Inscription Craze Resurfaces: A History of Colored Coins and a Simple Guide to Minting Bitcoin NFTs

#585

GM,

This is the second-to-last article of 2023. Originally, I planned to write about some simple topics at the end of the year, but plans couldn't keep up with changes. The market did not take a break; moreover, it ushered in a new trend. Recently, apart from Solana's coin price skyrocketing like a rocket, BRC20 tokens on the Bitcoin blockchain and NFTs have also attracted the attention of the media and investors.

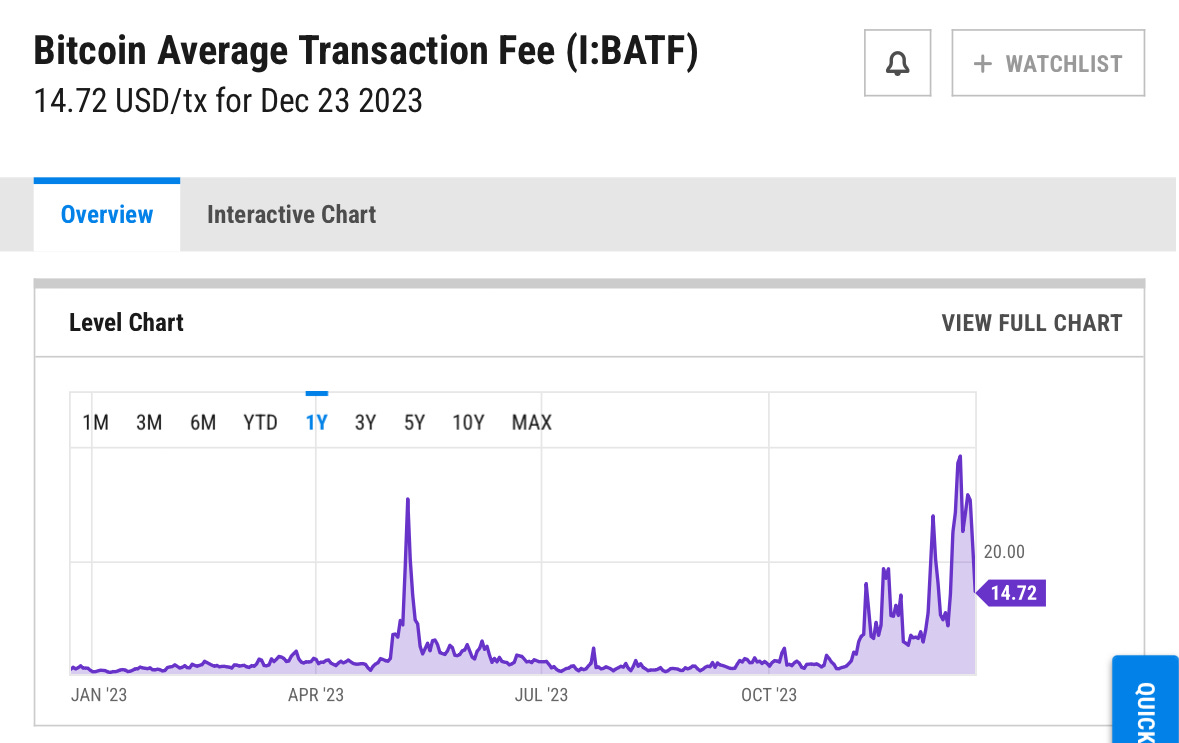

Six months ago, Blocktrend wrote about "Bitcoin Congested: Smart Contracts, Blockchain Route Dispute" At that time, transaction fees on the Bitcoin blockchain soared, mainly because people started creating meme coins, ordinals, and inscriptions trading markets, causing blockchain congestion. However, this trend did not last too long, and it's only recently that Bitcoin has congested again in the past few weeks.

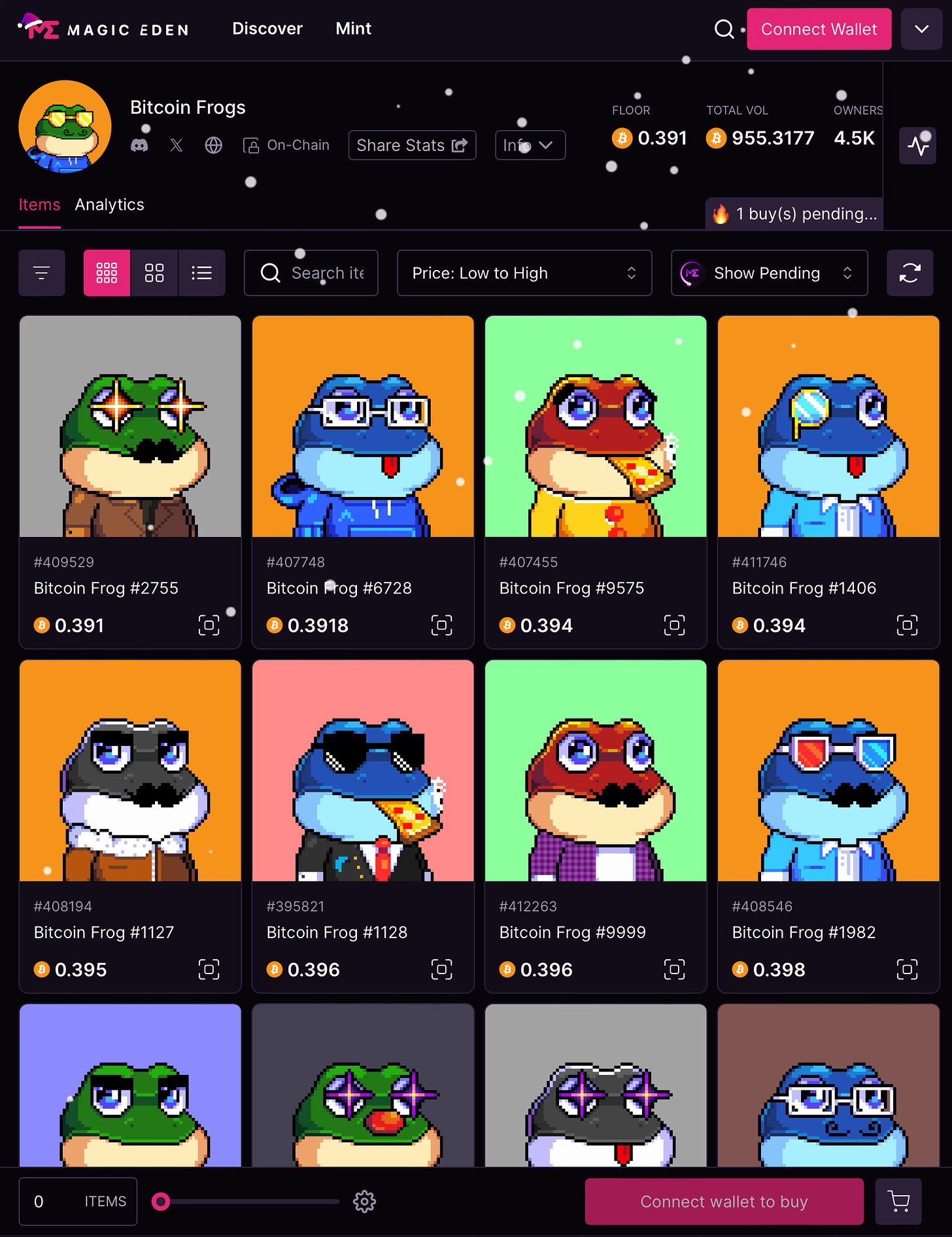

The reason remains the same; those meme coins, ordinals, and inscriptions we discussed six months ago have seen their prices doubling and rising. Take the “Bitcoin Frogs” for example, where the current floor price for each "image" of a frog is 0.29 BTC, equivalent to nearly NT$400,000, resembling a version of Ethereum's "Monkey Head" NFT. The market is filled with a strong FOMO atmosphere, with people starting to discuss unprecedented innovations in the Bitcoin NFT market and whether it will develop into the new theme of the next bull market.

To answer whether Bitcoin NFTs are worth participating in, one cannot just look at the current market conditions; it's necessary to start from the history of Bitcoin.

Colored Coins

Issuing NFTs on the Bitcoin blockchain is not a new project that emerged only in the past year; someone attempted it as early as 11 years ago.

The project called Colored Coins in 2012 can be considered the precursor to NFTs. Among the project's initiators were two prominent figures today—Yoni Assia, the founder of eToro, and Vitalik Buterin, the founder of Ethereum.

The concept of Colored Coins was simple, aiming to differentiate some bitcoins by "painting" them with different colors through metadata. It's like commemorative circulating coins; although the denomination is the same, people won't use it as a regular coin because of the special significance of the year and portrait printed on the coin. Here are some application scenarios mentioned in the Colored Coins whitepaper:

Companies can create their own corporate currency, such as airline miles or simple coupons, using Colored Coins…Rental car companies can use Colored Coins to represent each car and specify that these cars can only be started when a specific private key signs…Digital collectibles, representing ownership of digital songs, movies, e-books, and software, can also become Colored Coins stored on the blockchain.

Looking back from 2023, the myriad Colored Coins projects seem cumbersome, and the application scenarios have confused ERC20 tokens and NFTs. However, that's because the Bitcoin system back then did not have the concept of smart contracts, and the methods for issuing new tokens and NFTs were convoluted.

Colored Coins had to break down BTC into the smallest unit—Satoshi—and then "color" it again. It's like if I wanted to issue "MingEn Coin," I would have to collect a batch of 10 yuan coins and paint over Chiang Kai-shek's portrait with mine. Furthermore, issuing NFTs required more information to be written on the coin than just changing the portrait.

Although Colored Coins' approach seemed quite primitive at the time, the goals they aimed to achieve are no different from today. Both sought to issue more tokens and NFTs on the blockchain, creating new applications beyond finance. It can only be said that Colored Coins appeared too early, with immature infrastructure and a vision that was challenging for people to understand, ultimately becoming a page in the history textbook of the crypto space.

However, with Bitcoin's technological upgrades, there are occasional attempts by individuals to issue tokens and NFTs on the Bitcoin blockchain using new methods. The recently noteworthy ordinals and inscriptions are actually an upgraded version of the Colored Coins from that time.

Inscription Craze

Software engineer Casey Rodarmor developed Bitcoin ordinals (Ordinals) at the end of 2022, hoping to "make Bitcoin interesting again." Ordinals are software built on the Bitcoin system, which assigns unique numbers according to ordinal theory to each Satoshi on the Bitcoin system. Users can then bind external information such as text, images, or videos to specific numbered Satoshis. Since this resembles people engraving text on unique stones, it's called inscriptions.

It may sound abstract, but it becomes much clearer with practical operation. Recently, the Binance mining pool also launched an inscription service on the Bitcoin blockchain. Users simply need to log in to their Binance accounts, and Binance can, through their operated Bitcoin nodes, issue BRC20 tokens, upload images or text for you on the Bitcoin blockchain.

However, the price of the service is not affordable. Taking the cost at the time of my writing as an example, the operational cost of issuing a BRC20 token on the Bitcoin blockchain, such as MN Coin, is approximately $35 worth of BTC. However, if you want to engrave an image on the blockchain, you must pay about $2,000. Among these, the service fee charged by Binance is approximately $100, and the remaining $1,900 is the on-chain cost paid to Bitcoin miners.

So, what does an inscription look like? The image below is the "Bitcoin Frog" mentioned at the beginning of the article. Besides the shift of the marketplace from OpenSea to Bitcoin-supported Magic Eden, and the change of billing units from ETH to BTC, there doesn't seem to be any noticeable innovation from the appearance. But supporters would say, "You just don't understand; the power of inscriptions lies in the unseen!"

What they mean is that 100% of the content of the Bitcoin Frog exists on the Bitcoin blockchain. This is a less common practice in Ethereum NFT projects, and the key lies in technical limitations. Blockchains are not designed to store multimedia content, and most NFT images are stored outside the blockchain on IPFS, Arweave, or centralized servers. Therefore, NFT projects that can store all data on the blockchain appear relatively rare, inevitably making certain compromises or utilizing more advanced engineering techniques.

Storing all data on the blockchain becomes the greatest value in the eyes of Bitcoin inscription supporters, and the rest of the story is easily told, like: "Bitcoin is the most globally recognized and largest market value blockchain. Now, it can not only issue BRC20 tokens, mint NFTs, but also store all data on the chain. This is something even Ethereum finds challenging," and "Bitcoin will upgrade from its original simple P2P transfer system and begin unlocking non-financial applications. Although these frogs may seem simple now, they hold historical significance, much like CryptoPunks."

Price is justice. With a compelling narrative and rising prices, it attracts more attention. The barrier to entry for inscriptions is high, and people haven't had time to fully understand it, but watching the price rise day by day makes it easy to succumb to FOMO. Quick-thinking individuals smell the business opportunity and start spreading inscriptions from Bitcoin to other blockchains like Polygon, Solana, or Arbitrum, becoming a new trend.

However, within the Bitcoin community, opinions on ordinals and inscriptions are quite polarized. Supporters believe it is a new feature that should be promoted, while opponents consider it a bug that should be patched as soon as possible. This is because the two camps have different expectations for the Bitcoin blockchain.

Conservatism and Progress

I have previously pointed out that the Bitcoin community has long two distinct development paths, represented by the progressive faction led by miners and the conservative faction led by developers.

The "progressive" faction led by miners believes that the Bitcoin blockchain must evolve into a modern metropolis, supporting smart contracts and building BRC20, NFT, and even DeFi applications on top of it. However, the "conservative" faction led by developers believes that the Bitcoin blockchain doesn't need to compete for the economic center with emerging blockchains and should maintain its purest form—simple transfer functionality is sufficient.

Miners supporting development undoubtedly have vested interests at play. The more applications on the Bitcoin blockchain, the higher the transaction volume and more substantial the fees. Investors also support development because it transforms Bitcoin from just digital gold into "digital oil." There is greater speculative potential in price.

However, I lean more towards the "conservative" faction. Even if Bitcoin supports smart contracts, it is fundamentally an ancient city that cannot be compared with the "redevelopment area," which is still a barren land, in terms of urban functions and future development. Transferring BRC20, NFT, and DeFi to Bitcoin is challenging to surpass the user experience of emerging blockchains starting from scratch. This is the advantage of latecomers.

Going back to 2012, most people had not heard of Bitcoin, nor did they know what blockchain was, and Vitalik Buterin hadn't even finished writing the Ethereum whitepaper. Although some foresaw that blockchain could have purposes beyond transfers, limited by the tools at hand, they could only use the Bitcoin blockchain as a foundation, giving rise to the Colored Coins project.

Colored Coins ended in failure but can be seen as the prototype for Ethereum later. When Ethereum emerged in 2015, people had a more modern blockchain infrastructure to issue tokens and NFTs. Those aspiring to make a name for themselves in blockchain back then flocked to Ethereum development, but there remained a group of people who did not give up on the idea of issuing tokens and NFTs on the Bitcoin blockchain.

In the past few years, the Bitcoin system has undergone upgrades, and people's understanding of tokens and NFTs has improved significantly compared to 11 years ago, leading to the current trend of ordinals and inscriptions. However, Bitcoin is ultimately not a modern blockchain system. Most discussions about ordinals and inscriptions quickly dive into technical complexities, leaving the average person bewildered. Skipping the technical aspects, some may feel that it's just a replica of Ethereum's "Monkey Head" NFTs.

I would say that the current trend of Bitcoin inscriptions is essentially an extension of Ethereum avatar-style NFTs. If you don't care whether the frog image is actually stored on IPFS, Arweave, or the Bitcoin blockchain, then this wave of inscription trends is irrelevant to you.

Blockchain is a permissionless system. I respect those who want to develop new applications on Bitcoin, but I wouldn't want to spend a fortune to participate. I believe Bitcoin's best position is not to have more new applications to make it great or interesting again but to stay simple. Just like the highest realm of a martial arts master is not mastering various martial arts but winning without any moves.

Blocktrend is an independent media platform sustained by reader-paid subscriptions. If you think the articles from Blocktrend are good, feel free to share this article, join the member-created Discord for discussion, or add this article to your Web3 records by collecting the Writing NFT.

In addition, please recommend Blocktrend to your friends and family. If you want to review past content published by Blocktrend, you can refer to the article list. As many readers often ask for my referral codes, I have compiled them into a single page for everyone's convenience. You are welcome to use them.