Winter Member Gathering | RWA Stablecoin Decouples: Blocktrend Stablecoins Backed by Real Estate, Yielding Rental Profits in USD

#569

GM,

I have two announcements to make. Next Tuesday, I have scheduled a honeymoon trip to avoid upsetting my partner 🤫, so Blocktrend will be on a 2-week hiatus. Every year, I reserve a period for a year-end break for Blocktrend to readjust my life's rhythm. Even though I'm using up the year-end break period early this year, the publication will resume on 11/7 (Tuesday).

The first major event after the resumption in November will be the registration for Blocktrend's Winter Member Gathering. The Winter Member Gathering will be held on 11/25 (Saturday) afternoon, tentatively at the Google office in Taipei 101. The registration form will be open for registration at 12 pm on 11/9 (Thursday), and the event is free for members only. Those interested, please reserve the afternoon of 11/25 and fill out the registration form at 12 pm on 11/9.

Moving forward, I will also remind readers of this matter at the beginning of each article. Now, let's get to the point.

Recently, Blocktrend discussed MakerDAO's introduction of Real World Assets (RWA) to issue the DAI stablecoin, engaging in the lending business akin to that of a bank. Many have seen the glamorous side of RWAs but failed to recognize the underlying risks.

Last week, a RWA stablecoin, Real USD ($USDR), which is backed by real estate, experienced a significant decoupling in price, plummeting to half its value—each USDR stablecoin was only worth 0.5 USD. This article discusses how the USDR stablecoin operates and the risks associated with RWA stablecoins.

Pawnshop on the Chain

USDR is the fourth-largest DeFi project in terms of funds on the Polygon chain, surpassing well-known applications such as Compound, Curve, and Balancer. The issuing organization behind USDR, TangibleDAO (hereinafter referred to as Tangible), has tapped into the hottest topic in the current cryptocurrency circle — RWA stablecoins — by using physical assets as collateral to issue a USD stablecoin:

Tangible is an ecosystem that tokenizes real-world assets. Through the native income stablecoin USDR, backed by real estate, we tokenize real-world assets, fractionalize them, and create profit opportunities for users. Anyone on Tangible can use USDR to purchase physical goods. When people shop on Tangible, they receive an NFT representing the physical product, known as a TangibleNFT. These physical goods will be delivered to Tangible's secure warehouse and the NFT will be sent to the buyer's wallet.

In essence, Tangible functions as a pawnshop on the chain. People bring in assets such as cars, gold, or real estate contracts to pawn for a loan, with agreed-upon repayment terms and interest. If the repayment agreement isn't honored, the collateral becomes forfeited and is sold by the pawnshop.

Tangible has essentially digitized the pawnshop business, transitioning it from the physical world to the digital realm. However, while in the past people took home physical cars, gold, or luxury watches, Tangible issues digital NFTs to pawnshop buyers as proof of ownership. Tangible ensures that the NFTs can eventually be redeemed for physical goods, but encourages buyers not to redeem them if possible, to maximize potential returns.

The pawned items can range from fine wines, gold bars, and luxury watches to real estate, but the most popular items on Tangible are real estate contracts. This is because while investing in other pawned goods relies on the anticipation of selling them at a higher price in the future, investing in real estate NFTs not only presents the opportunity for capital appreciation but also enables investors to earn rental income during the holding period, making it even more enticing.

Taking the example of the red brick house in the top left corner of the image, Tangible claims it can generate approximately 500 USDC in rental income every month. If you hold a 1/10 share of the property's NFT, you would receive 50 USDC monthly.

So far, Tangible's operations have been relatively straightforward, running a pawnshop on the chain and using NFTs to bring physical-world investment targets into the digital realm. Individuals simply need to purchase fractionalized NFTs on Tangible to acquire corresponding income from the physical world.

However, Tangible's operations are not limited to running a pawnshop on the chain. In 2022, it also launched the USDR stablecoin based on real-world assets. Apart from being backed by real estate, USDR offers an annualized yield ranging from 8% to 15%.

RWA Stablecoins

The most familiar stablecoins, USDT and USDC, are primarily backed by the US dollar and U.S. Treasury securities, with holders not receiving any income. Tangible, on the other hand, uses real estate as the reserve for the USDR stablecoin, converting rental income from the real estate into profits distributed to holders. According to Tangible's description:

USDR is primarily collateralized by income-generating real estate tokens, making it the first yield-bearing, over-collateralized stablecoin pegged to the US dollar. Tokenized assets managed by USDR generate rental income, which is paid out daily to the holders. While real estate prices may fluctuate in the short term, compared to cryptocurrencies, fiat currencies, and most other commodities, real estate is one of the most stable stores of value currently available.

Acquiring USDR is quite straightforward: by depositing 1 DAI into Tangible's smart contract, one can mint 1 USDR and start earning profits. These DAI are used to purchase real estate NFTs for regular rental income, which Tangible then distributes among all USDR holders. Buying USDR is akin to becoming a landlord on the chain, with Tangible acting as the property management company responsible for handling the cash flow and management.

Tangible does not guarantee rental income, which is relatively healthier and sustainable compared to the 20% yields generated by subsidies from UST and Anchor Protocol in the past. The worst-case scenario is that holding USDR would yield no additional income—what could go wrong? Many investors have thus converted their DAI into USDR to become online landlords, earning an annual yield of 8% to 15%.

However, last week, the USDR price drastically decoupled, plummeting from its pegged value of 1 USD to 0.5 USD. Presently, the price continues to fluctuate between 0.5 USD and 0.6 USD. This turn of events has alerted everyone to the risks associated with RWA stablecoins—the underlying asset composition of USDR was unable to withstand significant redemptions within a short period.

User Redemptions can be considered the number one killer of stablecoins, and the risk tolerance of RWA stablecoins is even worse than that of other stablecoins. The death spiral of UST stablecoin is the most classic example. Even USDC stablecoin, the second largest in terms of market capitalization with a substantial reserve of US dollars and US Treasury bonds, experienced a decoupling in early 2023 due to the collapse of a US bank and difficulties in coping with significant redemptions within a short period.

During peacetime, USDR could function both as a USD stablecoin and also bring additional income to holders. However, the allure of these returns happened to be a key factor contributing to USDR's inability to cope with the redemptions. Tangible used all the DAI deposited to acquire income-generating real estate NFTs, but it wasn't as easy to sell the real estate NFTs and convert them back into DAI.

Last week, USDR was suddenly redeemed in large quantities. No one knew the exact reason, but the recent global real estate market fluctuations due to China's Evergrande and Country Garden might have led some investors to worry that the real estate-backed USDR stablecoin had insufficient collateral, and rental income might not be enough to cover it, prompting them to redeem their USDR holdings massively.

Unfortunately, the redemption mechanism is the most vulnerable part of USDR. When USDR holders want to redeem large amounts, Tangible may not have enough DAI on hand to fulfill these requests, causing market panic. Immediately, Tangible reassured everyone, stating, "Don't worry! We still have a lot of real estate on hand, and it's not going anywhere." However, no one knew how much time it would take for Tangible to sell the real estate and convert it back to the originally deposited DAI.

In the current environment and under time pressure, the selling price of real estate is likely to be less than expected. People didn't want to be the last one holding the bag and began selling USDR stablecoins at a discount, exacerbating the price drop.

Moreover, people discovered that the reserve behind USDR was not only DAI and real estate NFTs but also included some crypto tokens TNGBL issued by Tangible itself. This was the most unreliable and worthless collateral.

RWA Risks

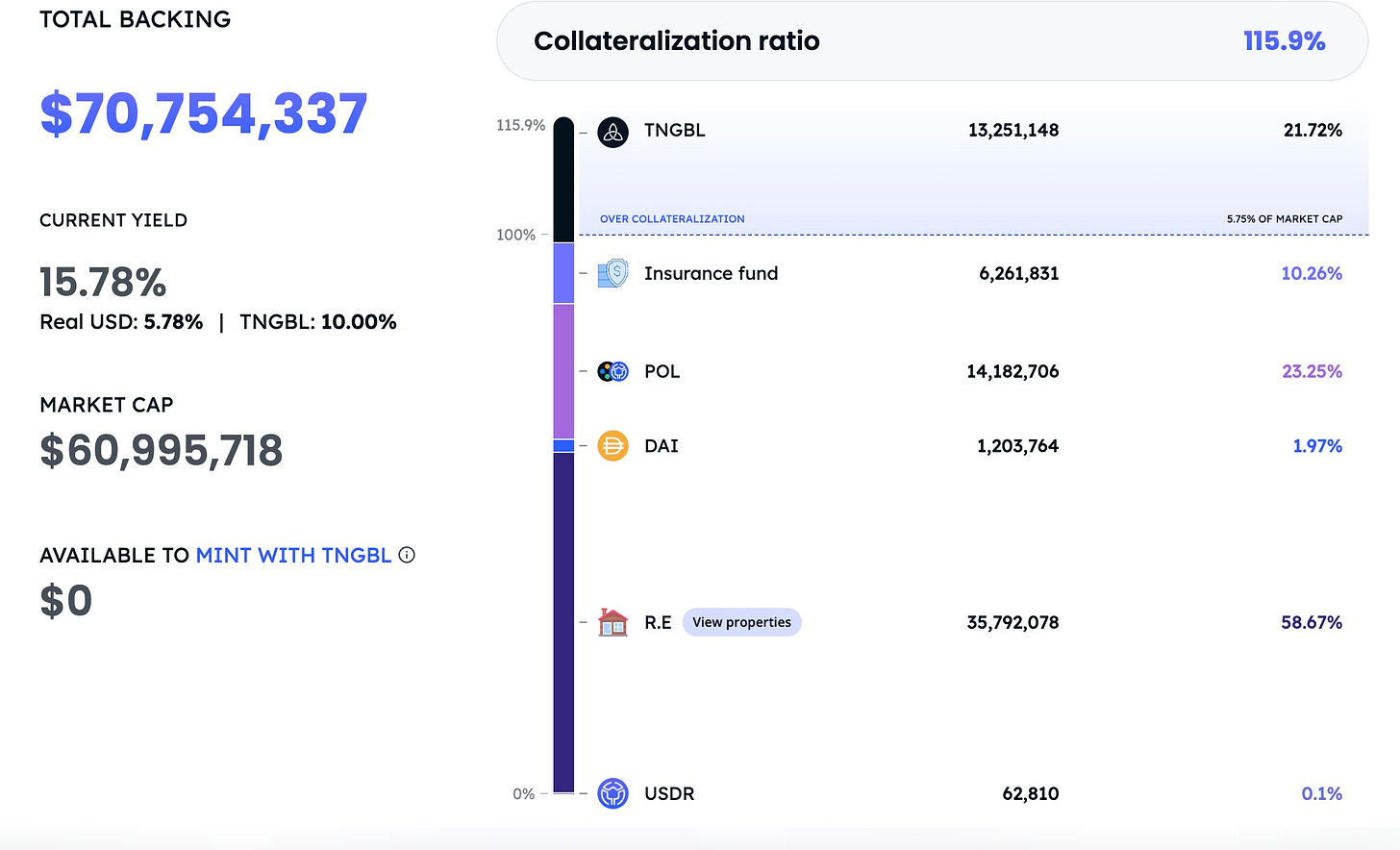

Below is a screenshot of the scene when USDR was redeemed last week, as shown in the upper right corner of the image. The collateralization ratio of USDR at that time was 115.9%. In other words, the reserve assets of USDR exceeded its liabilities, indicating no need to panic. However, 21.72% of it was comprised of TNGBL tokens issued by Tangible, which meant the truly valuable assets were less than 100%, and the immediately available assets were even less. This made investors concerned whether they were earning interest but losing their principal with their USDR holdings.

It's an open secret that TNGBL serves as collateral behind USDR, which Tangible proudly displays on its website, setting a cap on the collateralization of TNGBL. Clearly, the Tangible team was aware of the risks involved in using TNGBL as collateral for stablecoins, but they still chose to take the risk as it forms the business model for issuing USDR.

The higher the proportion of TNGBL in the USDR reserve, the more Tangible can profit. In theory, all USDR should be minted by individuals holding DAI at a 1:1 ratio, thus the reserve should be 100%. If we deduct the TNGBL proportion from the collateralization ratio of 115.9% in the image, we are left with 94.18%. The remaining 5.82% is essentially the money that the Tangible team borrowed from users based on TNGBL. The income generated from this money is Tangible's revenue.

However, even if the Tangible team did not use TNGBL tokens as collateral, the inherent design of RWA stablecoins would not be able to cope with significant redemptions within a short period. As long as Tangible cannot liquidate all the real estate NFTs on hand in a short period, decoupling of the price is inevitable.

Furthermore, some have questioned whether Tangible's rental income is essentially a Ponzi scheme, which is also a common vulnerability that RWAs often face. While Tangible clearly lists the location of each property and the rental income it can generate on its website, the cash flow is only partially recorded on the chain, as it is not practical to demand that tenants pay their rent in cryptocurrencies. For investors, it's difficult to verify whether the income from holding USDR comes from real rental income or is merely a case of using new investment to pay off previous investors.

The future development potential of RWA may be considerable, but it is not a native asset on the chain. Tangible originally hoped that real estate could appreciate in the long term while also generating rental income for holders. However, the transaction efficiency of physical assets is still not as efficient as digital assets, and the trustworthiness of the institutions assisting in the on-chain process is also a question. For stablecoins to be valuable, they must be able to survive for a long time, and their ability to withstand significant redemptions within a short period is the key to their survival. Unfortunately, USDR might win in the future but is losing in the present.

Blocktrend is an independent media outlet sustained by reader-paid subscriptions. If you think the articles from Blocktrendare good, feel free to share this article, join the member-created Discord for discussion, or add this article to your Web3 records by collecting the Writing NFT.

In addition, please recommend Blocktrend to your friends and family. If you want to review past content published by Blocktrend, you can refer to the article list. As many readers often ask for my referral codes, I have compiled them into a single page for everyone's convenience. You are welcome to use them.