MetaMask supports fiat currency withdrawals, and the United States revises cryptocurrency accounting standards.

#560

GM,

On Tuesday, I mentioned that we would be launching the first YouTube video this week, but I intend to postpone it and make it part of next week's content to provide a comprehensive overview of this new endeavor. Now, let's get to the main topic. This article discusses two seemingly unrelated but interrelated pieces of news.

MetaMask Supports Fiat Currency Withdrawals

To bring someone into the world of cryptocurrencies, at least two things are typically required: creating a wallet and registering on an exchange. A wallet serves as the gateway to the blockchain world, as without one, it's challenging to grasp the philosophy of "Not your key, not your coin," and one cannot engage with the innovative applications of Web3.

The next question after obtaining a wallet is, where do cryptocurrencies come from, and where can they be sold? Therefore, registering on an exchange account becomes a priority even before creating a wallet. Exchanges act as bridges that connect these two worlds, helping individuals convert their local currencies such as New Taiwan Dollars, Hong Kong Dollars, or US Dollars into cryptocurrencies. Unfortunately, some people choose to stay on this "bridge," buying cryptocurrencies but never withdrawing them from the exchange. This not only diminishes the experience within the blockchain world but can also be impacted by security incidents at the exchange.

However, if our bank or LINE Pay account could directly purchase cryptocurrencies and store them in our wallet, or if we could transfer BTC and ETH from our wallet to a bank account and have them automatically converted into fiat currency, then registering on an exchange might no longer be the obligatory path for people entering the world of cryptocurrencies.

I believe that eventually, banks will offer cryptocurrency buying, selling, withdrawal, and storage services, much like how we currently deal with US Dollars or Japanese Yen. However, as of today in 2023, only a few banks are willing to take this step.

Starting this month, users in the United States and Europe have a new option. MetaMask, one of the world's most widely used cryptocurrency wallets, announced last week that it has enabled fiat currency deposits and withdrawals. Users can now link their bank and PayPal accounts with their MetaMask wallet, eliminating the need for intermediaries like exchanges. According to MetaMask's announcement:

MetaMask Portfolio's "Sell" feature enables users to easily convert their cryptocurrencies into fiat currencies such as US Dollars, Euros, and British Pounds. When combined with the "Buy" feature, it allows users to be self-sufficient in the Web3 ecosystem, reducing intermediaries and enabling direct transfers of fiat currency to destinations like bank accounts or PayPal.

Currently, the "Sell" feature is available to users in the United States (in select states), the United Kingdom, and certain European regions. In the future, we plan to expand its availability to more regions to meet the needs of global users. We initially support ETH on the Ethereum mainnet and will soon add gas tokens on the second-layer networks.

MetaMask emphasizes the "fiat currency withdrawal" feature of its wallet because direct "fiat currency deposit" into wallets is not a new development. Many wallets already support services like MoonPay or Transak for credit card deposits, and some individuals may have even used credit cards to purchase NFTs. However, when it comes to selling NFTs or cryptocurrencies and converting them directly into local currencies like New Taiwan Dollars (NTD), relying solely on credit cards is insufficient. Typically, this requires the involvement of exchanges to facilitate the connection to bank accounts for the withdrawal of fiat currency.

Traditional financial institutions have been cautious about funds originating from the cryptocurrency space, as they are concerned about the possibility of dealing with illicitly acquired funds. Most financial institutions lack the capability to track on-chain financial flows and, therefore, may choose not to engage in such transactions. In recent years, there have been incidents where cryptocurrency businesses were denied bank accounts.

MetaMask's funds, in the eyes of traditional financial institutions, are essentially anonymous. Anyone can create multiple wallets through MetaMask without undergoing any form of identity verification, making it challenging to establish partnerships with banks.

Fortunately, there is a growing recognition among financial service providers of the potential of blockchain technology. For example, Visa allows merchants to accept USDC as payment, and PayPal has introduced PYUSD, a US Dollar stablecoin. More people are beginning to understand that cryptocurrencies hold promise for the future, and there are various tools available to trace illicit funds. This has resulted in reduced discrimination against the cryptocurrency space.

This evolving landscape has indirectly created opportunities for MetaMask to collaborate with entities like MoonPay, Transak, and PayPal. In practice, users sell their cryptocurrencies to these intermediaries, who then deposit the corresponding fiat currency into the bank accounts or PayPal accounts specified by the users.

For publicly listed companies like PayPal, holding cryptocurrencies or providing buying and selling services can be costly, and it can significantly impact their financial statements. This situation is closely tied to how the United States classifies cryptocurrencies for accounting purposes.

US Amendment to Accounting Standards

In the United States, companies purchasing cryptocurrencies can face challenging accounting implications. Cryptocurrencies are classified as "losing assets" in the U.S. accounting framework, implying that their value can only decrease and not appreciate.

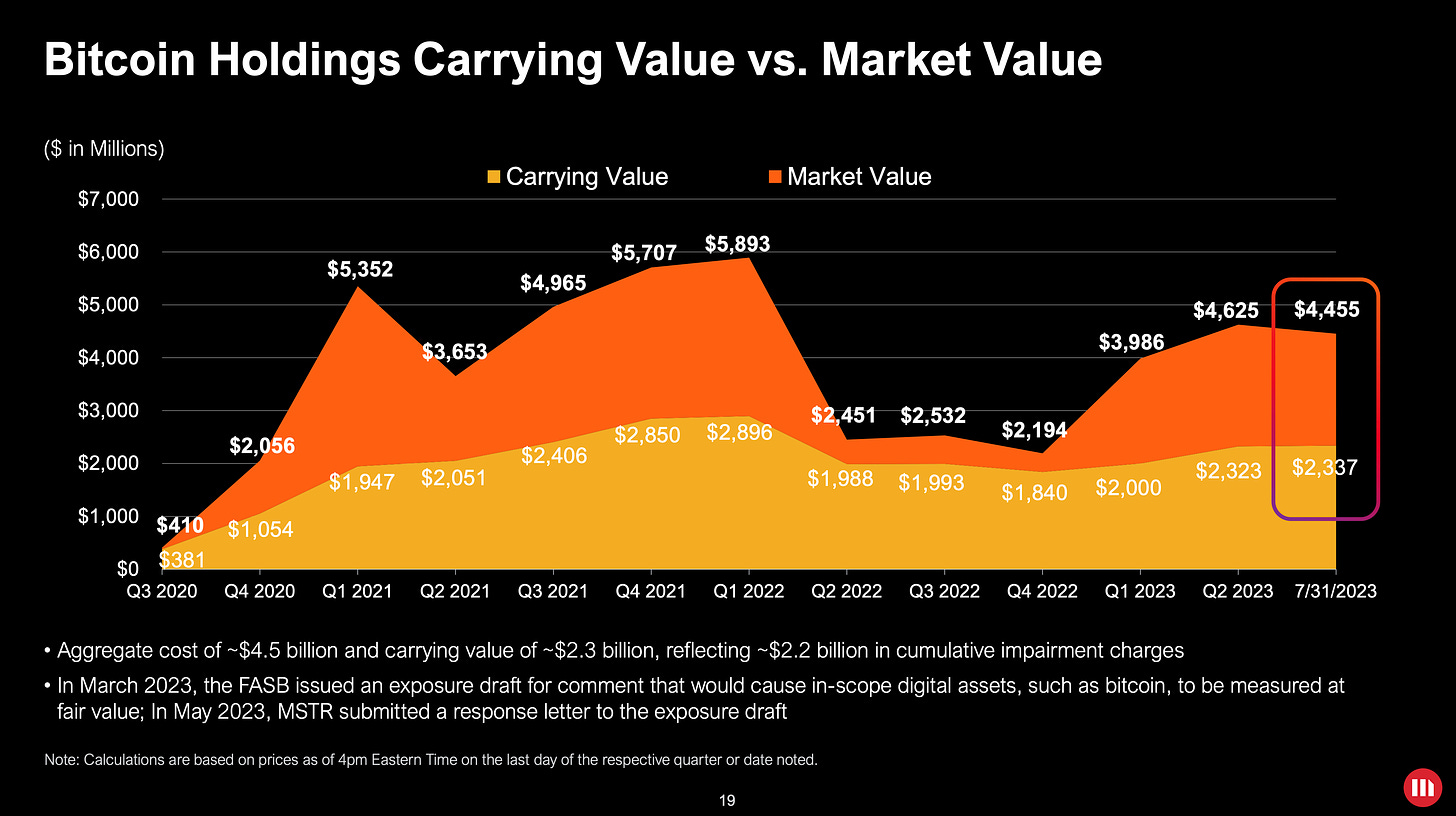

MicroStrategy is one of the world's largest holders of BTC, with nearly 153,000 BTC and an average purchase price of $29,672 per BTC, totaling $4.53 billion in expenditure. Based on the current market price of approximately $26,000 per BTC, MicroStrategy is currently at a slight loss. However, when the next bull market arrives, it is highly likely that the company will become one of the wealthiest enterprises globally.

But if you were to examine MicroStrategy's latest quarterly financial report, you would arrive at an entirely different conclusion. According to the report, the current value of BTC held by MicroStrategy is only $2.32 billion. To investors, this might seem like a poor decision by the company. They spent $4.53 billion to buy BTC, and now it's worth only half that amount, resulting in a substantial loss of $2.2 billion. Why would they continue to buy more?

The disconnect between financial reports and reality is indeed a result of the quirks in U.S. accounting standards. Accounting is inherently conservative and often struggles to keep up with the latest technological developments. Suppose there were a brand-new digital asset called "Mircoin," and your company held Mircoin. When you approach your accountants to ask how to account for this asset, you might receive a response along these lines:

These coins may hold value. However, if you claim that the price of these coins has risen since you acquired them, you might either be deceiving or being deceived. On the other hand, if you assert that the prices of these coins have fallen since your acquisition, that could very well be accurate.

This has been the logic behind the accounting classification of cryptocurrencies in the United States over the past few years.

In U.S. accounting, cryptocurrencies have been considered intangible assets, belonging to the same category as trademarks, copyrights, brands, or even online reputation. The value of such assets is not easily measurable, and they might lack a clear market, leading to a conservative accounting approach – assuming they can only decrease in value, not increase unless the holder can actually sell them.

Historically, classifying BTC as an intangible asset in the United States seemed out of place. However, in a recent development, the Financial Accounting Standards Board in the United States voted to change this. According to The Wall Street Journal:

The Financial Accounting Standards Board (FASB) recently voted to establish new rules for accounting and disclosure of cryptocurrencies. These rules require companies to calculate the fair value of cryptocurrencies, including Bitcoin and certain other specified crypto assets. Companies holding these assets will be able to more accurately reflect their financial positions. These rules are set to take effect in companies' 2025 financial reports, but companies have the option to adopt them earlier.

Conservatism in accounting is not inherently a bad thing. It serves to protect against the possibility that assets like "Mircoin" could collapse in value within a short period. However, when it comes to established cryptocurrencies like BTC with a significant global market, manipulating their global market prices is not an easy feat.

This change can be seen as a fair move for U.S. companies that hold BTC, allowing them not to suffer on their financial statements due to cryptocurrency holdings. I believe this is a significant milestone in the history of cryptocurrency development. Accounting rule changes are typically supported by substantial objective facts and are less likely to flip-flop or revert like policy changes.

Currently, companies like Tesla, Block, and MicroStrategy are well-known publicly traded U.S. companies that hold cryptocurrencies. The impact of this accounting amendment is likely to be long-lasting. While it may not lead to a massive surge in corporate Bitcoin purchases, it significantly reduces the hidden costs of holding cryptocurrencies for businesses. In the future, publicly traded companies like PayPal, when they see new market opportunities, won't have to worry about holding more cryptocurrencies making their financial statements less appealing.

Having cryptocurrencies on the balance sheet that faithfully reflects market fluctuations promotes more transparent information and encourages more companies to boldly participate in the emerging cryptocurrency economy.

Blocktrend is an independent media outlet sustained by reader-paid subscriptions. If you think the articles from Blocktrendare good, feel free to share this article, join the member-created Discord for discussion, or add this article to your Web3 records by collecting the Writing NFT.

In addition, please recommend Blocktrend to your friends and family. If you want to review past content published by Blocktrend, you can refer to the article list. As many readers often ask for my referral codes, I have compiled them into a single page for everyone's convenience. You are welcome to use them.