Reading "The Privilege of Getting Rich": How to Become Wealthy, Where Choices Matter More than Effort

#571

GM,

I'm delighted to be back at work, and the first thing I want to remind you is that the Blocktrend Winter Member Gathering registration will open at 12:00 PM Taipei time this Thursday (11/9). If you missed the Blocktrend and XREX co-hosted Member Gathering in August this year (event photos), don't miss this registration opportunity. This time, I will not only explain Blocktrend's long-term plans at the event but also invite Noah from da0 and Jacky from Bu Zhi DAO, along with on-site members, to record a live podcast.

Paid Blocktrend members can register for the Member Gathering for free. However, due to limited space, the last time we opened 50 slots, and they filled up in less than a day. If you don't want to miss this gathering, remember to check Blocktrend on Thursday during lunchtime. The event details and location are as shown on the poster below. If you're concerned about missing out, feel free to sign up as a volunteer for the event (limited to 10 slots) to reserve your spot!

Now, let's get to the point.

I've been traveling in Egypt for the past two weeks. Initially, it was just a vacation with my wife, but I was surprised by the daily life in Egypt. During the trip, I often took out my laptop (yes, I brought it to Egypt) to research and take notes while listening to explanations. One of the most memorable things was the significant devaluation of the Egyptian currency, the Egyptian pound (EGP).

At the beginning of 2022, you could exchange one US dollar for just 15 Egyptian pounds, but now it takes 30 Egyptian pounds to get one US dollar. In other words, if Egyptians didn't convert their Egyptian pounds into other assets at that time and instead kept their salaries in the bank, even though the total amount of money hasn't decreased, their purchasing power has been cut in half. This is because banks only guarantee the numerator (money supply), while the government controls the denominator (total currency in circulation). Even the homeless people begging in Egypt now prefer US dollars over Egyptian pounds.

The devaluation of the Egyptian pound has had a direct impact on tourists as entrance fees to tourist attractions have doubled. Although I'm not unfamiliar with the concept of currency devaluation and inflation, experiencing it firsthand was quite shocking. From the perspective of Taiwan, life in Egypt might seem challenging. However, after reading the book "The Privilege of Getting Rich," I realized that I'm in a different kind of challenging environment. That's also why the people I met on this journey either work in Hsinchu Science Park or invest in real estate—they all receive the "care" of the central bank.

Stones and Shells

Central banks are financial institutions that were created later on. In the early days, people traded with barter, and currency originally evolved from natural resources like stones and shells.

Let's imagine there are two countries in the world: Stone Country and Shell Country. Stone Country's currency is stones, and Shell Country's currency is shells. When residents of Stone Country want to travel to Shell Country, they need to exchange stones for shells, and vice versa, they exchange shells for stones.

But one day, Shell Country unexpectedly discovered a large ancient civilization site, and people from all over the world wanted to visit Shell Country, leading to an increased demand for shells. Originally, the exchange rate between stones and shells was 1:1, but later, it took 2 stones to get 1 shell, or even 3 stones for 1 shell.

The residents of Stone Country had to exchange more stones for shells, indicating that the value of stones had depreciated, and they could get fewer shells. On the other hand, it could be said that the value of shells had appreciated, and they could get more stones.

The global currency market is a more complex version of stones and shells, but the basic logic remains the same—the more capable a country is at exporting value (products or services), the easier its currency appreciates. The significant depreciation of the Egyptian pound against the US dollar in the past 2 years can be explained by Egypt's value in exports being much lower than that of the United States. Either Egypt suddenly became very weak in these 2 years, or the United States suddenly became very strong.

But the real answer is more complex than stones and shells; currency exchange rates are also influenced by international situations and central bank policies. Take Taiwan, for example, the exchange rate between the New Taiwan Dollar (NTD) and the US Dollar (USD) has hovered around 1:30 for a long time. This is the result of deliberate intervention by the Central Bank of Taiwan, and it's also a focal point discussed in "The Privilege of Getting Rich."

Central bank intervention in exchange rates may seem unrelated to everyday life, and foreign exchange reserves may sound like a term from textbooks. However, they are both similar to the depreciation of the Egyptian pound. Without special attention, people might not even realize that their assets are eroding because of these factors.

Foreign Exchange Reserves

Most people only pay attention to exchange rate fluctuations when they are about to travel abroad. Recently, I took advantage of the depreciation of the Japanese Yen to load up my "Super Urban Intelligent Card." However, exchange rate changes also affect daily life in the country. Take the coffee you drink every day as an example. If the New Taiwan Dollar appreciates, coffee shop owners can use fewer NTD to import better coffee beans and machines from abroad, and consumers can enjoy better quality coffee for less money.

A stronger New Taiwan Dollar benefits product imports and overseas travel, thus improving the quality of life for the entire population. However, the book points out that in the past 20 years, the Central Bank of Taiwan has intentionally allowed the NTD to depreciate. The reason given is that a weaker NTD is favorable for exporting products and boosting the economy.

For instance, if ASUS sells a computer priced at $1,000 in the US, and the NTD depreciates from the original exchange rate of 1 USD to 30 NTD to 32 NTD, ASUS can now exchange $1,000 for more NTD, increasing from the original 30,000 NTD to 32,000 NTD. If the raw materials and wages have not increased, ASUS can earn more money by exporting computers and would be more willing to increase production.

However, if the NTD appreciates, going from 1 USD to 30 NTD to 28 NTD, this is not good news for ASUS. $1,000 can only be exchanged for 28,000 NTD. Considering the costs, ASUS may increase prices, which could affect their competitiveness in international markets, and ultimately, they might even reduce production or close factories.

The Central Bank of Taiwan must make a choice between improving the quality of life for the entire population (a stronger NTD) and enhancing the competitiveness of businesses (a weaker NTD). I used to think that Taiwanese companies making a lot of money abroad meant the economy was doing well, and in the end, it would lead to an improvement in the quality of life for everyone. However, after reading the book, I realized that every time this cycle reached the midpoint, the central bank would intervene.

ASUS earns US dollars abroad but has to exchange those US dollars for NTD to cover operating expenses, which inevitably leads to the NTD appreciating. But an appreciating NTD weakens ASUS's price competitiveness, so ASUS cannot continue to thrive. This is a normal market cycle.

It's just that the Central Bank of Taiwan has chosen to intervene in the middle for the past 20 years, intentionally preventing the NTD from appreciating. Whenever exporting companies need to exchange a large amount of US dollars for NTD, the central bank will print a significant amount of NTD to buy these US dollars. The extra NTD offset the pressure for appreciation, and the US dollars exchanged for NTD become foreign exchange reserves in the textbook sense. As a result, exporting companies can continue to prosper under the care of the central bank.

When the central bank takes care of exporting companies, it inevitably sacrifices the interests of importing companies and foreign tourists. In other words, when people travel abroad, they find foreign prices expensive, not realizing that they are being taxed invisibly by the Taiwanese government. A portion of this money is used to subsidize exporting companies, while another part becomes Taiwan's foreign exchange reserves. This also explains why salaries in Taiwan's food and service industries are generally lower than those in the tech industry, because the latter is under the central bank's care, but the former is not.

However, people in the tech industry might also raise objections. Although tech industry salaries are generally higher than those in the service industry, they still can't afford to buy houses. The real money-makers are real estate investors all over Taiwan! If the tech industry benefits from the central bank's depreciation of the NTD exchange rate, Taiwan's landlords have benefited from the central bank's deliberate lowering of interest rates in the past 20 years.

High Real Estate Prices

Interest rates are an important tool for central banks to control the economy. If we compare the nation's economy to driving a car, the central bank's interest rate adjustments are like the accelerator and brake pedals. When the economic situation is worse, the central bank lowers interest rates to step on the accelerator, forcing money out of banks and into circulation to stimulate consumption. Conversely, when the economy improves, the central bank raises interest rates to step on the brake, as otherwise, it could lead to inflation.

However, the effects of each interest rate adjustment by the central bank take some time to become visible. Sometimes, you may be looking at an uphill slope and preparing to hit the gas pedal, but then you realize that the brake you pressed earlier is just taking effect. Deciding when to step on the gas pedal and brake is not easy.

However, the Central Bank of Taiwan doesn't have these worries. The book points out that over the past 20 years, the Central Bank of Taiwan seems to be driving a car without a brake pedal, maintaining low-interest rates and aggressively stepping on the gas pedal for a long time. Although this stimulated the economy and encouraged people to borrow money from banks for investments, it also led to excessively high property prices.

This is another "pick a side" game. Over the past 20 years, people who boldly borrowed money from banks were fortunate to receive the central bank's care. On the other hand, those who didn't borrow money for investments at that time, or who hadn't even been born yet, had a tougher time.

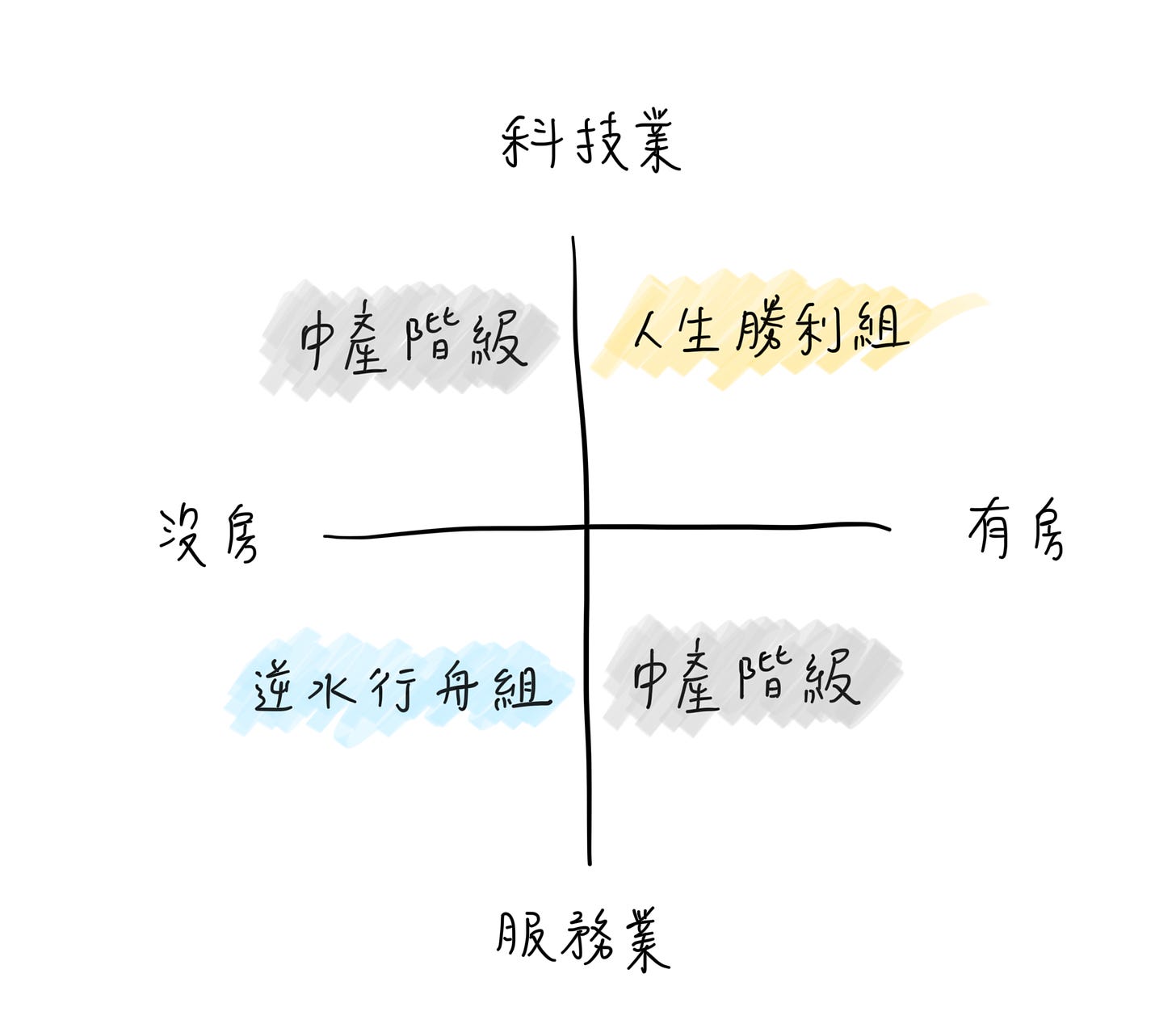

I use the quadrant chart below to summarize the impact of exchange rates and interest rates on people in Taiwan. The vertical axis represents exchange rates, with the tech industry and service industry at the two ends. The horizontal axis represents interest rates, with property owners and non-property owners at the two ends. The top right corner represents tech industry professionals who own property, and they are the winners in Taiwan's society. The bottom left corner represents service industry workers without property, who face the most challenging path of accumulating assets. The other two quadrants represent tech industry professionals without property and service industry workers with property, representing Taiwan's middle class.

With this chart, we can explain why the most contentious topics online are often related to arguments between STEM (science, technology, engineering, and mathematics) and non-STEM fields, as well as generational conflicts. The underlying reason is actually related to the policies of the Central Bank of Taiwan over the past 20 years—depreciating the NTD exchange rate and keeping interest rates low.

As someone who entered the workforce in 2015 and comes from a STEM background, I deeply understand why some people say that choices are more important than hard work and that your background matters more than your choices. On the one hand, I see peers of my age bearing the consequences of high property prices caused by low-interest rates. On the other hand, I feel that my STEM peers have been relatively fortunate and have unintentionally ended up on the opposite side of the central bank in terms of exchange rates and interest rates.

Young people choose to invest in cryptocurrencies, some because they believe in the potential of the digital economy, while others simply see it as a relatively fair starting point in life.

Blocktrend is an independent media outlet sustained by reader-paid subscriptions. If you think the articles from Blocktrend are good, feel free to share this article, join the member-created Discord for discussion, or add this article to your Web3 records by collecting the Writing NFT.

In addition, please recommend Blocktrend to your friends and family. If you want to review past content published by Blocktrend, you can refer to the article list. As many readers often ask for my referral codes, I have compiled them into a single page for everyone's convenience. You are welcome to use them.