Taiwan Also Has 600 Million! The U.S. Establishes a Bitcoin Strategic Reserve

GM,

First, a quick event announcement. This Sunday (March 16) at 2 PM, I’ve been invited to speak as an author alongside renowned Hong Kong writer Dong Qizhang and Wang Congwei, Deputy General Manager of Linking Publishing, at "Not Just Library" in Songshan Cultural and Creative Park, Taipei. We’ll be discussing digital publishing in the age of blockchain. The event is free to attend, and everyone is welcome to sign up!

A throwback news story. In 2019, the Taichung District Prosecutors Office investigated an illegal fundraising case and seized a total of 197 BTC. At the time, the office announced a judicial auction, valuing each BTC at $5,000, with a total estimated worth of NT$30 million. However, the auction ended up failing to attract any bids—which, in hindsight, was a stroke of luck.

Last year, the media revisited this case, reporting that the market value of the seized BTC had surged to NT$450 million. With Bitcoin now frequently surpassing $100,000, this stash is worth over NT$600 million, marking a 20x increase. It’s been a while since I last saw the prosecutors’ office auctioning off Bitcoin. If these 197 BTC are still in their possession, what would you prefer? Should they sell and cash out, or hold onto them for even longer?

The U.S. faces the same dilemma—but they've decided to hold. Instead of selling off seized Bitcoin, the U.S. has recently decided to keep it, using it to establish a national strategic Bitcoin reserve.

A Strategic Reserve

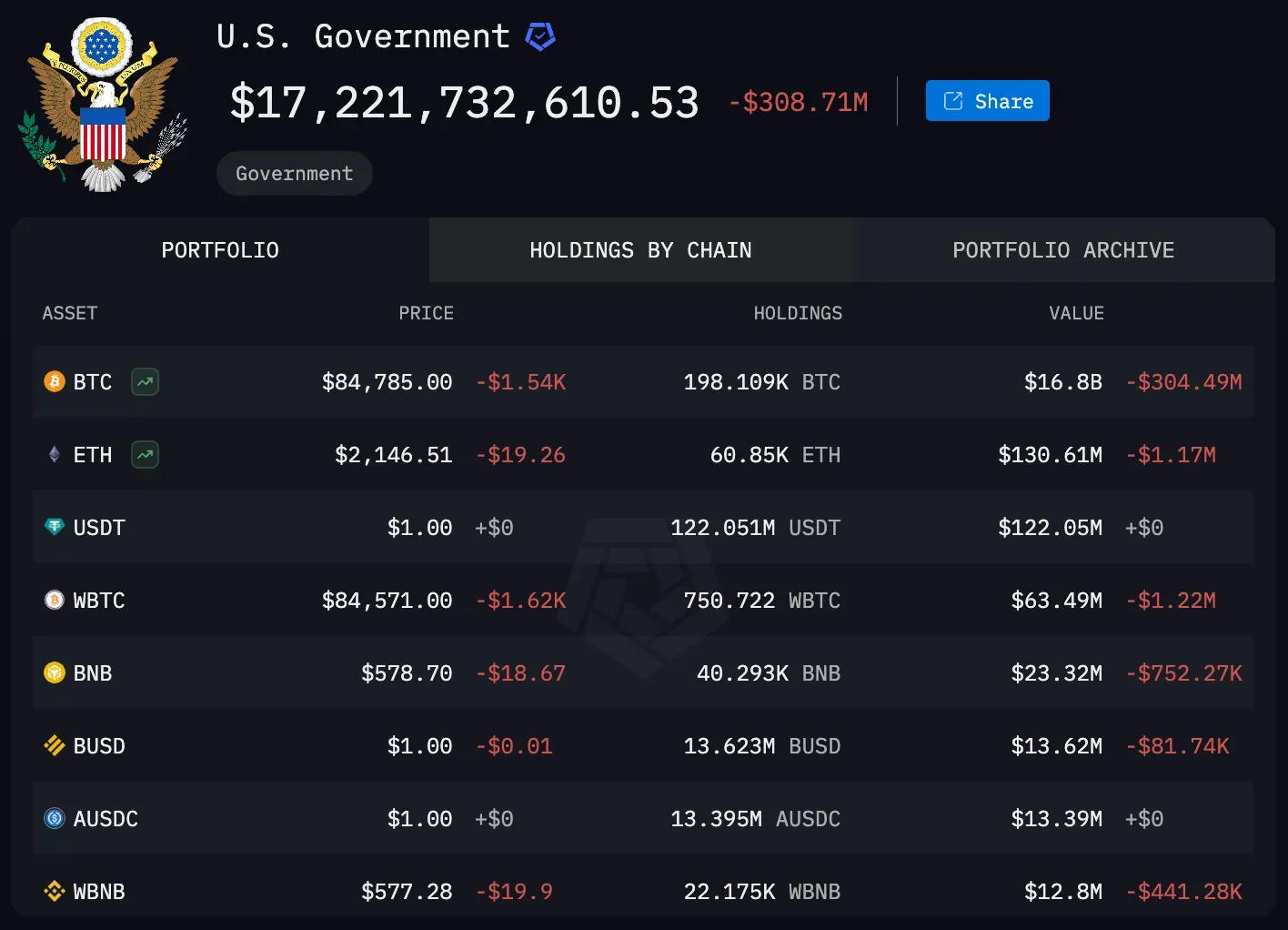

Last week, former U.S. President Donald Trump signed an executive order directing the Department of the Treasuryto create two dedicated offices responsible for establishing strategic reserves of Bitcoin and other cryptocurrencies for the United States. The funding source? Confiscated crypto assets seized through law enforcement actions. According to on-chain data from Arkham, the U.S. government currently holds nearly 200,000 BTC, accounting for 1% of Bitcoin’s total circulating supply. This policy doesn’t just have market implications—it also raises a broader question for other nations: Can cryptocurrencies serve as a strategic reserve asset for governments? Many critics remain skeptical, arguing that Bitcoin has no real value as a strategic reserve.

What Exactly Is a Strategic Reserve?

One of the earliest recorded examples comes from the Old Testament, in the story of the seven fat cows and the seven lean cows. In this biblical tale, the Pharaoh of Egypt had a dream in which seven emaciated cows devoured seven healthy, fat cows. He interpreted this as a divine warning: Egypt would experience seven years of abundance, followed by seven years of famine. Acting on this prophecy, he ordered farmers to store one-fifth of their harvests in royal granaries. When famine eventually struck, these reserves saved the nation and its people.

As civilizations evolve, so do the resources deemed essential for maintaining societal stability. In agricultural societies, reserves of grain and salt were paramount. The Industrial Revolution made coal and oil the backbone of national energy security. More recently, rare earth metals, crucial for manufacturing high-tech products, have become a key component of China’s strategic reserves.

For decades, the global financial system has relied on gold reserves as a hedge against economic instability. Now, with the U.S. officially incorporating Bitcoin into its strategic reserve system, a new precedent is being set. This move suggests that in the future, a nation's lack of digital assets could pose a threat to economic and national security. But many remain skeptical—how can something intangible and invisible like Bitcoin serve as a reliable safeguardduring a crisis?

Executive Order

In early March, Donald Trump announced via social media that BTC, ETH, SOL, and other cryptocurrencies would be included in the U.S. national strategic reserve. This news immediately triggered a surge in crypto prices. The more unexpected the token, the bigger the price jump—ADA soared over 50%, leaving even its founder bewildered. Could these cryptocurrencies really hold such strategic significance for the United States?

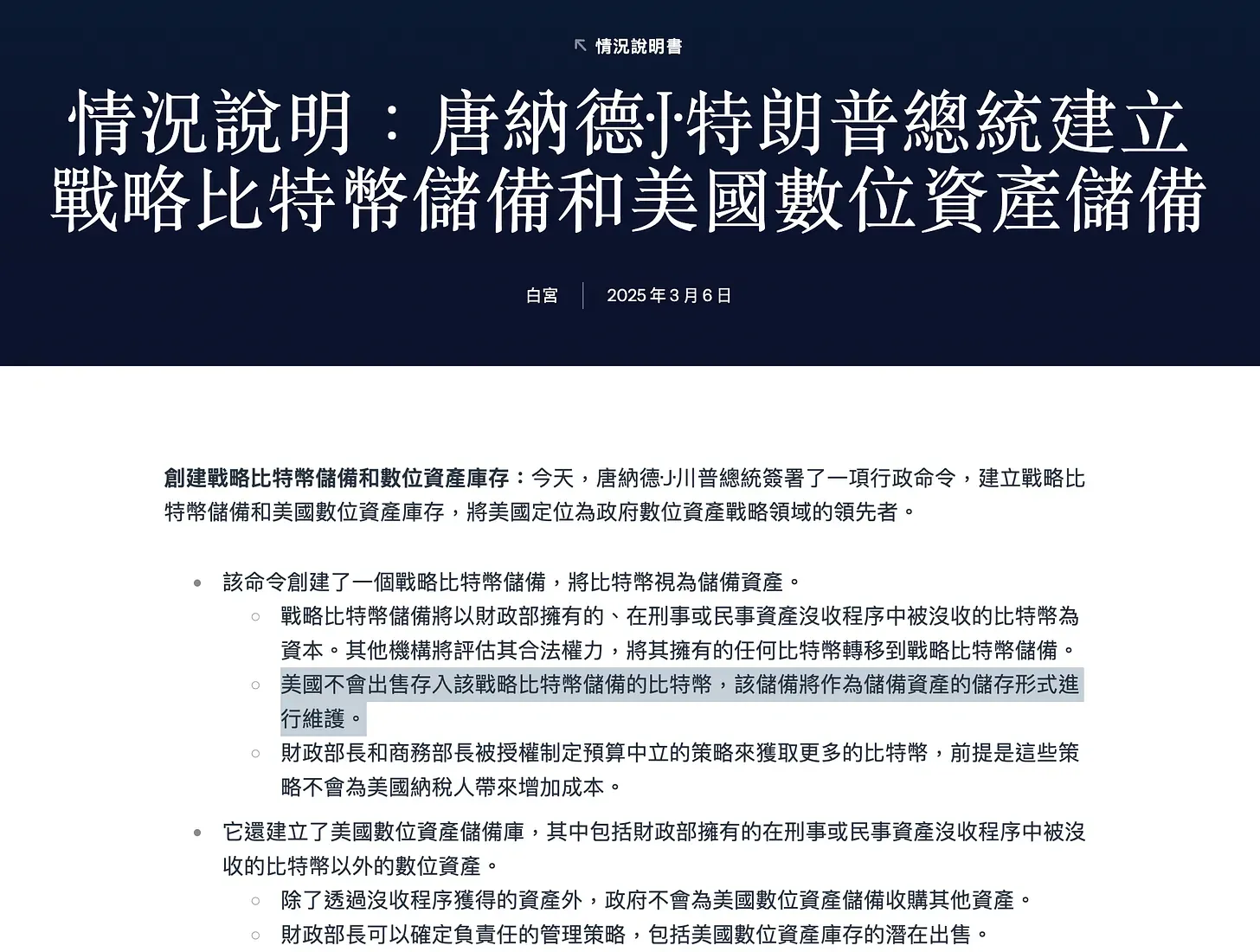

However, when the full executive order was released, prices quickly retraced to previous levels. It turned out that the U.S. government wasn’t actively purchasing these digital assets but had simply decided to halt sales and passively accumulate them instead. Among the listed assets, Bitcoin was given special status. The White House explicitly compared Bitcoin to gold, as noted in the official press release (1,2):

Bitcoin is the original cryptocurrency… Due to its scarcity and security, it is regarded as “digital gold.”… President Trump has signed an executive order establishing the “Bitcoin Strategic Reserve” and the “U.S. Digital Asset Reserve.”… A lack of clear policies in the past led the U.S. government to sell Bitcoin prematurely, costing taxpayers over $17 billion. The new policy reclaims digital asset management authority to ensure proper oversight… The U.S. gains a strategic advantage by becoming one of the first nations to establish a Bitcoin strategic reserve.

The White House provided only two conservative explanations for why Bitcoin was designated as a strategic reserve: The government sold too early in the past. The U.S. wants to establish itself as the crypto capital of the world.

However, the administration did not explain what kind of crises Bitcoin reserves could help mitigate. This lack of clarity has led some to criticize the move as mere political patronage by Trump.

A strategic reserve doesn’t necessarily have to be something that gets consumed. In today’s economy, gold’s symbolic significance far outweighs its practical use. A nation holding large gold reserves signals economic strength, helping to stabilize markets and public confidence. In other words, gold became a strategic reserve not because of its intrinsic value, but because of its consensus value.

Although the White House labeled Bitcoin as "digital gold," there remains a heated debate over whether it truly holds consensus value. To address concerns, Trump emphasized that the Bitcoin reserve will be built using confiscated assets from law enforcement seizures, rather than taxpayer funds. A "free" strategic reserve naturally faces less opposition.

Trump’s executive order explicitly prohibits the sale of Bitcoin held in the U.S. strategic reserve ("shall not sell"). Additionally, the Treasury Department is now tasked with developing a plan to continuously increase Bitcoin reserves without spending taxpayer money. Under this policy, the U.S. government’s Bitcoin holdings will only grow—never shrink.

But the U.S. government does not treat all cryptocurrencies equally. While ETH, SOL, and other digital assets have been included in the "U.S. Digital Asset Reserve," they do not enjoy the same privileged status as Bitcoin. The Treasury Department retains full discretion over their management, meaning these assets can be sold at market highs if deemed necessary.

Online discussions about this strategic reserve policy have largely focused on short-term price movements and which tokens made the cut. However, few have addressed the most profound implication of this event—the significance of accidental holdings.

The Power of Accidental Holdings

Trump’s business-oriented mindset is well known, and there’s no guarantee that the next U.S. administration—Republican or otherwise—will maintain this policy. I remain skeptical about its long-term survival, preferring to see it as a temporary anomaly in U.S. government history: its first step into crypto ownership. Anyone who has been in the crypto space for long understands the power of accidental holdings. I am a living example.

Years ago, a friend wanted to set up a mining rig at my place to mine ETH. I initially dismissed the idea as a waste of time, but reluctantly agreed. That accidental exposure led me to acquire my first cryptocurrency. To pay for electricity, I had to mine, transfer, cash out, and spend crypto firsthand. Only then did I realize, "Crypto can actually be converted into New Taiwan Dollars." That experience ultimately led me to found Blocktrend in 2017, and I’ve been writing about it ever since. Everyone’s entry into crypto comes with its own unexpected twists, but the common thread is that once people have a financial stake, they start paying attention—and their perspectives change.

Perhaps Trump is that "accident" for the U.S. government. Not only did he issue an executive order to establish a strategic crypto reserve, but just last week, the Office of the Comptroller of the Currency (OCC)—which operates under the U.S. Treasury—overturned a previous ruling, officially allowing banks to:

- Offer cryptocurrency custody services, such as crypto lending.

- Hold stablecoins as reserves, enabling stablecoin-based financial services.

- Operate as a node on public blockchains, allowing banks to directly send and receive cryptocurrencies.

This development is even more significant than the U.S. government establishing a crypto reserve. It means that crypto will not merely sit in vaults as a strategic reserve—it is on the verge of becoming a circulating asset within the banking system. The real test will be whether banks, once they start using it, ever go back.

Trump’s executive order could mark a turning point for cryptocurrencies. Right now, there are more negative headlines than positive use cases. But over time, people will begin to understand that blockchain is like the internet—there will always be criminals using it, but that’s not its only purpose.

At the crypto summit held at the White House last week, Gemini co-founder Tyler Winklevoss put it bluntly:

"A year ago, I thought my chances of going to jail were higher than my chances of getting invited to the White House."

Over the past decade, the U.S. has sold off more than 195,000 BTC. Now, it has decided to stop selling—but what does this mean for other countries?

Back to Taiwan

Last year, when the trailer for the TV series "Zero Day Attack" was released, I discussed asset allocation in a scenario where banks shut down. We face geopolitical risks daily, so we arguably need borderless, globally transferable cryptocurrencies even more than Americans do. At the time, I suggested that if the goal was simply to store money in an overseas bank, holding USD stablecoins like USDC or USDT would achieve the same effect. If someone wanted exposure to gold, they could just hold gold-backed stablecoins. Now, there’s yet another option—buying BTC and ETH—assets officially recognized as part of America’s strategic reserves.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.