Stripe Builds Its Own Blockchain! The Tension Between Payment Efficiency and Decentralization

GM,

Last week, payment giant Stripe and crypto venture firm Paradigm officially announced that they would jointly launch Tempo, a Layer 1 blockchain dedicated to payments. This marks the fourth major case of a large corporation building its own blockchain, following stablecoin issuers Tether and Circle 1, as well as Google 2.

It must be said—the lineup Stripe and Paradigm have assembled for Tempo is quite impressive. The founding nodes of the Tempo chain include Visa, OpenAI, Shopify, Revolut, Coupang, and Standard Chartered Bank—dominant players in their respective industries. The atmosphere feels reminiscent of Facebook’s ambitious Libra Association, which once sought to unite global companies under a single digital currency initiative. If these platforms eventually adopt stablecoin payments, the world could look very different.

That said, even before governments had a chance to respond, Tempo has already sparked heated criticism online. Many foreign netizens—who share views similar to Chubo’s (and there are plenty!)—argue that Stripe is simply using stablecoins to bypass regulation. Even within the crypto industry, some are critical, saying that building a proprietary blockchain is like reinventing the wheel.

Although Tempo emphasizes neutrality and has pledged to gradually move toward decentralization, Stripe has once again reminded everyone of the “gravity effect” corporations face when stepping into blockchain.

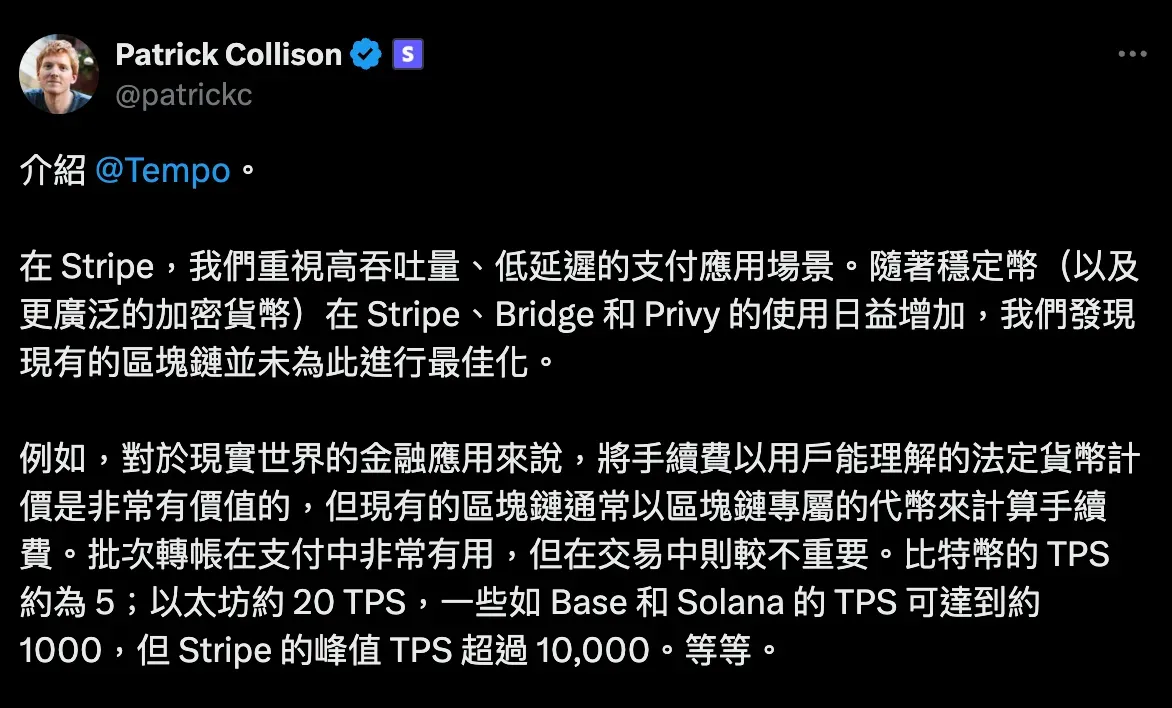

A Payment-Dedicated Chain

What exactly is the Tempo chain? More than technology, it’s about the people behind it.

Tempo is a blockchain jointly built by Stripe and Paradigm, designed with payments as its top priority. Tailored for stablecoins and real-world payment needs, it combines Stripe’s global payments expertise with Paradigm’s deep knowledge of cryptocurrency.

Stripe is the leading online payments processor—over one-third of global e-commerce sites use Stripe to accept payments. Even Blocktrend’s membership subscription system runs on Stripe.

Stripe isn’t just an expert in payments; its approach to cryptocurrency has always been pragmatic. As early as 2014, Stripe made headlines by becoming the first to enable online shopping payments in BTC. However, due to Bitcoin’s extreme price volatility and rising on-chain fees, the feature was discontinued in 2018. By mid-2024, Stripe reassessed blockchain infrastructure as mature and recognized the potential of stablecoins, announcing its official return to crypto 3.

Over the past year, Stripe has not only re-enabled cryptocurrency payments but has also acquired stablecoin startup Bridge 4, stealth wallet Privy 5, and launched a white-label stablecoin service that helped MetaMask 6 issue its own token. Stripe is now arguably the most aggressive fintech company worldwide in its stablecoin strategy.

Paradigm is no less significant. Founded in 2018 by Fred Ehrsam (Coinbase co-founder) and Matt Huang (former Sequoia Capital partner), Paradigm has built a strong reputation. Matt Huang sits on Stripe’s board and has long been an investor and builder in the Ethereum ecosystem. Paradigm is widely viewed as one of the most trusted crypto venture firms.

Its reputation stems not only from investments but also from a dedicated team of blockchain experts and white-hat hackers providing technical support to portfolio companies. Recently, Paradigm even brought on the renowned on-chain investigator ZachXBT as an advisor. Suggesting that Paradigm doesn’t understand Ethereum would be as strange as saying a16z doesn’t understand the internet.

And yet, a paradox emerges. In 2022, Paradigm published Base Layer Neutrality, emphasizing the importance of neutrality in public blockchains. Now, it is co-building a new Layer 1 with Stripe, enlisting giants like Visa and OpenAIas validators—seemingly falling into the very trap they once warned against.

Stripe’s motivation is more straightforward: whoever controls the settlement layer of stablecoins holds the keys to the next-generation “global clearing network.” But Paradigm’s role raises questions. If they understand Ethereum’s value and the necessity of decentralization, why didn’t they push Stripe to build Tempo on top of an existing blockchain instead of starting from scratch? As Bridge founder Zach Abrams pointed out in an interview, the key reason may be this: “Today’s blockchains still aren’t ready for everyday payment scenarios.”

In other words, if existing blockchains were already good enough, Stripe wouldn’t need to build its own. I was skeptical at first, but after hearing Abrams’ explanation, it all made sense.

Standing Around Waiting 12 Seconds

Tempo claims to be building “payment-grade” infrastructure, highlighting three core features:

- Sub-second finality: transactions become irreversible in under one second.

- Built-in transaction privacy: shielding spending records from full public traceability.

- Stable fees: native support for paying gas fees with stablecoins.

These promises are nothing new—but are today’s blockchains really incapable of delivering them? Abrams gave two examples in an interview: Solana and Stellar.

He explained that while Solana is fast, users must pre-deposit 0.002 SOL (roughly NT$12) as collateral before a wallet can even be activated. If Stripe had to create wallets for tens of millions of users, the collateral alone would cost over NT$100 million. Although Stripe could afford it, compared to other blockchains this becomes an unnecessary expense—effectively unfriendly to enterprises.

Stellar, on the other hand, was a painful lesson for Abrams. In 2022, Bridge helped the U.S. government distribute tens of thousands of small subsidies using Stellar. While expectations were high, the process took 18 hours to complete and suffered from numerous failed transactions, sparking waves of customer complaints. Abrams concluded that Stellar’s performance and reliability fall short of real-world demands for instant payments.

He didn’t name Ethereum directly, but it too has yet to meet Tempo’s three headline features. Ethereum has reduced cross-border settlement times from a full day to just a few blocks—about 12 minutes. But everyday consumer payments demand much faster finality, ideally immediate, so that money and goods can be exchanged on the spot. No one is going to stand at a checkout counter waiting 12 minutes for their transaction to clear.

Even Ethereum co-founder Vitalik Buterin admits more can be done. But the bottleneck lies in varying internet speeds across countries. Shortening confirmation times too aggressively could create centralization risks. For example, if developing nations’ networks can’t keep up with Europe and the U.S., Ethereum transactions could end up reflecting only a “Western consensus” rather than a truly global one. This is the geographic centralization challenge.

Privacy is an even bigger issue. On most blockchains, transactions are fully transparent—anyone can see which address spent how much money and when. Just this week, someone created an EtherFi Cash spending leaderboard, openly calling out which wallet addresses are “whales.” With the help of blockchain analytics tools, it becomes possible to piece together users’ real-world identities. Tempo’s built-in privacy mode is designed to address this problem at the blockchain level.

Once Stripe laid out these issues one by one, even Paradigm had to admit that Ethereum is unlikely to solve them all in the short term.

In the past, Stripe could simply fold its cards and stop supporting BTC payments, citing immature infrastructure as the reason. But with the stablecoin wars already underway, Stripe’s quickest path to solving problems isn’t waiting for existing blockchains to catch up—it’s building one of its own.

While I understand Stripe’s reasoning for launching Tempo, I don’t agree with its approach. In my view, the best path forward would be for Stripe to help accelerate blockchain development, not start from scratch.

The Gravity of Control

Tempo is designed for efficiency. But why can’t existing blockchains deliver? Are researchers and developers just freeloading on their salaries? I don’t think the issue is technical—it’s about trade-offs in values. The biggest misconception enterprises have about blockchains is treating them as tools for profit, rather than as public infrastructure for the digital world. A theme park is a private business run for profit, while a public park is an open facility anyone can use freely. The design philosophies are entirely different.

Tempo assumes decentralization is relatively easy: bring in a handful of large companies as nodes, get transactions on-chain, and gradually decentralize later. The key is to solve the problem now—decentralization can wait.

Ethereum’s philosophy is the opposite. Vitalik lays out a roadmap showing that technical issues will eventually be solved—whether faster finality, lower fees, or greater transaction privacy. But if decentralization is compromised at the start, it can never be regained when the day comes that it’s truly needed. For Ethereum, technology can take its time, but decentralization must be defended from Day One.

So, who’s right? Christian Catalini, a founding member of Facebook’s Libra team, recently argued in an op-ed that Libra wasn’t killed by regulators but by internal disagreements over decentralization:

People assume Libra failed because of regulation. But what really killed it was internal value conflicts. We never managed to convince colleagues to make Libra’s network permissionless. The problem with corporate blockchains isn’t the code—it’s the incentives. Tech companies always promise fairness, but once the market depends on them, they tilt the rules in their favor. As long as there’s a throat to choke, the system can never truly change. Any network with an ‘architect’ will eventually betray privacy, openness, and neutrality—that’s the gravity of control.

Catalini revealed that Libra engineers believed they excelled at building the world’s most efficient centralized systems. They had no real commitment to open networks, often asking, “Why decentralize a database at all?” In his view, Libra’s internal abandonment of decentralization gave regulators even more room to intervene. Will Tempo repeat the same mistake? The key is whether it can escape the gravity of control. Personally, I’m pessimistic. History is full of blockchains that tried to transition from centralized beginnings to decentralization—but not a single one has succeeded.

Tempo’s official website highlights its “built-in compliance mechanisms”—and that, in my view, is the first step toward failure. It’s not that I advocate breaking the law, but the reality is that regulations will never be uniform across jurisdictions. Once compliance is hard-coded into a blockchain, it is destined to undergo endless compromises under different legal systems. In the end, the Tempo chain will either splinter into multiple versions or bend entirely to the will of the most powerful regulator. This runs directly counter to Tempo’s own claim of “base-layer neutrality.” A blockchain is like a rocket lifting off: the bigger the participants, the harder it is to escape the gravity of control.

Even more fundamentally, building a neutral blockchain simply doesn’t align with the mission of for-profit companies like Stripe and Paradigm. If competitors were ever to become more successful on Tempo than Stripe itself, what guarantee is there that Stripe wouldn’t use technical levers to “backstab” them? That’s why Google’s Web3 lead once remarked: “Tether won’t use Circle’s chain, and Adyen won’t use Stripe’s chain.” Such “promises of neutrality” are cheap. Contrast this with Ethereum: when North Korean hackers launder money on Ethereum, the U.S. government already knows better than to go after Vitalik—it targets the application layer instead. But what if criminals used Tempo? Could Stripe really say, “You can hold me accountable today, but not tomorrow”?

I admire Stripe for consistently approaching technology with pragmatism. Many financial experts like to mock the crypto space for being too idealistic. Yet ideals are like a compass—they provide direction. A lack of ideals isn’t necessarily a strength for enterprises, because in their worldview, a free and open public park simply has no place. This is precisely why corporate-led blockchains are often doomed to fail. If Stripe thinks public infrastructure isn’t good enough, the answer should be to contribute resources to improve it, not to build a private pay-to-play amusement park. As for Paradigm, while it has long been regarded as a top-tier crypto venture firm, it still seems to miss a crucial point: the hardest part of blockchain isn’t the technology—it’s the practice of decentralization.

1 What Impact Will Circle and Tether’s Proprietary Blockchains Have on Ethereum?

2 Google Builds Its Own Financial Blockchain: Public Infrastructure as Private Business

3 Stripe Returns to Crypto Payments: Enabling USDC Transactions and the Need for Middlemen