Blocktrend has been around for over 5 years since its establishment in July 2017. During this time, Blocktrend has published nearly 500 articles and 172 podcast episodes. Thank you to all members who have supported my full-time creation through paid subscriptions and helped me explore new possibilities.

If one day I announce that Blocktrend will refund everyone’s subscription fees with interest, please don’t be scared. This is not the end of Blocktrend’s operations, but rather, I am trying out a new possibility — Web3 Social Impact Bonds — turning everyone’s early sponsorship into a profitable investment.

This is not a sudden whim of mine, but a concept proposed by Ethereum founder Vitalik Buterin in July 2021 — Retroactive Public Goods Funding (RetroPGF). However, its name is not only tongue-twisting, but also overturns everyone’s existing knowledge.

I am trying to use Blocktrend as an example to help everyone understand the innovation of this mechanism.

Public Goods and Free Riders

The last time you heard about public goods may have been in your junior high school history textbook. Simply put, public goods [1] are things that everyone hopes to enjoy but few are willing to pay for, such as maintaining a clean park, reducing crime rates, or subscribing to paid media.

People want a clean park, a safe society, and high-quality news media, but the problem is that these resources have a commonality — free riders. For example, in the case of subscribing to media, the number of paid subscribers is usually 1/10 of the number of free readers.

In other words, if a subscription-based media claims to have 100,000 free readers, you can estimate that there are about 10,000 paid subscribers. The other 90,000 can be considered as “free riders”. Media without paywalls, such as The Reporter, may have an even lower paid ratio.

After all, everyone will ask, “What do I get for paying?” Unfortunately, the answer is usually nothing. Therefore, public goods generally rely on government funding (taxes) to maintain operations, and venture capitalists or individuals are less willing to sponsor public goods with a return on investment of 0. But this also makes it difficult for everyone to enjoy the benefits of public goods.

Public goods in the Web3 field are more common than in the physical world. For example, the code of the Ethereum blockchain and subsequent functional upgrades [2] can be enjoyed free of charge, even without government funding. However, even if the Ethereum Foundation has more money, it is difficult to support the research and development of so many aspects of the entire blockchain.

Therefore, Buterin thought that if sponsorship of public goods could be turned into a profitable investment and public issues could be handled with a new business model, it might attract more funds to flow in and accelerate overall development. This model is not created out of thin air. I would say it is the Web3 version of “Social Impact Bonds”.

Social Impact Bonds

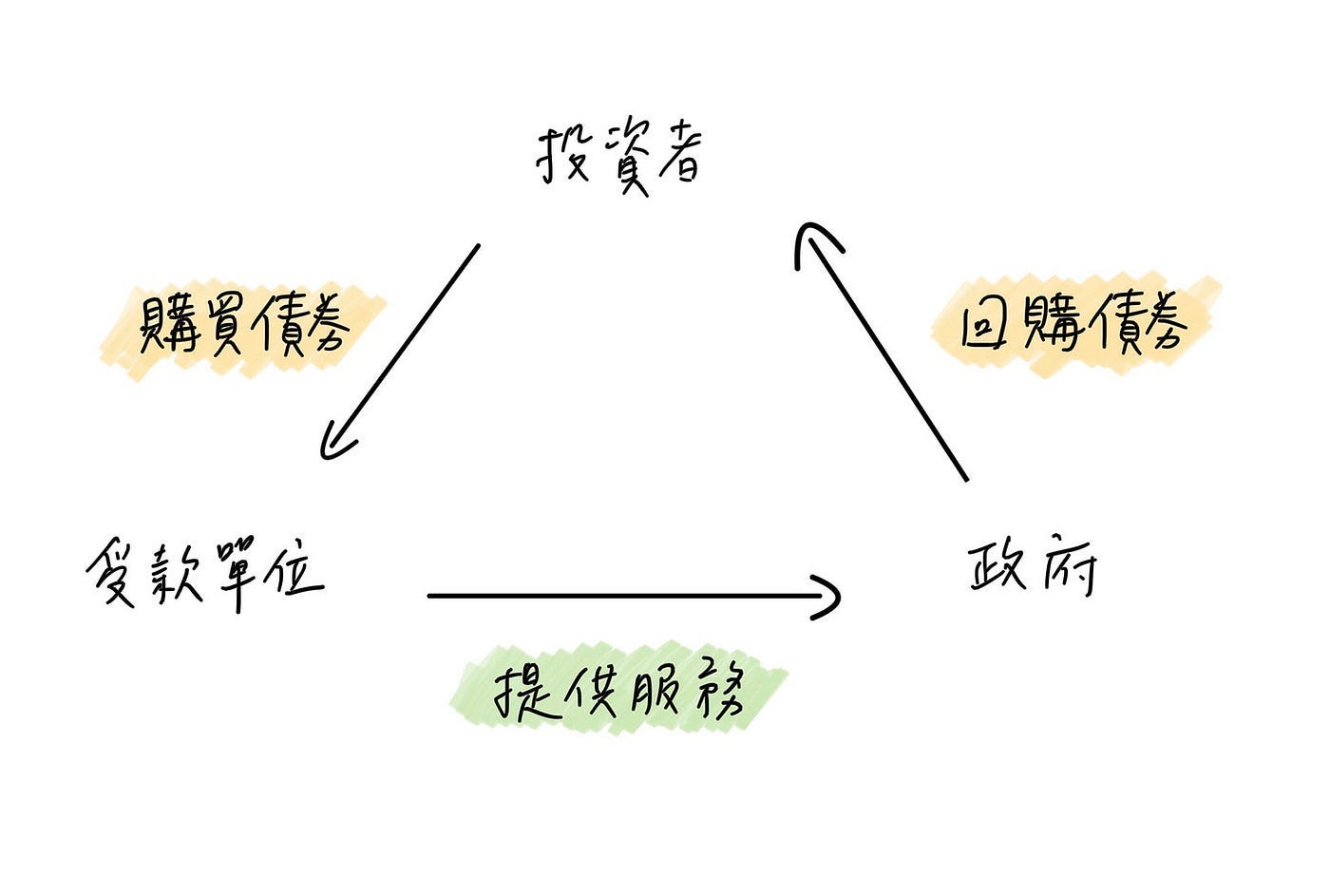

Social Impact Bonds (SIBs) is a new concept that emerged in 2010, which uses potential future profits to attract people to invest in public goods. It turns the two-way interaction between the government funding and the recipient into a three-party relationship between the government, the recipient, and the investor.

For example, in Taiwan, Public Television Service plays the role of a non-profit television station and is funded by the government.

However, if the government sponsors public media through Social Impact Bonds in the future, the government’s budget will not directly flow into Public Television Service, but will become funds used to purchase bonds. Various media operators, such as The Storm Media, The Reporter, TVBS, Sanlih, or CTV, must first issue bonds to raise funds and find a way to become high-quality media in the eyes of the government, so that the government can purchase bonds in the hands of investors and allow early investors to profitably exit.

This model was initially used in Peterborough Prison in the UK. The UK government allocated a budget to solve the problem of reducing recidivism rates among ex-offenders. Social Finance, a non-profit organization, volunteered to issue Social Impact Bonds and raised 5 million pounds from 17 investors.

Seven years later, the UK government found that the recidivism rate of ex-offenders from Peterborough Prison had already decreased by 9% compared to before. Therefore, the UK government used the budget to buy the Social Impact Bonds from the investors. In other words, the 17 investors at the time could all receive an annual investment return of about 3%.

Although the return on investment is not high, this mechanism successfully turned public goods that everyone wanted to “free ride” into a profitable investment. While making money, it can also solve social problems and attract funds to enter.

The same model can be applied to the Web3 field with slight modifications. This is the Retroactive Public Goods Funding (RetroPGF) proposed by Buterin.

RetroPGF

There is no government in the Web3 field, so where does the funding for sponsoring public goods come from is a problem. In addition, the allocation of funds in Web3 will be the second challenge if it is all decided by the government, which will cause controversy.

Currently, funding for sponsoring public goods in Web3 mainly comes from the cryptocurrency circle and personal donations. For example, the second-layer network Optimism of Ethereum [3] set aside a budget of $1 million as a sponsorship of public goods in 2021 and used it to experiment with RetroPGF. As long as you consider yourself a team building Ethereum public goods project, you can apply for funding sponsorship from Optimism proposal.

However, who is eligible to receive the money is not determined by Optimism, but by 22 representatives selected in advance who vote to confirm. In the end, the following teams received different amounts of funding.

At first glance, this may seem like another form of subsidy application, and it is difficult to see the relationship between it and Social Impact Bonds.

This is because most of the teams in the figure have not experienced the complete process of Social Impact Bonds from fundraising, execution to profitability, but have already completed fundraising through other channels. The sponsorship budget of Optimism is just an additional way for them to obtain funding. Even if they really get sponsorship, the funds are unlikely to return to the investors’ pockets, so there is no investment return to announce.

But RetroPGF is a new attempt in the field of Web3 public goods, and it is still in the exploration stage. If it can attract more funds and promote the development of public goods in the Web3 field, it will be a new possibility worth trying.

[1] 平方募資法:Podcast 的商業模式 ft. 激進改變台北社群梁智程、黃雅信

[3] Optimism 生態系入門指南

[4] 平方投票法:票票不等值的公平投票