Visa Clears the Final Milestone for Stablecoin Payments: Merchants Enable USDC Acceptance, Support Solana Blockchain

#559

GM,

Have you recently felt the subdued atmosphere in the cryptocurrency market? With cryptocurrency prices hanging by a thread, traders taking a temporary hiatus, and key opinion leaders (KOLs) gradually venturing into other domains, it's been quite a lackluster period. During my recent attendance at events, I've also noticed people expressing concern about the Blocktrend. Some have been incredibly supportive, encouraging me by saying that Blocktrend is a vital barometer, and we must endure through this bear market 🤣.

While we don't know exactly how much longer the bear market will persist, it should be manageable to weather this downturn. Recently, Blocktrend has been actively producing new content and will be launching its first YouTube video this week. We will notify everyone as soon as it goes live. Now, let's get to the point.

I personally speculate that we are already well past the halfway point of this bear market, and now we find ourselves in the darkest moments just before dawn. Even though the sun has not yet risen, there is still a glimmer of starlight in the night. This article discusses how Visa is clearing the final hurdle for stablecoin payments.

The Broadband Era

Last week, Blocktrend likened the blockchain space to the era of dial-up internet, emphasizing that blockchain is still in its "dial-up era." However, with lower on-chain costs and a growing number of applications, the beginning of the next bull market is not far off.

Recently, another article used the analogy of the"Blockchains are entering their 'broadband era'." The internet emerged as the ultimate winner, and blockchain is poised to follow suit.

At first glance, the title might lead one to think this is another article by a venture capitalist, expressing unwavering optimism about blockchain development during a cryptocurrency bear market. However, the author is none other than Cuy Sheffield, the head of cryptocurrency at Visa, one of the world's largest payment networks.

This article was indeed published on the Visa website, reflecting the company's perspective:

In the early days of the internet's development, mainstream media often featured comments that ridiculed the recently emerged technology innovation known as the internet. For some, the concepts associated with the internet seemed laughable, such as the idea of remote work, one-click dinner reservations, or online shopping.

The reason others didn't find these statements absurd at the time was because people generally assumed that the world would continue to function as it always had. Shopping meant going out, and the internet was merely an experimental playground for bookworms and tech enthusiasts. Today, blockchain shares some similarities with the early internet, especially when it comes to doubt and mockery. Whenever analysts claim that blockchain is too slow, too expensive, too difficult to use, or lacks any use cases, it inevitably brings to mind those confident echoes of the past.

Indeed, blockchain was once in such a state, but the internet was also slow, expensive, and challenging to use in its early days. Now, the internet has become fast enough to livestream from space, affordable enough to provide free access in many places, and user-friendly to the point where 6-year-olds can navigate it. Visa has been researching payment technology for over 60 years, and we recognized its potential during the early days of the internet, using it to conduct business. Today, we see that blockchain holds tremendous potential and offers many promising possibilities for the future.

There are only a few companies globally that dare to claim a deeper understanding of payments than Visa. Visa is also one of the most proactive players in the industry when it comes to utilizing blockchain technology for global cross-border settlement in the payment network.

In 2021, Blocktrend previously discussed Visa's news about opening up settlement transactions with USDC for issuers. However, at that time, I pointed out in the article that this was only half of the equation; Visa still needed to enable merchants to accept USDC directly for full cryptocurrency support.

Just last week, Visa finally announced the expansion of USDC settlement capabilities to acquirers. This not only clears the final hurdle for stablecoin payments but also represents a significant milestone in USDC's integration into the mainstream payment ecosystem.

Visa Settlement with USDC

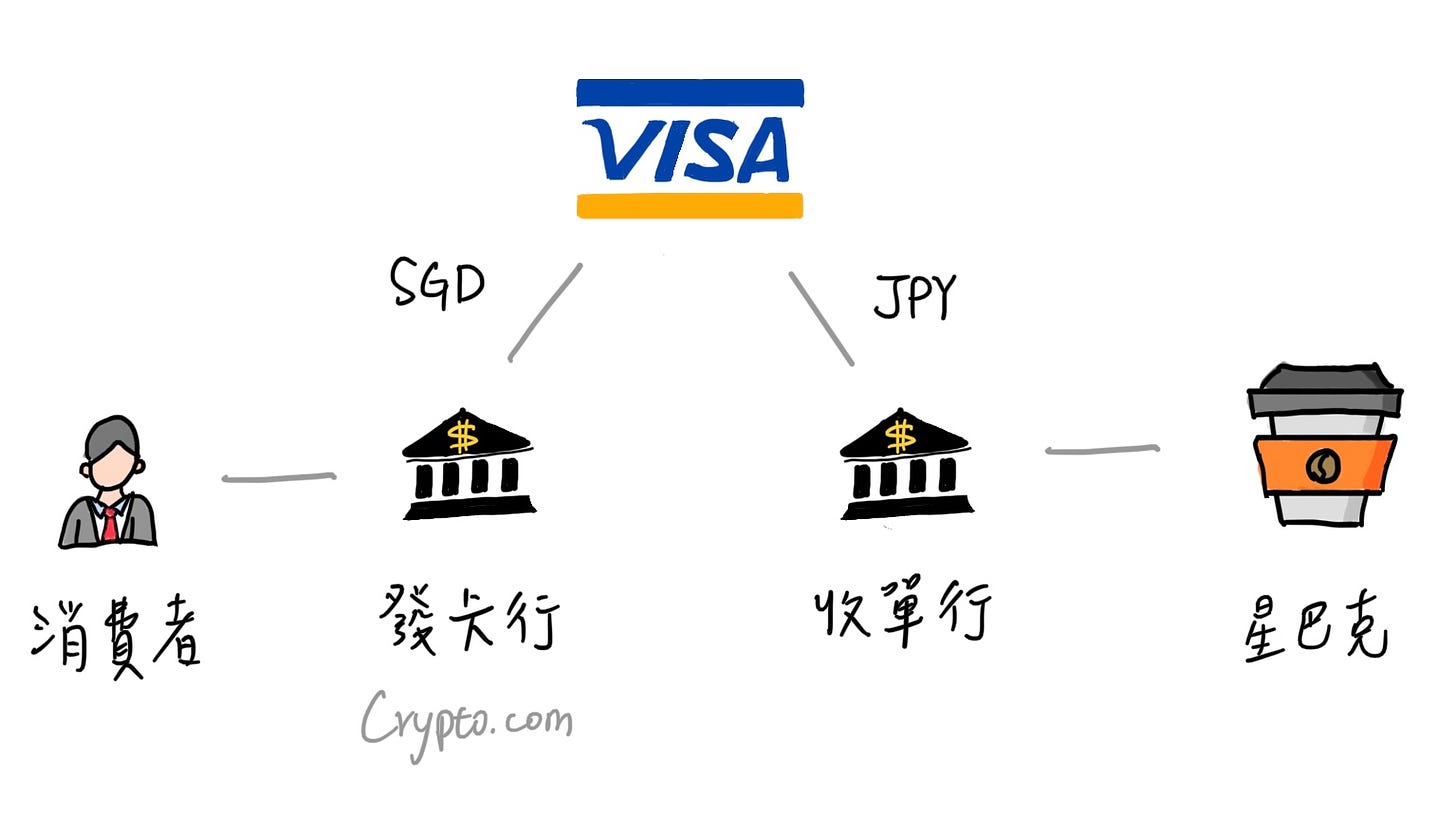

Even for those who use credit cards every day, the settlement process behind each transaction may not be entirely clear. Let me explain with the help of an illustration.

Suppose I have a Visa card issued by Crypto.com and I use it to buy coffee at Starbucks in Japan. After I swipe or tap my card at the counter, Starbucks will request payment from their affiliated bank (the acquiring bank). The acquiring bank, in turn, will initiate a payment request through Visa to the consumer's bank (the issuing bank). Finally, the issuing bank will tally up the charges on my card.

At this point, my mobile device will notify me of the amount I spent at Starbucks in Japan, and I'll await the billing statement to settle the card payment later.

Originally, the entire settlement process was conducted in fiat currency—Crypto.com paid Visa in Singapore Dollars, and Visa converted the funds into Japanese Yen before transferring them to Starbucks.

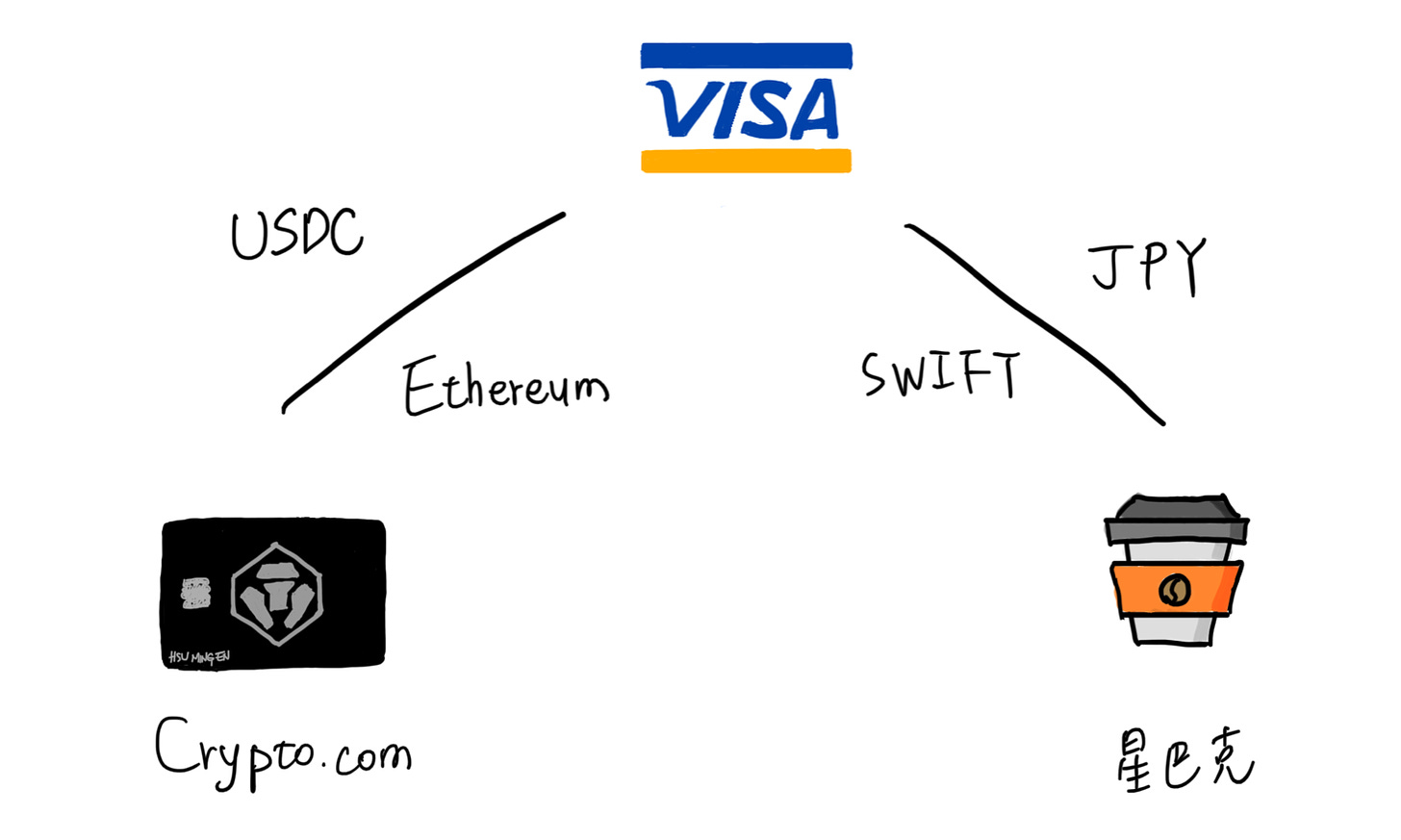

However, starting in 2021, Visa began experimenting with the integration of USDC stablecoins and the Ethereum blockchain into the settlement process. Visa pioneered this approach by allowing Crypto.com to settle payments directly in USDC through Ethereum, which proved to be more efficient than the traditional method. Once Visa receives USDC, it converts the stablecoin into US Dollars and then uses the SWIFT international transfer system to pay Starbucks in Japanese Yen. Starbucks only needs to receive the funds; Visa's billing process with Crypto.com becomes inconsequential.

However, at that time, it was limited to small-scale testing between Visa and a few cryptocurrency institutions. Even financial institutions might have only become aware of Visa's support for blockchain and cryptocurrencies through news reports. It wasn't until last week when Visa announced the expansion of its stablecoin settlement feature to acquiring institutions. In other words, if Starbucks chooses to do so in the future, they can also opt to accept payments in USDC. This represents a significant advancement, as per Visa's press release:

Although Visa is still testing the reception of on-chain funds from multiple issuing institutions, having new settlement tools like USDC enables Visa to send on-chain funds to acquiring institutions like Worldpay and Nuvei, expediting the settlement times for merchants.

Worldpay and Nuvei are cross-border acquiring institutions that provide services to businesses across various industries worldwide. This includes many businesses that engage frequently with blockchain and the crypto economy, such as gateway providers, gaming companies, and NFT markets. They may be more inclined to receive payments in stablecoins rather than traditional fiat currencies. Visa can settle with Worldpay and Nuvei using USDC through its Circle account, and then these institutions can forward the USDC funds to their respective end merchants.

The 16-second animated short film below perfectly explains Visa’s initiative.

In the past, only companies that could act as custodians for cryptocurrencies on behalf of their customers and were also capable of issuing Visa cards, such as Coinbase, Crypto.com, or Binance Exchange, had the opportunity to participate in Visa's USDC testing. Businesses like Starbucks had no choice but to accept payments in various national fiat currencies. However, in the future, as long as the acquiring institutions partnered with by businesses are Worldpay or Nuvei, merchants can choose to accept USDC payments, regardless of whether consumers pay with fiat currency or cryptocurrency.

It's not difficult to imagine that the number of businesses willing to accept USDC payments worldwide will be much higher than the number of cryptocurrency exchanges capable of issuing Visa cards. In the future, Visa is likely to collaborate with other acquiring institutions to enable more merchants to choose to accept USDC.

Visa's initiative carries two layers of significance. Firstly, it signifies that USDC has become the "Web3 fiat currency" in Visa's perspective. In the future, USDC will be treated like any other fiat currency within the Visa payment network, becoming the preferred currency for "Web3 citizens."

Furthermore, this also indicates that Visa will begin using blockchain technology to replace the SWIFT international wire transfer system. In the past, SWIFT was the most critical financial network for financial institutions, and most interbank transfers were conducted through wire transfers. Being excluded from SWIFT meant isolation from global financial institutions. However, in recent years, there have been many criticisms of SWIFT internationally, with concerns that it has transitioned from a simple financial organization to a diplomatic weapon. Blockchain represents a new payment network with greater efficiency than traditional wire transfers. With Visa's support, blockchain has the potential to become an equally important international financial network as SWIFT.

However, in recent years, Visa faced challenges in its stablecoin experiments. Until 2023, Visa only recognized USDC on the Ethereum blockchain, and during bull markets, mining fees may not have been cheaper than SWIFT's wire transfer costs. Visa is aware of this issue and has therefore announced support for USDC on the Solana blockchain in this latest announcement to reduce on-chain costs.

Support for Solana

According to Visa's press release:

With more users utilizing Visa's stablecoin settlement feature, there is a growing need for a high-performance blockchain that offers faster speeds and lower costs for sending and receiving stablecoins. Therefore, Visa has chosen Solana as its new settlement payment network. Solana can process an average of 400 transactions per second and can even handle up to 2,000 transactions per second during peak periods, making it suitable for various payment scenarios.

Seeing Visa support Solana, many in the cryptocurrency community who have witnessed Solana's temporary outages might be skeptical. Whether Solana is up to the task will likely depend on real-world testing results, but I am particularly interested in the last sentence of Visa's press release.

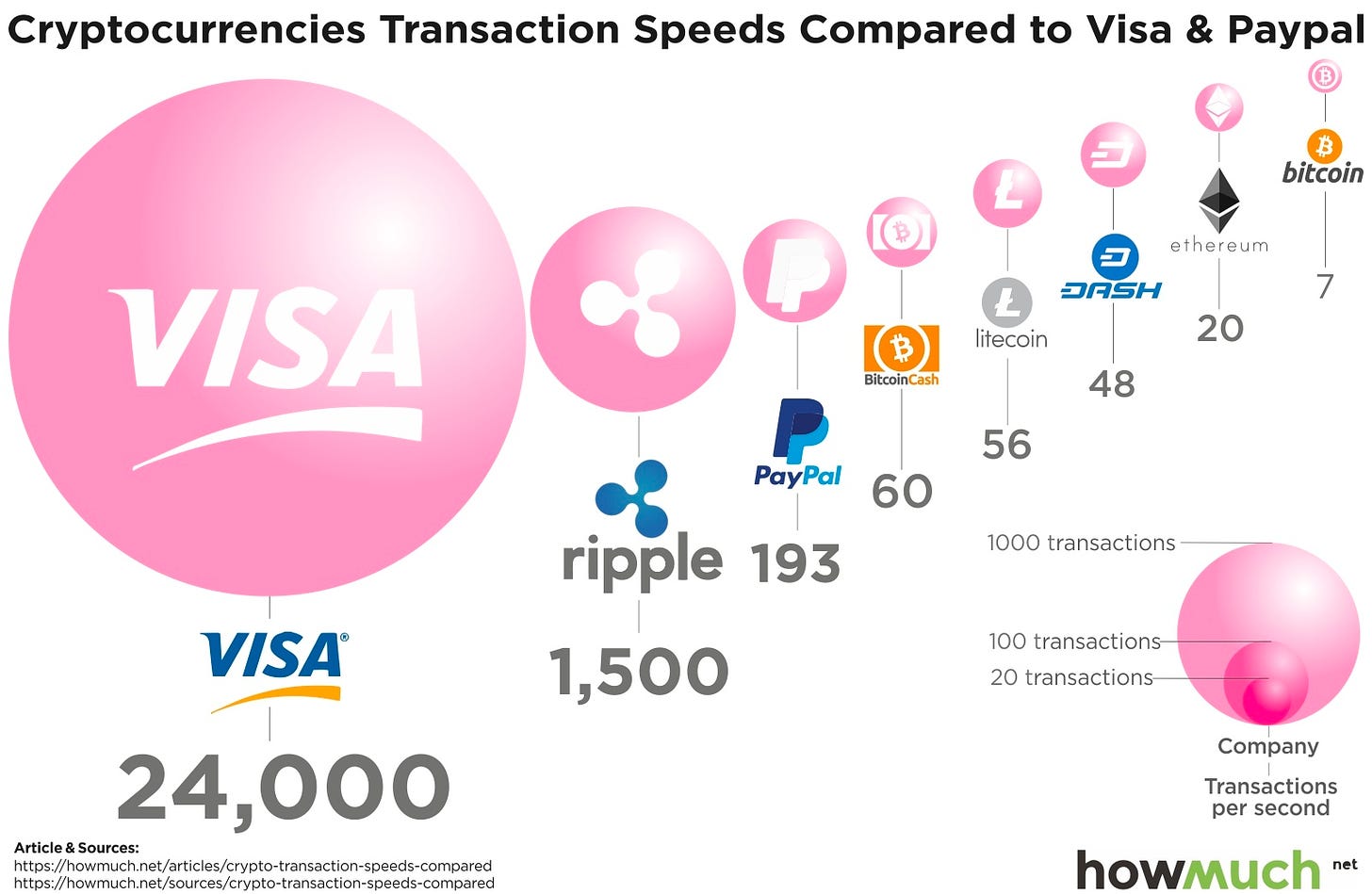

As Cuy Sheffield, Visa's Head of Crypto, mentioned, many people have the impression that blockchain is slow, expensive, and difficult to use. Perhaps you've even seen the image that compares the efficiency of different payment methods based on the size of the circles. Many critics use this image to say, "Blockchain is so inefficient; it can't compare to Visa!"

Surprisingly, Visa has publicly stated that Solana's performance is already up to par. Regardless of whether Visa is more tolerant of blockchain or if its processing efficiency is nearly 2,000 transactions per second, as Ethereum's second-layer solutions mature and software upgrades occur, blockchain speeds are bound to increase. Meeting real-world usage demands is ultimately not a difficult task.

Although we are currently in a bear market in the cryptocurrency space, compared to the previous bull market, there are more and more applications being built on blockchains that offer faster speeds and lower transaction fees or on Ethereum's Layer 2 networks. Perhaps uploading to the blockchain is not as easy as accessing the internet right now, but as blockchain transitions from the "dial-up era" to the "broadband era," it's only a matter of time before even 6-year-olds can easily navigate it.

Blocktrend is an independent media outlet sustained by reader-paid subscriptions. If you think the articles from Blocktrendare good, feel free to share this article, join the member-created Discord for discussion, or add this article to your Web3 records by collecting the Writing NFT.

In addition, please recommend Blocktrend to your friends and family. If you want to review past content published by Blocktrend, you can refer to the article list. As many readers often ask for my referral codes, I have compiled them into a single page for everyone's convenience. You are welcome to use them.