Member Gathering Registration | Ripple Wins Lawsuit Against SEC: XRP Is Both a Security and Not a Security

#544

GM,

Member Gathering Registration is now open. Here are the details of the event:

Date: August 19th (Saturday), 14:00 - 17:00

Location: 5th Floor, No. 35, Guangfu South Road, Songshan District, Taipei City (XREX Exchange)

Number of participants: Limited to 50 members. Registration will close once the quota is reached.

The event will include light refreshments.

This Member Gathering is co-organized by XREX Exchange and Blocktrend. In the past, I have invited Wayne, the CEO of XREX, to participate in recordings for Blocktrend, and XREX's podcast "Web3 Expedition" has shared a lot of knowledge about how to assess the security of exchanges.

The venue for this Member Gathering is XREX Exchange, and it's an opportunity for everyone to visit and learn about how the exchange operates. XREX will also share an exclusive piece of news with the participating members during the event, giving everyone time to prepare in advance. Now, let's get to the main topic.

Last week, there was a celebratory market rally, and Ripple (XRP) experienced the highest surge, rising nearly 80%. This was mainly due to the outcome of the lawsuit between Ripple Labs, the issuer of XRP, and the U.S. Securities and Exchange Commission (SEC). The judge ruled that the SEC's accusation of Ripple Labs unlawfully issuing securities was incorrect because XRP is both a security and not a security (huh?). Although the ruling seems ambiguous, it is considered a win for the cryptocurrency market, which has been experiencing a subdued atmosphere recently.

XRP remains a vague presence for many people. Despite being the fourth largest cryptocurrency in terms of market capitalization, trailing only BTC, ETH, and USDT, very few have actually used it. This article discusses why Ripple Labs was sued by the SEC, what the judge's ruling actually means, and the significance of this case for the cryptocurrency market. Let's start with an orange grove from 80 years ago.

Orange Grove

80 years ago, a company named Howey operated a resort hotel in Florida. The hotel was located near a scenic forest area, offering tourists the opportunity to stay overnight and enjoy leisurely walks in the surrounding nature.

In addition to the hotel, Howey owned a vast 200-hectare orange grove within the scenic area, covering an area roughly equivalent to 8 Taipei Daan Forest Parks. When tourists grew tired during their exploration of the scenic area, they would often spot the expansive orange grove and couldn't resist the temptation to buy a few oranges to enjoy. However, instead of setting up a stall to sell oranges to the tourists, Howey strategically placed advertising billboards around the orange grove, enticing people to invest and make money together.

Howey Company's primary business was the "Cloud Farmer" concept. Investors could purchase land in the orange grove from Howey Company, but on the condition that they sign a separate 10-year service contract, delegating the maintenance, harvesting, and sales of the orange grove entirely to Howey Company. In other words, investors only needed to invest money to buy the land in the orange grove and didn't have to worry about anything else. They would earn an annual investment return of approximately 10% to 20%. Many tourists who initially came for sightseeing unexpectedly became owners of orange grove farms.

However, soon after, Howey Company was sued by the U.S. Securities and Exchange Commission (SEC) in court, accusing the company of illegally issuing securities. Howey Company vehemently denied the allegations, claiming that they were selling land and service contracts, not financial securities. Nevertheless, the U.S. Supreme Court ultimately ruled against Howey Company. This orange grove case became the enforcement basis for the SEC in determining whether a company has illegally issued securities over the past 80 years.

This standard can be considered the SEC's "keen eyes." It is specifically used to uncover financial activities that may not appear directly related to financial products on the surface, such as investing in an orange grove, but are essentially illegal securities issuances. In 2020, based on this standard, the SEC also filed a lawsuit against Ripple Labs, the issuing company behind Ripple (XRP), claiming that the issuance and sale of XRP by Ripple Labs were essentially no different from the "orange grove contract" of the past.

Ripple

XRP, also known as Ripple, was introduced in 2012, earlier than the more well-known ETH. As a result, Ripple had a more "old-school" goal of creating a faster, cheaper, and more energy-efficient blockchain to compete with Bitcoin.

The digital asset associated with XRP is referred to as XRP, and it operates on the XRP Ledger. Ripple Labs aims to establish XRP as an intermediary bridge for cross-border transactions, eliminating the need for expensive and slow SWIFT systems.

If I want to send money from Taiwan to Mexico, I could go to a bank and initiate a wire transfer. However, the efficiency of the SWIFT system used by banks is often lacking. People familiar with cryptocurrencies would probably avoid going to a bank and instead ask the recipient, "Can you accept cryptocurrencies?"

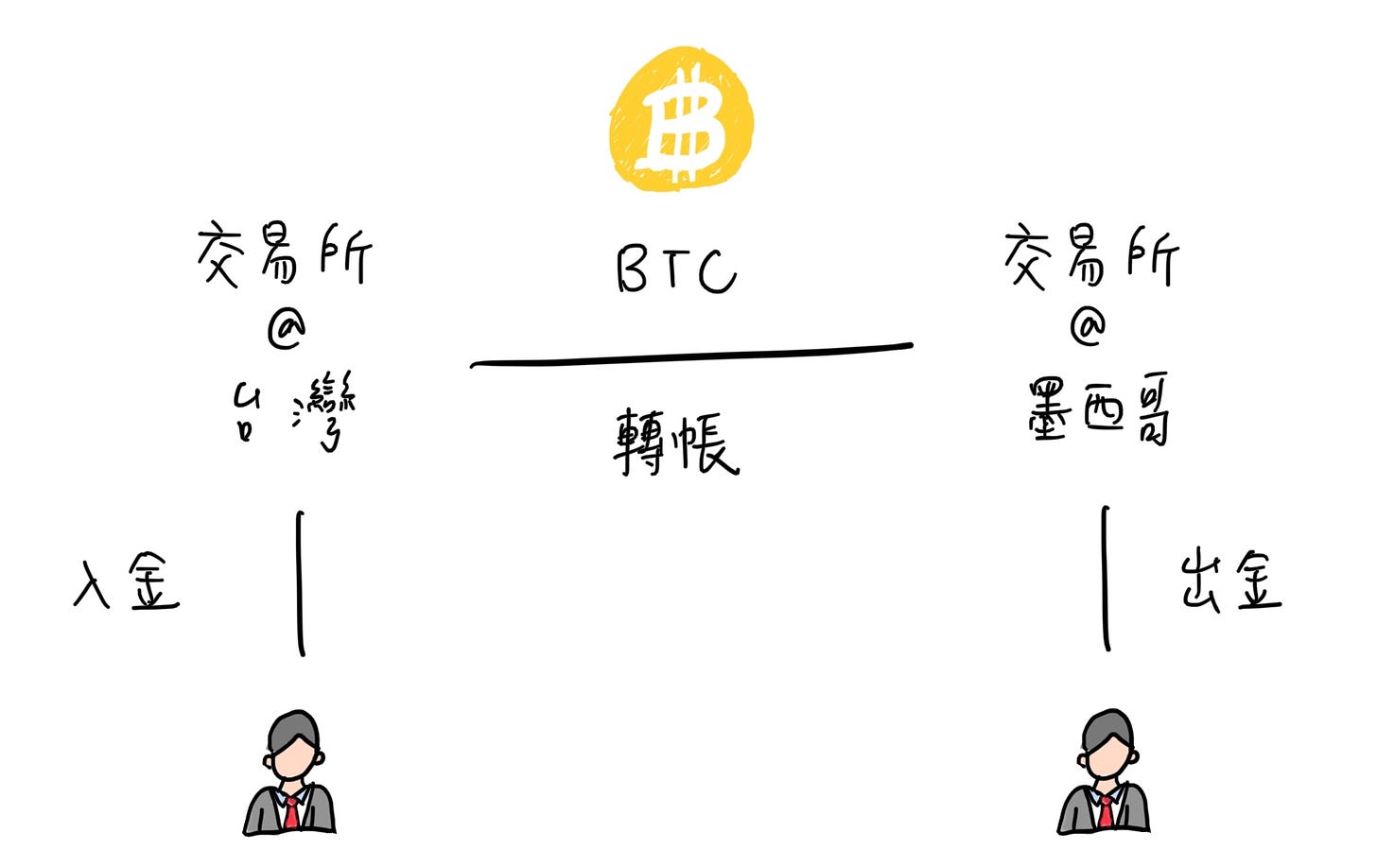

If they can, I can simply transfer USDT directly to them, and the transaction would be completed in less than a minute. By the time someone is ready to go to the bank for a wire transfer, the USDT would have already arrived in the recipient's account. However, going back 10 years, people generally had low trust in cryptocurrencies, and there was no USDT to serve as an intermediary. At that time, people relied on BTC. So, I would buy BTC on an exchange and transfer it to the recipient, who could then sell it on a Mexican exchange and receive the funds in their bank account, completing a cross-border remittance.

Ten years ago, only a few people understood how to use BTC, and cryptocurrency exchanges were not as widespread as they are now. Very few individuals knew how to use BTC for cross-border remittances. Ripple Labs came up with a simpler approach - why not start directly with the banks? They issued XRP and sold it to banks, telling these financial institutions, "If all banks use XRP for transfers, we won't need to rely on the SWIFT system anymore!"

Ripple Labs envisioned a future where banks would use XRP for customer transfers, eliminating the need for individuals to buy BTC for cross-border remittances. In other words, the average person wouldn't even need to know what XRP is, but upon visiting a bank, they would discover that the transfer system had quietly been upgraded. Not only would cross-border transfer fees be significantly reduced, but funds would also arrive instantly. The secret behind this improvement would be the adoption of XRP among banks for processing cross-border remittances.

Ripple Labs' business plan was well-calculated. They issued a total of 100 billion XRP. Banks had to purchase XRP to join the XRP transfer network. As more and more financial institutions adopted XRP for transfers, the demand for XRP in the market would increase, driving up its price. Ripple Labs and early investors who held a significant amount of XRP could profit from this. Consequently, many financial institutions buying XRP may not necessarily be upgrading their transfer systems, but rather seeking investment opportunities for profit.

This model caught the attention of the SEC, as it resembled the "Howey Test" from 80 years ago. The difference was that financial institutions were purchasing digital XRP instead of physical land like in the "Howey Contract." However, the similarity lies in the fact that both cases involved investors (tourists and banks) hoping to rely on the efforts of others (Howey Company and Ripple Labs) to generate profits after purchasing a particular asset.

The SEC accused Ripple Labs of actively promoting the utility and value of XRP to investors since 2013, which they deemed illegal. After three years of litigation, the judge's ruling was quite intriguing. The judge stated that XRP was both a security and not a security, and the key factor was who Ripple Labs sold XRP to. According to iThome's report:

Judge Torres pointed out that transactions involving XRP from institutions should be subject to regulation under the Securities Act, but it may not apply to the buying and selling of XRP by general consumers through cryptocurrency trading platforms.

This is because Ripple was initially founded with the slogan of attracting institutions for investment purposes. Institutions bought XRP based on their confidence in Ripple's management abilities and the potential for profit from XRP. The selling of XRP by institutions was also considered an investment rather than a consumer transaction, with some institutions agreeing to lock-up provisions or resale restrictions based on the trading volume of XRP. This led the judge to conclude that the XRP transactions between Ripple and institutions constituted unregistered investment contracts, violating the Securities Act.

In contrast, unlike institutional buyers who expected Ripple to use the funds obtained to improve the XRP ecosystem and increase the price of XRP, general consumers who used programmatic sales platforms to trade XRP were not aware of their transaction counterparties. Furthermore, the majority of consumers who purchased XRP from cryptocurrency trading platforms did not invest in Ripple, and many of them were not even aware of Ripple's existence when buying XRP.

While the tourists who invested in the orange groves knew that buying the land could generate profits because the money went into the pockets of Howey Company, which would take care of the groves, the situation in the XRP lawsuit is different. The judge was clear in the ruling: "Many retail investors of XRP simply purchased it blindly. They not only have no idea what XRP is used for but also have no way of knowing if the money they used to buy the coins would ultimately end up in Ripple Labs' pockets. How can we say the two situations are the same?"

This ruling led to a peculiar conclusion: the XRP sold by Ripple Labs to institutional investors is considered illegal securities, but the XRP listed on exchanges is not. Although both are XRP, the outcome differs based on whether investors are informed. At this point, one may wonder why the market was celebrating if Ripple Labs didn't achieve a complete victory and still faced legal issues. The key lies in the cryptocurrency industry involved in the case.

The XRP lawsuit and its significance extend beyond Ripple Labs. It has shed light on the regulatory environment surrounding cryptocurrencies and their classification as securities. The ruling clarified the distinction between investment contracts and the tokens themselves, indicating that the mere presence of a digital asset on an exchange does not necessarily make it a security. This nuanced decision has implications for the entire crypto market, providing insights into the regulatory landscape and investor protection in the industry.

Judgment significance

The significance of this ruling lies in the determination of whether cryptocurrencies are considered securities in the United States. It is crucial because it not only involves the legality of the issuing party but also affects the livelihoods of numerous industry participants. If cryptocurrencies were deemed securities, many exchanges would likely have to "devolve" into being solely Bitcoin exchanges since Bitcoin is confirmed not to be a security. If the market could only accommodate one type of cryptocurrency, it would be akin to directly expelling exchanges from the United States.

Apart from Ripple Labs, another party likely celebrating this ruling is Coinbase exchange. Recently, the SEC accused Coinbase of operating an unregistered securities exchange, primarily due to the listing of several cryptocurrencies on Coinbase that the SEC considered illegal securities. Although Coinbase had preemptively delisted XRP a few years ago, this ruling effectively tells the SEC, "Your enforcement boundaries may differ from the court's interpretation!"

This directly touches on the core dispute between the SEC and various cryptocurrency industry players. Both sides disagree on their legal interpretations of cryptocurrencies, ultimately leading to their disputes being resolved in court.

In the past, when the SEC filed lawsuits against industry participants, most of them chose to settle. Just last month, SEC Chairman Gary Gensler confidently stated, "If we haven't lost in court, it means we haven't brought enough cases." However, the court's ruling did not favor the SEC this time. Not only do issuers no longer have to feel constantly on edge, but Coinbase can also safely continue its operations.

Taking this ruling as a reassurance, Coinbase and Kraken exchanges announced over the weekend that they would resume allowing US users to trade XRP. Coinbase's stock price also rose nearly 25% due to the increased likelihood of winning against the SEC in future lawsuits.

An SEC spokesperson stated they were "partially satisfied" with the outcome but did not rule out the possibility of appealing. Previously, the SEC sought to regulate the entire cryptocurrency industry, encompassing issuance, trading, and custody, under securities rules. However, the result of the XRP lawsuit significantly narrows the SEC's jurisdiction. This is the desired outcome for US cryptocurrency industry players. Although Ripple Labs can only be considered partially victorious in this lawsuit, the SEC is no longer as overbearing as before.

What truly brings joy is not just the victory for XRP but the long-awaited balance of power against the SEC in the United States.

Blocktrend is an independent media outlet sustained by reader-paid subscriptions. If you think the articles from Blocktrendare good, feel free to share this article, join the member-created Discord for discussion, or add this article to your Web3 records by collecting the Writing NFT.

In addition, please recommend Blocktrend to your friends and family. If you want to review past content published by Blocktrend, you can refer to the article list. As many readers often ask for my referral codes, I have compiled them into a single page for everyone's convenience. You are welcome to use them.