLink (SBET), for example. It argues that the magic beans it holds will be staked to generate yield. I call this model the “magic bean farm,” where the beans you buy can sprout more little beans. In this version, investors aren’t just buying “magic beans + optimism,” but “magic beans + optimism + a yield strategy.”

At first glance, a yield strategy seems more reasonable than simply hoarding beans—but in truth, it won’t last long either. While U.S. regulations still don’t allow ETFs to stake coins for yield, it’s only a matter of time before that changes. When it does, “magic bean companies” will once again need to find a new story.

Some quick thinkers, however, believe stablecoins have even greater potential and are rushing to become “quasi-stablecoin reserve companies.” That really caught me off guard.

Stablecoin Reserve Companies

Since stablecoins don’t fluctuate in price, the magic bean formula shouldn’t apply. No matter how optimistic the market gets, a stablecoin must stay pegged 1:1 with the U.S. dollar, otherwise no one would use it. Yet recently, Nasdaq-listed StableX announced it had purchased the governance token FLUID from a decentralized exchange, hoping to brand itself as a “quasi-stablecoin reserve company.” According to its press release:

In less than a year, FLUID has grown from nothing into the leading stablecoin trading marketplace, generating millions of dollars in monthly transaction fee revenue while its community expands at an astonishing pace … StableX’s purchase of FLUID marks its first investment into a token supporting the rapidly growing stablecoin industry.

In essence, a “stablecoin reserve company” is an IQ test. Unless stock market investors are willing to pay $2 for a $1 bill? Judging from market mania, I wouldn’t say it’s impossible. Fortunately, StableX hasn’t gone completely crazy—it didn’t buy stablecoins themselves, but the FLUID token, whose price fluctuates. This is more about packaging itself as a “stablecoin concept stock” and riding the hype.

As someone with an engineering mindset, I still can’t fully buy into the way “magic bean companies” use stories to dress up complicated financial engineering. But I have to admit, after inviting “MSTR guru” Fenix 4 onto the Blocktrend podcast, I gave in to my experimental spirit and bought MSTR and SBET to experience it firsthand. Who knows whether these magic beans will ultimately let me laugh in my sleep—or wake up crying.

1 MicroStrategy Soars 10x! The Risks of Leveraged Bitcoin and the Death Spiral