The Ethereum Version of MicroStrategy! How Did SharpLink Go from the Brink of Delisting to Becoming the World's Largest ETH Holder?

GM,

MicroStrategy (MSTR) began purchasing BTC in 2020, sparking a wave 1 of corporate crypto acquisitions. Even Figma, the design company preparing for an IPO, disclosed in its prospectus that it holds Bitcoin ETFs worth a staggering $70 million. Public companies holding crypto is no longer news — in fact, many firms with seemingly no ties to the crypto world are quietly entering the space. At this rate, companies not holding any crypto might soon become the real headline.

Bitcoin (BTC) has long been the go-to choice for corporate treasury allocation. MicroStrategy has already tested the waters and proven its effectiveness for everyone to see. But recently, a few companies have begun shifting their focus to Ethereum (ETH), with the most aggressive player being online gaming company SharpLink Gaming (SBET).

Dubbed the “Ethereum version of MicroStrategy,” SharpLink has accumulated more ETH in under two months since announcing its entry than even the Ethereum Foundation — making it the largest organizational holder of ETH in the world. Let’s start with some background on this company.

Back from the Brink

SharpLink Gaming (SBET), a U.S.-based company founded in 2019, originally operated as a marketing and affiliate platform for online gambling. SharpLink didn’t run casinos itself — instead, it created online content to attract betting-focused users and redirected them to legal gambling platforms in exchange for affiliate commissions.

Despite being recognized as a “Top Affiliate Marketing Site,” SharpLink’s core business struggled to gain meaningful traction. The company incurred years of continuous losses, and its stock price began a steady decline from 2021, eventually dropping below $1 per share.

In 2024, SharpLink received a delisting warning from Nasdaq, giving the company six months to boost its share price or risk being removed from the exchange. But everything changed in May 2025 with a single announcement — a decision that would completely transform the company’s fate.

SharpLink announced that it had entered into a private placement agreement with Ethereum development firm Consensys, selling common stock at $6.15 per share to raise an expected $425 million. The deal was led by Consensys CEO and Ethereum co-founder Joseph Lubin. Following the transaction, Joseph Lubin officially assumed the role of Chairman at SharpLink, with the stated goal of reshaping the company “in the image of Ethereum.”

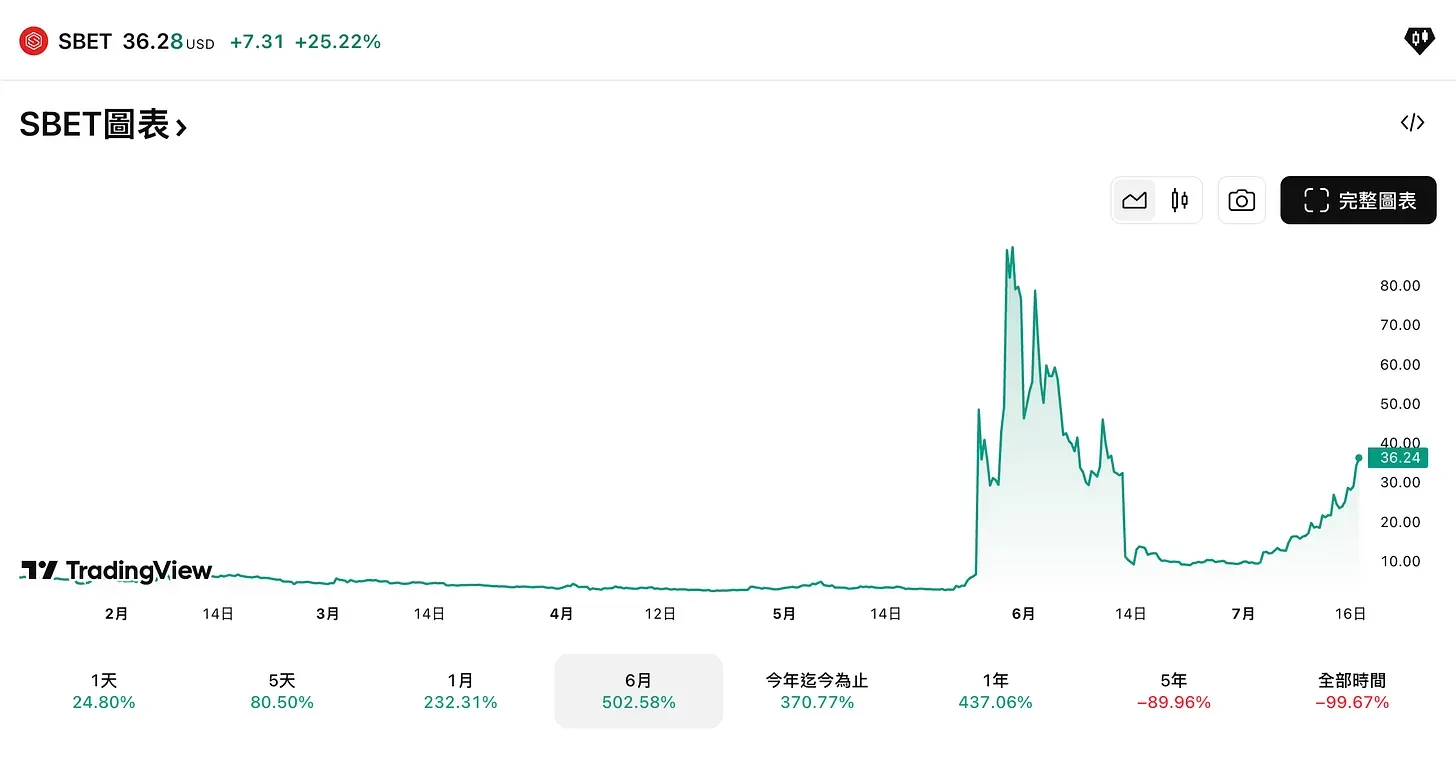

According to the press release, SharpLink plans to use the funds raised to purchase ETH as a treasury reserve asset, while Consensys will assist in formulating the company’s Ethereum reserve strategy. The day after the announcement, SharpLink’s stock skyrocketed from $7 to $35 — a staggering 500% surge. A few days later, the stock soared further to $80. However, the rally was short-lived. As ETH prices dropped, SharpLink’s stock also slid back down to around $10. For those looking to invest, strong nerves are definitely required.

So far, SharpLink has essentially borrowed MicroStrategy’s playbook: a company with poor stock performance introduces cryptocurrency, raises capital through traditional corporate financing tools to buy crypto, and then creates a miracle. SharpLink even mimicked MicroStrategy by introducing a new metric — ETH Concentration per Share — aiming to convince investors that buying SharpLink stock is nearly equivalent to buying ETH itself.

However, there’s a key difference: MicroStrategy founder Michael Saylor used BTC purchases to drive stock volatility and capture investor interest, while SharpLink’s story is the reverse. This is a proactive move by the Ethereum ecosystem — deliberately partnering with a public company to create “Ethereum’s MicroStrategy” in hopes of reversing the downward trend in ETH prices.

The Ether Ambush

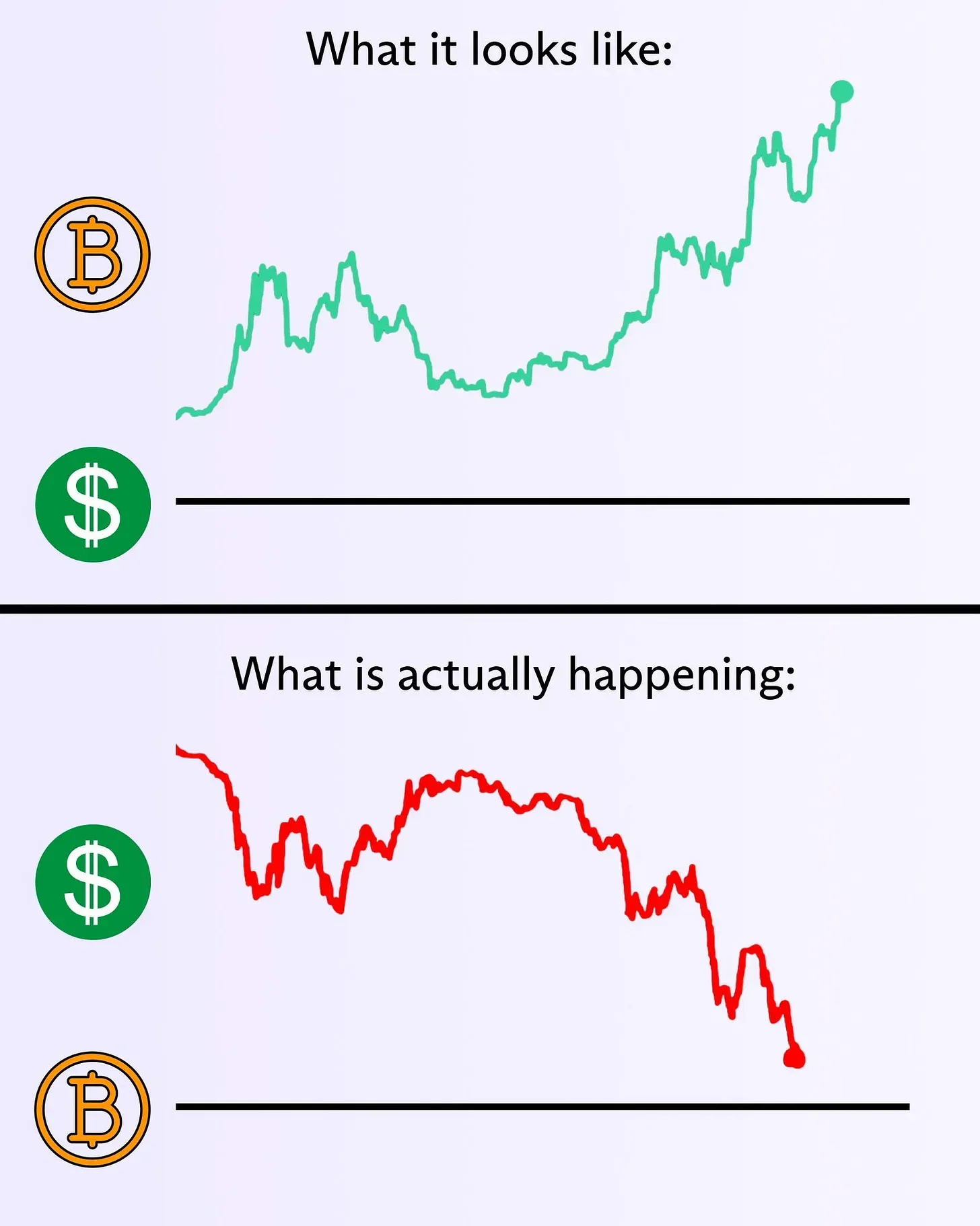

BTC recently broke through $120,000, setting a new all-time high, while ETH continues to lag, still far from its 2021 peak of $4,891.

Why isn’t ETH rallying? The most common explanation: ETH is not as “simple” as BTC. From a utility standpoint, ETH is clearly more versatile — but that’s also its weakness. It’s too useful, which leads to fragmented narratives and divided opinions.

Some believe blockchain will eventually disrupt finance, making ETH the core infrastructure. Others argue that traditional finance isn’t going anywhere, so ETH has little inherent value. Everyone’s busy discussing use cases, tokenomics, and long-term potential — diluting the most critical component of value: belief.

BTC is the opposite. It offers little beyond basic transfers, has high fees, a fragmented community, and far less frequent software upgrades compared to Ethereum. Only those who don’t understand Bitcoin judge it based on utility.

But Bitcoin’s narrative is straightforward and powerful: it runs on belief, and that belief aligns perfectly with current macroeconomic trends. With inflation rising, the U.S. dollar’s purchasing power shrinking, and central bank policy in flux, Bitcoin’s role as “digital gold” is more solid than ever. MicroStrategy’s Michael Saylor famously argues, “The dollar will continue to depreciate; Bitcoin is a hedge.” Not only has he bought in heavily, he’s even issued debt to go all in.

Ethereum’s strong technology and wide-ranging applications also come with a major downside: significant operational costs. The Ethereum Foundation needs to support researchers, distribute grants, and host conferences. While striving to advance both the technology and community in tandem, an increasingly frustrating reality has emerged: on one hand, MicroStrategy is aggressively buying BTC; on the other, the Ethereum Foundation is continuously selling ETH. Over time, “Ether (以太幣)” began to be mocked as “Already Obsolete Coin (已汰幣)”. Criticism from the community has grown louder, and in recent months, the Foundation has begun to undergo major reforms.

The Ethereum Foundation was once the largest holder of ETH in the world — a position that naturally attracted attention. But at the end of the day, it’s still a cost center. If it were to become a hoarding institution, that would raise even more concerns. This is precisely where SharpLink’s value comes in — it seeks to translate Ethereum’s technological achievements into a compelling financial narrative.

SharpLink doesn’t aim to build specific applications. Instead, it acts as a financial proxy, helping ETH gain a stronger voice in the capital markets. When people see the company holding the most ETH in the world continuing to buy, they are more motivated to convert their belief into real asset allocations — which in turn, reinforces that belief.

In a media interview, Joseph Lubin stated that he doesn’t need to convince Wall Street investors — he just needs them to see ETH rising for a few consecutive quarters. After that, they’ll come on their own.

In recent years, we’ve all heard the phrase, “MicroStrategy bought more Bitcoin.” Now, Joseph Lubin wants to establish a new norm: “SharpLink bought more ETH.” The difference is that SharpLink is buying ETH — and its financial strategy is not as leveraged as MicroStrategy’s.

Becoming a Center of Belief

When I first saw SharpLink adopting a strategy similar to MicroStrategy’s “blind accumulation” approach, I couldn’t help but feel concerned. After all, while this playbook works well when prices are rising, if the market reverses, leveraged positions could become the biggest threat to the company’s survival. I’ve never been a fan of prosperity built purely on financial engineering.

But after a deeper look, I realized that SharpLink’s strategy is actually much more conservative than it appears. Unlike MicroStrategy, which issues debt to buy crypto, SharpLink uses an At-The-Market (ATM) offering mechanism — issuing common shares at market price to raise capital from the public, which it then uses to purchase ETH in tranches. At its core, this isn’t about borrowing to buy crypto. It’s about allowing disillusioned shareholders to exit, and replacing them with a new set of long-term ETH believers. Without leverage, the risk profile is much lower.

To date, SharpLink has acquired roughly 280,000 ETH, valued at around $880 million, officially surpassing the Ethereum Foundation to become the largest ETH-holding organization in the world. But these ETH holdings aren’t just sitting idle. SharpLink has staked nearly all of them in Ethereum’s Proof-of-Stake system — earning yield while simultaneously contributing to the network’s security. That’s the key difference between SharpLink’s ETH strategy and MicroStrategy’s Bitcoin holdings.

SharpLink calls this approach its “Ethereum Reserve Strategy,” which essentially boils down to two things:

- Buy and hold ETH for the long term

- Use staking to generate stable cash flow for the company

SharpLink stated that 99.7% of its ETH has already been staked. At the current annual yield of around 3%, this could generate approximately $26 million in annual revenue for the company. And this is only the beginning — as SharpLink accumulates more ETH, the resulting cash flow will grow even further.

In the past, ETH investors often watched the Ethereum Foundation’s wallet closely, to the point where the Foundation’s necessary token sales for operations felt like a betrayal. But how can you build anything without spending money? The emergence of SharpLink helps shoulder that burden — it's like Ethereum’s version of MicroStrategy: not only does it never sell, it also publicly reminds everyone from time to time, “We’re buying more!”

I used to think people calling BTC a "faith-based asset" were just joking. Now I get it — they weren’t. MicroStrategy’s entire business model is essentially about building a temple 2, becoming a center of belief. Even though the BTC it holds is only worth about half 3 of its market cap, the company continues to thrive. That excess premium? It’s the donation money from the faithful.

Ethereum has traditionally avoided faith-based narratives — and even marketing — relying solely on its technological merit. But after years of price stagnation, the enthusiasm of many ETH supporters has started to fade. Even the most price-agnostic developers need a psychological boost. What’s needed is a company that will step up when things look bleak and keep buying ETH — and that’s exactly the role SharpLink aims to play.

1 MicroStrategy Surges 10x! The Risks of Leveraged Bitcoin and the Death Spiral

2 MicroStrategy Ups the Leverage: Bitcoin Vault Company or Institutional Trap?