Member Gathering Arrives | Ethereum Towards Practicality: Current Development and Five Promising Areas Worthy of Investment

#543

GM,

Announcement of Event News: The Blocktrend Member Gathering is finally happening after years of anticipation!

This event is limited to 50 participants and will take place on Saturday, August 19th, at 2 PM in the Taipei office of XREX Exchange (Google Map). The event program includes panel discussions, an AMA session, and open networking, with an estimated duration of 2 hours. In order to ensure that everyone has a chance to see this event information, registration for the member gathering will open next Tuesday (July 18th). The registration link will be provided in next Tuesday's article, so please make sure to seize the opportunity. Now, let's get to the main topic.

The recent outlook of the cryptocurrency market remains uncertain. Investors are still waiting to see how prices will unfold, and developers are wondering which areas hold the most potential for growth. This is a situation that we didn't encounter a few years ago. Back then, the answers people gave were typically DeFi, NFTs, or even building their own blockchain from scratch. However, we are no longer in the "money flooding the market" bull run of the cryptocurrency industry. Last week, Ethereum's founder, Vitalik Buterin, addressed the current chaotic market conditions in a speech he delivered in Canada, highlighting five promising areas worthy of investment.

The story begins in 2021.

Argentina

In 2021, Vitalik traveled to Argentina. He entered a coffee shop and noticed that everyone inside was discussing cryptocurrencies, and the shop even accepted cryptocurrency payments. Curiously, Vitalik asked if they would accept ETH, to which the owner gladly agreed. However, to his surprise, instead of opening a MetaMask wallet, the owner opened an account on the Binance exchange.

This made Vitalik reflect. He knew that in Argentina, cryptocurrencies were an essential "savings" method for people to prevent their hard-earned money from being eroded by inflation. If Taiwanese people put their wealth into cryptocurrencies, they would likely be praised as "brave." However, in Argentina, where the inflation rate reached a staggering 100% in the past two years, it was courageous to keep one's salary in a bank. Locals were accustomed to immediately converting their income into other more stable assets, such as black-market US dollars, bricks for building houses, or self-managed cryptocurrencies.

Understanding the importance of asset autonomy, it seemed contradictory for them to place cryptocurrencies in another centralized institution like the Binance exchange. This was a compromise made by the people of Argentina. Without transferring funds within the exchange, each transaction incurred a miner fee of around $3, and the funds might not arrive immediately. Moreover, if they stored their assets in a MetaMask wallet and lost their private key, the consequences would be even worse.

Vitalik 以 2020 年作為以太坊整體發展的分水嶺。在 2020 年之前,人們會說阿根廷人碰到的問題「理論上」可以透過區塊鏈來解決。在 2020 年之後的今天,以太坊已經在嘗試實際解決問題。

用蓋房子來比喻,2020 年之前以太坊這棟「房子」都還在挖地下室、打地基。現在這棟房子已經蓋出了一點雛形,雖然隔間、裝潢都還沒完全做好,但已經可以進到更務實的討論。

以阿根廷的情況為例,以太坊至少還有三件事要做,才能幫助當地人真正實現資產自主。

three things

Lowering blockchain transaction fees is the top priority.

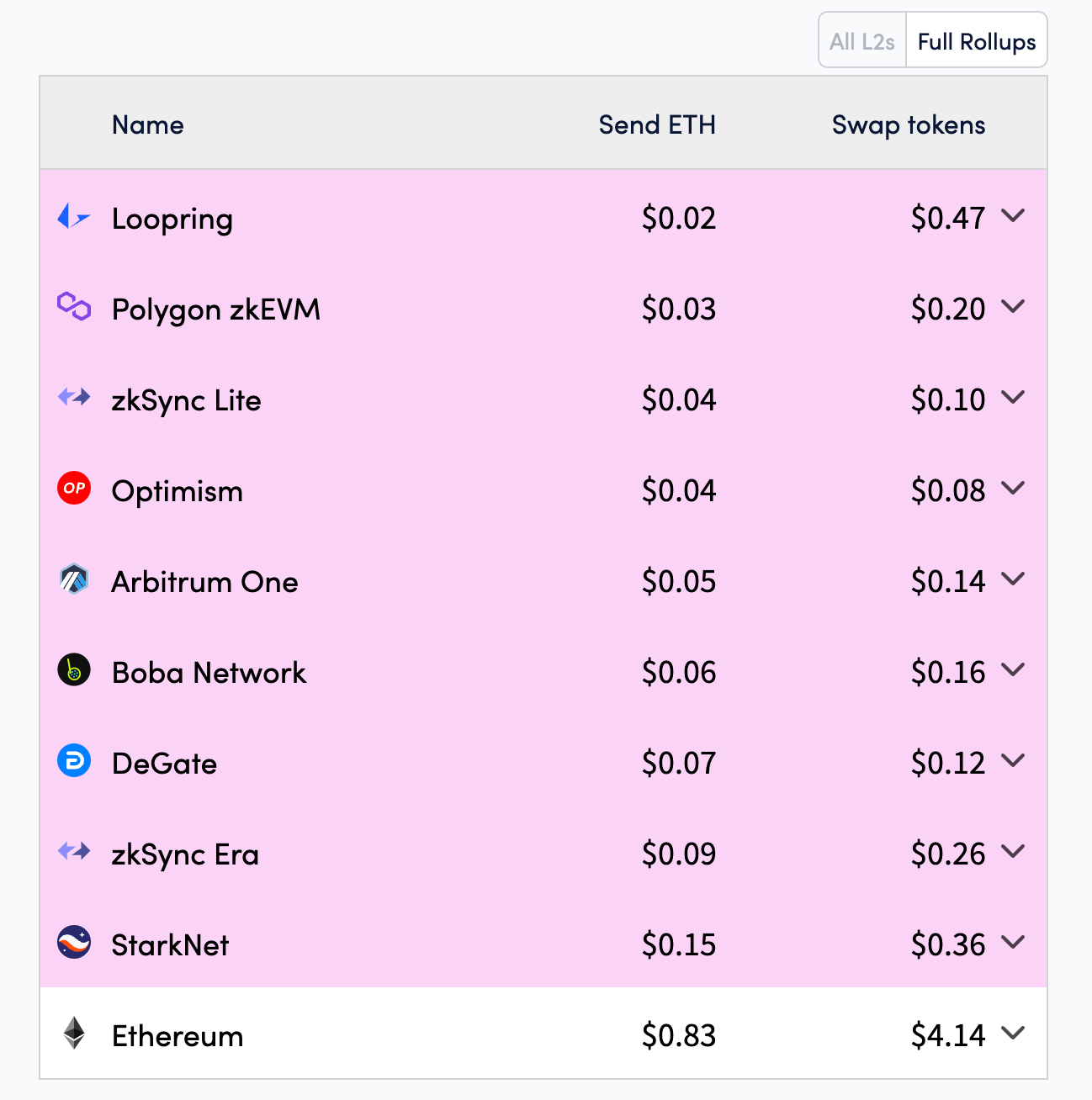

Ethereum Layer 2 networks are currently the best solution. The table below provides a breakdown of transaction fees for several Ethereum Layer 2 networks. Taking the most well-known examples, Optimism and Arbitrum, as references, their transfer fees are approximately 10% of Ethereum's fees. Each ETH transfer (send ETH) can be completed with a transaction fee of less than 2 TWD. Even for more complex operations like token swaps, the transaction fees are around 10 TWD.

The emergence of Ethereum Layer 2 networks has been the most significant progress in the blockchain space in recent years.

When Vitalik visited Argentina, the most iconic Layer 2 network, Arbitrum, had not yet been officially launched. Most people were unfamiliar with Layer 2 networks, and there were no exchanges supporting the deposit and withdrawal of assets on these blockchains. If Vitalik were to visit Argentina again in the future, there might be a chance to see coffee shop owners accepting payments through MetaMask wallets.

However, if the owner still opened the Binance exchange account, it would indicate that the user experience of wallets is not yet optimal. Currently, wallets face two major pain points: backup and user experience. People are not unfamiliar with MetaMask; rather, they lack confidence in using it. It is difficult for individuals to safeguard the randomly generated private keys, especially considering that wallets manage real assets that nobody wants to take lightly.

Safeguarding private keys requires intentional practice. However, even if individuals don't lose them, their devices may still be vulnerable to malicious actors. Social recovery is the wallet backup mechanism that Vitalik has been advocating for in recent years. Its greatest advantage is that it doesn't require much mental effort and is easy to understand. By practicing a few times, hackers' ability to compromise wallets is greatly diminished.

Social recovery works like collecting "Dragon Balls." Wallet private keys are split into multiple pieces and hidden in different locations. From that point on, individuals only need to remember where they hid their "Dragon Balls." This is much easier than remembering 24 sets of unfamiliar English words. In case a phone is lost in the sea or a computer malfunctions, individuals can summon the "Dragon" through the social recovery mechanism and regain access to their wallets.

Social recovery also helps prevent phishing attacks. Users can designate an additional wallet guardian. If only one person signs transactions, they have to wait for a 7-day cooling-off period before the transaction is sent. However, if someone wants to expedite the process, they need the wallet guardian to sign simultaneously, allowing for instant transaction submission.

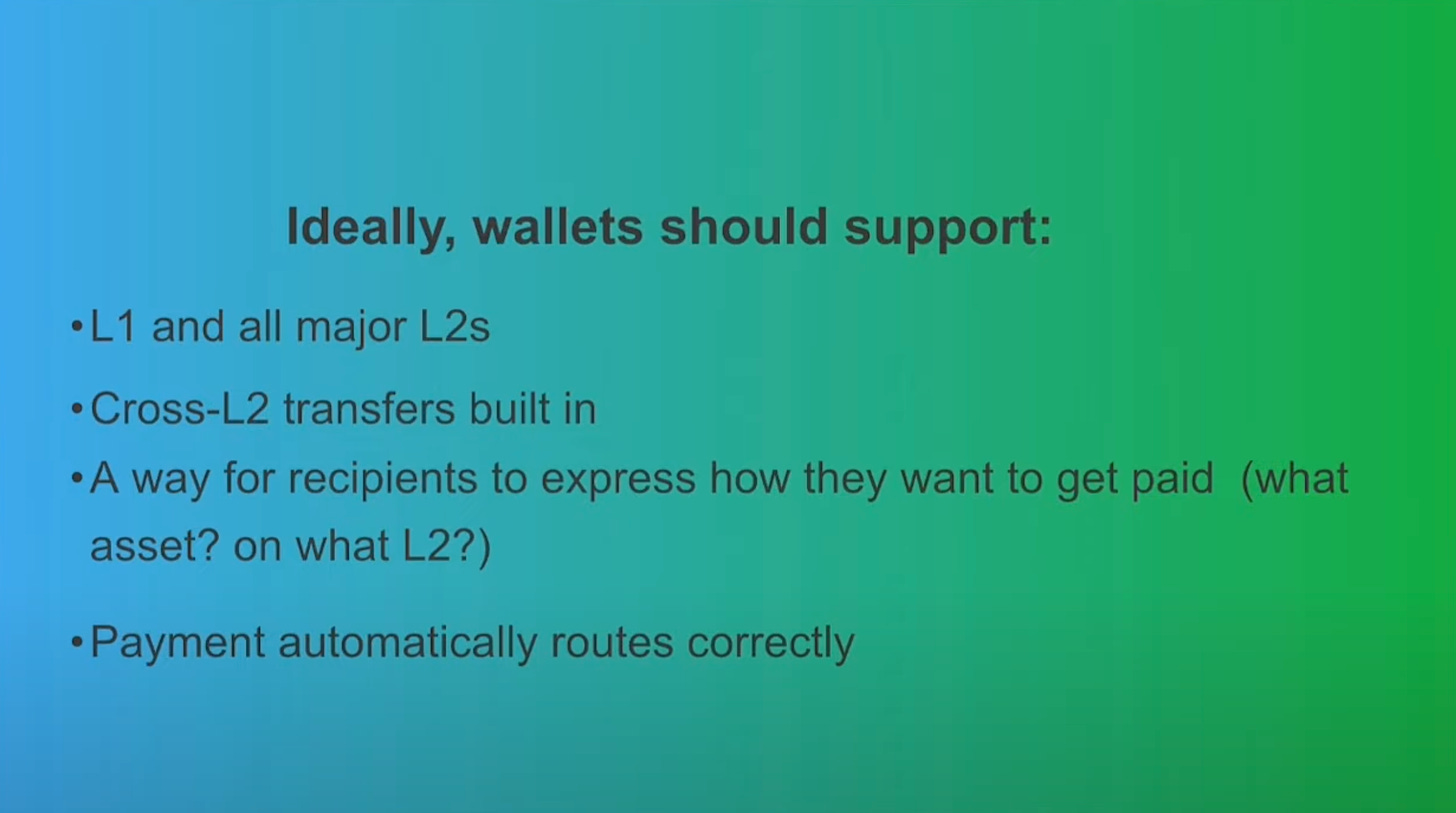

Another pain point of wallets is the user experience. For instance, if Vitalik wants to pay ETH to a coffee shop owner using Ethereum, but the owner only accepts assets on Arbitrum, it might not be quick to transfer ETH from Ethereum to Arbitrum. Customers waiting in line would surely become impatient. Hence, Vitalik also advocates for wallets to have built-in cross-chain asset transfers. This is similar to what Visa and MasterCard are doing. When people use their cards to pay in Japan while their banks deduct funds in Taiwanese dollars, the Japanese merchants receive payment in Japanese yen. Consumers don't need to know the details; they only need to tap their cards. The same applies to cryptocurrency payments. Vitalik pays in ETH on Ethereum, while the coffee shop owner can simultaneously receive USDT on Arbitrum. There is no need for compromises, and customers waiting in line won't roll their eyes. This is technically feasible but requires engineering innovation that has yet to be realized by anyone.

At this point, if the coffee shop owner still opens the Binance exchange account, it may indicate a strong emphasis on privacy.

Transferring funds within an exchange means the assets are simply moving from one hand to another within the exchange, without leaving a trace on the blockchain that can be observed by outsiders. However, if the owner were to accept payments through MetaMask, consumers who have used cryptocurrency for transactions would know the owner's wallet address. With the address, one can trace the transaction history through a blockchain explorer.

There is a solution being developed in the industry, known as stealth addresses, to address this issue, but it is not yet mature. The concept is similar to disposable email addresses, such as the "Hide My Email" feature in iCloud. For less important online accounts, I use automatically generated disposable email addresses from iCloud for registration. iCloud automatically forwards the emails received by these addresses to my main inbox. Merchants would only see an address like skyline-efforts.0y@icloud.com, without knowing my real email address.

A similar concept can be applied to the blockchain to protect privacy. However, unlike emails, if there are no ETH in the stealth address, it is challenging to automatically transfer received assets back to the designated wallet. The entire mechanism requires collective brainstorming for further development.

Transaction fees, wallets, and privacy are the three aspects that Vitalik highlighted as worthy of investment. Additionally, Vitalik sees promising developments in the fields of social and public goods.

Social and Public Goods

As Taiwanese individuals, our understanding of cryptocurrencies differs from that of people in Argentina. We hold cryptocurrencies not to solve immediate survival problems. In fact, the majority of Taiwanese people who are interested in blockchain development likely have some economic foundation.

However, we also have our own concerns. For Taiwanese, Ethereum is more like an experimental ground for a new mechanism.

We constantly switch or "escape" between different social platforms. Taking the example of Threads discussed in a previous article, while the concept of a "federated universe" is novel and disruptive to existing operations, some individuals want to take it further by introducing the concept of digital assets within social platforms, turning each post into an NFT owned by individuals. This creates economic incentives, where people can not only like but also directly pay to collect these posts. As a result, someone developed the Lens Protocol to experiment with the feasibility of this idea.

Furthermore, there seem to be few trustworthy and respected media outlets on the internet. I believe this highlights the importance of public goods and resource allocation.

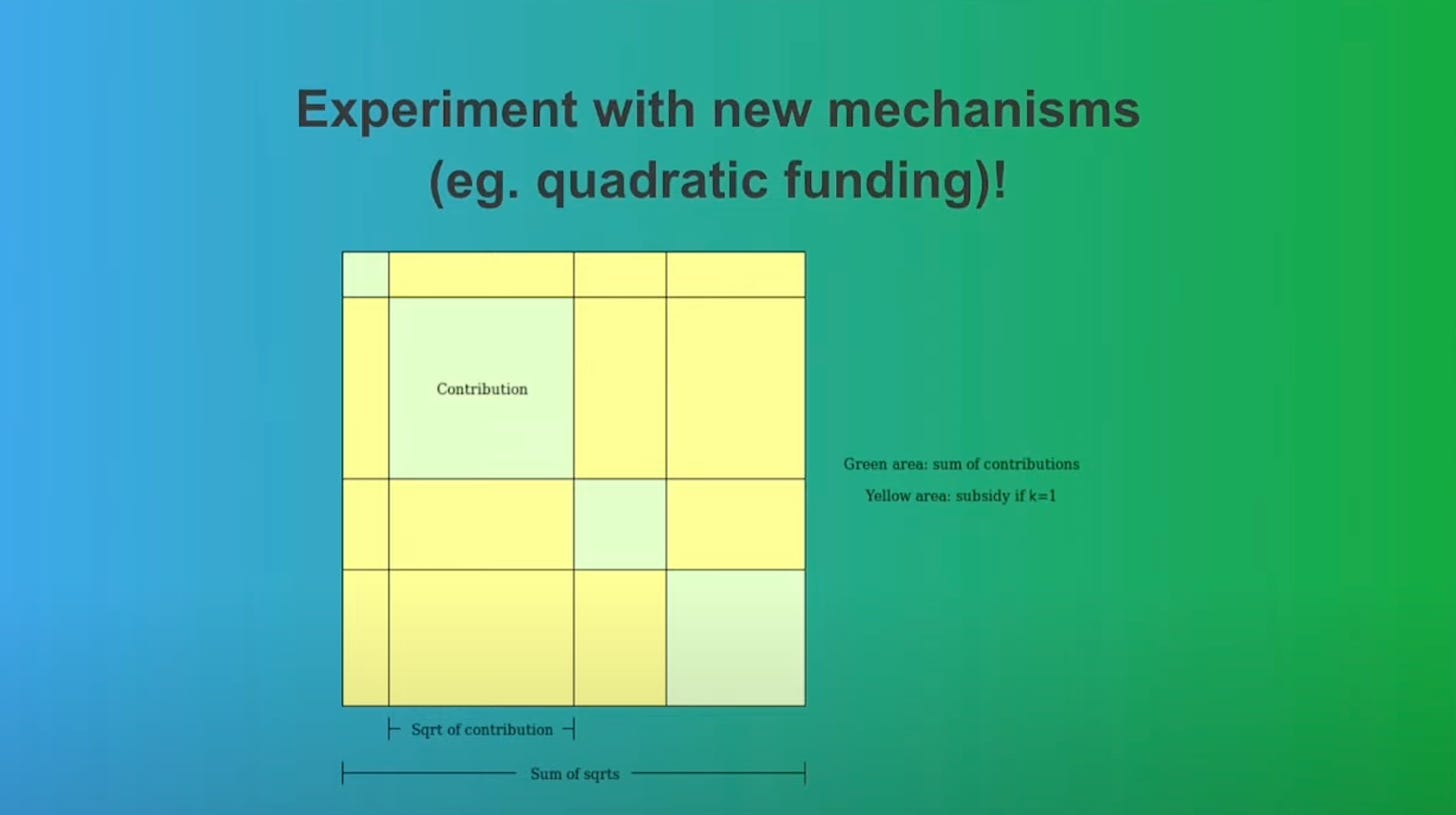

In the past six months, Blocktrend has participated in RetroPGF and Gitcoin Grants, experimenting with new social resource allocation mechanisms. Previously, these mechanisms could only be found in academic papers or, at most, small-scale tests. However, since Vitalik and economist Glen Weyl proposed the concept of Quadratic Funding in 2020, there have been dozens of large-scale social experiments conducted on the blockchain.

The RetroPGF organized by Optimism follows the same principle. The total budget allocated to support public goods in the next round of RetroPGF is three times greater than the previous round, with a staggering amount of 30 million OP tokens. This is an astonishing number, and both you and I are actively participating in this real-life experiment. The experiment is about taking action. While spectators may not have to bear the operational risks, there are also people who will tell you that the greatest risk in life is never taking any risks at all.

Blocktrend is an independent media outlet sustained by reader-paid subscriptions. If you think the articles from Blocktrendare good, feel free to share this article, join the member-created Discord for discussion, or add this article to your Web3 records by collecting the Writing NFT.

In addition, please recommend Blocktrend to your friends and family. If you want to review past content published by Blocktrend, you can refer to the article list. As many readers often ask for my referral codes, I have compiled them into a single page for everyone's convenience. You are welcome to use them.