GM,

Announcing Some Exciting News! The Blocktrend Podcast has recently been selected by Apple Podcasts' editorial team as a featured recommended program and is prominently showcased on the front page of Apple Podcasts for listeners. This achievement marks a significant milestone for Blocktrend, and we extend our heartfelt gratitude to our members for their continued support, which enables us to consistently produce high-quality content and earn greater recognition!

Additionally, the Citizens' House of Optimism is currently in the process of selecting the next cohort of Civic Representatives for RetroPGF 3. While this selection doesn't involve traditional voting and is based on the appointment of existing Civic Representatives, Optimism has established a self-nomination zone, encouraging individuals to put themselves forward. This initiative aims to include candidates who have been engaged with Blocktrend and bring a balanced representation of resources from both the Chinese and English-speaking communities to the future RetroPGF evaluations.

Lastly, earlier this week, I recommended that everyone take the initiative to verify their Gitcoin Passport. If you encounter any difficulties or fall short of the required 20 points, feel free to ask questions on Discord and refer to discussions among other members. Now, moving on to the main topic.

This week, third-party payment service provider PayPal announced the issuance of their proprietary stablecoin called PayPal USD (abbreviated as PYUSD), introducing a new choice in the market. In this article, we will first delve into what PayPal does as a business and why they have chosen to launch the PYUSD stablecoin.

PayPal

PayPal was founded in 1998, a time when personal computers were just beginning to become popular and people's daily lives and work primarily relied on paper-based operations. I still remember back then, in school, we would pass around a mail-order catalog to see if anyone wanted to buy stationery, books, or daily supplies. In today's terms, that was essentially a paper-based version of online shopping.

Mail-order was quite cumbersome. Each individual had to wait for the product catalog to reach them, someone had to manage who wanted to buy what, collect the money, send out the mail-order form, and simultaneously go to the bank to make the payment. People of my generation likely have childhood memories of this process.

Later on, as computers and internet access became more common, online shopping gradually replaced mail-order. The range of items available for purchase was no longer limited to a few pages in a product catalog; you could now directly contact sellers online. However, even though the process was digitized, payments remained just as troublesome. When I first made an online purchase, I had to rush to an ATM to make a payment to the seller right after placing the order, and only then would the order be confirmed. In even earlier times, people would send paper checks or even money orders through postal mail to make payments.

A similar situation was happening in the United States. PayPal's founders, Peter Thiel and Max Levchin, noticed that people buying items on eBay were using quite primitive methods – placing bids online but paying with paper documents. PayPal's original intention was to enhance the online shopping payment experience – bidding online and paying online. Their first product aimed to replace home addresses with email addresses.

Buyers simply had to input the seller's email address, and the seller would receive the payment. From then on, buyers no longer needed to go to the post office to send money, and the speed of transactions significantly improved. Seeing more and more people using PayPal for payments, the e-commerce giant eBay acquired PayPal for $1.5 billion in 2002.

By 2009, PayPal recognized the diversification of payment scenarios, such as splitting bills among friends after meals. Consequently, PayPal acquired Venmo, which combined social and payment functionalities, further expanding its payment ecosystem. Today, Venmo is an essential app for young people in the United States, especially for splitting bills during meals. In essence, over its more than two decades of existence, PayPal has been focusing on one thing – digital payments. However, it adapts its product offerings to evolving technology and changing user habits.

This week, PayPal announced the launch of a new product called PayPal USD (PYUSD), a USD stablecoin. Its symbolic significance is evident.

PYUSD Stablecoin

According to PayPal's press release:

PayPal has announced the launch of the PayPal USD (PYUSD) stablecoin. PYUSD is backed by reserves including USD deposits, short-term US government bonds, and similar cash equivalents, with a 1:1 exchange ratio to the US dollar. Dan Schulman, CEO of PayPal, stated, "As people transition to digital currencies, they will need a stable, digital-native medium of exchange that connects with the world of traditional currencies like the US dollar."

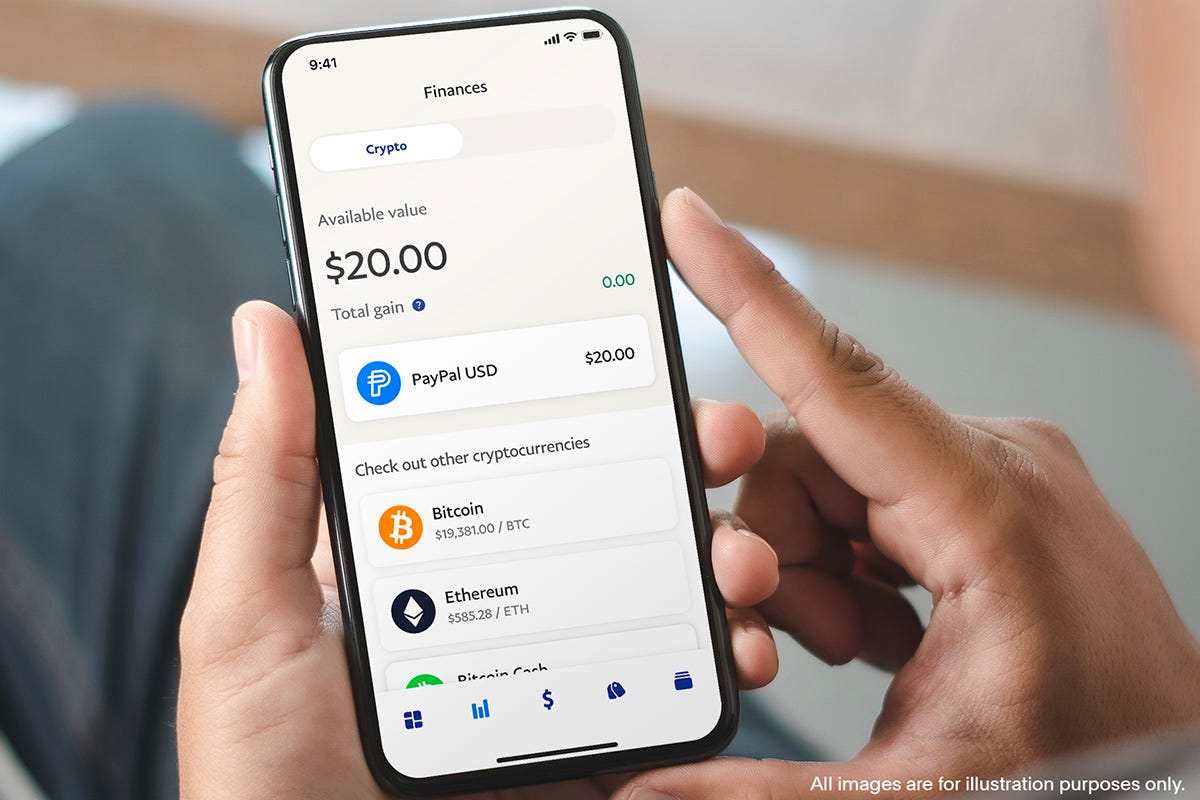

The design of PYUSD aims to reduce friction in digital payments, allowing friends and family to easily and quickly transfer assets, send remittances, or conduct cross-border payments. While most stablecoin transactions are limited to specific Web3 environments, PYUSD will be compatible with the PayPal ecosystem from day one and will soon be available on Venmo.

PayPal is no stranger to the world of cryptocurrencies. In 2019, when Facebook was forming the Libra Association to launch its own cryptocurrency, PayPal was one of the 21 founding members of the association. However, the Libra project encountered numerous obstacles, and PayPal was among the first to announce its withdrawal from the association.

The following year, PayPal announced its integration of cryptocurrencies, allowing users to make payments to merchants using cryptocurrencies. Upon this news, the price of Bitcoin rose by 7%. However, I held a negative view at that time, criticizing this feature as quite lackluster. On one hand, buyers wanting to pay with cryptocurrencies had to first purchase cryptocurrencies from PayPal before using them to pay merchants. On the other hand, sellers receiving payments couldn't directly withdraw cryptocurrencies; they could only convert them back to USD within PayPal.

Paying with cryptocurrencies wasn't cheaper; buyers had to pay an additional 2% transaction fee to PayPal just to buy the necessary cryptocurrency for the payment. Sellers, if they wanted to convert the received cryptocurrency to USD, had to pay another fee. Regardless of the angle, there was no incentive for users to utilize this feature. The key issue was that PayPal locked an open payment tool within its closed ecosystem. Not only did PayPal control the entry (deposit) and exit (withdrawal) points, but they also charged users fees for entering and leaving. It simply didn't make sense.

However, people didn't care about these details back then. PayPal supporting cryptocurrencies? Everyone jumped on the bandwagon! Three years later, the launch of the PYUSD stablecoin by PayPal seems much more reasonable. It not only aligns with PayPal's core digital payment business but also demonstrates a more suitable use of cryptocurrencies. The image below highlights the three main features of PYUSD: high-quality reserves, external asset transfers, and integration with the PayPal ecosystem.

The biggest difference between now and before is that PayPal is transitioning from a closed approach to an open one. PayPal's primary source of revenue comes from the 3% transaction fee charged to merchants during payment processing. In the past, if both parties in a transaction wanted to use cryptocurrencies, PayPal would say, "Sure, but please buy the cryptocurrency from me first, and you can only sell it back to me later." This was a closed-loop financial system. Regardless of how much cryptocurrency people held or how transactions flowed, it ultimately remained within different pockets of PayPal. However, PYUSD represents an open-loop financial system. It is not restricted to circulating only within the PayPal application; users can also withdraw it to their personal MetaMask wallets.

Competitive Advantage

The primary distinctions between PYUSD and other stablecoins like USDT and USDC lie in brand identity and use cases.

PYUSD is a branded stablecoin – it is not issued directly by PayPal, but rather facilitated through collaboration with Paxos, the company that previously helped launch Binance's BUSD stablecoin. As one might anticipate, the underlying technical infrastructure is quite similar.

The initial users of PYUSD are unlikely to be seasoned crypto veterans; rather, they are individuals who have lower confidence in cryptocurrency security but wish to leverage the convenience of blockchain technology. These individuals don't have high trust in USDT or USDC; even if Circle were to open its entire reserves for scrutiny, they would still worry about potential risks. Trust takes time to build. PayPal was founded back when people were still mailing paper checks – finding a more reliable digital payment company than PayPal might be challenging.

More crucial than brand recognition is the use case of the stablecoin. In recent years, despite USDT not being the most transparent or legally compliant stablecoin, its market capitalization has consistently outperformed other stablecoins. The key lies in its widespread exchange support and rich utilization in both on-chain (DeFi) and off-chain (trading) scenarios.

Take BUSD, the stablecoin issued by Binance, as an example. They effectively leverage their ecosystem to empower their stablecoin. When trading pairs involving BUSD were listed on Binance exchange, users enjoyed zero trading fees. If someone wanted to use USDT to buy BTC and wished to save on trading fees, they could convert USDT to BUSD first and then buy BTC with BUSD.

Moreover, Binance had also automatically converted various other stablecoins (USDC, USDP, TUSD) within their exchange into BUSD. While users could always convert back, these measures subtly expanded the utility of BUSD. Similarly, PayPal will undoubtedly create unique use cases for PYUSD. In this regard, PayPal holds a distinct advantage.

Currently, PayPal boasts over 400 million users globally and more than 30 million merchants accepting PayPal payments. This figure stands in stark contrast to the number of individuals and businesses currently utilizing cryptocurrencies, differing by several orders of magnitude.

For consumers, it's difficult to directly use USDT or USDC for transactions; they often need to withdraw and exchange them for fiat currencies. However, in the future, individuals can simply exchange USDT or USDC for PYUSD through exchanges and deposit it into their PayPal accounts for merchant payments – a highly convenient process. On the merchant side, the psychological barrier to accepting PYUSD payments is low. PYUSD is essentially a digital token issued by PayPal, instantly convertible back to USD at a 1:1 ratio.

However, PYUSD doesn't necessarily compete with other stablecoins; their use cases are quite distinct. Other stablecoins might even find this move by PayPal favorable, as it provides those who were initially hesitant about cryptocurrencies with a reason to try. When facing concerns about risks, one can simply convert their existing stablecoins to PYUSD for enhanced safety.

I am optimistic that PYUSD could become an entry point for many into the world of cryptocurrencies, as well as an avenue for using cryptocurrencies for tangible goods or services. PayPal's stablecoin issuance might also encourage other Web2 companies to follow suit, issuing various branded stablecoins while emphasizing their unique use cases.

While stablecoins might become so abundant that they create confusion, Ethereum's founder, Vitalik Buterin, mentioned that the future of payments should involve automated token swaps and cross-chain capabilities. Even if people hold various stablecoins and desire different receiving currencies, decentralized exchanges embedded within wallets could automatically convert the received cryptocurrency into the desired form.

In contrast to the current landscape where every retail outlet has its own payment system (e.g., XX Pay), but these systems are unable to interoperate, stablecoin issuance could break down these barriers and provide a new choice for digital payments through an open approach.

Blocktrend is an independent media outlet sustained by reader-paid subscriptions. If you think the articles from Blocktrendare good, feel free to share this article, join the member-created Discord for discussion, or add this article to your Web3 records by collecting the Writing NFT.

In addition, please recommend Blocktrend to your friends and family. If you want to review past content published by Blocktrend, you can refer to the article list. As many readers often ask for my referral codes, I have compiled them into a single page for everyone's convenience. You are welcome to use them.