Stablecoin Payment Cards Are Booming! Visa Is Becoming Ethereum’s Layer 2 Network

GM,

Do you have a crypto payment card in your wallet? Last week, the two global payment giants—Visa and Mastercard—each made major announcements expanding their support for stablecoins, signaling an intense rivalry. One thing is clear: more and more companies will soon be issuing stablecoin-backed payment cards, and the rewards for using them will become increasingly attractive. That’s great news for card-loving consumers in Taiwan.

But as I read the news, a few questions came to mind. I personally own several crypto payment cards, yet I barely use them. The rewards aren’t as good as my regular credit cards, and I have to keep funds on an exchange. Plus, almost no one around me is actually using these cards. It made me wonder—what exactly do Visa and Mastercard see in this space? Why are they so eager to integrate blockchain technology? Who really benefits from launching stablecoin payment cards? After digging into a few interviews and charts, I came to a conclusion—stablecoin payment cards are about to explode in popularity!

The Turning Point for Stablecoins

I recently came across an article by the Federal Reserve Bank of Atlanta, in which the author highlighted how the role of stablecoins has evolved in recent years:

“When I first heard about stablecoins, they were just a niche tool used by crypto traders to avoid price volatility. Today, stablecoins are entering the mainstream and showing up in unexpected places—food delivery services, gas stations, and retail stores. This transformation made me wonder: how did stablecoins go from being a safe haven for crypto investors to a reliable means of payment?”

The article points out that blockchain’s ability to enable real-time settlement is a key reason behind the rise of stablecoins—but that’s only part of the story. After all, Tether launched its U.S. dollar stablecoin, USDT, as far back as 2014. Why has it taken nearly a decade for people to begin using stablecoins for payments?

I believe there are three major catalysts:

- Regulatory clarity

- Lower transaction fees

- Integration with payment networks

With Circle filing to go public 1, issuing stablecoins is no longer a shadowy, underground business. More than half of all stablecoins are circulated within the Ethereum ecosystem, but prior to Ethereum’s Dencun upgrade 2 in 2024, transaction fees were prohibitively expensive. Just recently, when collecting dues for our Web3 badminton club 3, one member asked to pay via Tron, explaining that “Ethereum gas fees are too high.” This shows many still haven’t realized that Ethereum’s costs have significantly dropped.

In practice, the biggest hurdle has been that merchants are unwilling—or unable—to accept stablecoins. That changed with the involvement of Visa and Mastercard. By issuing crypto payment cards, they’ve solved the onboarding pain for merchants. The most well-known example is the CRO Visa Card issued by Crypto.com. Though it functions like a traditional card, the user is actually spending crypto at the point of sale.

Interestingly, crypto payment cards were originally intended to help traders “spend their gains” from Bitcoin. But over time, it became clear that no one actually wants to spend their Bitcoin—what they’re spending are stablecoins. That’s what finally connected the dots between stablecoins and payment cards.

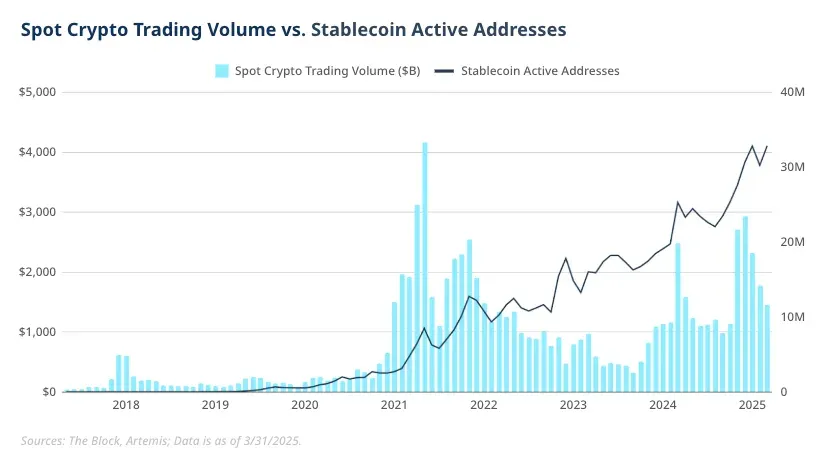

The light blue bars in the chart above represent spot trading volume for cryptocurrencies, while the dark blue line indicates the number of active stablecoin addresses. As you can see, regardless of market conditions, the number of stablecoin users continues to rise. Stablecoins have evolved beyond their original purpose as a hedging tool for trading and are now becoming a means of everyday payment.

That said, most of us probably know very few people who actually use crypto payment cards. So who, exactly, is using stablecoins for payments? After experiencing this week’s fluctuations in Taiwan’s foreign exchange market, the answer may be more relatable than ever.

Emerging Markets

Over the past week, the New Taiwan dollar appreciated by 10%, causing a rush to currency exchange counters, and even online banking platforms were overwhelmed, requiring users to queue for access. While people in Taiwan were eager to snap up cheap foreign currencies, the situation in Latin America was the exact opposite.

Take the Argentine peso as an example. Last month, 1 peso could be exchanged for 0.00093 USD, but today it only gets you 0.00084 USD—a 10% depreciation. The chart below shows the peso’s exchange rate against the U.S. dollar over the past 20 years, revealing a staggering devaluation of over 99%. Looking at the chart alone, some might even mistake it for the price history of a meme coin.

Argentinians are also scrambling to buy foreign currency—not to snag a deal, but to prevent their hard-earned wages from evaporating. This gives U.S. dollar stablecoins a completely different meaning in Latin America. They serve as vital tools for storing value, and when paired with a payment card, can also be used for daily expenses. That brings us to Visa’s major announcement last week:

Global payments leader Visa and Bridge, a subsidiary of Stripe, jointly announced a new product today. Developers using Bridge can now integrate a single API to offer Visa debit cards connected to stablecoins for end users across multiple countries. This allows new cards to be issued in several countries, starting with Argentina, Colombia, Ecuador, Mexico, Peru, and Chile. The goal of issuing cards in Latin America is to meet the growing demand from consumers and businesses to store value and make everyday purchases using stablecoins. This service will expand to Europe, Africa, and Asia in the coming months.

A key player mentioned in the press release is Bridge 4, a behind-the-scenes facilitator of stablecoin payments that Stripe acquired for a hefty sum last year.

There may already be companies in Argentina that have issued crypto Visa cards, but these early pioneers had to do all the heavy lifting—managing users' crypto assets, and figuring out how to convert those assets into a format Visa accepts. For example, if a user holds USDT on the Tron blockchain but Visa only accepts USDC on Ethereum, several layers of conversion are required. It's already a hassle for individuals to handle such conversions, let alone for companies to do it at scale for each user. No wonder early crypto Visa card issuers were mostly exchanges—they were already used to handling money, token swaps, and cross-chain transactions.

Thankfully, Visa’s announcement simplifies the process. Companies wanting to issue stablecoin payment cards can now just plug into Bridge’s API. The backend tasks—swapping tokens, bridging chains—are all handled by Bridge. This is especially good news for wallet providers and banks or payment services that want to manage crypto assets on behalf of users. All they need to do is debit the user’s wallet or account; Bridge will handle the rest. As the barrier to issuing cards drops, more players are likely to join the fray.

Latin America is the first to benefit. Crypto wallets and exchanges have already become the de facto underground banks for locals. Integrating with Visa’s payment network transforms stablecoins from mere savings instruments into tools for everyday spending.

There’s also upside for Taiwan. The government recently greenlit financial institutions to custody crypto assets. If a Taiwanese bank wants to issue a stablecoin Visa card in the future, all it has to do is integrate with Bridge. It’s very convenient. However, I don’t expect progress to be fast—most Taiwanese still lack a strong incentive to convert their assets into on-chain stablecoins for hedging. People care more about crypto prices than utility.

Interestingly, Visa’s head of crypto, Cuy Sheffield, said at a forum that Visa is becoming like a Layer 2 network on Ethereum. If that metaphor becomes reality, the price action in crypto likely won’t stay stagnant.

Visa as a Layer 2 Network

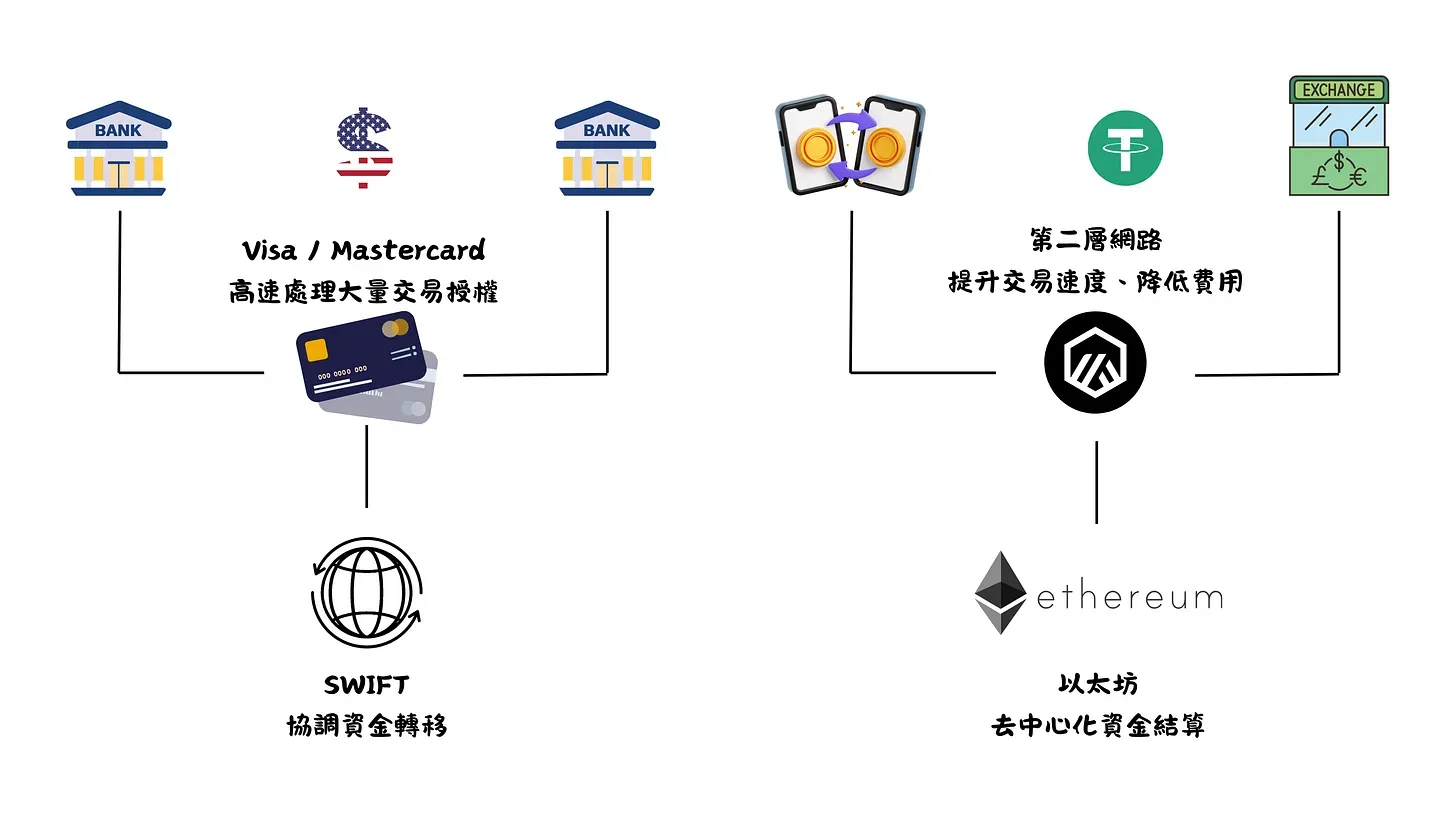

Cuy Sheffield explained that even though Visa can process 75,000 transactions per second, it can’t move funds in real-time because it still relies on the SWIFT messaging system. But once Visa understood how stablecoins and blockchain worked, it suddenly saw itself as similar to a Layer 2 network on Ethereum. After a user taps their Visa card at a coffee shop to authorize a payment, the actual movement of funds becomes far more efficient when done via blockchain.

One night before bed, I found myself wondering—what if the world isn’t how I imagine it to be? What if Bitcoin is ultimately a scam, Ethereum is only usable by a handful of people, and all those Web3 applications end up like NFTs—dead and forgotten? After all, if these things were to vanish tomorrow, it doesn’t seem like life in Taiwan would be all that different.

But after finishing this article, that “what if” scenario feels a little less likely. There really are people in the world who need stablecoins, and the two largest payment networks on the planet are actively integrating blockchain, turning it into essential infrastructure. Ethereum’s recent Pectra upgrade 5 6 over the past couple of days promises to further improve the user experience. Sure, crypto prices still look pretty stagnant—but if price eventually reflects the significance of blockchain, then this discount sale may not last much longer. Maybe.

1 Circle Files for IPO: The First Public Stablecoin Company and Its Competitive Moat

2 Ethereum’s Most Impactful Upgrade Is Here! Dencun Cuts Fees Tenfold and Unlocks New Business Models

3 Shuttlecock Meets Web3: Why I Started a Web3 Badminton Club

5 Ethereum’s Pectra Upgrade (Part 1): Giving Smart Powers to Private Key Wallets