GM,

Have you recently come across news about asset tokenization or "RWA"? Asset management firms like BlackRock and banks like JPMorgan have separately highlighted that asset tokenization will be a crucial trend in the future. At the end of August this year, the Society for Worldwide Interbank Financial Telecommunication (SWIFT) released a report titled "SWIFT Sees the Potential of Asset Tokenization Through Blockchain." Following this, Citibank launched Citi Token Services, enabling real-time, round-the-clock settlement of assets through cryptocurrencies and smart contracts.

Several major financial institutions have recognized that the nature of assets is undergoing a transformation, moving from physical to digital and eventually transitioning into tokens. However, while financial institutions prefer to use the term "asset tokenization," the cryptocurrency community uses another term - "Real World Assets" (RWA).

Recently, RWA has gained significant attention in the cryptocurrency community, often closely associated with MakerDAO, the issuer behind the USD stablecoin DAI. MakerDAO not only pioneered RWA in the crypto space but has also seen significant growth in the circulation of DAI and the governance token's price due to RWA. This article explores the origins of RWA and how MakerDAO is gradually moving towards the real world.

MakerDAO

In 2014, the issuer of USDT, Tether, first introduced the concept of the USD stablecoin, allowing people to make payments using the familiar US dollar on the blockchain. Tether claimed that each USDT was backed by one US dollar and could be exchanged bidirectionally. However, the US government found that Tether did not always maintain a full reserve of US dollars and, in 2021, fined and expelled its parent company, iFinex, from the United States.

Even today, many people remain skeptical of Tether's ability to redeem its tokens. MakerDAO, founded in the same year as Tether, also ventured into the USD stablecoin business, launching DAI in 2017, which is currently the third-largest stablecoin by market capitalization worldwide. Unlike USDT, which is backed by US dollars held in banks, DAI's asset reserve is composed of Ethereum (ETH) on the Ethereum blockchain.

This reflects two entirely different value propositions. Tether merely moves the universally recognized value of the US dollar onto the blockchain, while MakerDAO transforms ETH, which is not yet widely accepted by people, into a medium of exchange. The latter approach is considerably more radical and enjoys widespread support in the cryptocurrency community, as it operates independently of the traditional financial system.

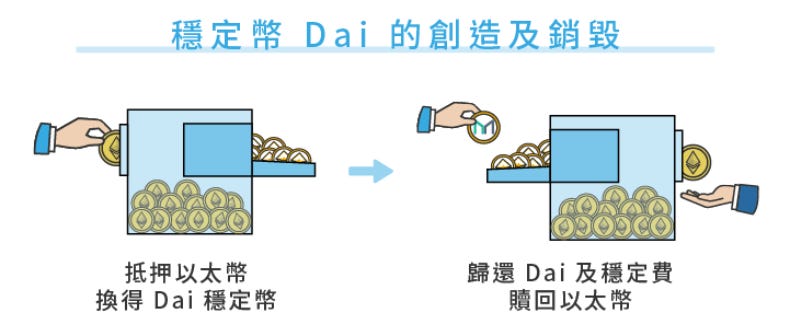

MakerDAO operates in a relatively straightforward manner, functioning as a "virtual bank." Just as people can go to a bank to secure a mortgage, offering a property valued at 10 million Taiwanese dollars as collateral to borrow 5 million Taiwanese dollars for investment, MakerDAO operates similarly. The difference lies in the collateral MakerDAO accepts, which is ETH. People can use 1,000 Taiwanese dollars' worth of ETH as collateral to borrow 500 Taiwanese dollars' worth of DAI from MakerDAO for investment.

Every collateral in MakerDAO has a traceable presence on the blockchain, unlike concerns that people might have with Tether. The higher transparency in DAI's operation has attracted many, even though it might be less lucrative to "collateralize and borrow" in MakerDAO.

However, MakerDAO faced a crisis in 2020 that prompted them to turn towards RWA.

Introduction of RWA

Blocktrend has discussed this crisis before. At the time, the COVID-19 pandemic had just erupted, and cryptocurrency prices were fluctuating with the global stock market. On March 12, 2020, the price of ETH plummeted by 33%, dropping from $200 to just $132. This sharp decline in prices triggered a wave of liquidations, and MakerDAO was hit hard.

Many had used ETH as collateral to borrow DAI for investment. Unexpectedly, the price of ETH plummeted by 33% in an instant, and many couldn't repay their loans in time, resulting in forced liquidations by MakerDAO.

However, there were too many people facing liquidation, and all blockchain transactions were congested, unable to be executed in time. The first batch of ETH had not completed their auctions when the next batch of liquidated ETH flooded in. Due to missed auction windows, many collaterals were sold at very low prices. When all transactions were finally executed, MakerDAO realized a total loss of $4 million, approximately 120 million Taiwanese dollars.

This event made MakerDAO realize the importance of risk diversification. To prevent a repeat of the tragedy, they needed to introduce more "independent" collateral for DAI. This was the turning point when MakerDAO started looking towards RWA.

At that time, MakerDAO made a groundbreaking decision to add USDC as collateral. USDC's price does not fluctuate with ETH. The more independent the asset, the better suited it is as collateral. However, this also raised concerns about centralization. After all, DAI's most prominent feature compared to other stablecoins was its distance from the traditional financial system. If DAI's collateral asset was another USD stablecoin like USDC, and if the issuer of USDC, Circle, was subject to U.S. government regulations, wouldn't DAI become just a derivative of USDC?

This decision sparked a heated debate at the time. Ultimately, for the sake of MakerDAO's stability, they had to compromise temporarily. However, MakerDAO continued to search for collateral assets outside the cryptocurrency space and eventually found an unexpected partner, a U.S. real estate developer called 6s Capital LLC.

MakerDAO has pledged to allow 6s Capital LLC to use real estate contracts or the properties themselves as collateral to borrow DAI, as stated in the proposal:

"As MakerDAO evolves, we need to diversify collateral assets and introduce real-world assets unrelated to cryptocurrencies. This not only brings stability but also adds liquidity to the DAI ecosystem through real-world economic and legal systems, helping to stabilize the DAI price. We will use a series of legal frameworks to protect MakerDAO, allowing us to lend DAI to borrowers.

6s emerged during the COVID-19 banking credit contraction when its affiliated company, 6s Development Company, faced issues with banks no longer willing to provide credit. The head of 6s Development Company has been involved in credit lease development for over 15 years and has participated in over 1,000 land development projects. 6s Capital LLC aims to establish a sound financial structure, and currently, there is no record of default in the construction locations of 6s Development Company."

MakerDAO is essentially serving as a bank for 6s Capital LLC. 6s uses real estate as collateral to borrow USD-pegged stablecoin DAI from MakerDAO to sustain its operations. This move not only represents MakerDAO's transition from being an "on-chain bank" to an "off-chain bank" but also serves as an innovative case of a real estate company borrowing cryptocurrency from DeFi.

However, MakerDAO needs to enter into contracts with 6s Capital LLC. To facilitate this, MakerDAO established the RWA Foundation in the Cayman Islands in 2021, dedicated to signing collateral loan agreements with business partners and providing a rough definition for RWAs:

MakerDAO's strategy is to diversify the types of collateral by increasing the presence of Real World Assets (RWA). In this proposal, RWAs are broadly defined as any type of securities, bonds, stocks, tokens, loans, promissory notes, mortgages, or collateralized interests.

6s became MakerDAO's first business partner, and many knowledgeable companies have approached MakerDAO, eager to use their assets as collateral to borrow from MakerDAO. For instance, music creators could potentially use their intellectual property as collateral since music copyrights are assets independent of cryptocurrencies, aligning with MakerDAO's risk diversification needs. However, MakerDAO must assess the value of the collateral. In case the borrower defaults, the recourse would involve auctions and legal processes.

In essence, MakerDAO is engaging in businesses that traditional banks often avoid, and naturally, this comes with higher risks. Just two months ago, MakerDAO faced a situation where a debtor could not repay their debt. MakerDAO took immediate action, voting to freeze the pool of funds initially granted to the debtor and then following the legal procedures to seek repayment. Despite the seemingly rudimentary and technology-reversing aspects of this process, MakerDAO remains committed because making money is always a source of satisfaction.

DAI's New Features

Originally, MakerDAO's intention was to diversify collateral types to reduce risk. However, the RWA experiments of the past few years have revealed that "banking" can be quite profitable! MakerDAO is not only engaging in corporate lending, earning income from lending operations, but is also simultaneously using its own treasury's USDC collateral to invest and generate additional returns. According to a MakerDAO proposal:

USDC is a significant asset on Maker's balance sheet, but it has not generated any income. We believe that diversifying our assets and partnering with professional bond managers should be a priority.

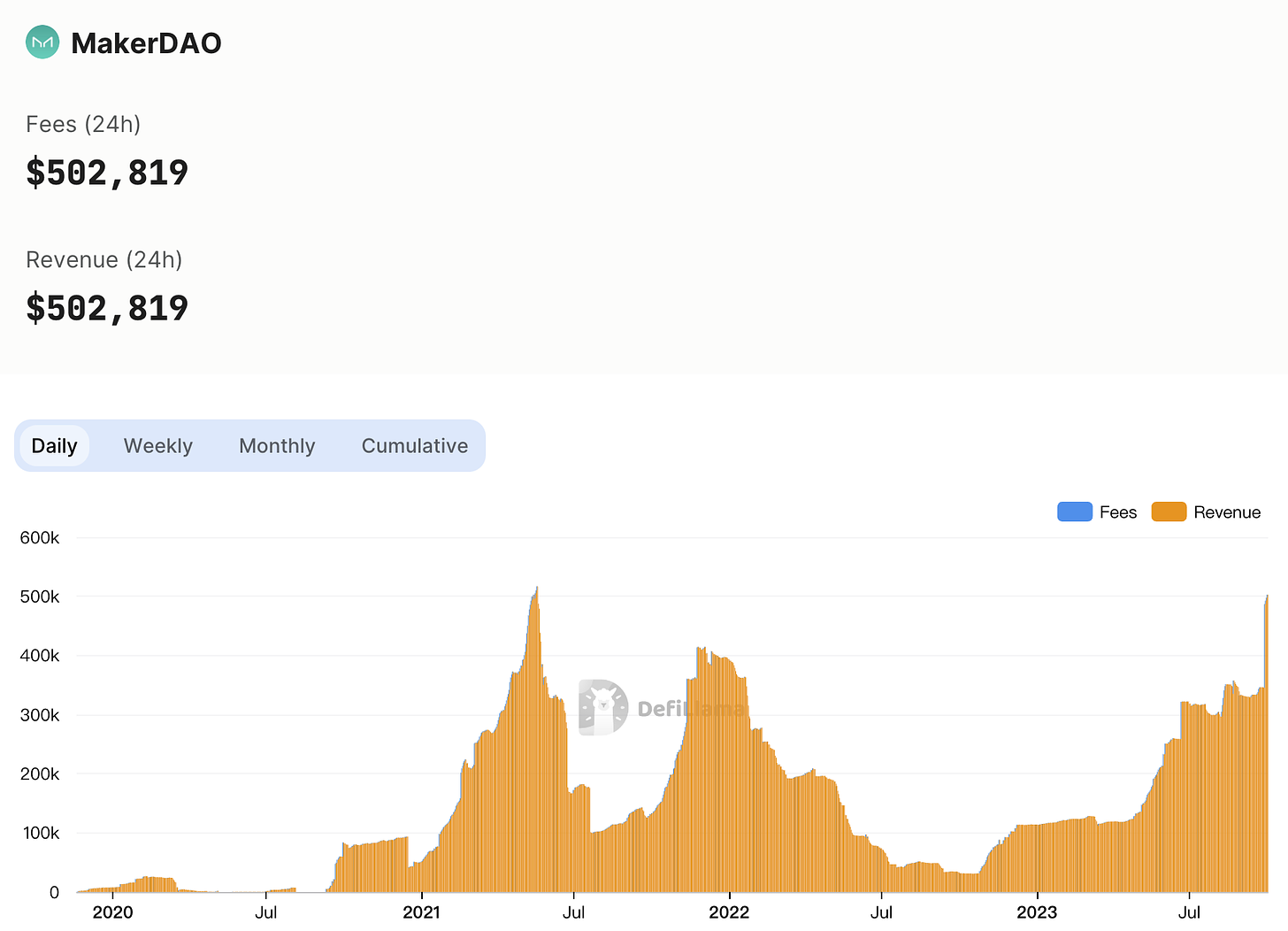

This is the allure of financial opportunities. In the past, MakerDAO only accepted ETH as collateral for loans, and those ETH holdings seemed locked up in MakerDAO without generating returns. However, MakerDAO is now relaxing its stance, recognizing that holding USDC is already a compromise in terms of centralization. Even USDC doesn't need to be locked in the treasury but can be used to purchase short-term U.S. Treasuries, yielding an annual return of 5%. Currently, MakerDAO's daily income is as high as $500,000, with the majority of it coming from investment returns brought about by RWAs.

Many people still have the impression that MakerDAO is an organization that issues decentralized stablecoins, sustaining its operations with minimal borrowing interest. However, most of the information about MakerDAO online is outdated. The current MakerDAO operates more like an asset management company. While it justifies diversifying collateral for risk management purposes, its primary goal is to generate more income and return those earnings to holders through the DAI Savings Rate (DSR).

In other words, MakerDAO aims to package DAI as a USD stablecoin that can generate income from RWAs. Recently, MakerDAO founder Rune set an ambitious goal called the "Endgame," aiming to make DAI's market capitalization surpass that of USDT and USDC, reaching a scale of $100 billion within three years. MakerDAO also promptly increased the DAI savings annual interest rate to 5%. This attracted many participants and indeed boosted DAI's overall market capitalization.

However, it reminds me of the now-defunct USD stablecoin UST and the Anchor Protocol, which once boasted a 20% annual yield. UST gained rapid popularity by leveraging Anchor's 20% yield, dominating the market but eventually collapsing due to the drop in LUNA's price, causing a death spiral in UST's value. From my perspective, MakerDAO is building a similar mechanism, with the difference being that DAI is backed by a reserve of RWAs, which include U.S. bonds and corporate bonds.

In the event that this experiment fails, it could potentially become another textbook example of a disaster. However, if successful, DAI will become a game-changer, not just a USD stablecoin but also a new gateway for cryptocurrency investors to earn real-world income.

Blocktrend is an independent media outlet sustained by reader-paid subscriptions. If you think the articles from Blocktrendare good, feel free to share this article, join the member-created Discord for discussion, or add this article to your Web3 records by collecting the Writing NFT.

In addition, please recommend Blocktrend to your friends and family. If you want to review past content published by Blocktrend, you can refer to the article list. As many readers often ask for my referral codes, I have compiled them into a single page for everyone's convenience. You are welcome to use them.