Swiss Bank Launches First-Ever Wallet Insurance! Annual Fees Starting at $99 to Help You Recover Lost Assets

GM,

Lately, the crypto market has been flooded with nonsense—from Pi Coin getting listed on exchanges to Argentina’s president launching a token to cash in on retail investors. Even though the crypto space can be a mess, digging deep enough can still uncover valuable insights.

One such discovery comes from Swiss crypto bank Sygnum, which recently introduced an innovative service for Safe multisig wallets1: “Wallet Loss Insurance.” This service essentially adds a “forgot password” function to your wallet—without sacrificing self-custody. Even Safe co-founder Lukas Schor has signed up as a customer. But before diving into the details, let’s start with a related story from recent headlines.

Buying a Landfill

Recently, a British man named James Howells announced plans to buy an entire landfill—all in a desperate bid to recover a hard drive he accidentally threw away in 2013. You can probably guess why.

That hard drive contains 8,000 BTC, now worth approximately $800 million. For over a decade, local authorities have refused to grant him access to the landfill, but now that the government has decided to close the site in 2026, James is racing against time—and proposing to buy the entire landfill just to get his Bitcoin back.

James Howells’ story is a microcosm of the crypto space. Take me as an example—I used to upgrade my phone regularly, but ever since holding crypto, I’ve become hesitant to sell old devices. I worry about private key leaks and dread becoming the next “buy a landfill” headline. Even though I’ve already moved my assets from cold storage to a multisig wallet this year—reducing the risk of a single point of failure—disasters like fires or earthquakes could still prevent me from gathering enough signatures to access my funds.

Fortunately, Safe wallets offer an account recovery mechanism. By pre-assigning an “emergency contact”, users can regain control of their wallet when needed. This emergency contact could be a family member or a third-party service. Sygnum Bank saw a business opportunity and introduced “Wallet Loss Insurance.” By paying a periodic insurance fee, users can rely on the bank to help recover their wallet if needed.

Switzerland’s Crypto Bank

Founded in 2017, Sygnum is a regulated crypto bank with licenses in Switzerland and Singapore. It recently closed a new funding round, pushing its valuation past $1 billion, officially making it a unicorn. Positioning itself as crypto’s insider in traditional banking, Sygnum focuses on providing crypto-native financial services. However, for now, it only serves institutions and professional investors—Binance is among its clients.

Recently, Sygnum launched a new service called "Sygnum Web3 Recovery," offering insurance for Safe wallet users. According to its official website:

Web3 Recovery is the world's first wallet recovery service. Users must activate the recovery module within their Safe wallet. Sygnum can only replace an inactive signer’s address but does not have direct control over the assets. The recovery process includes a user-defined buffer period, during which requests can be canceled or permissions removed, ensuring that users retain ultimate control.

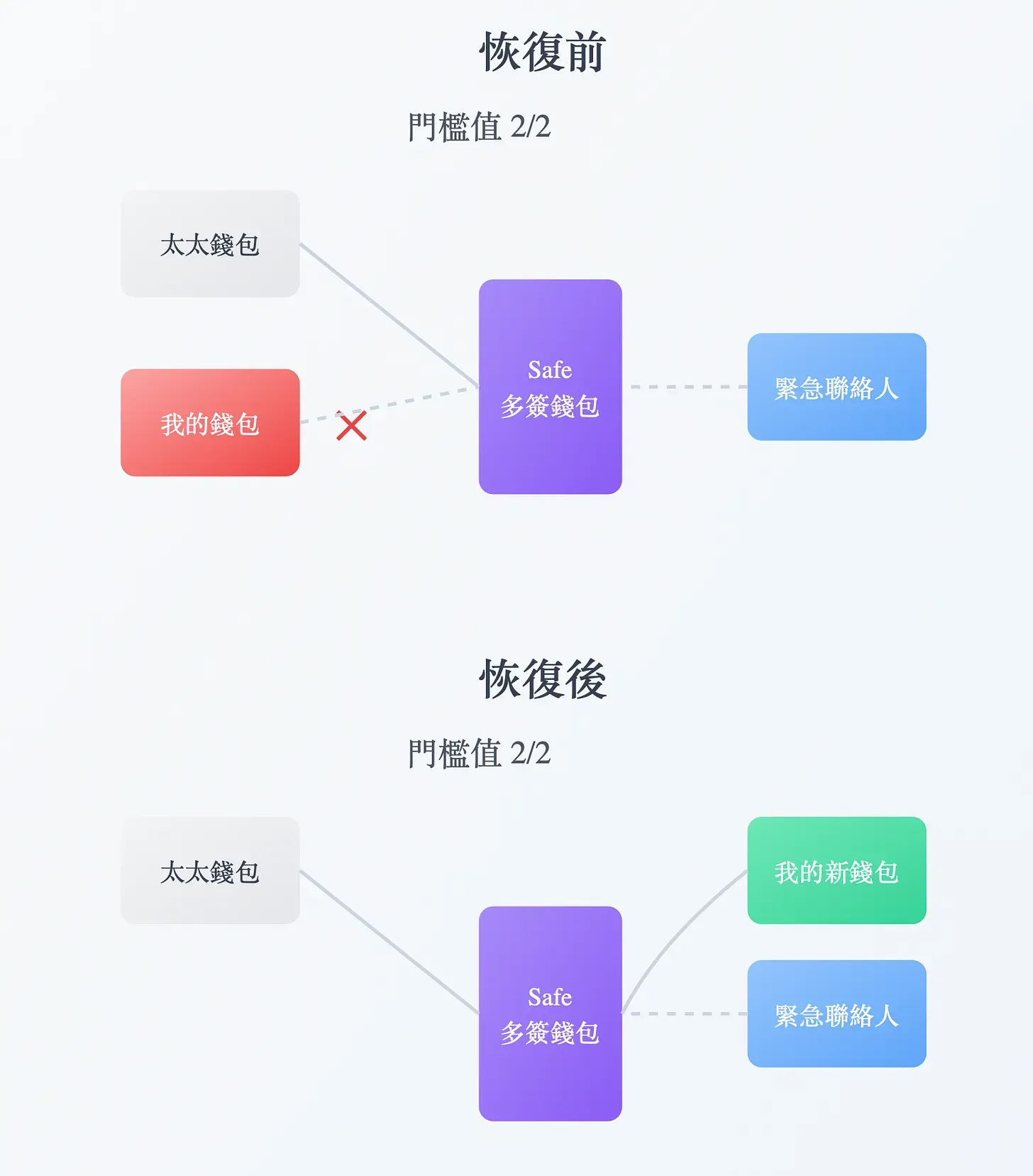

Let’s say my wife and I set up a 2-of-2 multisig wallet, meaning both of us must approve every transaction. If my phone is unexpectedly damaged, not only would I lose access to the assets on my phone, but our multisig wallet would be permanently locked due to the missing signature.

However, if we had enabled the account recovery feature and designated a trusted friend as an emergency contact, they could initiate a recovery request. After the cooling-off period, we could then replace the old address with a new one, regaining full control over our wallet.

But here’s a key question: Who is the right person to be an emergency contact? Not only do they need to understand wallet operations, but I also have to ensure that our friendship lasts. If the assets involved are substantial, they could even become a target for hackers.

This is precisely the business opportunity Sygnum has identified—positioning the bank as a trusted emergency contact. The image below illustrates the three recovery options for Safe wallets, from left to right: User-defined recovery (choosing your own trusted contact), Recovery via Sygnum, Email-based recovery (coming soon). While Sygnum’s solution is the most centralized, the recovery process functions much like the familiar “Forgot Password” feature we use for traditional accounts.

If a signer loses their wallet, they can simply verify their identity with Sygnum, and the bank will initiate the recovery process. After the cooldown period, a new signer can be added. However, this service doesn’t come cheap: The basic plan costs $99 per year, covering up to $100,000 in assets. The premium plan costs $4,999 per year for higher coverage.

Like traditional insurance, the higher the coverage, the more expensive the fees.

Additionally, recovering a wallet incurs a 1% transaction fee on the total asset value. This pricing suggests that only businesses or high-net-worth individuals might be willing to adopt the service. However, it solves a crucial problem: allowing institutional entities to participate in wallet recovery.

Imagine a future where not only Swiss banks but also institutions like Taiwan’s Fubon or Cathay United Bank offer similar services. In the worst-case scenario, you’d simply pay a 1% fee and have a bank recover your wallet for you. Doesn't that provide peace of mind?

But Does This Introduce a Centralization Risk?

Compromise vs. No Compromise

Every day, countless cryptocurrencies become permanently inaccessible due to lost private keys. In 2023, Ledger, a well-known cold wallet provider, attempted to address this issue with Ledger Recover, a backup service. However, the product faced widespread backlash even before its launch. At the time, Blocktrend analyzed this controversy in the article "The Cold Wallet’s Hot Backup Dilemma":

People choose cold wallets to keep their private keys completely offline—trading convenience for security. However, Ledger Recover attempted to assist users with key management by introducing an online backup mechanism, splitting the private key and storing fragments across Ledger, Coincover, and EscrowTech. The debate wasn’t just about whether Recover’s mechanism was secure, but about different interpretations of security. For new users, having a backup means security. For critics, true security means staying fully offline. Ledger tried to cater to both sides and ended up creating a "half-measure" that pleased no one. What was meant to be a one-size-fits-all solution backfired, damaging its brand trust.

Ledger Recover’s flaw was that three separate companies held pieces of the private key. If any of them were hacked or colluded, user assets would be at risk. Sygnum’s approach is fundamentally different: The bank can only initiate the recovery process—it does not have direct access to assets. Safe wallet holders can cancel the recovery request during the cooldown period.

Sygnum has also implemented multiple layers of internal security. Any recovery request must be approved by three separate departments, ensuring that the user remains in full control of their wallet. The only trade-off? User privacy. Sygnum will know the identity of the wallet owner. However, even if the bank shuts down, users can simply switch their designated emergency contact—they won’t lose their assets.

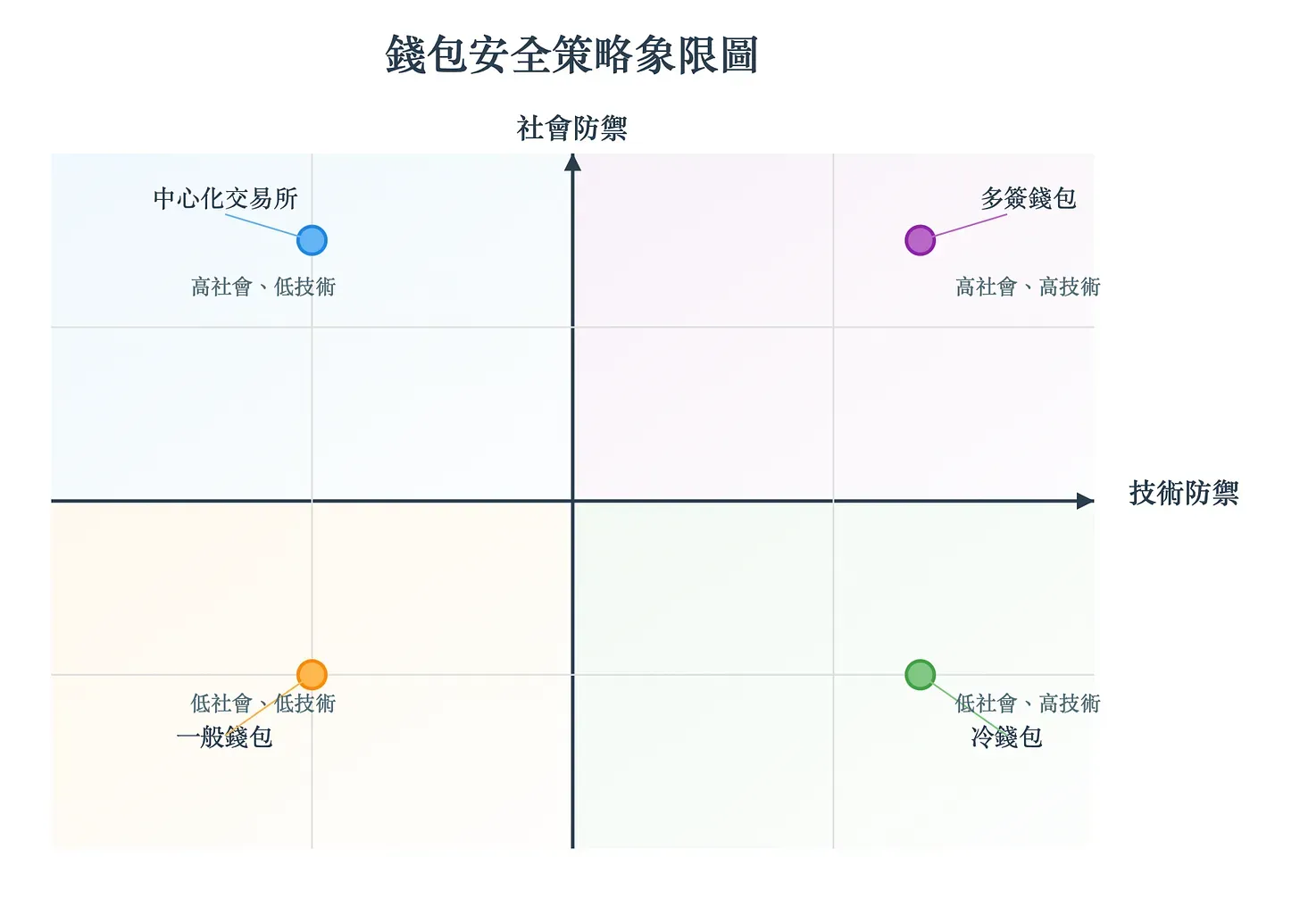

Sygnum’s service finds a middle ground between centralization and decentralization. This aligns with the innovation behind Safe multi-signature wallets—giving users the flexibility to choose whom to trust and how much trust to place. Previously, people faced a black-or-white choice: Store assets on centralized exchanges, constantly fearing another FTX-like collapse. Use a fully decentralized personal wallet, risking losing access forever. Safe breaks this binary dilemma—allowing users to incorporate centralized trust into a decentralized framework.

Many in the crypto community hope to eliminate banks, but Sygnum has found a new role for them within decentralized frameworks. Instead of disappearing, banks can reinvent themselves as providers of trust in new ways. Safe is considered one of the most secure wallets because it doesn’t force all users to follow a single set of rules. Instead, it offers a flexible mechanism that adapts to different user needs. A truly secure wallet isn’t just one that is technically robust—it’s one that people will actually use. That’s what makes Safe a truly "antifragile2" wallet.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.

- Safe Multisig Wallet: A Smarter and Safer Alternative to Cold Wallets

- Bitcoin Crash: MA Investment Advisory and Antifragile Systems