Testing Stripe’s Stablecoin Payments! Instantly Save 94% on Payment Processing Fees

GM,

In my previous article, I mentioned Central Bank Governor Yang Chin-long’s question 1 about stablecoins:

“If future stablecoin issuers and related businesses are brought under regulation—required to follow AML, CFT, KYC, cybersecurity, and consumer-protection rules—will they still be able to offer the fast, freely circulating, and low-cost services they provide today?”

In this article, I respond with real money and actual Stripe data. Here’s the conclusion upfront: Even under full compliance, merchants who switch to stablecoin payments can save up to 94% in payment processing fees. So the next time someone says “Stablecoins are cheap only because they’re unregulated,” you’ll know they’re either inexperienced or just talking nonsense.

Let’s start with the recent “IQ tax” controversy circulating on social media.

The “IQ Tax”

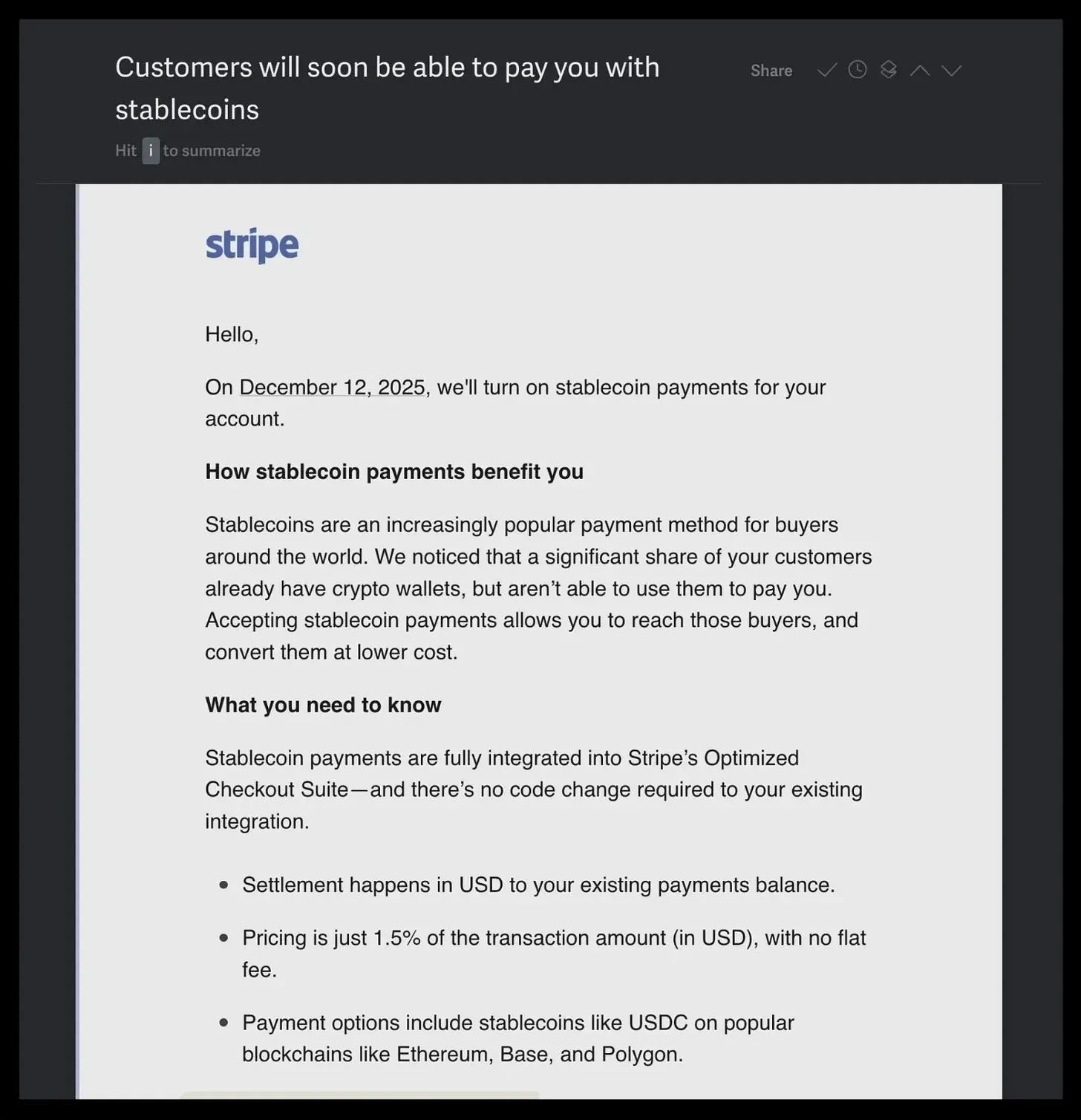

After Stripe—the global leader in online payments—announced its “return to crypto” in 2024, its top priority was enabling stablecoin payments on its platform. Over the past few months, some U.S. merchants have already been able to try the new feature early. This week, Stripe sent another batch of emails to new users, signaling its official rollout. According to the email:

We will enable stablecoin payments for your account on December 12, 2025 … We’ve noticed that a large portion of your customers already have crypto wallets but currently cannot use them to pay you … Once enabled … funds will be settled in U.S. dollars (USD) to your existing payment balance. The fee is just 1.5% of the transaction amount (in USD), with no additional fixed fees. Supported payment options include stablecoins such as USDC on popular blockchains including Ethereum, Base, and Polygon.

What should have been good news unexpectedly turned into a firestorm once screenshots of the email were posted on social media.

Critics questioned why Stripe would charge a 1.5% fee just for helping merchants accept USDC—calling it an “IQ tax” on people who don’t understand crypto. Others mocked Stripe, saying that taking a 1.5% cut on stablecoin payments is the most “innovative” shock to the industry.

The implication is: Isn’t accepting USDC as simple as creating a wallet and sharing an address? Using MetaMask costs nothing and takes only a few minutes from start to finish.

But as someone who has been accepting crypto payments for subscriptions since 2019, I’d like to say a word in Stripe’s defense.

Saving 94% in Fees

First, let’s clarify: accepting payments directly with your wallet and accepting payments via Stripe are completely different models. Using a restaurant analogy, the former is like accepting cash, while the latter is like installing a POS machine. Both involve collecting money, but they are not comparable. In this rollout, the biggest beneficiaries of Stripe’s stablecoin payment support are merchants, not consumers—hence the misunderstanding.

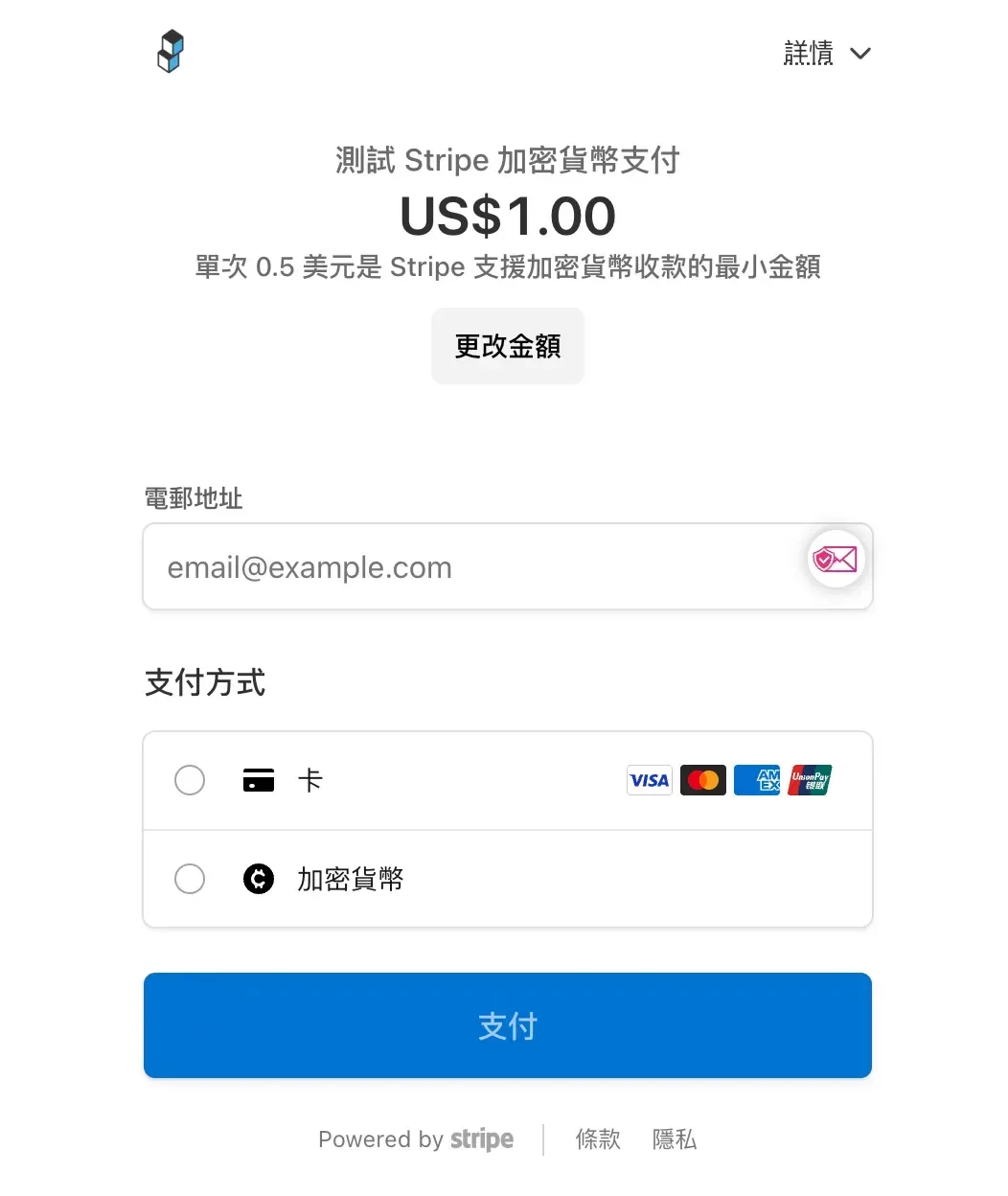

Blocktrend uses Stripe to collect subscription payments, so I can share firsthand experience. Below is the USD $1 payment link I created—feel free to try it yourself. You can choose to pay by credit card or via cryptocurrency. If you select the latter, the page will automatically redirect and prompt you to connect your wallet to complete the payment.

Currently, Stripe supports three stablecoins across four blockchains. Regardless of which option you use to pay, the amount you send is always 1 USD.

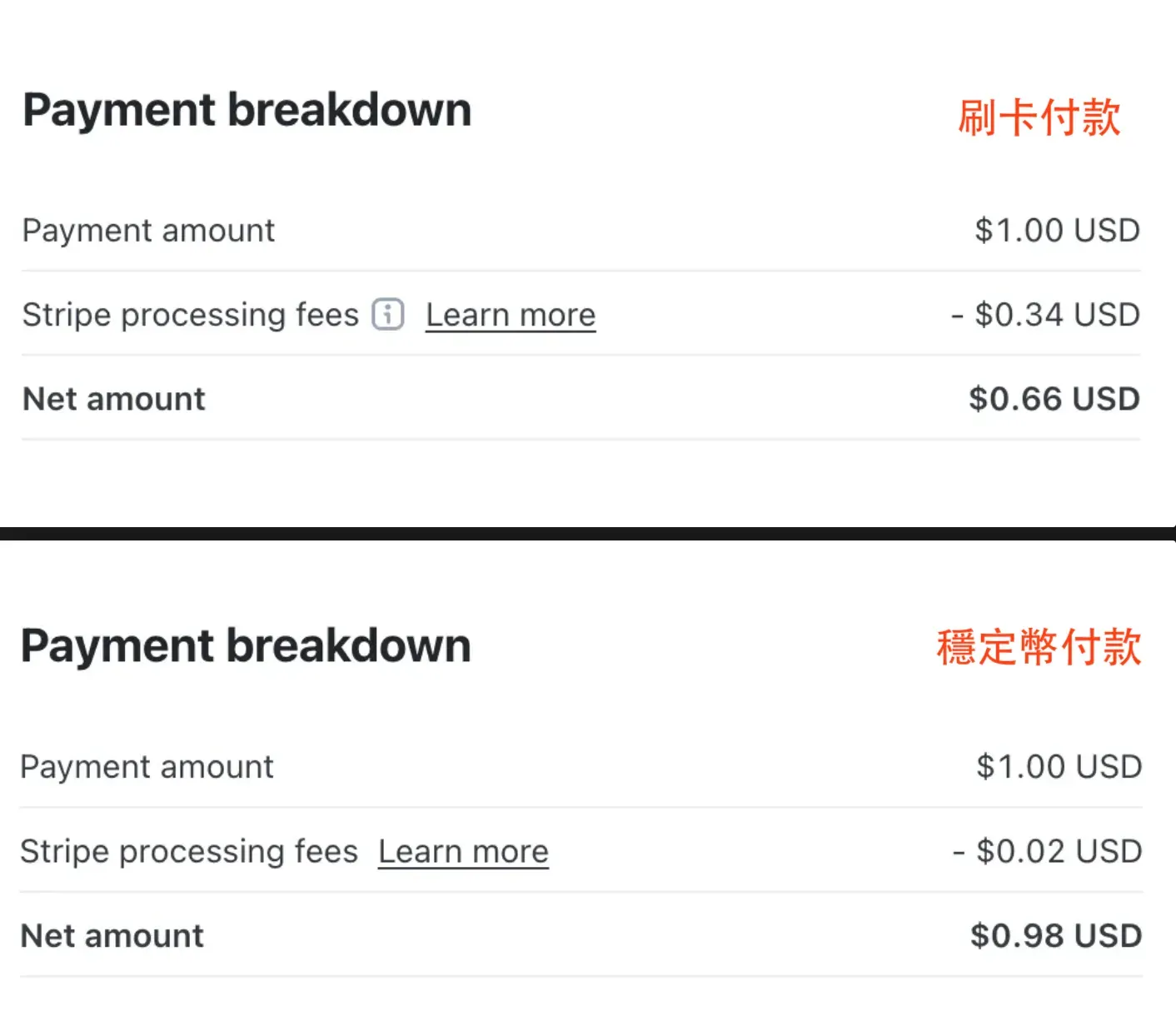

The real difference lies in how much of that amount is eaten by fees before the merchant receives it.

If a customer checks out with a credit card for $1, the amount I actually receive is $0.66—a 34% loss. If the customer instead pays with a stablecoin, I receive $0.98, a 2% loss. Comparing the two methods, when a customer pays with a stablecoin, the merchant can save up to 94% in payment processing fees. That’s significant.

The large difference in fees exists because Stripe uses different pricing formulas for card payments and stablecoin payments. Credit card fees are 2.9% + $0.30, while stablecoin payments cost 1.5%. If you look only at percentage rates, it may seem like stablecoin payments are merely “half the cost.” But for small payments, that fixed $0.30 fee wipes out revenue directly—the smaller the payment amount, the worse the impact.

It was only then that I suddenly understood why Substack requires creators to price monthly subscriptions at no less than $5. When the price is too low, payment processing fees swallow the creator’s earnings, making the whole effort essentially unpaid work. And that’s with Stripe, which already offers comparatively reasonable rates—never mind traditional payment processors. Once Stripe enables stablecoin payments, the fee becomes just 1.5%, meaning merchants will no longer lose money even on low-priced products.

Don’t get me wrong—I certainly hope Stripe will lower its fee below 1.5% someday. For example, Coinbase Commerce and KryptoGo currently charge only 1%, so Stripe clearly still has room to cut prices. But I would never call Stripe’s 1.5% fee a “stupidity tax,” like some people online. Stripe is providing payment infrastructure, and you can’t judge that solely by looking at on-chain transfer fees.

Three Core Values

Critics oversimplify online payments, assuming that accepting payments is nothing more than posting a wallet address. In reality, Stripe offers far more than a wallet—it provides a full suite of integration, convenience, and compliance. These three elements together are what justify the 1.5% fee.

Although I’ve long had my personal wallet address displayed on the Blocktrend website, many people still don’t realize that they can subscribe using cryptocurrency. That’s because it’s an additional payment channel, not part of the standard subscription flow. Stripe integrates crypto payments directly into the checkout process. In the future, stablecoin payment options may appear side-by-side with credit cards in the most prominent position, and I won’t need to append extra instructions on how to pay using a wallet. That is the value of integration.

Over the past few years, some members have indeed noticed my wallet address and paid their subscription manually with cryptocurrency. But the entire process is handled by hand: I must manually verify who the sender is, what their email address is, and if they pay in BTC or ETH, I must also provide the exchange rate at the moment of payment. If Stripe integrates crypto payment into the subscription workflow, the system automatically links the payer with their subscription plan and automatically calculates the exchange rate. Payment addresses also refresh each time, preventing others from deducing a merchant’s revenue on the blockchain. That is convenience.

And once there’s revenue, you need accounting. Stripe already integrates tax tools and can automatically withhold taxes for different regions—not to mention invoicing, chargebacks, monthly billing, fraud prevention, and other financial safeguards. These are not things that can be handled by simply posting a wallet address. Those who complain that Stripe’s 1.5% fee is too high are usually people who never encounter these situations. It’s like splitting the bill with friends at dinner; you don’t bring out a POS machine for that.

If it’s just personal payments, I strongly recommend using Fluidkey instead 3—simple, convenient, and with zero fees. I even helped with the Chinese localization of the interface recently. But if you are running a business, Stripe takes over all of these tedious responsibilities and only asks for a 1.5% cut. To me, that’s a great deal.

The controversy around Stripe highlights how traditional finance and crypto participants seem to live in two parallel worlds. Central bank governors believe stablecoins are cheap and efficient only because they avoid compliance costs; crypto users, on the other hand, question whether a 1.5% payment-processing fee is just an “IQ tax.” But both sides are mistaken. Stripe has already provided a concrete answer: without sacrificing compliance, technology alone cuts costs in half. The smaller the transaction, the more you save.

As a merchant, I would of course strongly encourage customers to switch to paying in stablecoins (Substack doesn’t support this yet). With competition, traditional financial institutions will be forced to find ways to reduce payment-processing costs. Until another breakthrough technology emerges, blockchains remain the lowest-cost option.

Quantity eventually becomes quality. When payment-processing fees drop significantly, it’s like when mobile networks upgraded from 3G to 4G. At first, everyone thought it was just about faster speeds, but the real impact was ushering in a new era of streaming, live broadcasting, and short-form video content. I am optimistic that Stripe’s support for stablecoin payments marks the beginning of blockchain integration into the financial system. Businesses will have no choice but to catch up.

2 Stripe Returns to Crypto Payments: Enabling USDC Transactions and the Necessity of Middlemen