GM,

This is the second-to-last article of 2024, with the next one scheduled for release on the final day of the year. The main focus of this article is Safenet, a project that has just entered its development stage. However, its emergence seems to herald a significant transformation for Ethereum in 2025—a 180-degree shift from integration to fragmentation back to consolidation after fragmentation. In this article, I’ll first explain the problem Safenet aims to solve and then explore how it could become the Visa payment network of the blockchain.

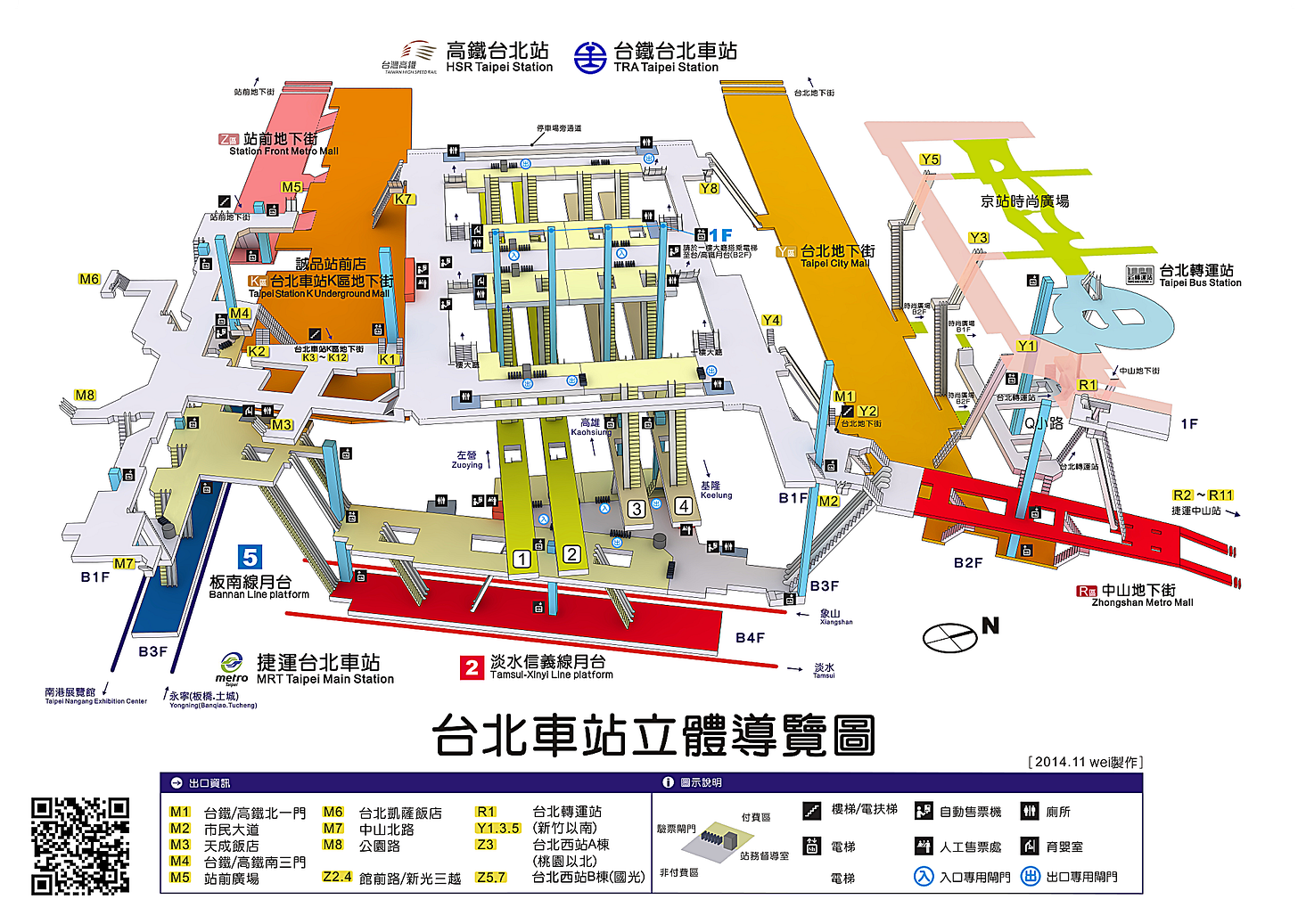

Taipei Main Station

Taipei Main Station resembles a giant maze. It houses bus, train, MRT, and high-speed rail stations, along with several underground malls named by letters. Even with signage, it’s easy to lose your way. But compared to Ethereum’s current state, Taipei Main Station seems like child’s play. Ethereum hosts over 100 transportation systems, and navigating through it to find an exit and reach your destination isn’t easy.

The development history of both is also quite similar. Taipei Main Station was originally just a train and bus transfer hub. In 1980, the MRT system was added, followed by the high-speed rail in 2007. While these systems reduced the cost of mobility, they also significantly increased the complexity of transfers, with each system having its own ticketing counters and platforms.

Before 2020, Ethereum was relatively straightforward, with traffic congestion being its biggest issue. To address the surge in usage, developers gradually built Ethereum's second-layer networks (L2s) to alleviate the crowds. Each of these newly established "transportation systems" has its unique features—some focus on low fees, others on faster transactions, and still others on enhanced security. While the congestion problem was resolved, Ethereum became a digital maze in the process.

In recent years, Taipei Main Station improved its issues with clearer signage, but the digital maze of Ethereum can be addressed with more advanced solutions. Enter Safenet, the protagonist of this article. Safenet aims to create a "Dokodemo Door" for the blockchain, allowing users to effortlessly reach their destination simply by specifying it.

Safenet's Dokodemo Door

Safenet aspires to become the Visa payment network of the blockchain because Visa itself is essentially a "Dokodemo Door" for money. For instance, when I use a Visa card to buy coffee at a Starbucks in Japan, it’s like telling a Dokodemo Door, "I want to pay Japan's Starbucks." The New Taiwan Dollars in my Taiwanese bank account are automatically converted into Japanese Yen and deposited into Starbucks Japan’s account. Transaction complete.

Without Visa managing cross-border transfers and currency exchanges for me, using a bank transfer to buy a Starbucks coffee in Japan would be expensive, slow, and cumbersome.

Cryptocurrencies face the same issue. The Safenet team realized that cross-chain transfers can be incredibly confusing. To address this, they proposed a decentralized money-processing network that connects blockchains, exchanges, and even Visa’s payment network. If Visa is a Dokodemo Door, then Safenet is a decentralized anywhere door. According to Safenet:

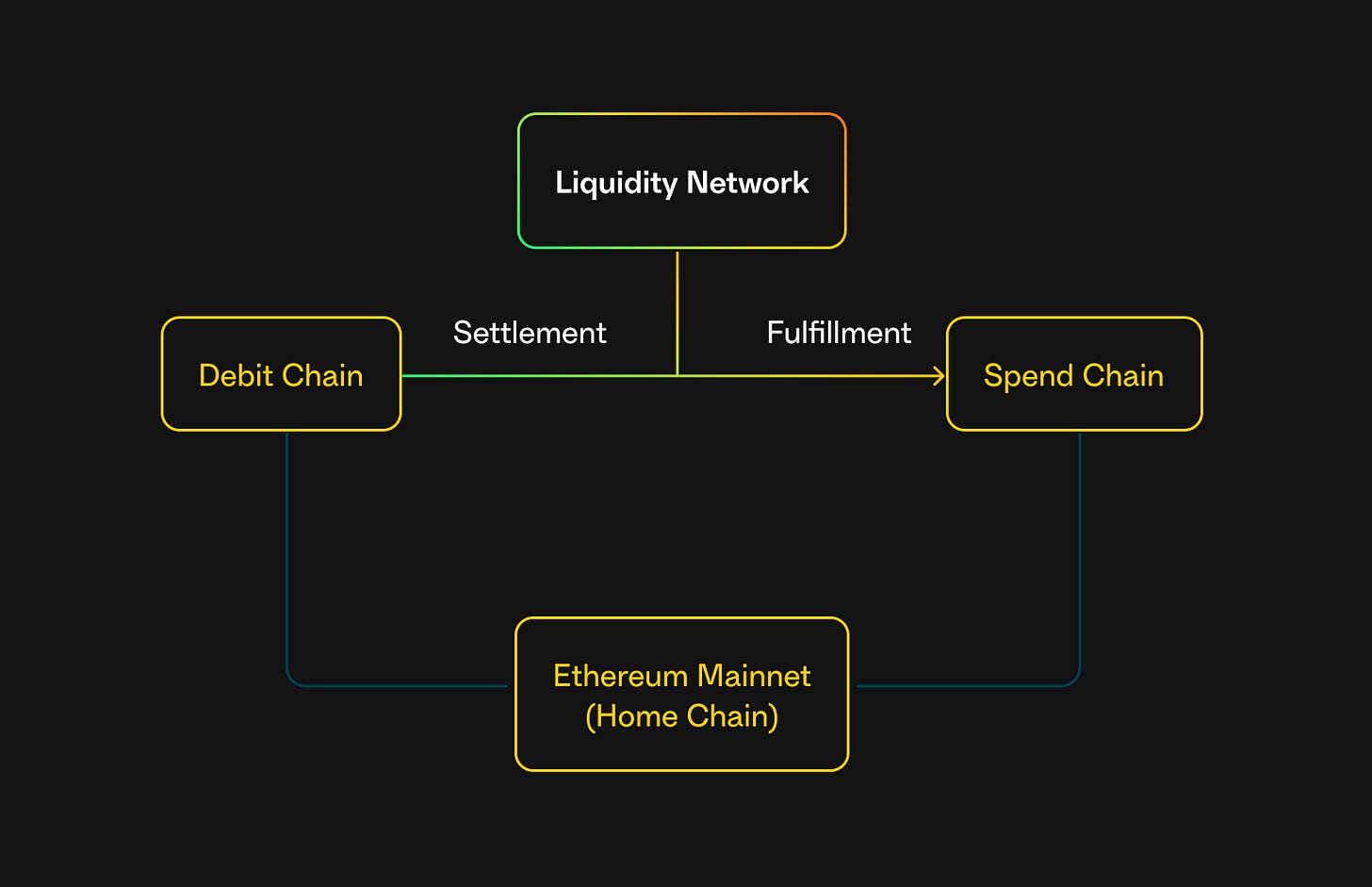

Safenet is not a blockchain, not a second-layer network, and not just a cross-chain bridge.

It is a transaction payment network built on Ethereum's mainnet. It can operate on any current or future blockchain and connect on-chain and off-chain networks, such as Visa or centralized exchanges. Safenet separates transactions from settlements, enabling users to interact with any supported blockchain protocol.

The "Dokodemo Door" effect is about making wishes come true, which is the ultimate experience Safenet aims to deliver. In the future, when people want to buy something, they won’t need to worry about whether their money is in a bank, an exchange, or on a specific blockchain. As long as it’s under your control, you’re good to go.

Safenet only needs to know that I have money and who I want to pay, and it will complete the transaction for me. This is a meteor-strike-level innovation. Once it happens, the entire ecosystem will be reshuffled. Existing services that help users connect disparate systems, such as cross-chain bridges and fiat-to-crypto card services, will all feel the impact.

The concept of an "anywhere door" is mysterious, but Safenet is not as complex—it simply implements Visa's operational logic in a decentralized way. Take cross-chain transfers as an example: when you want to transfer assets from Polygon to Solana, Safenet first locks the assets on Polygon and then arranges for someone to front the funds on Solana.

This is similar to buying coffee with a credit card. I can immediately take the coffee (transaction), but Starbucks won’t receive the payment (settlement) until a few days later. At the moment of purchase, all Starbucks has is Visa’s "guarantee." Trust-based systems are efficient but inherently fragile. Safenet replaces this trust with token staking as collateral. If I take the coffee and Starbucks doesn’t receive the money, someone will face a penalty—their staked tokens will be slashed to compensate for the loss. Visa’s advantage is speed; token staking provides trustlessness. Safenet combines both, ensuring speed and security.

Imagine a future where Taishin Bank and Binance are both Safenet members. You wouldn’t need to withdraw funds through a centralized exchange in Taiwan. Instead, Bitcoin could be directly deducted from your Binance account, with New Taiwan Dollars deposited straight into your Taishin Bank account. Conversely, renewing an on-chain ENS domain with New Taiwan Dollars would also become much simpler.

But is Safenet secure? That remains to be proven over time. What’s clear is that the financial sector is already transitioning from centralized to decentralized models. For example, banks adopting stablecoins for cross-border remittances rely on blockchain’s economic security.

If you believe in Safenet’s future, holding SAFE tokens is the most direct way to participate.

SAFE Tokenomics

Safenet was developed by Safe, one of Ethereum’s most reliable development teams. Their most well-known product is the Safe multisig wallet, favored by many enterprises and organizations. Even Vitalik Buterin uses it to safeguard his assets.

This year, the Safe team airdropped the SAFE token to users. Unfortunately, people soon realized it was just another governance token with limited utility, prompting many to sell it off. As a result, SAFE’s token price has struggled to gain traction.

Safenet aims to give SAFE tokens a new purpose. Institutions joining Safenet must stake a certain amount of SAFE as collateral. Token holders will also be able to stake SAFE to become validators and earn rewards. This transforms SAFE from a mere governance tool into the backbone of the entire payment network.

Still, I’m cautious about being overly optimistic. In its ideal form, Safenet would connect various heterogeneous systems, becoming the ultimate "Dokodemo Door" for money. However, where this door leads isn’t up to Safenet alone. Even if it successfully links multiple blockchains, it would essentially just be a faster cross-chain bridge. To unlock its full potential, Safenet must break into traditional financial institutions.

As a child watching Doraemon, I believed the Dokodemo Door could take me to any corner of the world. Growing up, I realized it only works within an open world.

Blocktrend is an independent media platform sustained by reader subscription fees. If you find Blocktrend's articles valuable, we welcome you to share this piece. You can also join discussions on our member-created Discord or collect the Writing NFT to include this article in your Web3 records.

Furthermore, please consider recommending Blocktrend to your friends and family. If you successfully refer a friend who subscribes, you'll receive a complimentary one-month extension of your membership. You can find past issues in the article list. As readers often inquire about referral codes, I have compiled them on a dedicated page for your convenience. Feel free to make use of them.