The Biggest Liquidation in History! Why Did Trump’s Tariff Announcement Cause the World’s Third-Largest Stablecoin, USDe, to Depeg on Binance?

GM,

Last weekend was Taiwan’s National Day holiday, but the cryptocurrency market went through a bloodbath. The turmoil began when Donald Trump suddenly announced a 100% tariff on Chinese goods starting November 1. The news triggered a global selloff—both in traditional markets and crypto. The Nasdaq Index plunged 3.56% in a single day, while BTC and ETH fell by 10% and 15%, respectively. The biggest casualty, however, was USDe—the world’s third-largest U.S. dollar stablecoin by market cap. Its price briefly depegged to $0.65 on Binance (trading around $0.65 against USDT and $0.62 against USDC).

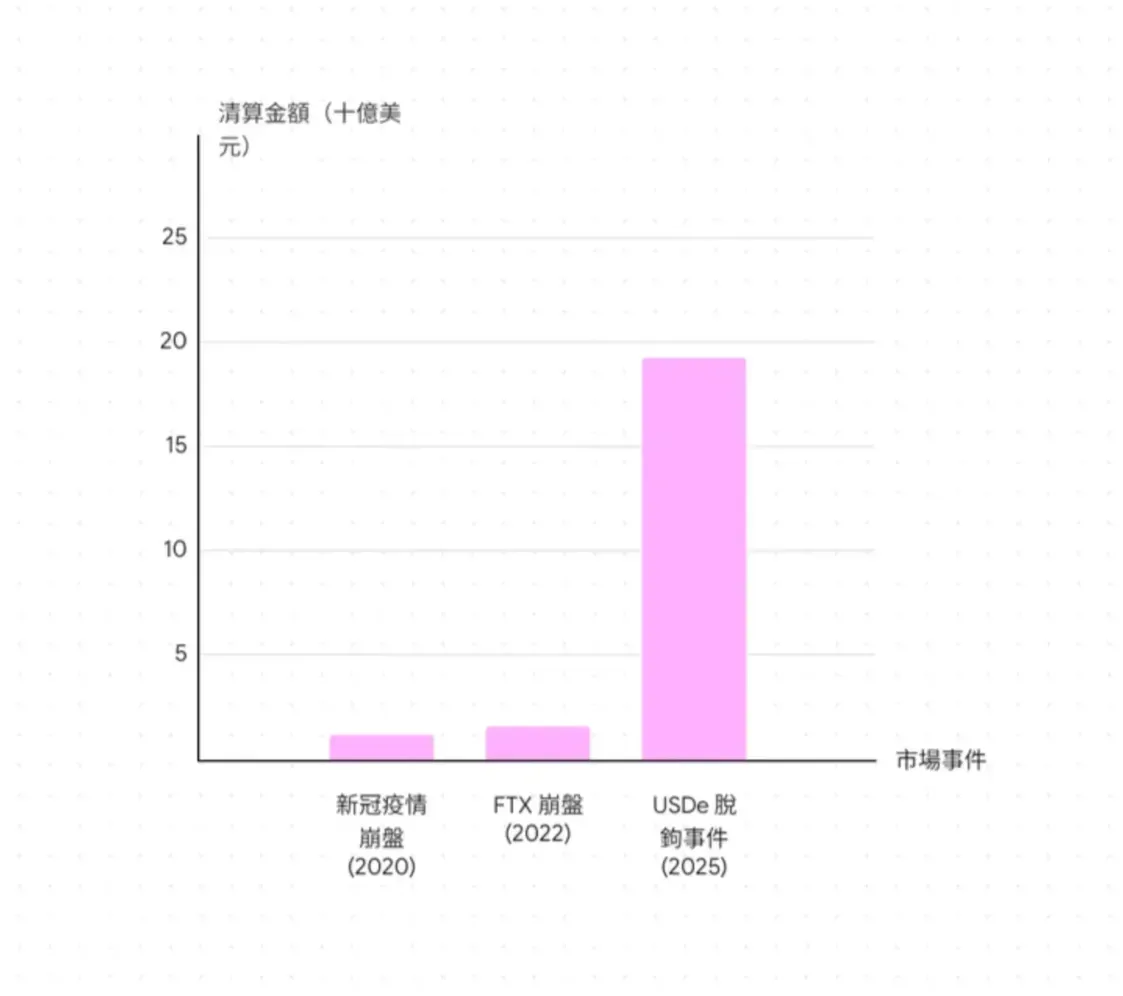

The shockwave sparked the largest liquidation event in crypto history. Over 1.6 million traders were liquidated in a single day, with total positions worth $19 billion wiped out—more than ten times the scale of liquidations during the FTX collapse or the COVID market crash. Panic gripped the market, and reports even surfaced of investors taking their own lives.

Some believe this was a repeat of the algorithmic stablecoin collapse of Terra/Luna, while others point to conspiracy theories of an “external attack,” claiming that Binance and its market makers were targeted. However, mounting evidence suggests that the real cause of USDe’s depegging wasn’t an outside assault—it was a structural issue within Binance itself. The exchange later publicly admitted its mistake and, in a rare move, offered compensation to affected users. To understand how this storm unfolded, we first need to look at USDe, one of the fastest-growing “synthetic dollars” in the market today.

USDe Is Not a Stablecoin

For most people, USDe is still unfamiliar—it only launched in early 2024, and its mechanism is remarkably complex.

Although USDe aims to keep its price near $1, it’s not technically a stablecoin. Unlike USDT or USDC, which are backed primarily by U.S. Treasury reserves, USDe maintains its dollar peg through trading strategies rather than collateral assets. It is, in essence, a synthetic dollar.

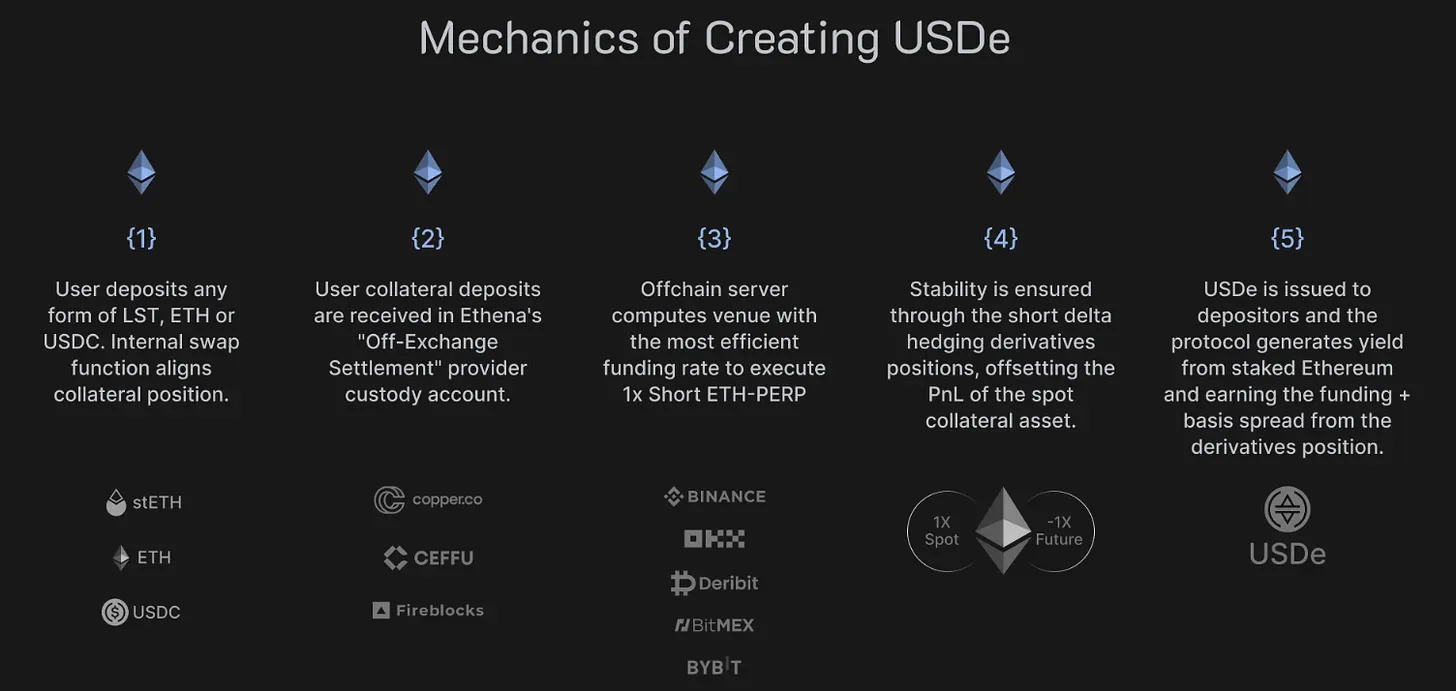

The issuer, Ethena, allows users to deposit assets such as ETH or BTC as collateral to mint USDe. At the same time, Ethena 1 opens an equivalent short position in the perpetual futures market. This means:

- If the collateral value rises, the short position loses value.

- If the collateral value falls, the short position gains value.

The two sides offset each other’s movements, theoretically keeping USDe stable around $1. This mechanism is known as a delta-neutral hedging strategy.

Ethena’s source of yield doesn’t come from reserve assets—it comes from the funding rate in perpetual futures contracts. A perpetual futures contract has no expiration date. To prevent its price from deviating too far from the spot market, exchanges regularly settle a funding payment between long and short traders:

- When the market is bullish and the futures price is higher than the spot price, long traders pay funding to short traders.

- When the market is bearish and the futures price is lower than the spot price, short traders pay funding to long traders.

This funding rate acts like an hourly interest payment. In bull markets, long traders vastly outnumber shorts, allowing short positions to earn steady income. Since Ethena maintains a constant short position to keep USDe delta-neutral, it can collect these funding payments as a continuous stream of passive income—the backbone that sustains the entire USDe system.

In 2024, the average annualized yield for staking USDe reached as high as 19%, fueling explosive growth. Within less than two years of launch, USDe’s market capitalization had surged to $14 billion.

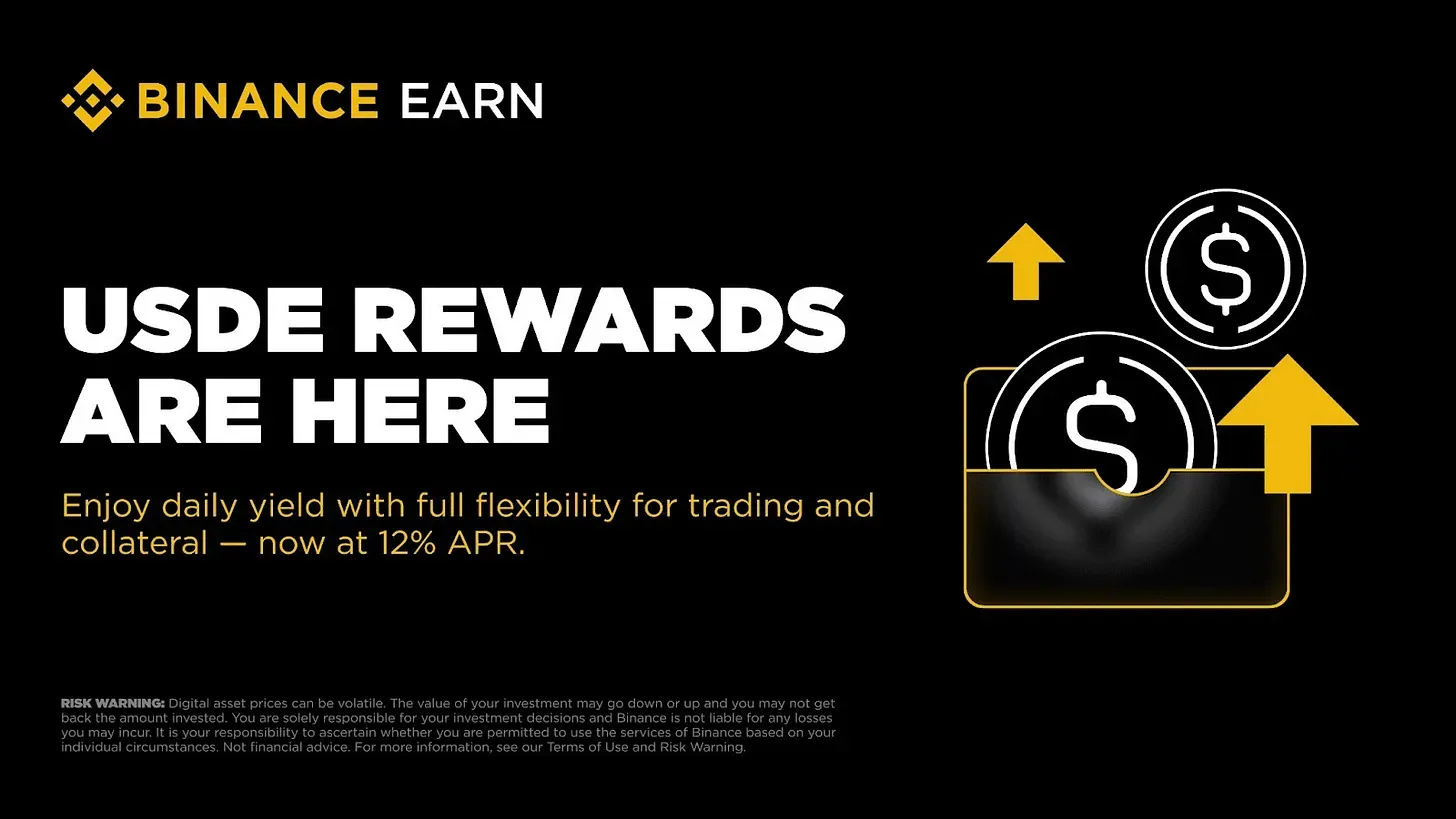

Many investors couldn’t distinguish between a “synthetic dollar” and a “stablecoin,” so they simply called USDe a “yield-bearing stablecoin.” By late September, Binance launched a “12% annualized USDe rewards campaign,”introducing the token to an even broader user base. Under Binance’s marketing, a complex hedge fund trading strategywas repackaged as an accessible stablecoin deposit promotion for everyday users.

The campaign successfully attracted massive inflows of capital—but it also lit the fuse for the collapse that followed.

Binance Rewards Campaign

According to Binance’s promotional announcement (paraphrased):

The platform officially launched the USDe Rewards Campaign on September 22, offering an annualized yield of up to 12%… Rewards have no upper limit and are distributed weekly in USDe to users’ spot accounts. No additional locking or action is required during the campaign period…

In addition, USDe can be used as collateral in spot, margin, and lending markets, allowing users to continue earning rewards while borrowing or trading…

The campaign runs from September 22 to October 22.

Binance specifically noted that the 12% annualized yield was a marketing subsidy provided by Ethena to promote USDe — and, remarkably, that no deposit cap was imposed. This was highly unusual. In past promotional campaigns, platforms typically set deposit limits to prevent marketing budgets from being drained by a few large investors. But Ethena’s subsidy seemed virtually unlimited. Even if a Binance user deposited $100 million, they would still earn a 12% annualized return. The terms were so generous they seemed unreal, and major market players rushed to participate.

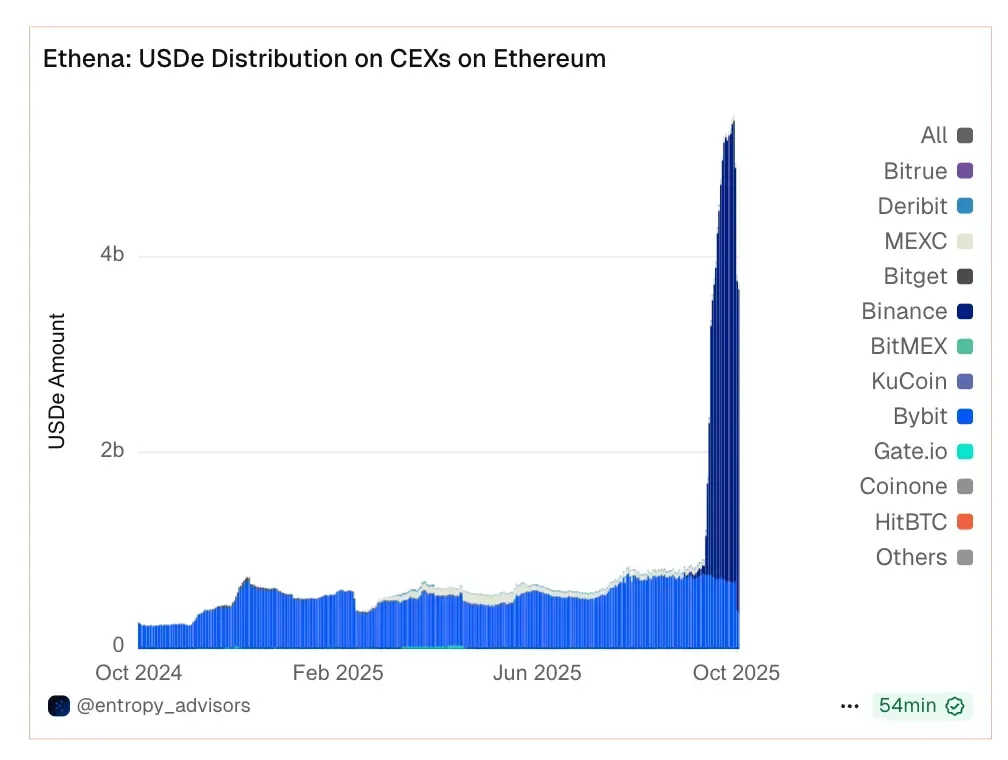

According to data from the on-chain analytics platform Dune Analytics, within just a few days after the campaign launch, the total USDe holdings on Binance skyrocketed from under $100 million to $4.6 billion. Everyone was rushing to grab a piece of the one-month marketing subsidy.

The simplest approach was to swap existing USD stablecoins for USDe and deposit them on Binance to earn the 12% annual yield. But investors more familiar with financial mechanics quickly noticed the implicit leverage opportunitieshinted at in the announcement — allowing them to further amplify returns. The strategy was straightforward:

- Exchange 100 USDT for 100 USDe

- Deposit the 100 USDe on Binance to earn 12% yield

- Use those 100 USDe as collateral to borrow 80 USDT

- Use the borrowed 80 USDT to buy another 80 USDe and earn even more yield

After one cycle, and factoring in borrowing costs, the effective yield could rise from 12% to about 16%. Repeating this process multiple times could, in theory, push returns close to 30% annualized — extremely tempting. However, this was effectively a leveraged position, and the biggest risk was USDe price volatility. The higher the leverage, the lower an investor’s ability to withstand any fluctuation in USDe’s value. Even minor market turbulence could trigger margin calls and forced liquidations if investors couldn’t add collateral in time.

Each leveraged position was like a small powder keg, and Binance became the warehouse where all these kegs were stored. As long as no one struck a match, everyone — Binance, users, and Ethena — would profit when the month ended. Unfortunately, former U.S. President Donald Trump’s social media post last weekend was exactly that match — blowing up half of Binance in an instant.

Binance Exchange Implodes

After Trump announced new tariffs on China, global risk assets plunged simultaneously, and the market sentiment flipped from bullish to bearish in an instant. USDe was especially sensitive to this shift because its price wasn’t backed by reserves — it was “synthetically constructed” through trading strategies. When the market tanked and funding rates flipped, Ethena went from earning interest to paying it. Some investors began dumping USDe, causing its price to loosen.

On most exchanges, even as prices fell, USDe remained around $0.99. But Binance was different. Because of the high-yield promotion, many users there had maxed out their leverage, leaving them extremely vulnerable. The most leveraged traders were the first to be liquidated, leading to massive USDe sell-offs and the beginning of a depegging spiral. As prices dropped, more liquidations were triggered — feeding into a death spiral.

In theory, external arbitrageurs should have stepped in to buy the discounted USDe, helping restore the peg. But right in the middle of the crash, Binance suffered a “system outage” — outside capital couldn’t enter, and internal users couldn’t top up their collateral.

Cut off from the rest of the market, Binance became an isolated island. The falling price triggered liquidations, which in turn pushed prices even lower. While USDe prices on other exchanges held above $0.99, Binance’s price collapsed all the way to $0.65, resulting in a rare and dramatic “exchange implosion.”

In other words, Binance bears the greatest responsibility for USDe’s depegging this time. After the incident, two main narratives emerged in the community. One camp accused Binance of acting with intent—knowing full well that USDe wasn’t a true stablecoin, yet still launching a 12% yield campaign and encouraging leveraged trading, which exposed vast amounts of capital to extreme risk. When market volatility struck, Binance could then scoop up assets at bargain prices, becoming the biggest winner in the chaos.

The other camp argued that this wasn’t a conspiracy, but rather a cascade of product design flaws and system failures. Binance’s USDe price feed relied solely on its own internal market data. Had it incorporated external market prices earlier as references, the massive wave of liquidations might have been avoided. Even though the reward campaign amplified leverage and Trump’s surprise tariff announcement triggered market panic, if the system hadn’t frozen at the most critical moment, the exchange wouldn’t have turned into an isolated island. It was the simultaneous collapse of all safeguardsthat sent USDe’s price on Binance plunging to $0.65.

Regardless of which explanation one believes, Binance cannot escape blame. In its post-incident statement, Binance vaguely admitted that “recent market volatility and platform issues affected some users,” promising compensation for those impacted, while also insisting that “the system remains generally stable, with only minor temporary delays in certain functions.” This half-hearted response only deepened public skepticism and further eroded trust in Binance.

Accountability

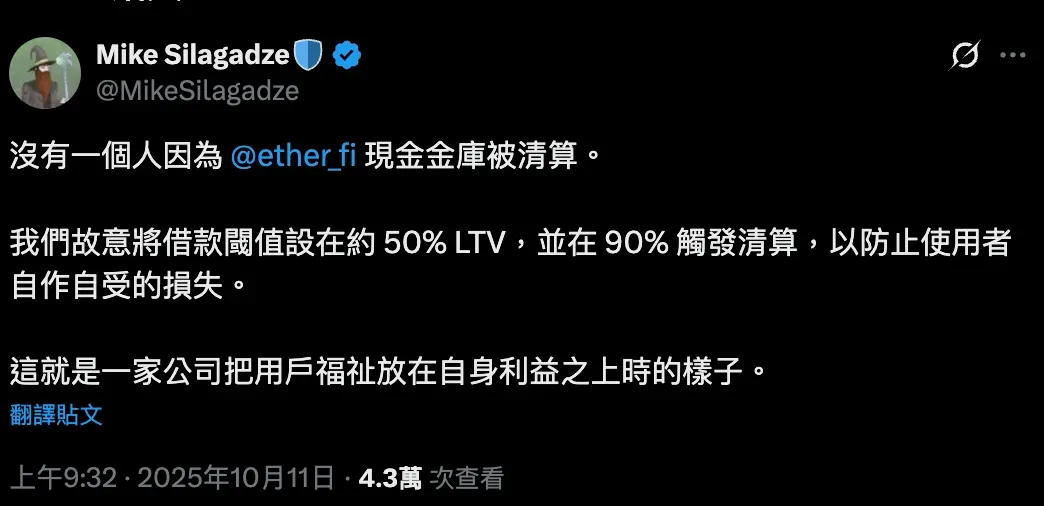

While it’s true that investors chose to use high leverage, the exchange’s product design defines the boundaries of risk. Mike Silagadze, CEO of EtherFi, pointed out that his own platform also offers borrowing features but deliberately caps loans at 50% of collateral value and sets liquidation thresholds at 90%. During this recent market crash, not a single EtherFi user was liquidated. This is a prime example of protecting users through prudent product design—better to let users borrow a bit less than to let them burn themselves with leverage.

As the world’s largest exchange, Binance is supposed to be a safe haven for the market. Yet this incident revealed a very different side of it. Rather than standing with its users, Binance appeared to stand against them, leveraging its professional expertise to extract profit from its own customers. While it later offered compensation, money can’t make up for the lives that were lost.

The investors who were liquidated for using leverage made the mistake of mistaking perfection for normality—assuming that Binance would always have deep liquidity, that USDe would never depeg, and that deposit and withdrawal systems would never fail. In most cases, those assumptions hold true. But perfection is fragile. The higher the returns are stacked, the more fragile perfection becomes.

The crypto market’s volatility often misleads people into thinking that the only way to win is to chase fast profits. Those who’ve lived through market crashes understand better: in crypto, survival matters more than speed. Still, as long as prices keep setting new all-time highs, it feels like there’s no disaster we can’t move past, right? (Yes, that’s sarcasm.)

1 Perpetual Futures: How Derivatives Can Earn You Steady Interest